Teller Yields, Weekly Digest 12/04

Date: December 04, 2025

Source: Teller on DeFiLlama

The week’s top-performing USDC pools show steady lending activity and moderate borrower rollover patterns across active pools.

🏆 Top Lending Pools

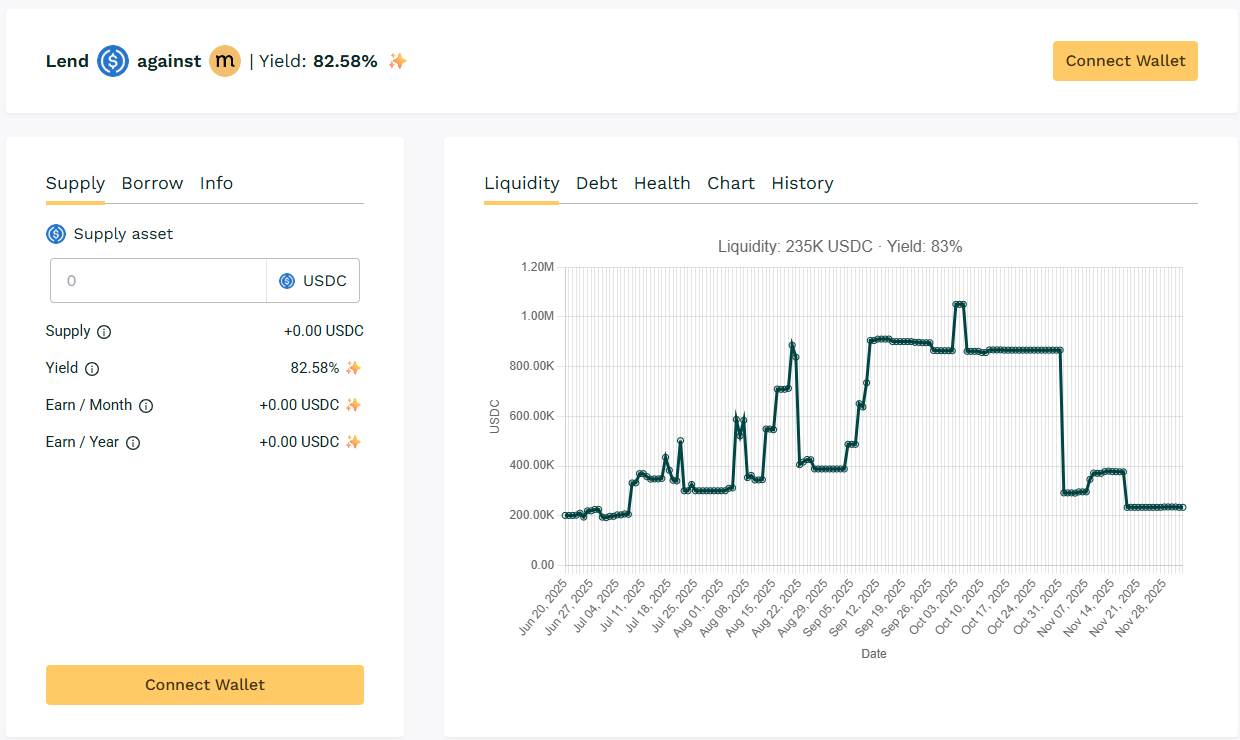

🥇 USDC / $MASA

🧮 APY: 82.58%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Pool APY is in the 80% range, still it is one of the most liquid pools with over $235K USDC in liquidity.

🎯 $MASA topped the charts, crossing the 80% APY mark.

