What is DeFi Lending? A Beginners Guide to Decentralized Finance

Introduction

Decentralized finance (DeFi) has taken the world over by storm. There is over $61 billion total value locked (TVL) across all blockchains (as of May 2023). DeFi activity reached peak volumes in 2022 ($230 billion TVL). As crypto adoption increases, interest in DeFi activities including Liquid Staking, DeFi Lending, Yield farming, and Decentralized Exchanges will continue to rise.

DeFi lending, which is borrowing and lending crypto assets through peer-to-peer transactions, has proven itself as a foundational DeFi activity. It consistently ranks at the Top-3 (in total volume) across the entire Decentralized Finance ecosystem.

What is Decentralized Finance? (DeFi)

In its simplest form, Decentralized Finance makes financial services more accessible by removing the middleman. The majority of DeFi uses a combination of secure blockchain ledgers and smart contracts that allow users to interact with other users in an immutable and trusted environment.

The majority of traditional finance (TradFi) activities can be done more efficiently and cheaper with the blockchain technology that DeFi utilizes.

Activities like: borrowing and lending, exchanging currency (swaps), high-frequency trading, earning APY from saving, and more, can all be done within seconds in a decentralized way.

In order to participate in DeFi, users need a decentralized wallet (or a web3 compatible wallet) to access the Decentralized Applications (dAPPS). They’ll also need to purchase cryptocurrencies, typically stablecoins (like USDC or USDT) or native tokens ( like ETH, MATIC, ARB, etc.)

If you already know how DeFi works, you can unlock liquidity for any crypto token on Teller Protocol.

DeFi compared to Traditional Finance (TradFi)

The world is very used to Traditional finance (TradFi) activities. Credit cards, mortgages, Certificates of Deposit (CDs), Stocks and Bonds - the list goes on. Even if you don't work in the banking or finance industries, TradFi affects every part of your life.

In TradFi, banks and large companies facilitate most transactions. The best way to understand the differences between Decentralized Finance and Traditional Finance is with a real-world example. The example we'll use is buying a car in TradFi versus DeFi.

Using TradFi to buy a car:

- You want to buy a car on a Saturday

- But you need a loan

- You get pre-approved for a loan on Friday

- Your credit is average, so the interest is pretty high

- Since it’s Sunday, your bank is closed and can't transfer the money

- So you sign the papers and go home emptyhanded

- You come back in two days once your bank sends a wire transfer to the dealer

- And drive your new car home

Wow, that’s a lot.

In DeFi, peer-to-peer transactions are quicker, easier, and can be done 24/7. Since there is no large bank or complicated middleman with DeFi, transaction time and fees can be reduced by 99%.

Using DeFi to buy a car:

- You get a crypto loan with lower interest (thanks to your on-chain activity)

- You use crypto or NFTs as collateral for the loan

- In less than two minutes, the loan is approved and is paid over to the dealer

- Then, you drive away into the sunset

In TradFi, there is always a centralized custodian. The APY earned when you deposit money into a savings account, is actually a borrowing fee (that the bank pays you to use your money.)

In fact, the money in your account isn’t even there. Most banks use fractional reserve banking, which means your deposits are used without your consent for lending purposes.

Fun fact: If everyone went to withdraw all their money from their bank, the bank would not have enough money to give to everyone.

DeFi uses smart contracts to isolate capital and automate lending and blockchain ledgers to verify and record transactions. The biggest DeFi protocols publish their Proof of Reserves, which shows that customer money deposited is held 1:1.

This means, if 100% of people went to withdraw their money, everyone would get their money back.

DeFi interest rates are typically above the market average. The decentralized nature of peer-to-peer lending allows greater competition to drive down rates based on market demand.

ie. a DeFi lender might give out a 10% APR loan, just to be undercut by another lender at 9.5%.

This type of healthy competition adjusts in real time to deliver attractive rates for both borrowers and lenders.

How does DeFi lending Work?

Decentralized finance uses blockchain technology. Transactions are recorded in “blocks” and are then verified by other users (validators, stakers, or miners.) As transactions are approved, the “block” is closed, encrypted, and unchangeable. Each block contains information about the previous block and is “chained” together.

