Why Lending and Earning Crypto is One of The Best Strategies in Bear Markets?

The crypto market is full of ups and downs, and this is known to everyone who wishes to become a part of it. There is a constant battle between the bears and the bulls globally 24 hours a day, making it one of the most volatile investment classes. Market conditions and sentiment play an essential role in deciding the return an investor will receive in time. A period of consecutive negative returns where the prices fall below 40% from their recent all-time high is generally considered a sign of a bear market in the crypto industry.

The last bear cycle of 2018 was devastating for many crypto investors. The current bear cycle of 2022 has already witnessed an 80% drop on average in altcoins prices from their all-time highs. This, by some experts, is believed to be the worst crypto winter in the last decade. While many investors are still looking for different solutions to protect their funds, many have already succumbed to the bear's ferocious claws.

However, there is a solution to every problem, and therefore there are strategies that can help you navigate the bear market successfully. Your risk appetite, financial goals, and various objectives play a crucial role in deciding which investment strategy might prove fruitful for you. While the crypto market, in general, is trying to survive the wrath of the mighty bears, there are a few sectors in this space that are thriving despite the crypto winter. Every alternate day there is one story about the decentralized finance (DeFi) sector making breakthroughs in the blockchain space.

From letting investors lend their holdings to earn passive income to helping people buy real estate with crypto mortgages, the DeFi space is still thriving. However, the question remains: What is the best strategy for new investors in this bear market? Investors look for passive income opportunities without doing anything, an opportunity to generate returns on their idle assets.

Bear markets are the best time to keep your portfolio either in stablecoins or in Bitcoin. Is there a way to earn passive income on these coins even during these challenging times? Can my depreciating assets still prove helpful in generating some returns?

Before we deep dive into how the Lend & Earn strategy can help you minimize your losses during this bear market, let us walk you through what is crypto lend and earn. How is it different from HODL? and how can you earn passive income from your assets using this strategy during this bear market?

What is Crypto Lend and Earn

The process of depositing cryptocurrencies that are then lent out to the borrowers in return for regular payments of interest is called crypto lending. The payments are usually in the form of crypto assets that get compounded on a daily, weekly, or monthly basis.

Crypto lending serves a great opportunity for investors to borrow against their crypto assets. On the other hand, lenders can earn extra interest in the form of crypto rewards for contributing to the lending pool. Lending platforms emerged in 2020 and are worth billions today.

There are two components in a crypto lending process: The crypto loans and the deposits through which interests are earned. Just like a bank account, investors can deposit their cryptocurrencies in a deposit account which then helps them earn an interest of up to 8% APY. This percentage return depends both on the platform used as well as the cryptocurrency. The platforms then use these deposited funds to lend them to borrowers for their requirements. These crypto loans are usually over-collateralized loans given to the borrowers requiring them to deposit a minimum of 100% and sometimes 150% of their crypto loan’s value as collateral.

If you think overcollateralization is too heavy on your portfolio, protocols like Teller also provide zero-collateralized crypto loans in various markets.

Read: Ultimate Guide to Zero collateral crypto loans

While depositing crypto to a lending platform, users can easily earn a generous amount of interest on these deposits, which are usually way more than the interest offered by traditional banking systems. When lent out to the borrowers, the deposited funds require the borrowers to pay a portion of the interest. These funds can also be alternatively invested to earn additional yield. With the advent of DeFi loans, interests can be earned right away, typically compound on a minute-by-minute basis. The best part about DeFi lending and earning is, the deposited collateral also earns interest despite being attached to a loan.

Additional Read: 5 Factors to Remember while choosing a Crypto lending & Borrowing Platform

HODL vs. Lend & Earn

What is HODL?

The word HODL (misspelled for HOLD) stands for "Hold on to dear life" and is a commonly used slang in the crypto space. This word specifically refers to the firm decision of the investor to acquire a crypto asset and store it for a long time. This decision is seen as an investment philosophy for crypto assets with a large market cap or a promising roadmap. The HODL strategy is based on investing in crypto purchases which are generally at a low price and holding them for the long run to obtain a large profit on the investments when the value of the crypto asset increases and the market peaks its bull momentum.

