Understanding Fixed APR for Teller Time-Based Loans

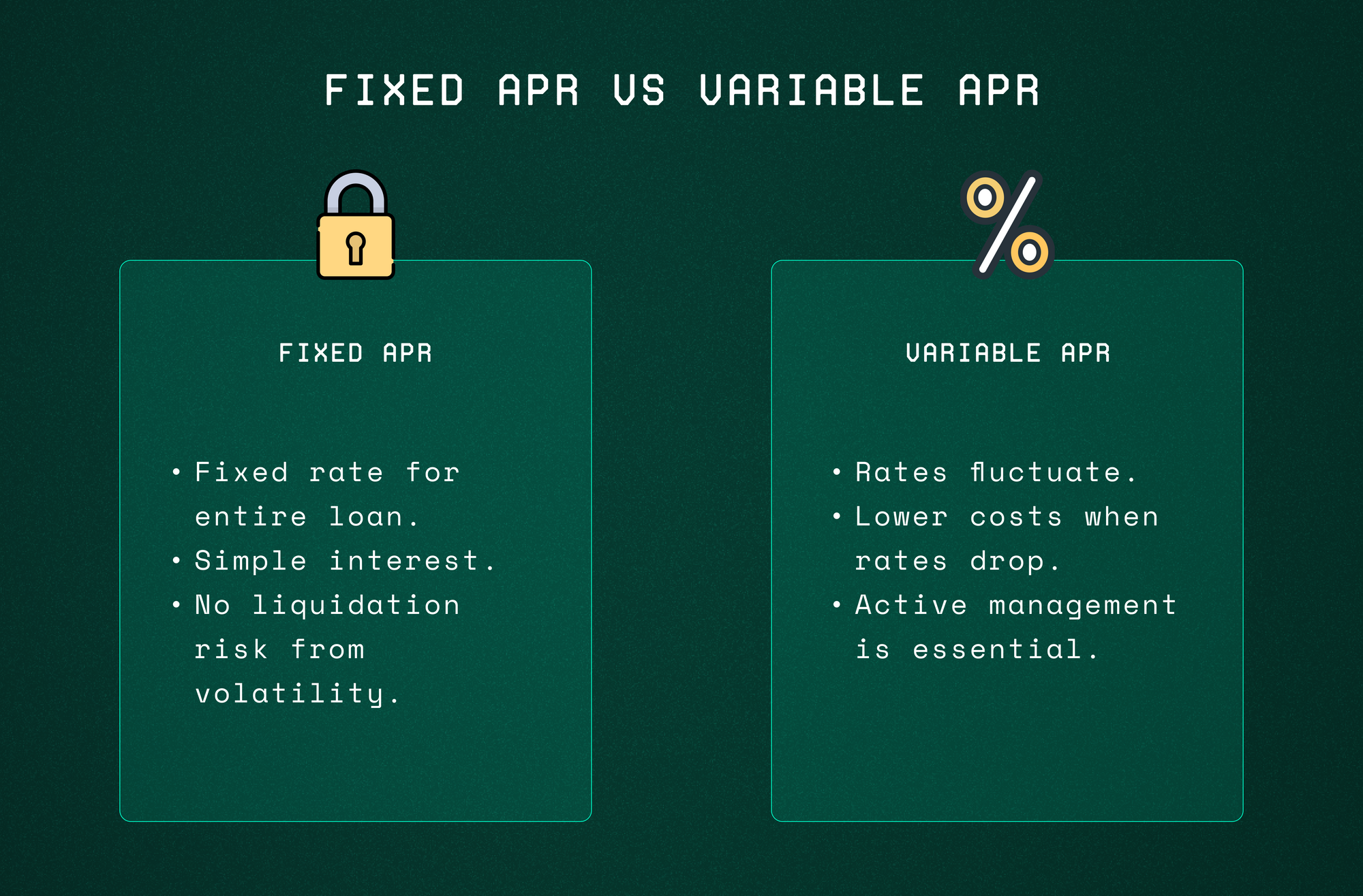

There are two main types of interest rates in DeFi loans: fixed APR and variable APR. In this blog, we’ll dive into the advantages of Teller’s fixed APR model for time-based loans and compare it to the variable APR used by DeFi money markets.

