Understanding Teller's loan extensions

When your next loan is due, but you don’t want to pay back just yet, simply roll it over into a new loan on Teller.

Why should a borrower use Teller’s loan extensions?

In stark contrast to conventional lending with unforgiving demand for immediate loan repayment, Teller ushers in a new era of flexibility. Users are granted the power to extend their loan duration, contingent upon the availability of liquidity from a willing lender. This unique feature alleviates the burden of instant repayment, effectively transforming DeFi lending into a more user-centric experience.

DeFi has been a game-changer in the world of finance, offering users unprecedented control and flexibility over their assets. However with such flexibility also comes risk and volatility. Teller's loan extension capability allows users to seamlessly extend their existing loans, eliminating the immediate pressure for repayment and the risk of loan liquidation.

How the magic works

1. Borrowers Initiate the Extension:

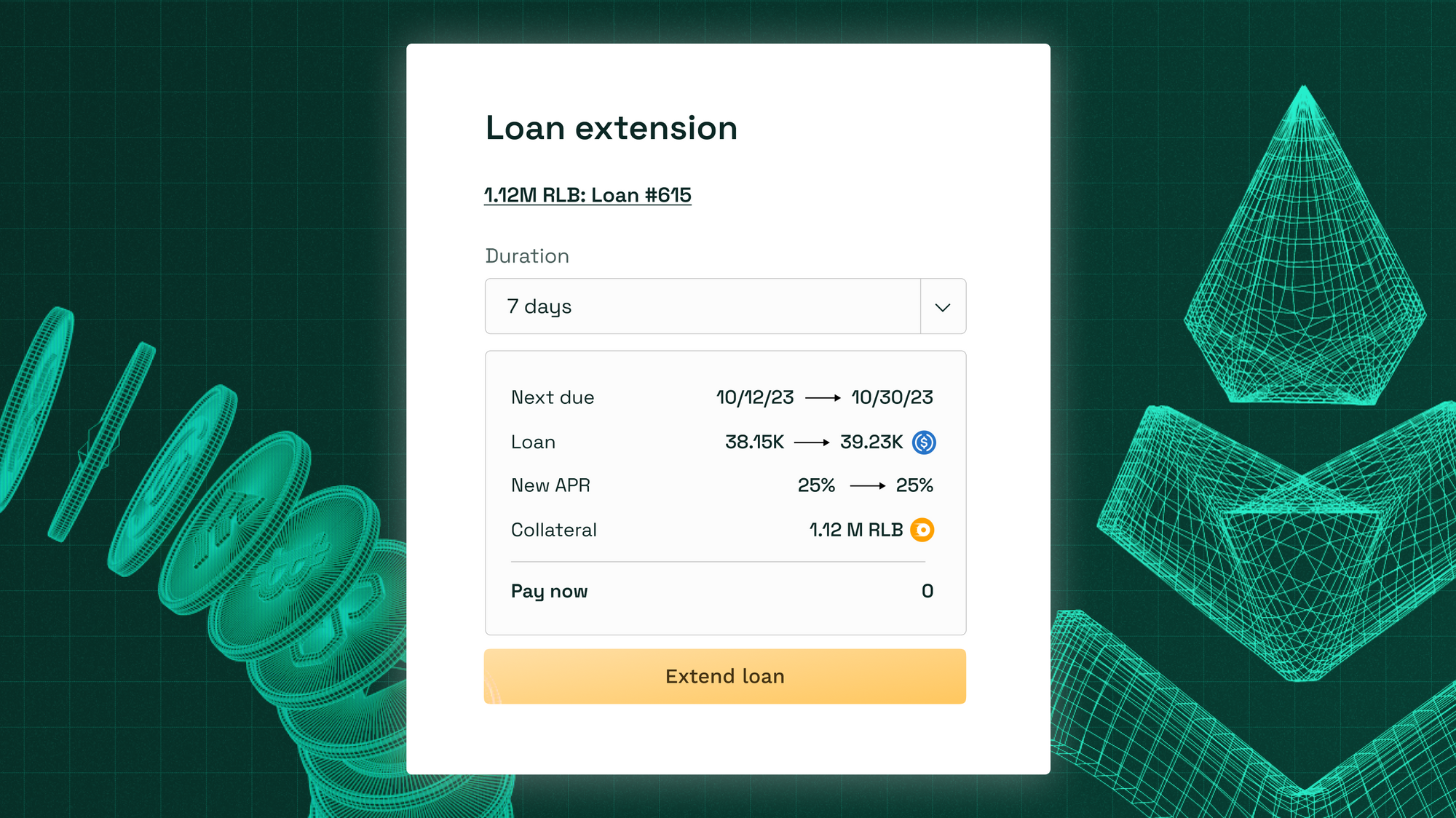

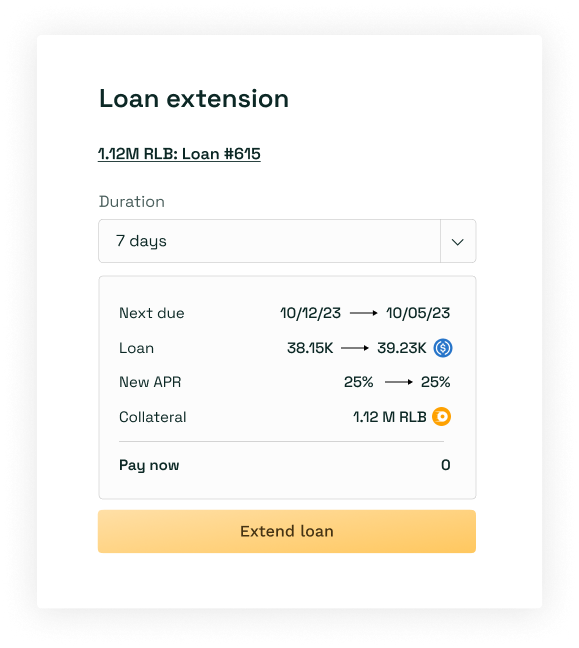

When nearing repayment, borrowers can extend their loan by choosing the "Extend Loan" option next to the "Repay Loan" button on their activity page. This opens a modal with an extended loan duration alongside new loan terms. In some instances, a borrower may end up with even better terms than the loan terms they agreed upon in their previous loan. This level of convenience is a significant advantage for users who need to adapt their lending terms to changing circumstances or market conditions.

