Teller Yields, Weekly Digest 12/18

Date: December 18, 2025

Source: Teller on DeFiLlama

This week’s yields reflected moderate borrower rotation, with utilization holding steady across most USDC pairs.

Below is a breakdown of current pool activity and yields.

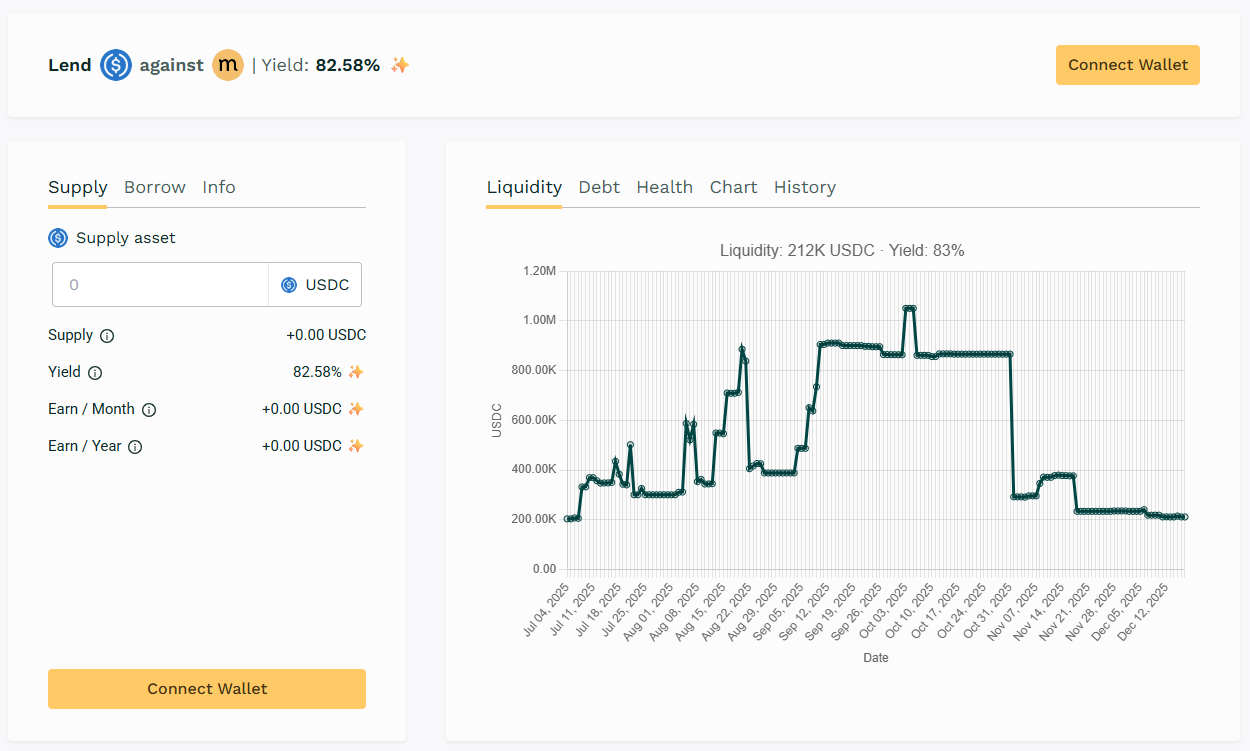

🥇 USDC / $MASA

🧮 APY: 82.58%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

One of the largest active pools this week by liquidity. $MASA takes the top rank this week based on recurring borrowers, reaching yield at above 80% range.

🎯 $MASA anchors the leaderboard with scale and yield.