The most common blockchains for DeFi are Ethereum, Arbitrum, and Polygon.

All of these blockchains have decentralized applications called dAPPS. These applications allow users to interact with each other through a secure database.

DeFi lending is fully trustless and peer-to-peer. Because of the immutable (unchangeable) nature of blockchains, users don’t need to rely on or trust unknown intermediaries with their money. The middleman is replaced with a fully permissionless, transparent tool that lets users be in complete control of their finances.

Borrowing and Lending in DeFi are accomplished in three ways:

- Liquidity Pools

A smart contract that contains large amounts of crypto that users can borrow and lend tokens into - Order Books

An order book matches lenders & borrowers with each other. Requests or offers are “pending” until the loan terms match up with another user. - Over-the-counter (OTC)

Borrowing and lending crypto between two parties with agreed terms (typically negotiated ahead of time)

DeFi loans can vary greatly, fixed duration, variable APR, collateral requirements, etc. But at the heart of all DeFi lending is a peer-to-peer transaction on an immutable blockchain.

Learn more about DeFi lending and how to get a crypto loan here.

Are Defi Loans worth it?

Decentralized lending apps have several advantages for savvy crypto DeFi users:

For borrowers: Below average interest rates, a large variety of collateral token options, and flexible loan terms.

For lenders: less upfront capital required, faster and more transparent recourse in the event of a loan default, and overcollateralized loans.

Both DeFi loans and TradFi loans have a handful of Pros and Cons. Interested participants should research thoroughly before engaging in any lending or borrowing activities.

Pros and cons of DeFi Loans:

Pros

- removes the middleman in transactions

- Creates an opportunity for more users to earn yield from lending

- High level of trust through blockchain technology

Cons

- DeFi can be complicated

- Protocol hacks and scams can be common

- Crypto can be very volatile

What are the Top 6 DeFi Apps?

We've grouped the Top 6 DeFi apps into three categories (ranked by popularity and volume). The categories are: Liquid staking, dexes, and lending.

