Liquid Staking after Shanghai

TL;DR:

1. The Shanghai fork will change staking forever

2. Volume in liquid staking protocols is continuing to grow

3. Users can boost the yield of LSDs by leveraging them in DeFi

Ethereum Staking

When Ethereum transitioned into ETH 2.0 with a proof-of-stake (PoS) consensus network, it opened up the opportunity to stake ETH on the Beacon Chain. Stakers or validators with a minimum of 32 ETH, verify transactions on the blockchain and in exchange earn staking rewards.

However, any staked ETH and any rewards earned were locked up indefinitely.

But on April 12th, the Shanghai Fork went live, and over $34 billion in staked ETH is now unlocked for the first time in two years.

That’s over 15% of all ETH that exists.

Liquid Staking

During the lock-up period for staked ETH, an alternative emerged. Liquid staking unlocks liquidity for staked tokens with a derivative token (LSD). A liquid staked derivative/token (LSD/LST) is issued in exchange for an equivalent value of ETH.

These tokens continue to earn staking rewards and can be used across many DeFi protocols.

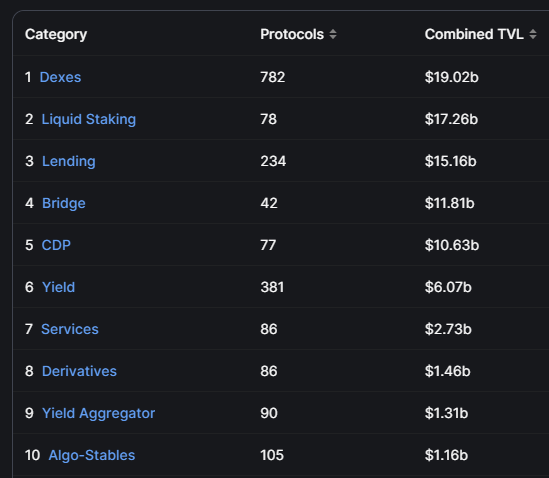

Since 2020, Liquid staking has dominated in volume across the DeFi ecosystem.

Currently #2 in TVL

Staking after Shanghai

Now that Shanghai is live, it’s likely that a percentage of the $34 billion locked up will migrate into liquid staking protocols, Dexes, and lending protocols as stakers take advantage of the opportunities from increased liquidity.

Full withdrawal of staked ETH will take approximately 400 days to be unlocked due to a withdrawal queue.

Top Liquid Staking Protocols

Here are the Top-5 LSD protocols (ranked by volume)

- Lido

- Token: stETH

- TVL: $11.5B

- APR: 4.7%

- Benefits: 10% protocol fee is evenly split between the DAO (LDO token) and node operators - Coinbase

- Token: cbETH

- TVL: $2.3B

- APR: 3.43%

- Notes: Coinbase is a notable, centralized entity, and this comes with varying benefits & risks. - Rocket Pool

- Token: rETH

- TVL: $1.3B

- APR: 3.65%

- Notes: Mini pools increase opportunity for stakers and increase yield for node operators. - Frax

- Token: frxETH

- TVL: $252M

- APR: 6.96%

- Notes: Including FXS incentives, offers the highest APR - Ankr

- Token: ankrETH

- TVL: $196M

- APR: 3.41%

- Notes: Stakers earn additional farming rewards

DeFi Opportunities

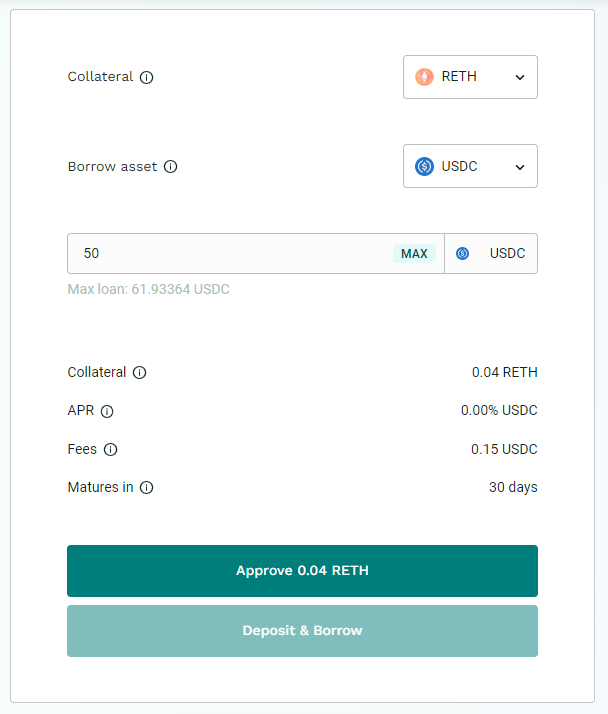

Users can leverage their staked ETH in a variety of ways. One example would be leveraging rETH (Rocket Pool) on Teller for a 30-day loan.

What you can do with rETH:

1. Stake ETH on Rocket Pool & earn 3.65% APR

2. Leverage rETH as collateral for a USDC loan on Teller

3. Use USDC for additional yield farming opportunities

Risks

- Teller loans have fixed durations. That means if a borrower misses a payment, they forfeit ALL of their collateral.

- Depending on what a user does with the borrowed money, could result in an inability to make loan repayments on time, which would lead to a loss of collateral.

- Transaction fees from activities could reduce yield

- A DePegging event could reduce the yield

Summary

Liquid staking is a viable option for users looking for ways to balance risk, reward, and opportunity.

Lending protocols, like Teller, that accept staked tokens as collateral offers endless opportunities to leverage liquidity throughout the DeFi ecosystem.

You can borrow against your staked ETH (rETH, stETH, cbETH) on Teller today: Borrow Now.

📃 Teller V2 Docs – https://teller.gitbook.io/teller-lite/

🔒Github – https://github.com/teller-protocol

👾 Discord – https://discord.com/invite/teller

🐦 Twitter – https://twitter.com/useteller

🖥️ Teller App – https://alpha.app.teller.org