Teller Yields, Weekly Digest 12/11

Date: December 11, 2025

Source: Teller on DeFiLlama

This week’s pool data shows dynamic APY shifts as rollover activity and borrowing trends moved across multiple pools. The following breakdown captures the latest liquidity, and yields across pools.

🏆 Top Lending Pools

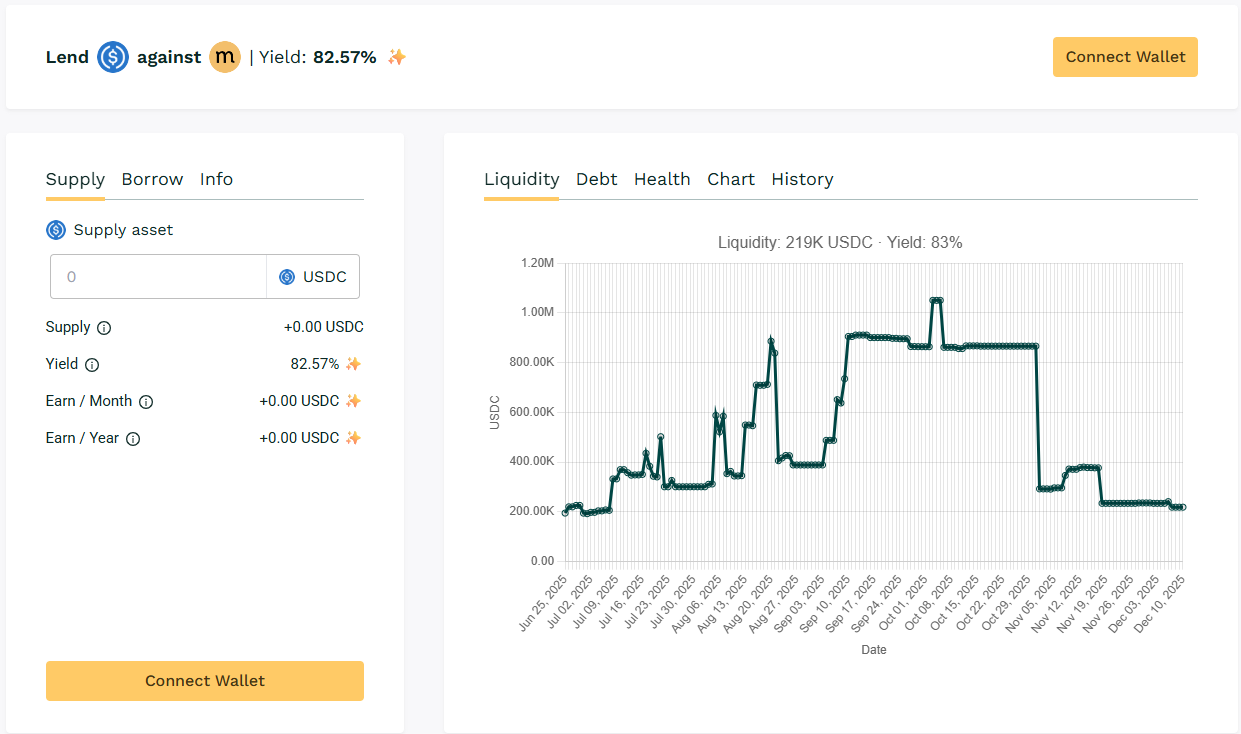

🥇 USDC / $MASA

🧮 APY: 82.57%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

One of the largest active pools this week by liquidity. $MASA takes the top rank this week based on recurring borrowers, reaching yield at above 82% range.

🎯 $MASA topped the charts, crossing the 80% APY mark.