Liquid Staking Apps

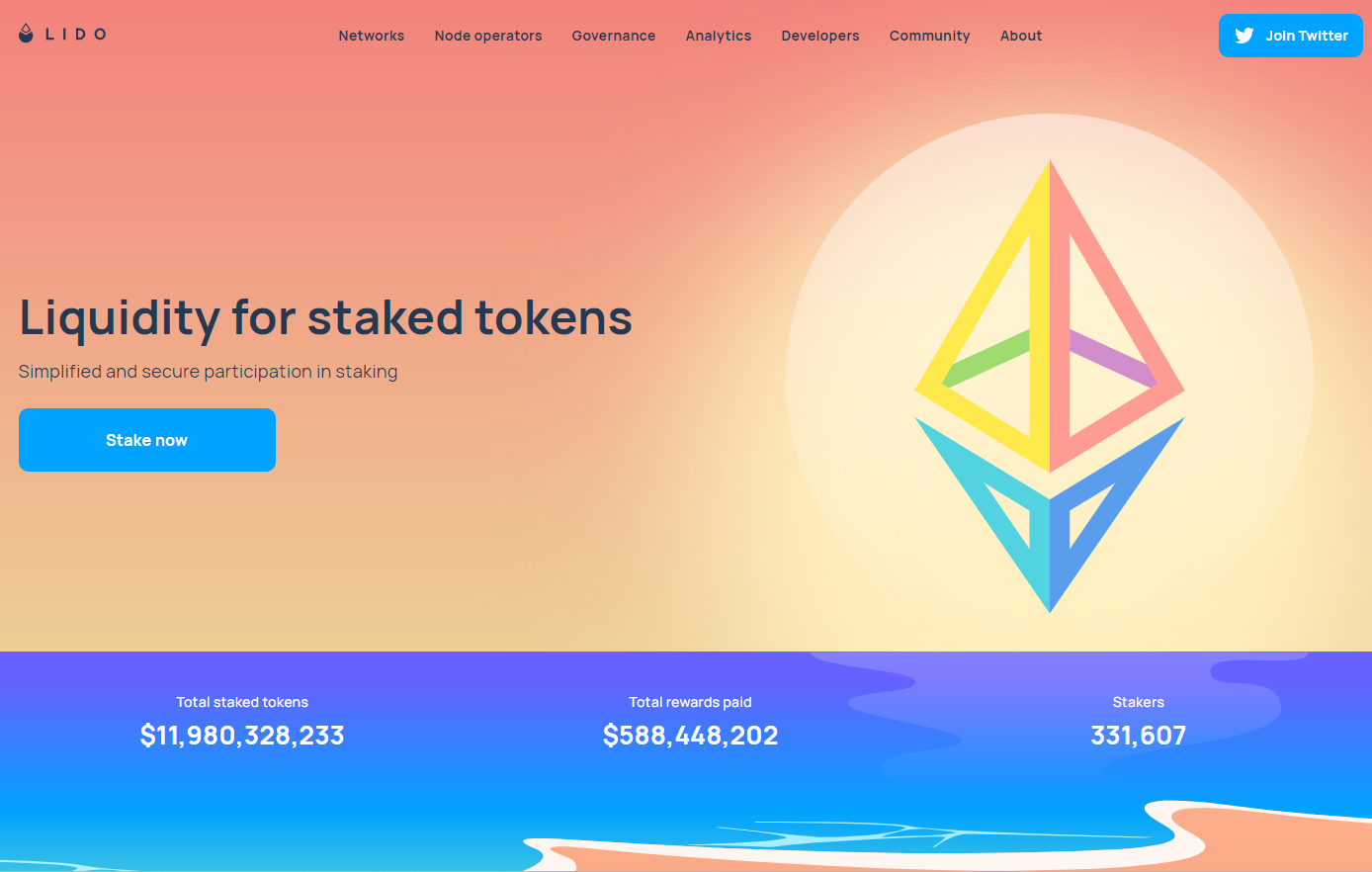

Top Pick - Lido (LDO)

Lido is a liquid staking solution for proof-of-stake currencies. Before the Ethereum Merge in March 2023 which unlocked ETH staking withdrawals for the first time, Lido was the first protocol to offer liquid staking, which allowed users to deposit and withdraw ETH at any time.

Learn more about Lido here.

Best Value - Rocket Pool (RPL)

Rocket Pool is a liquid staking protocol on Ethereum that allows anyone to stake ETH or join a decentralized node operator network. Rocket Pool makes use of mini-pools, staking pools that require less ETH to run which helps give higher yields to stakers.

Learn more about Rocket Pool here.

Decentralized Exchanges (DEX)