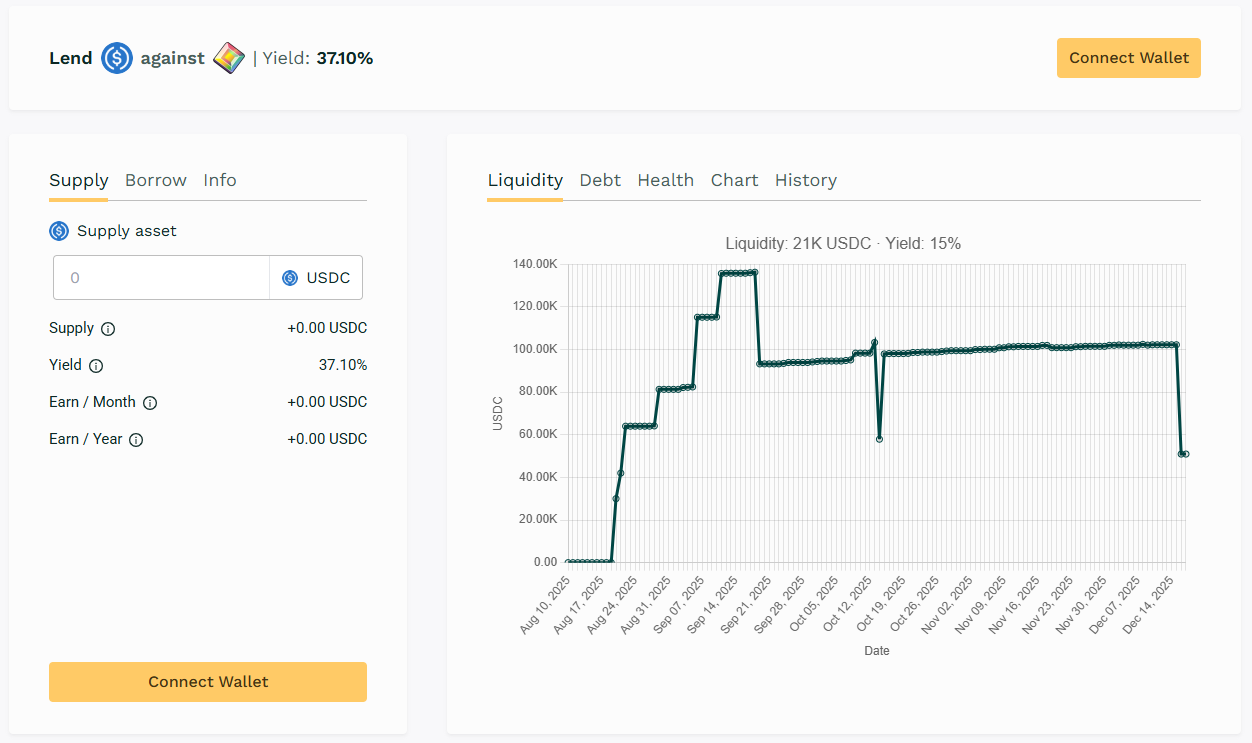

🥈 USDC / $PIXL

🧮 APY: 37.10%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

$PIXL maintained short-term loan cycles with steady borrower participation. This activity kept APY above 35%.

🎯 $PIXL remains one of the most consistently performing pools anchored by recurring borrower activity.