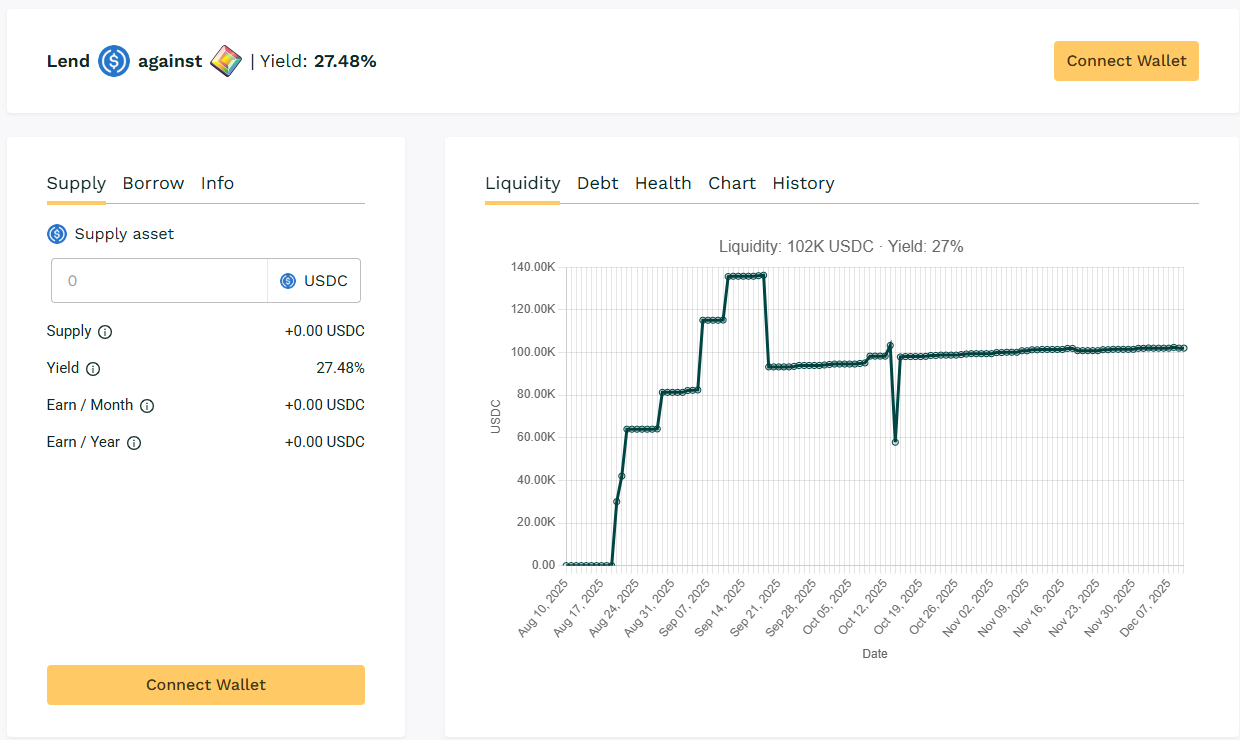

🥈 USDC / $PIXL

🧮 APY: 27.48%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

This pool continues to deliver above ~25% APY for lenders. Borrowers appear to be leveraging $PIXL for short-term funding needs.

🎯 Frequent loan renewals boost compound yield for lenders.