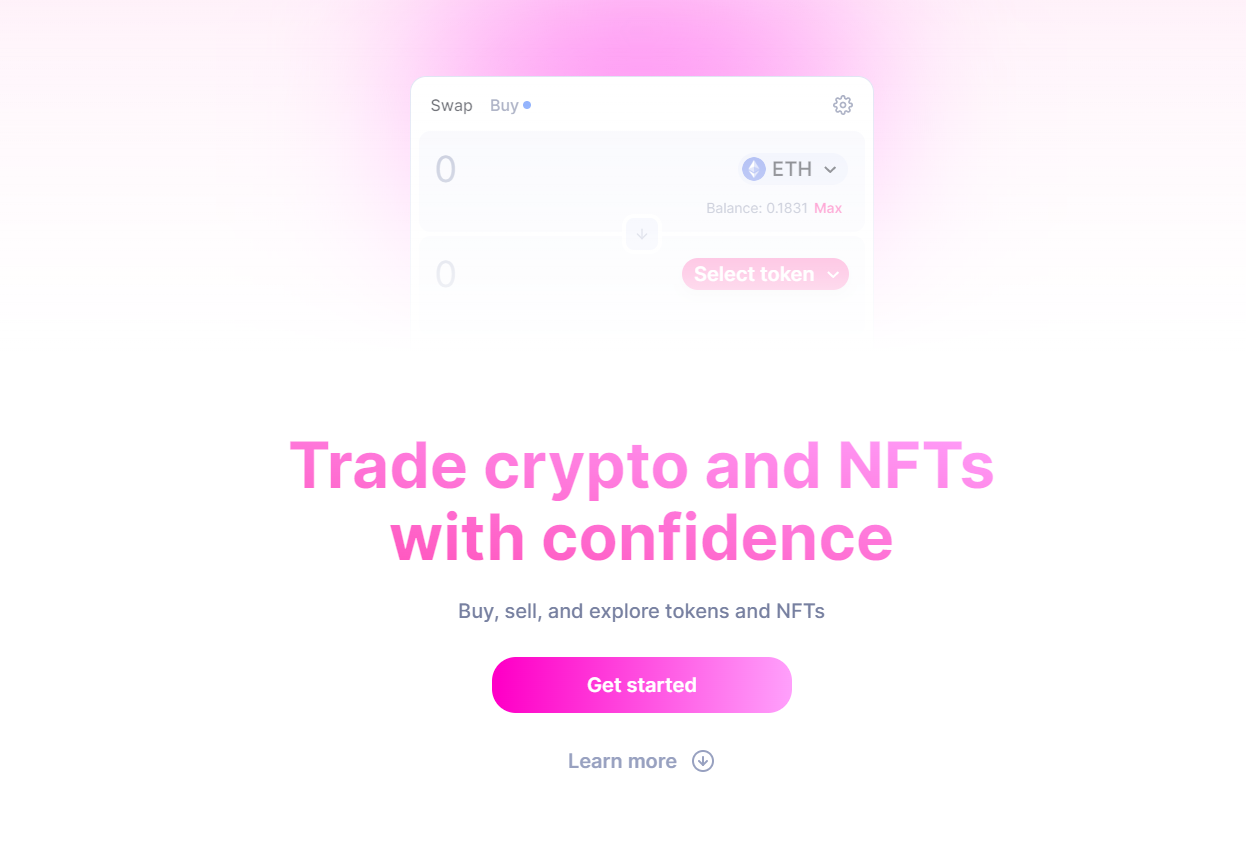

Top pick - UniSwap (UNI)

UniSwap is the largest decentralized crypto exchange. Through the use of smart contracts, users can trade ERC-20 tokens in liquidity pools with paired tokens. This method ensures that there is always a buyer/seller of a token as long as the pool holds enough liquidity.

Learn more about UniSwap here.