Teller Loans and Fixed APR

Teller’s fixed APR loans provide borrowers with stability and predictability. By locking in the interest rate for the full duration of the loan, Teller ensures that users borrowing costs remain consistent from start to finish. The interest calculation is straightforward: the APR is divided by 365 to determine the daily rate, which is then multiplied by the number of days in the loan term.

For example, a user borrows $5,000 from Teller at a 5% APR for 30 days, the interest is calculated as follows:

- Daily interest rate = 5% APR ÷ 365 = 0.013% per day

- For 30 days, the total interest = 0.013% × 30 = 0.39%

- Interest on $5,000 = $5,000 × 0.39% = $19.50

In this case, the borrower would owe $5,019.50 at the end of 30 days, and this amount remains fixed, regardless of changes in the market. By locking in a constant interest rate, Teller’s fixed APR eliminates the risk of liquidation due to market fluctuations, allowing borrowers to focus on making their scheduled repayments without worrying about sudden interest rate hikes or volatile conditions.

Variable APR

Variable APR loans, such as those offered by DeFi money markets, adjust interest rates based on market conditions, particularly the supply and demand for liquidity. For example, a user might borrow at 1% APR today, but if liquidity becomes scarce, the rate could rise to 4% tomorrow. This dynamic model offers flexibility, as rates may decrease when market conditions improve, allowing borrowers to benefit from lower costs. However, because rates can fluctuate daily and compound continuously (per block), the total cost of borrowing can vary, making it harder to predict the final repayment amount.

In some cases, a low APR can make loans cheaper initially, but if rates increase, the overall cost may rise. Borrowers also need to be mindful of their collateral levels, as changes in interest rates or collateral values can impact the risk of liquidation. This type of loan structure is ideal for those who can actively manage their positions and take advantage of favorable market conditions.