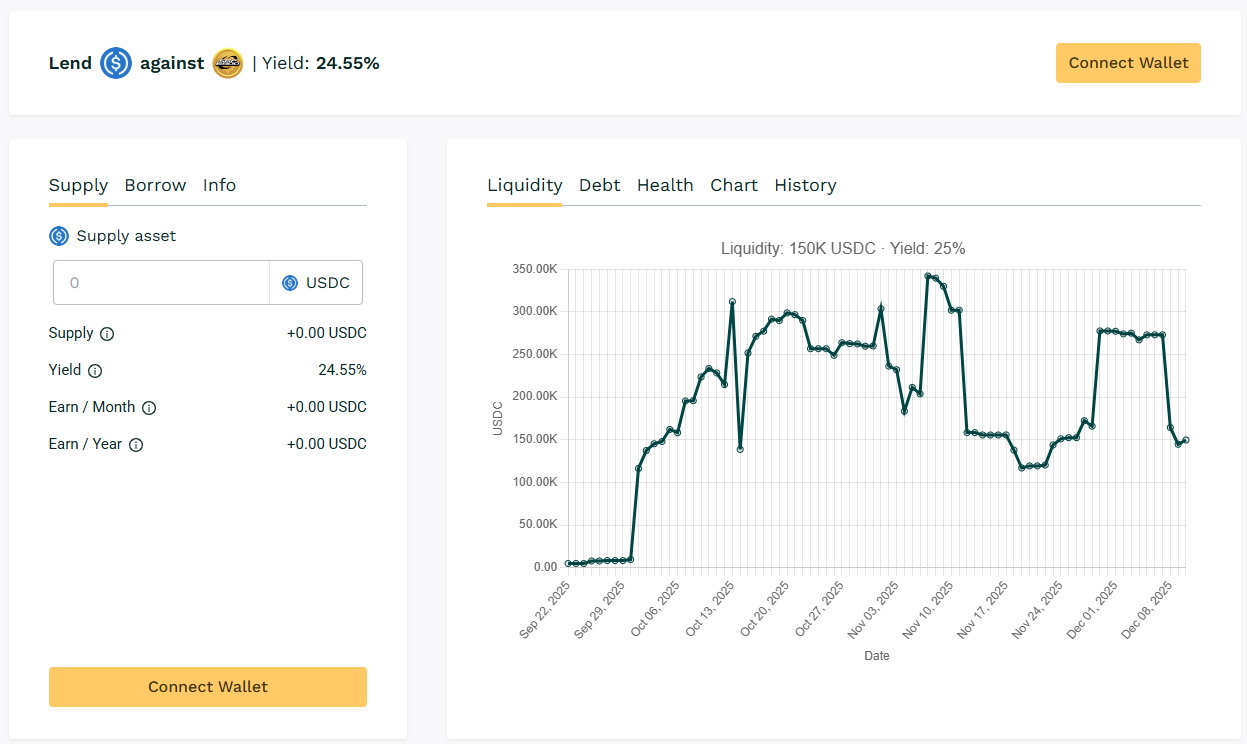

🥉USDC / $SPX

🧮 APY: 24.55%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX remains as a high-volume lending market with loan issuance and repayment frequency, maintaining yield levels above 20%.

🎯 Ongoing borrower activity support yields reaching above the 20% range.

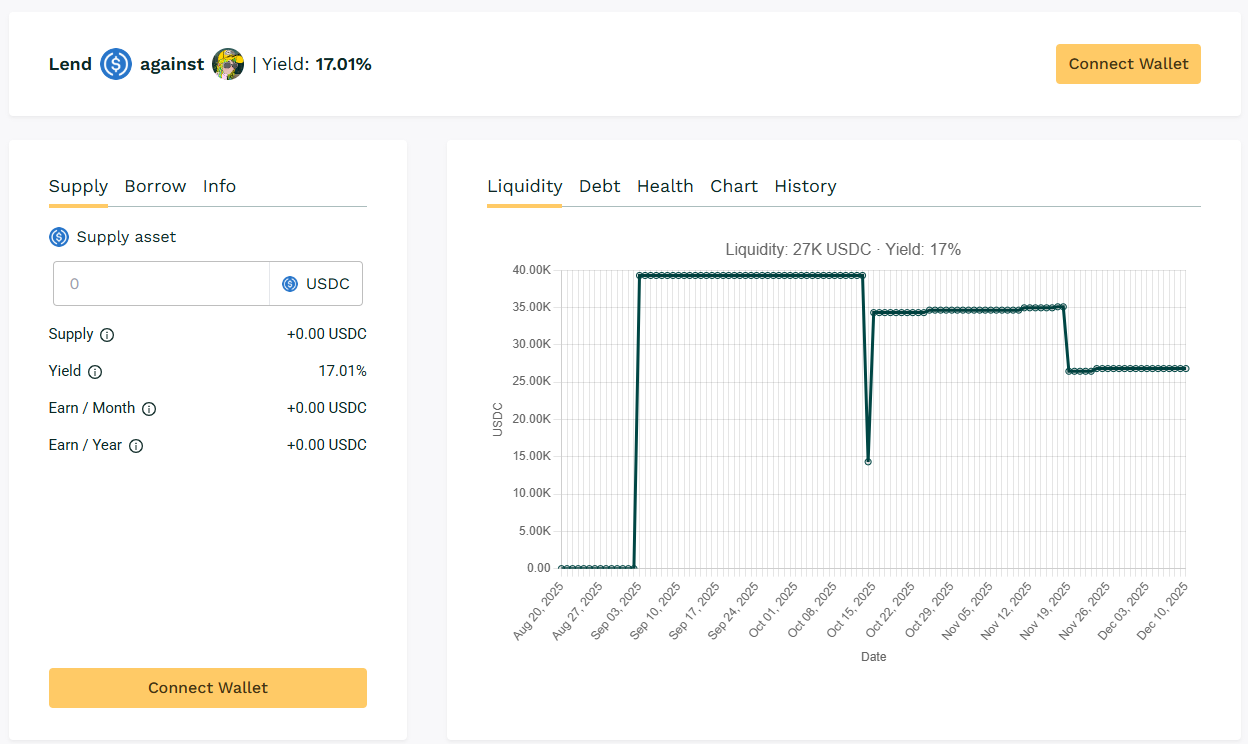

🏅 USDC / $DMT

🧮 APY: 17.01%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper-15% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

🎯 Borrower rollovers keeping yield above 15%.