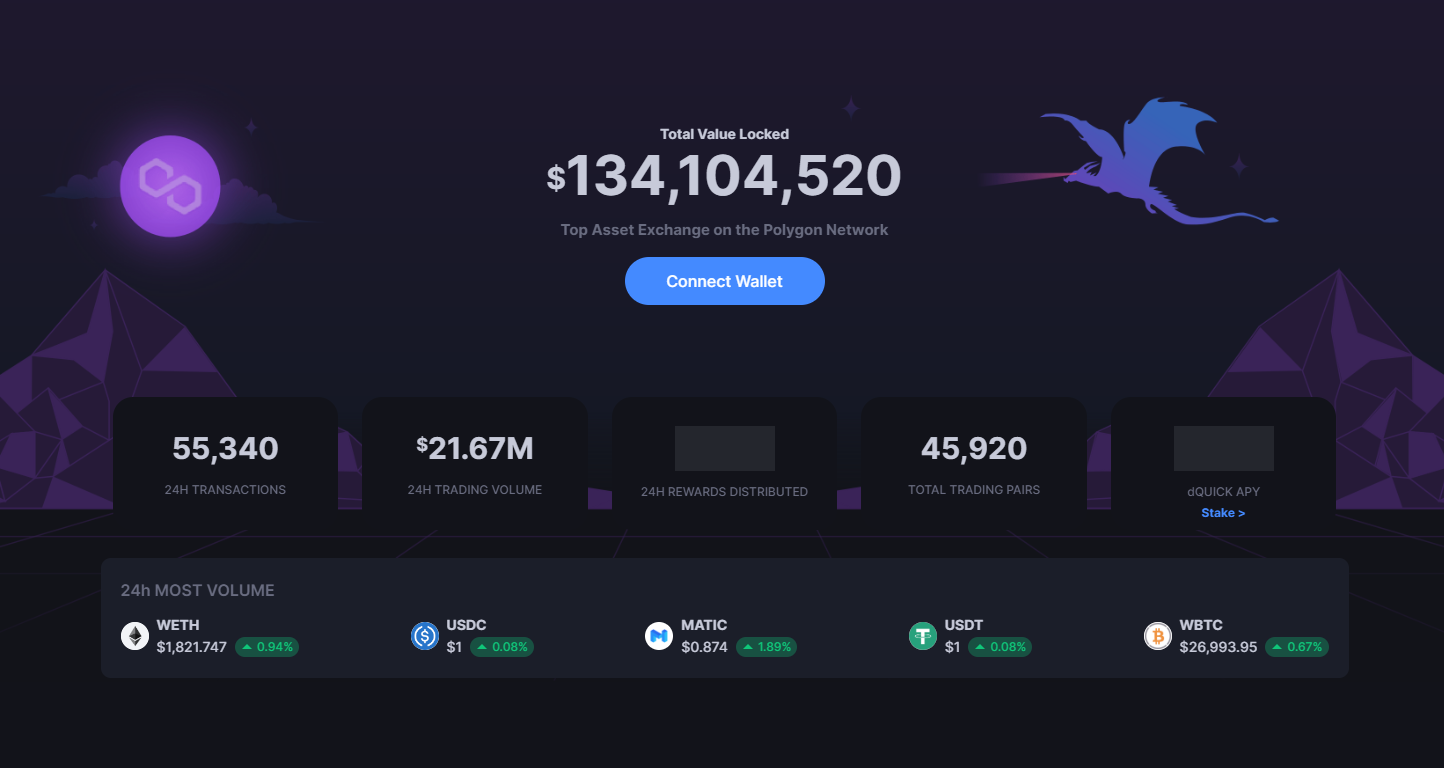

Best value - QuickSwap (QUICK)

QuickSwap is a decentralized crypto exchange built on Polygon, Polygon zkEVM, and DogeChain. It uses an automated market maker (AMM) that allows users to swap and trade tokens via liquidity pools. It is built on a layer-2 scaling solution, which allows for cheaper transaction fees.

Learn more about QuickSwap here.