Pros of HODL

- HODLing is a good entry strategy for new investors.

- HODLing is simpler compared to advanced strategies like day trading.

- Investors don’t need to analyse price activities. They don’t need to track price movements daily to plan their entry and exit points.

Cons of HODL

- Experienced traders believe that the HODLing strategy might not prove helpful in maximizing profit as compared to other strategies.

- No returns on idle assets.

- HODLing does not help investors take full advantage of Bitcoin's volatility or any other crypto. HODLing combined with staking or lending can help investors earn greater profits without giving up their positions.

What is Lend & Earn?

Lending is collecting or earning interest from people by lending your crypto assets. Crypto lending, though not as mainstream as other investment strategies like HODLing and staking, is one of the most efficient methods of earning passive income and generate returns, especially during crypto winters.

While a few crypto exchanges offer lending or earning options, much-decentralized finance (DeFi) lending apps like Teller and Aave also make this possible for their users. To use these, you must buy and add compatible coins to the crypto wallet and then deposit the fund into the app. A step-by-step guide on this is below.

Additional Read: Teller vs Aave

The interest earnings on crypto loans are way higher than any other investment method. However, you must do your due diligence before choosing any investment strategy.

Pros of Lending

- Excellent source of Passive Income

- Attractive interest rates (much higher than banks)

- Investors can lend without losing their open position in the market.

- HODLing and Lending can go hand-in-hand. Investors can sell the assets when they obtain a very high value and earn extra interest while achieving that value.

- Interest can be earned irrespective of the market sentiment i.e. bearish or bullish.

- DeFi applications help investors earn profits right away, sometimes compounding daily.

Cons of Lending

- Higher chances of default than in traditional loans. Platforms make over-collateralization on the loans mandatory to protect lenders from losing their funds.

- Lending protocols are not as insured as the traditional banking systems and the news of centralized lending platforms failing in the current bear market has raised doubts in investors.

It is interesting to note that none of the DeFi lending platforms have faced any challenges due to 3 reasons:

- Community-driven pools or loan requests

- Transparency for users as all activities are visible on the blockchain. This transparency also prevents companies from acting anyway against the community’s interest

- Governance is also democratic and decentralized.

How to Lend Crypto and Earn rewards

The process of crypto lending and borrowing is super simple. The lender deposits crypto assets, say Ethereum or Bitcoin, to the lending platform. The lending platform then proceeds to make the accumulated fund available to the borrowers at agreed conditions. Borrowers can then avail of this loan for a specific period paying an agreed interest and return the fund when the period expires.

Here's a step-by-step guide to avail of uncollateralized crypto loans using Teller, a premium protocol offering under-collateralized crypto loans for multiple financial markets.

Step 1: Visit the official website of Teller, and click on Launch App. This will take you to our marketplace.