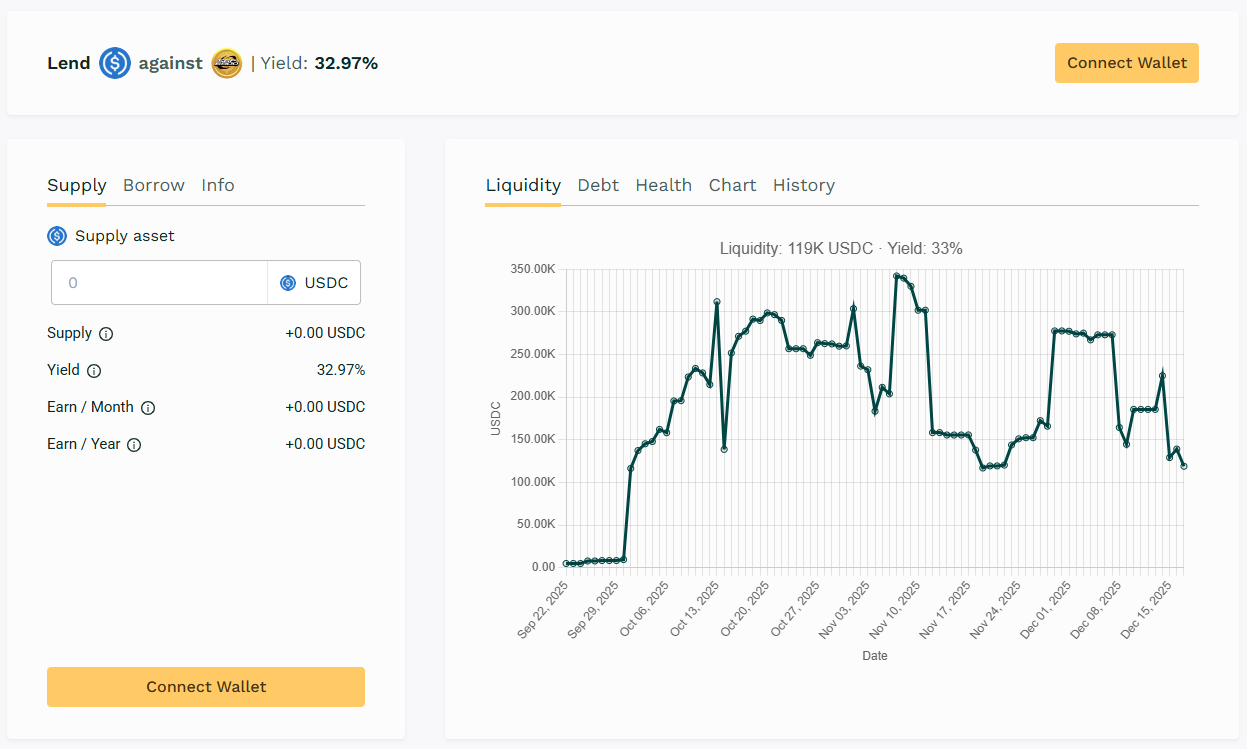

🥉USDC / $SPX

🧮 APY: 32.97%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX continues as a high-volume lending market with loan issuance and repayment frequency, maintaining healthy yield levels above 30%.

🎯 $SPX takes the top 3 spot this week with 30%+ returns.