Lending Apps

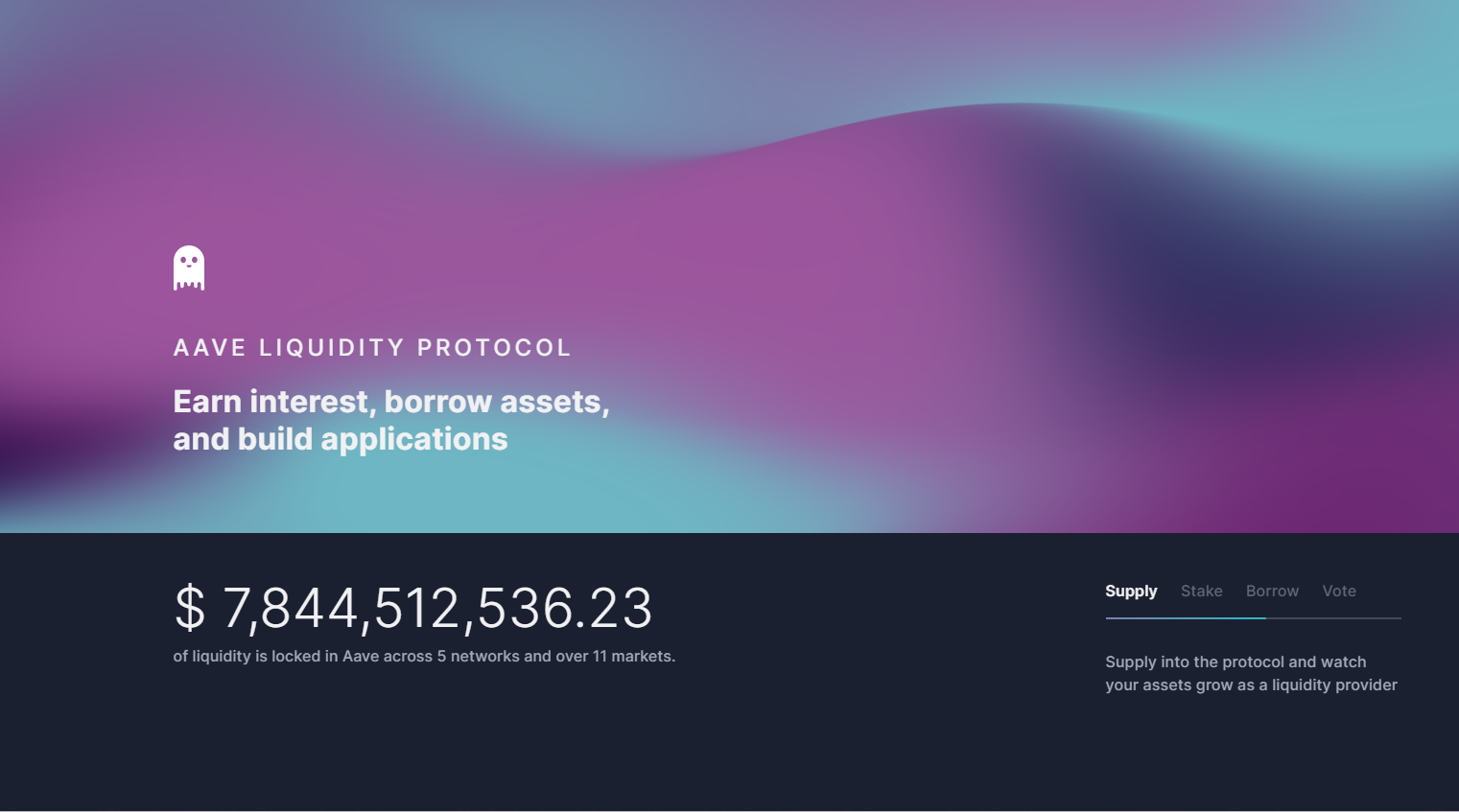

Top pick - Aave (AAVE)

Aave was launched in 2020. It is a non-custodial, open-source liquidity protocol. Interest rates for borrowing/lending fluctuate based on the supply and demand within specific token liquidity pools. Loans on Aave are open-ended but they rely on “health factors” and collateral ratios. This means, if the value of collateral decreases too much, a loan can be auto-liquidated.

Learn more about Aave here.

Best value - Teller Protocol

Teller is a liquidity order book where you can lend, borrow and swap any token. Teller loans are fixed duration loans that utilize a time based liquidation function. That means, as long as the loan payments are made there is no risk of liquidation. Learn more about Teller here.

Frequently Asked Questions

Is DeFi risky?

TradFi and DeFi lending are both risky. It's important to do your research when choosing a lending platform. Before engaging in any DeFi or crypto activity, make sure you understand the risks.

Are crypto and DeFi the same thing?

Crypto and DeFi are not the same thing. Crypto refers to digital currencies which are built on blockchain technology. DeFi (Decentralized Finance) refers to an ecosystem of applications and protocols that use blockchain technology. So not all crypto is DeFi. But, all of DeFi uses cryptocurrencies.

What is a dAPP?

dAPP is short for decentralized application. It is an application that runs on a decentralized blockchain. dAPPS can be used to facilitate DeFi lending, currency exchange, token trading, yield farming, etc.

Is DeFi legal?

The legality of DeFi depends on where you live. Some countries have very strict rules and regulations surrounding DeFi and crypto in general. In the United States, the legality of DeFi can vary state-to-state. Make sure to research the governing rules of your state and country before engaging in any DeFi activities.

How much can you make in DeFi?

Investing in crypto can be risky and you are not guaranteed to make money, earn yield, or income through DeFi activities. However, many DeFi users have been able to make above-average returns on their investments through lending, leveraged trading, and yield farming. Again, nothing is guaranteed and investing is risky.

What's the difference between NFTs and DeFi?

NFTs, non-fungible tokens, are unique digital assets that exist on a blockchain. NFTs can be artwork, music, videos, and anything really. DeFi, decentralized finance, basically includes any peer-to-peer service on a blockchain. They are not the same thing. Although, NFT owners do frequently participate in DeFi by using NFTs as collateral for a crypto loan, Buy Now Pay Later options and yield earned from staking.