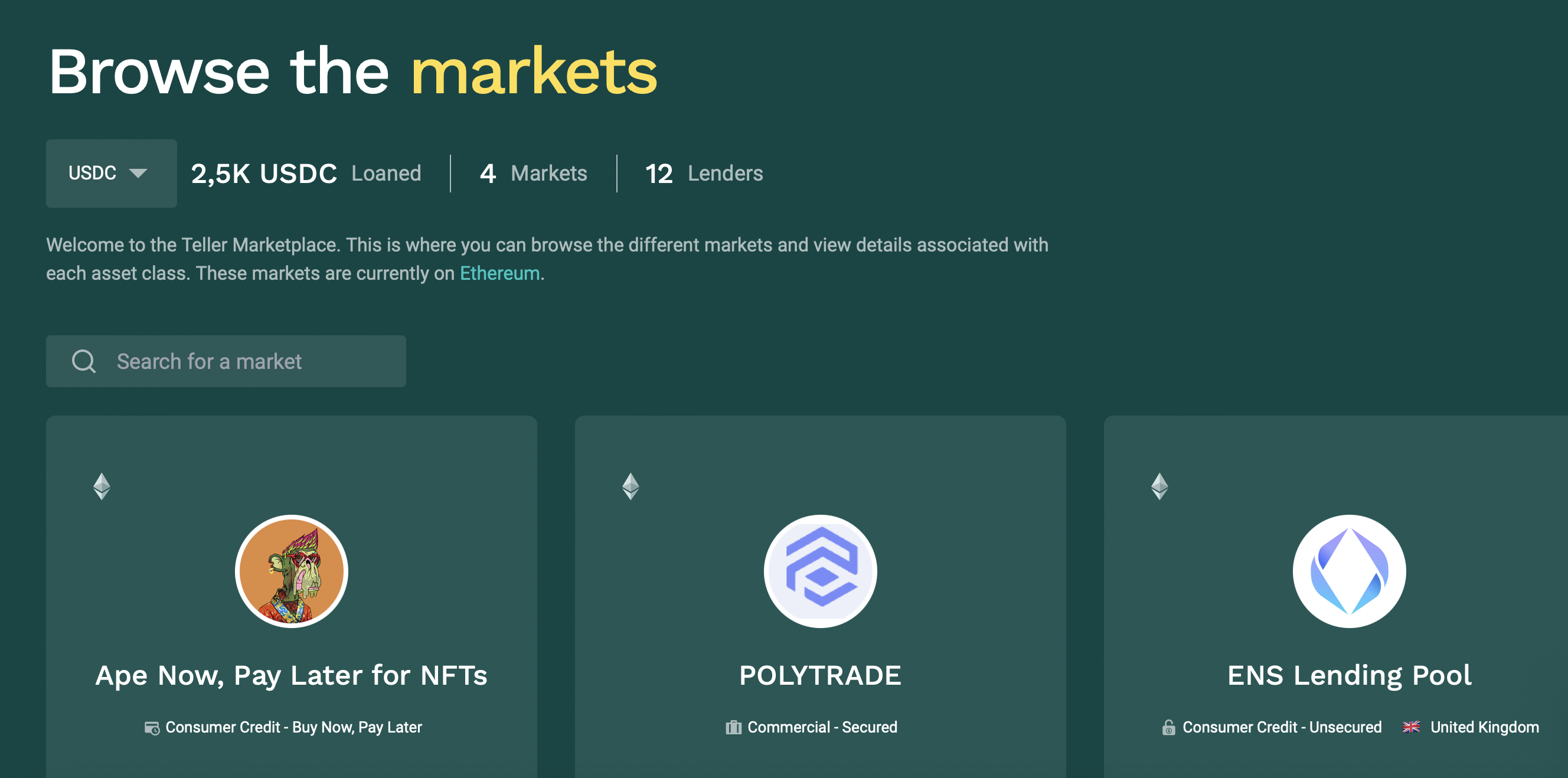

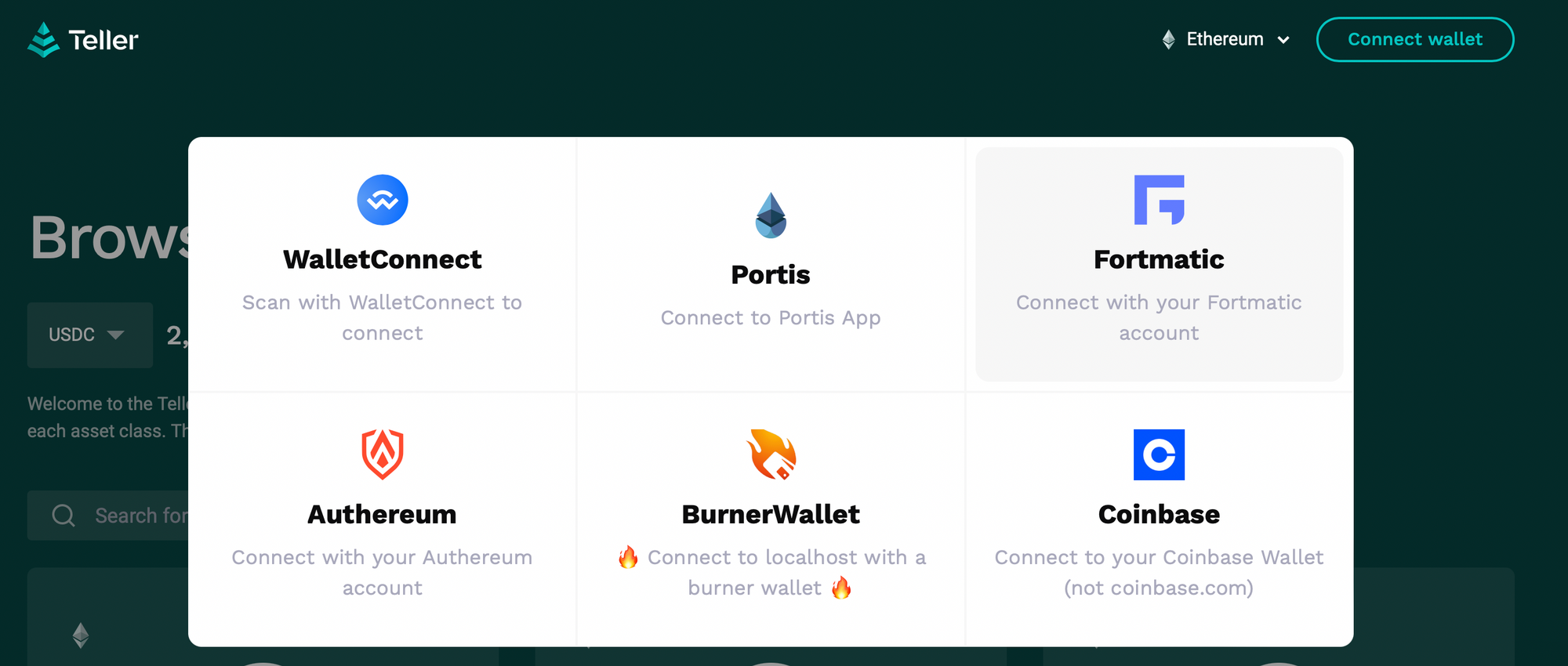

Step 2: Upon opening the lending page of Teller, you are asked to connect your wallet. Various wallet options like WalletConnect, Authereum, Coinbase, Fortmatic, etc, are available. Choose the wallet you are most comfortable with to connect to the Teller protocol.

Step 3: Once the wallet is connected, you are asked to choose from the multiple financial markets available for lending, such as Polytrade, ENS Lending Pool, and USDC.Homes, etc.

Additional Read: Crypto Mortgages: How to buy a house using cryptocurrencies

Step 4: Before choosing any market, read about it in detail to understand whether they serve your purpose. Upon clicking on the "Go to Market" button, you are directed to the landing page containing all the information regarding the APY, expiry date, and the lending period.

Step 5: If satisfied with all the conditions, all you have to do is click on the "Fund the Market" button, and Voila! You are ready to earn some extra interest on your crypto holdings.

Conclusion

HODLing and lending are some of the most popular investing strategies in the crypto space. However, adopting these techniques should solely be at the investors' discretion. While hodling has its perks, lending can prove to be a very profitable strategy during bear markets. We cannot argue that one strategy is better than the other; it ultimately depends on the needs and purposes of the investor. However, lending can help you enjoy the perks of hodling while helping you earn an extra income otherwise, the bear market does not permit it.

Lending is one of the simplest and easiest ways to earn excellent interest rates compared to traditional banking systems; however, not every protocol offering these perks should be trusted. You should do thorough research before trusting any protocol with your hard-earned money. Always do your research before making any decision that involves your finances.

Stay updated with the DeFi space and more with Teller, a one-stop solution for all your crypto lending and borrowing needs!