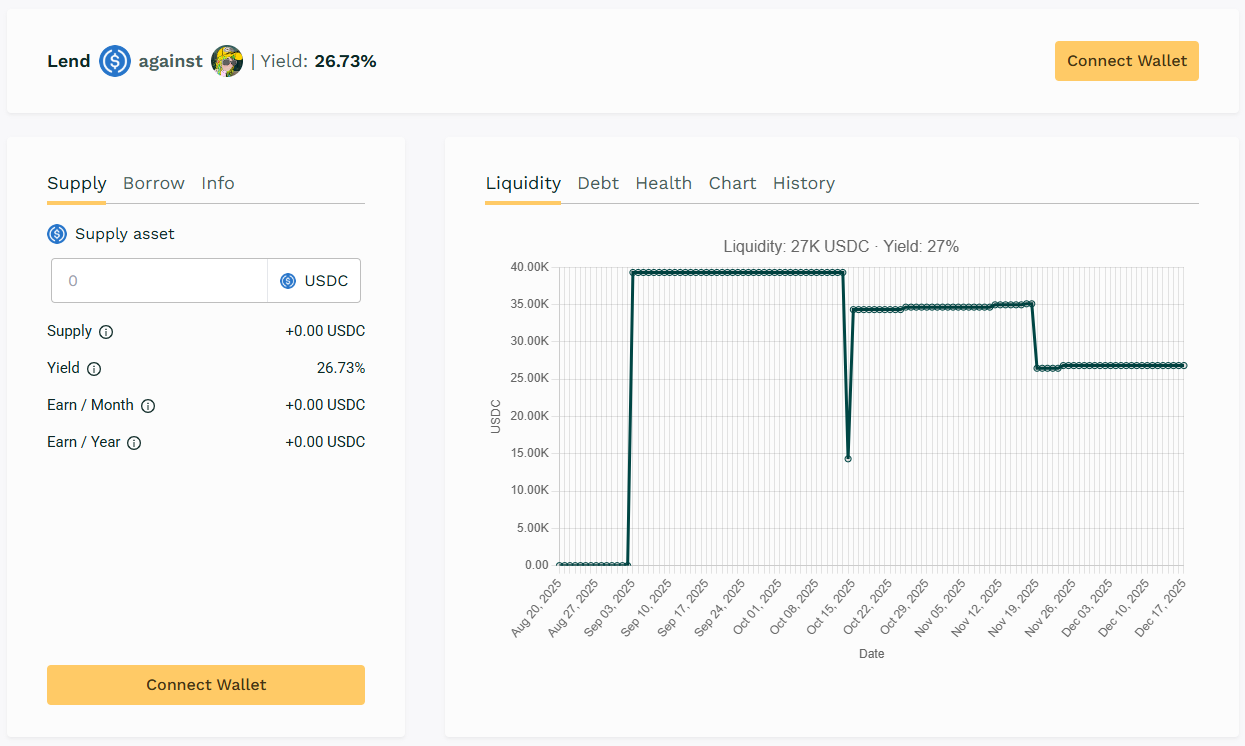

🏅 USDC / $DMT

🧮 APY: 26.73%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper 25% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

🎯 Borrower rollovers keeping yield above 25%.

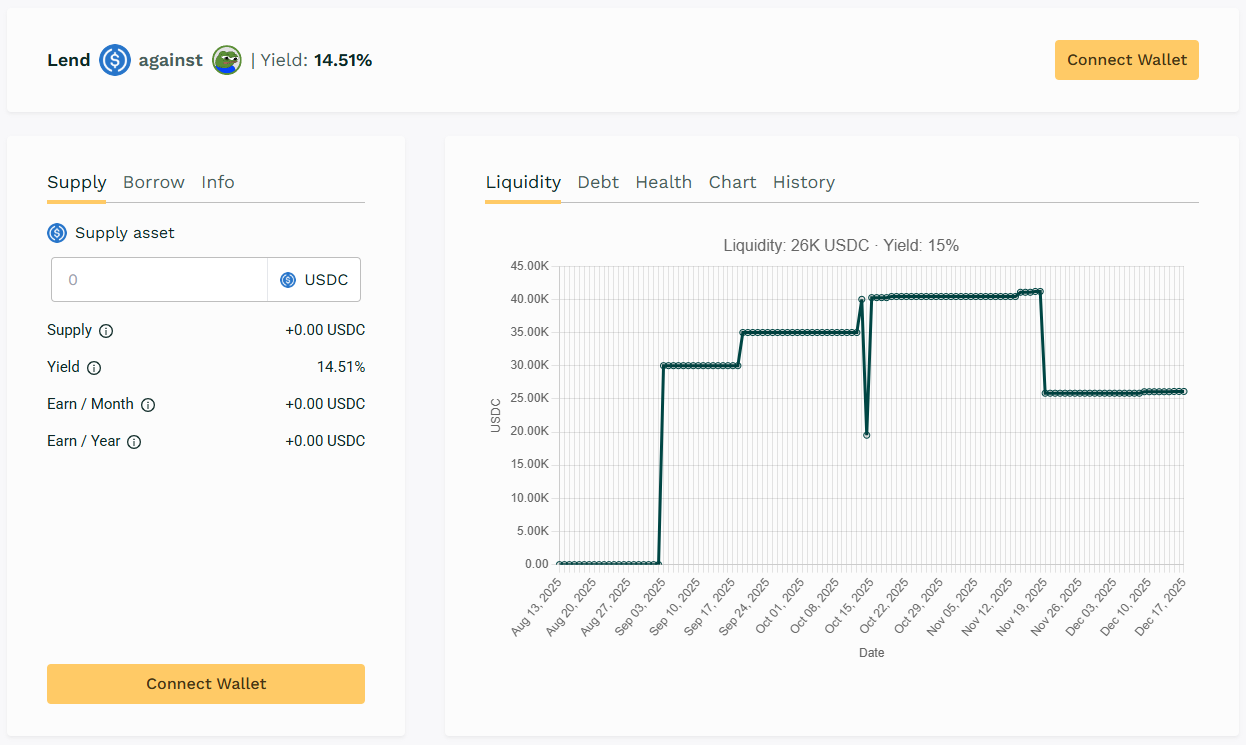

🏅 USDC / $APU

🧮 APY: 14.51%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU continues to demonstrate active loan rollover behavior, maintaining yield levels near 15%.