Benefits of Fixed APR Teller Loans

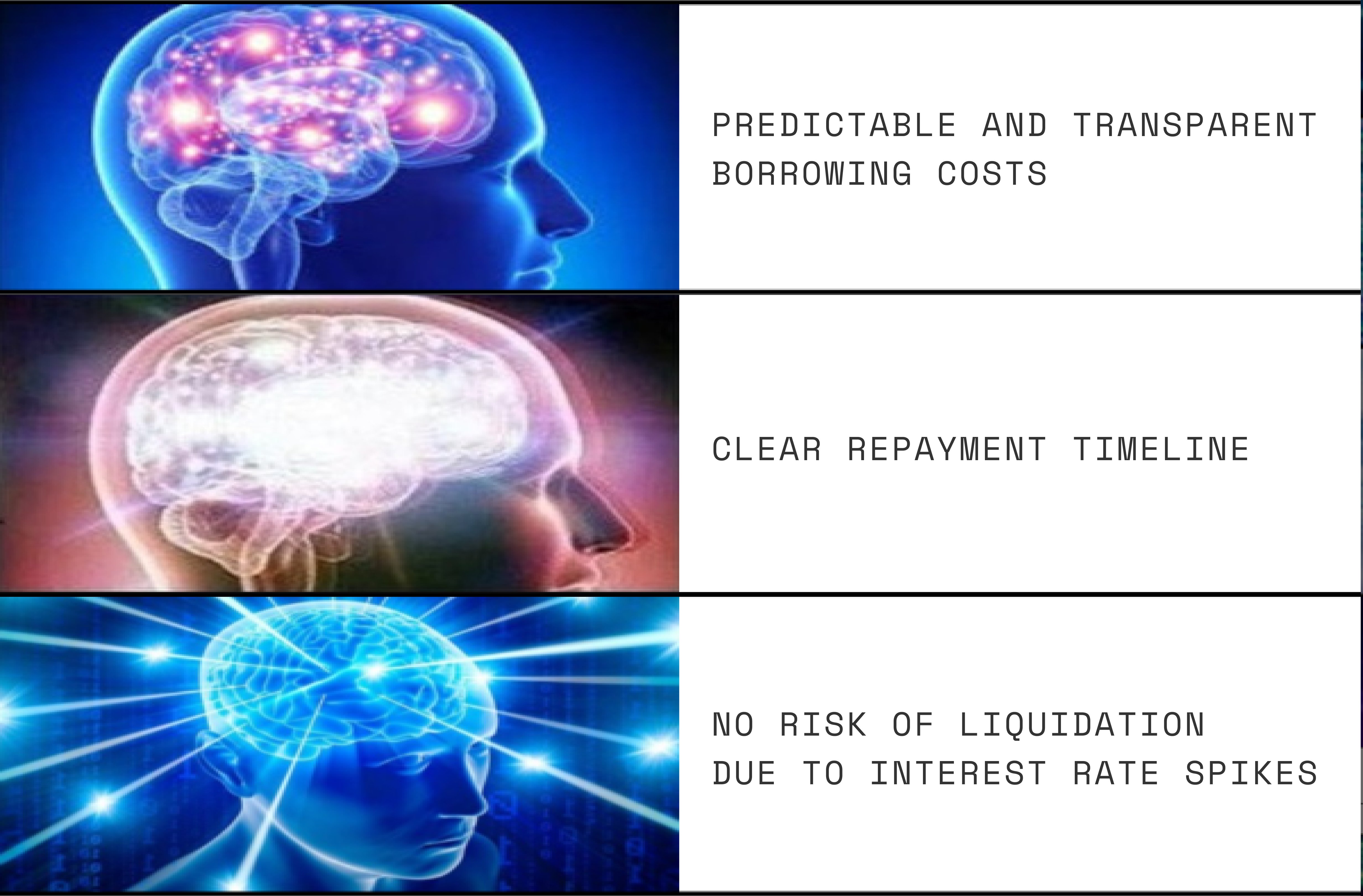

Choosing a fixed APR loan from Teller offers a few key advantages:

- Predictable and Transparent Borrowing Costs

With fixed APR, users know exactly how much interest they’ll pay from the start. Whether it’s a 7-day, 30-day, or 90-day loan, the interest is calculated using a simple cumulative method based on the loan duration. This transparency allows for precise financial planning and avoids unexpected costs due to fluctuating interest rates. - Protection from Market Volatility

Teller’s fixed APR shields borrowers from the uncertainty of market fluctuations. Unlike variable APR loans, which adjust with liquidity and demand, Teller’s fixed rate remains stable throughout the set loan term, providing peace of mind regardless of changes in market conditions. - No Risk of Liquidation Due to Interest Rate Spikes

In variable APR loans borrowers risk liquidation if collateral values drop or interest rates surge. Teller’s fixed APR eliminates this risk by ensuring a constant rate, allowing borrowers to focus on meeting their repayment schedule without worrying about sudden rate changes or market volatility.

How to Use Teller Time-Based Loans

Teller time-based loans offer flexibility for a wide range of DeFi activities, from protecting leveraged positions by improving health ratios to borrowing against one token to purchase another or unlocking liquidity for yield farming without selling long-term assets. They can also be used for real-life expenses outside of DeFi, providing quick access to capital with a clear repayment schedule.

For a deeper look into how Teller time-based loans can be utilized, explore 4 Ways to Use a Teller Time-Based Loan.

Teller’s fixed APR loans offer predictable, transparent borrowing with the security of stable interest rates, making them ideal for DeFi users looking to avoid market fluctuations. Whether users are protecting leveraged positions or covering real-life expenses, Teller’s time-based loans provide flexible solutions without risk of liquidation.

Ready to take advantage of Teller’s fixed APR loans? Borrow now on Teller.org.