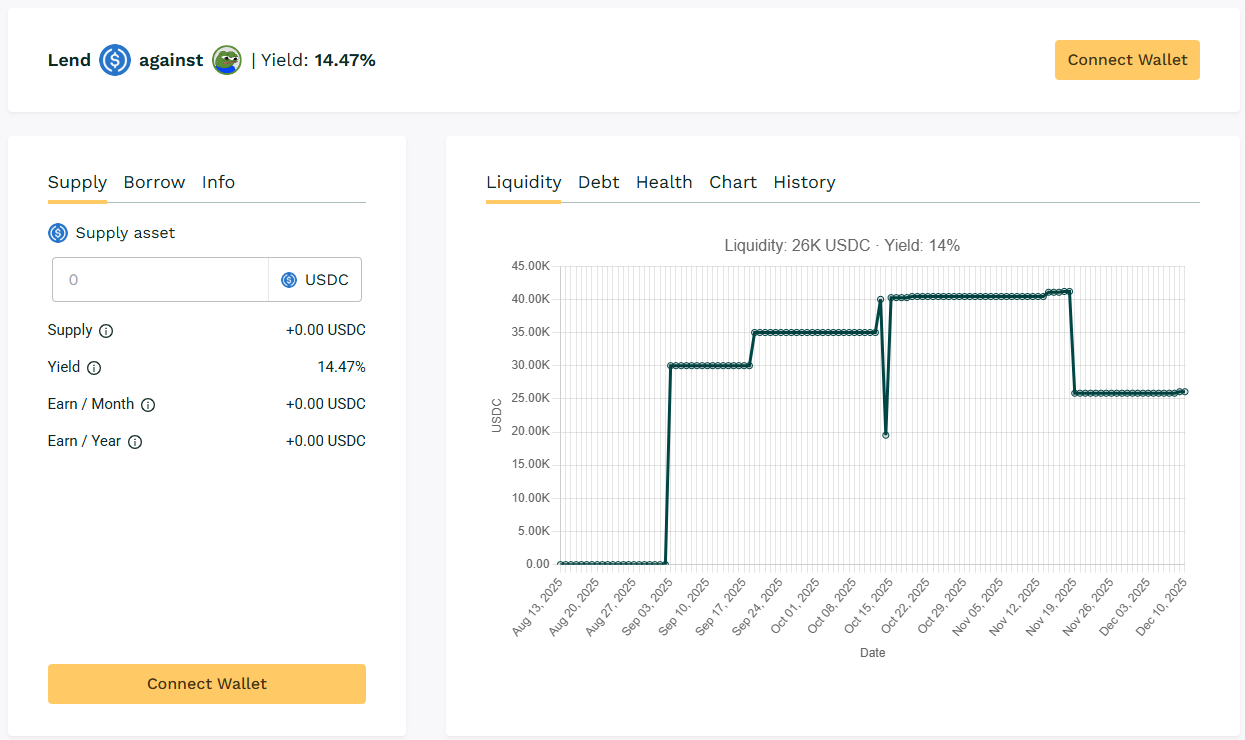

🏅 USDC / APU

🧮 APY: 14.47%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU continues to demonstrate active loan rollover behavior, maintaining yield levels near 15%.

📌 APYs are sustained by consistent monthly borrowing volume.

🧊 Blue‑Chip Lending

USDC / WBTC: 2.85% APY

$WBTC offered baseline APYs in the 2% range. The pool continues to provide lower-risk lending opportunities.

📸 Snapshot

- Top performing pools: $MASA, $PIXL, and $SPX

- Highest liquidity: $MASA (219.04K USDC)

- Across these pools, borrower demand and rollover behaviors continue to shape APYs.

🛎️ Next Digest

Next week’s update will track rollover trends and analyze whether utilization shifts toward high-yield pairs continue into November.

Track live data here 👉 https://app.teller.org/ethereum/lend