🎯 $APU pools raised over 26K liquidity with near 15% range yields.

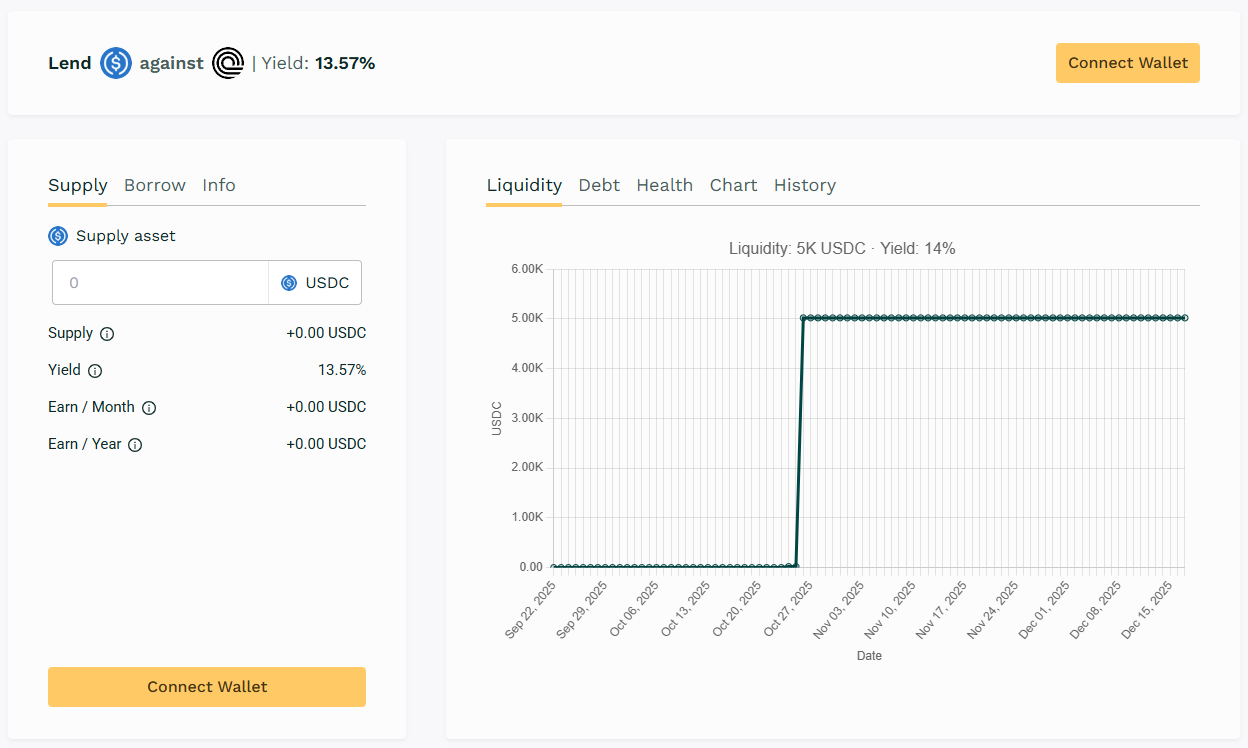

🏅 USDC / $ONDO

🧮 APY: 13.57%

📉 Collateral: ONDO (DeFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 350%

$ONDO pool's new borrowing delivered yields close to 14% despite smaller liquidity size.

🎯 $ONDO entered the top pools this week.

📈 Yield Summary

$MASA takes the top spot with over 82% yield from full utilization. $PIXL follows, while $SPX, $DMT, and $APU sustain returns. $ONDO entering the top charts this week. Overall market behavior points to continued borrower rollover patterns driving mid- to high-tier yields.

📢 Next Week

Stay tuned for next week’s Digest for updated yield movements and borrower trends across Teller markets.

👉 Monitor live APYs anytime at app.teller.org/lend