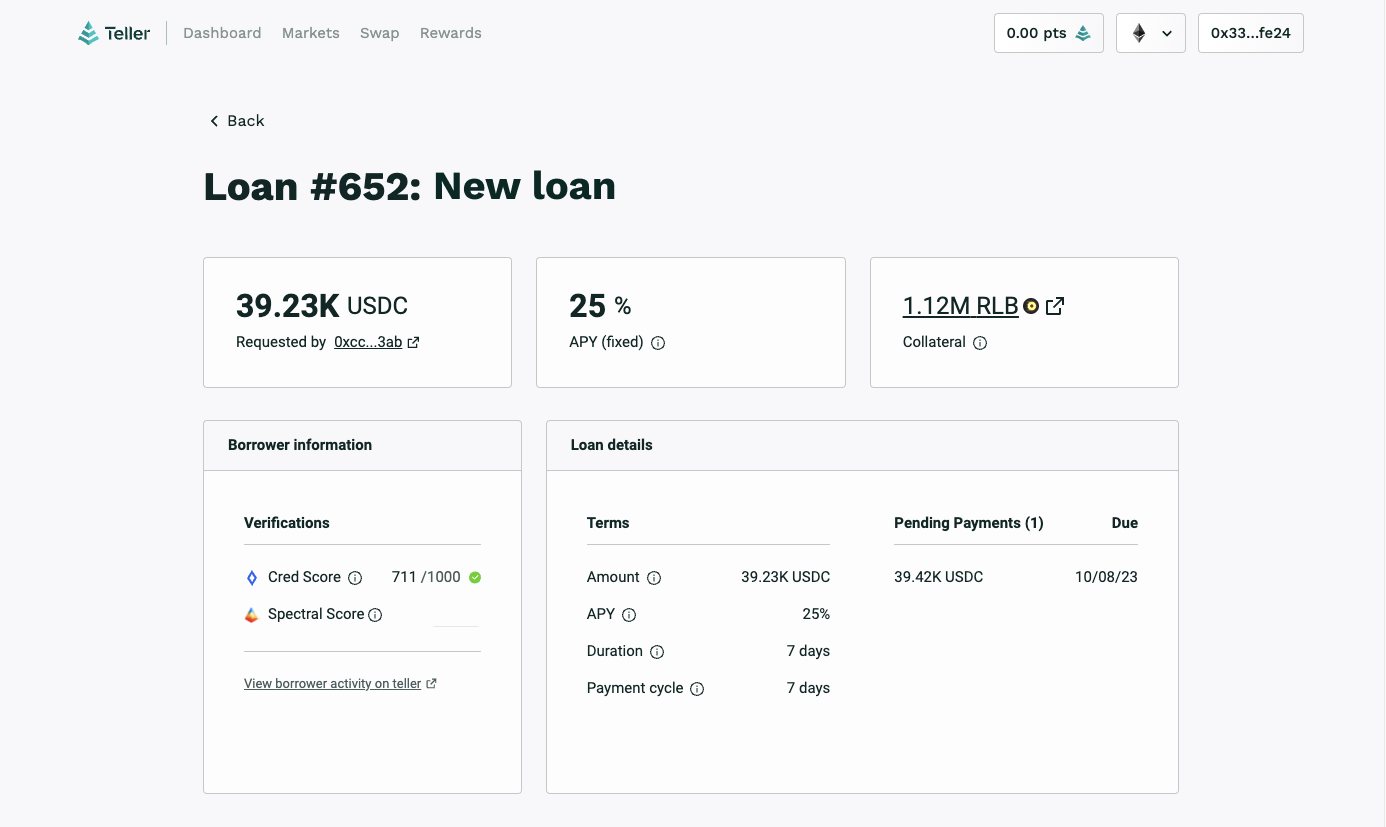

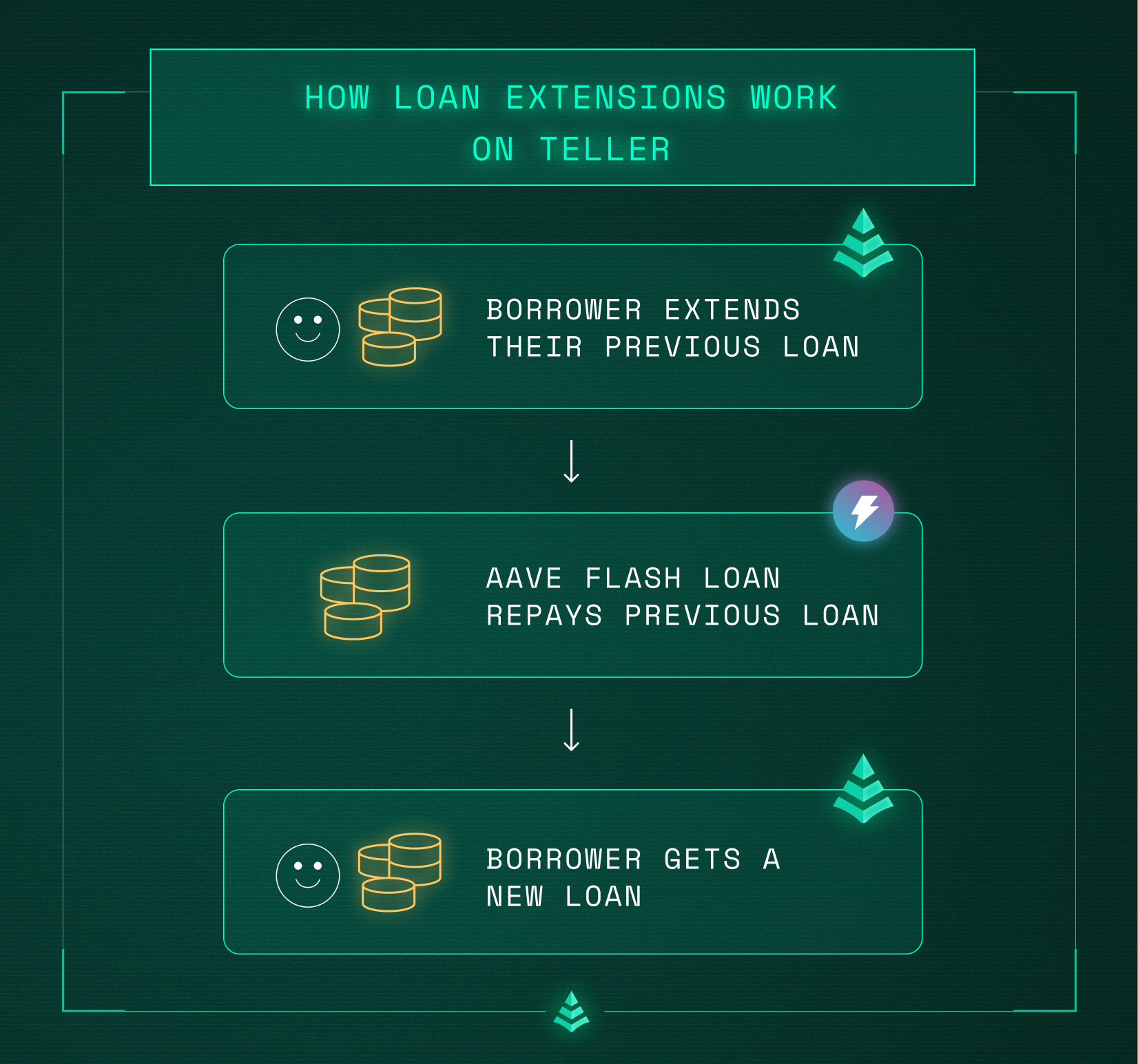

2. Repayment and opening a new loan:

Teller's loan extension utilizes Aave's flash loan to settle the existing debt seamlessly as the new loan is being introduced to the borrower. With the previous loan successfully settled using the flash loan, Teller then opens a new loan for the borrower, effectively extending their loan duration. Borrowers are able to continue using their assets without going through the hassle of obtaining a new loan.

It's important to note that, like any financial transaction, extending a loan may involve certain fees. Borrowers should be prepared to cover any protocol costs and interest occurred during the previous loan, though in some instances, this may not apply. To get a better understanding of how the fees are broken down, go to the loan extension calculator here.

Endless Possibilities

Teller's loan extension offers borrowers a more flexible and convenient way to manage their loans, without the pressure of liquidation or repayment. By simplifying the extension process and minimizing the risks, it eliminates the need for borrowers to repeatedly apply or look for new loans, reducing time spent within the lending process.. Akin to a credit line, borrower can extend indefinitely, ensuring a greater flexibility of financial positions, ultimately redefining the landscape of DeFi lending.