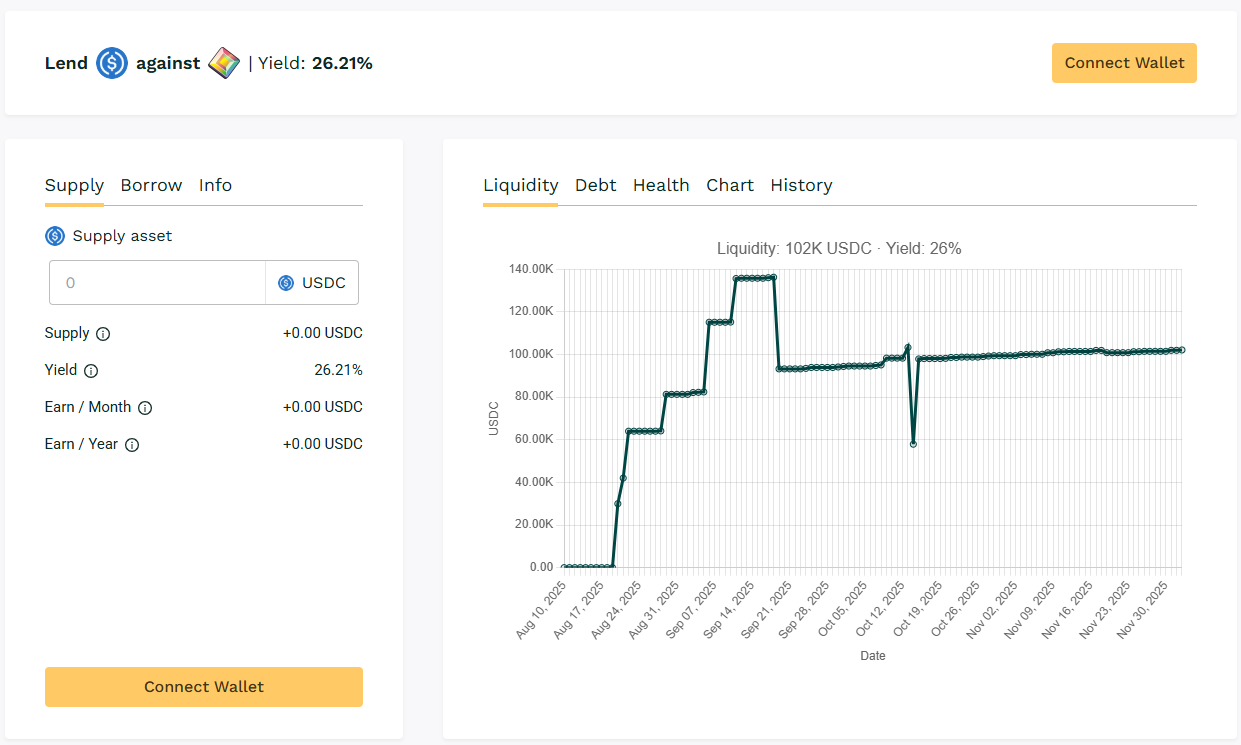

🥈 USDC / $PIXL

🧮 APY: 26.21%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

$PIXL continues to draw steady borrowing interest with balanced pool utilization. Loan rollovers keep yield performance consistent.

🎯 $PIXL remains one of the most consistently performing pools anchored by recurring borrower activity.

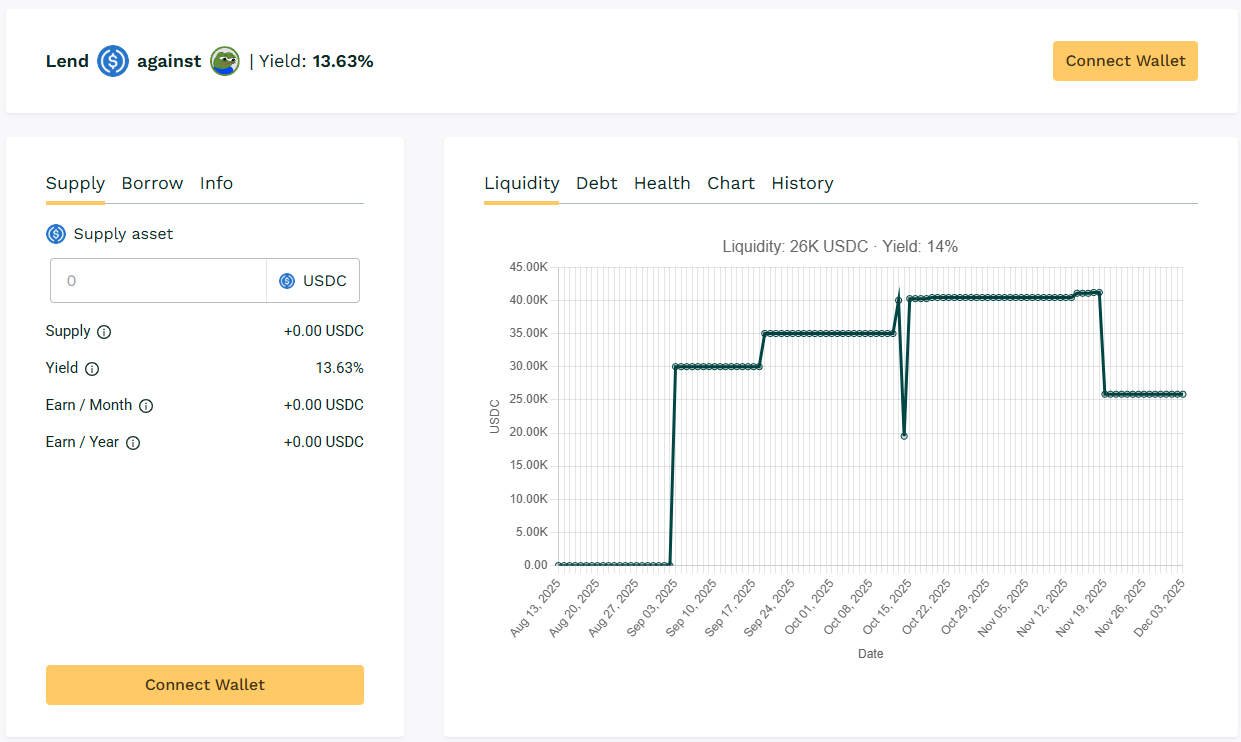

🥉 USDC / $APU

🧮 APY: 13.63%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU continues to demonstrate active loan rollover behavior, maintaining yield levels at 13%.

🎯 APYs are sustained by consistent monthly borrowing volume.

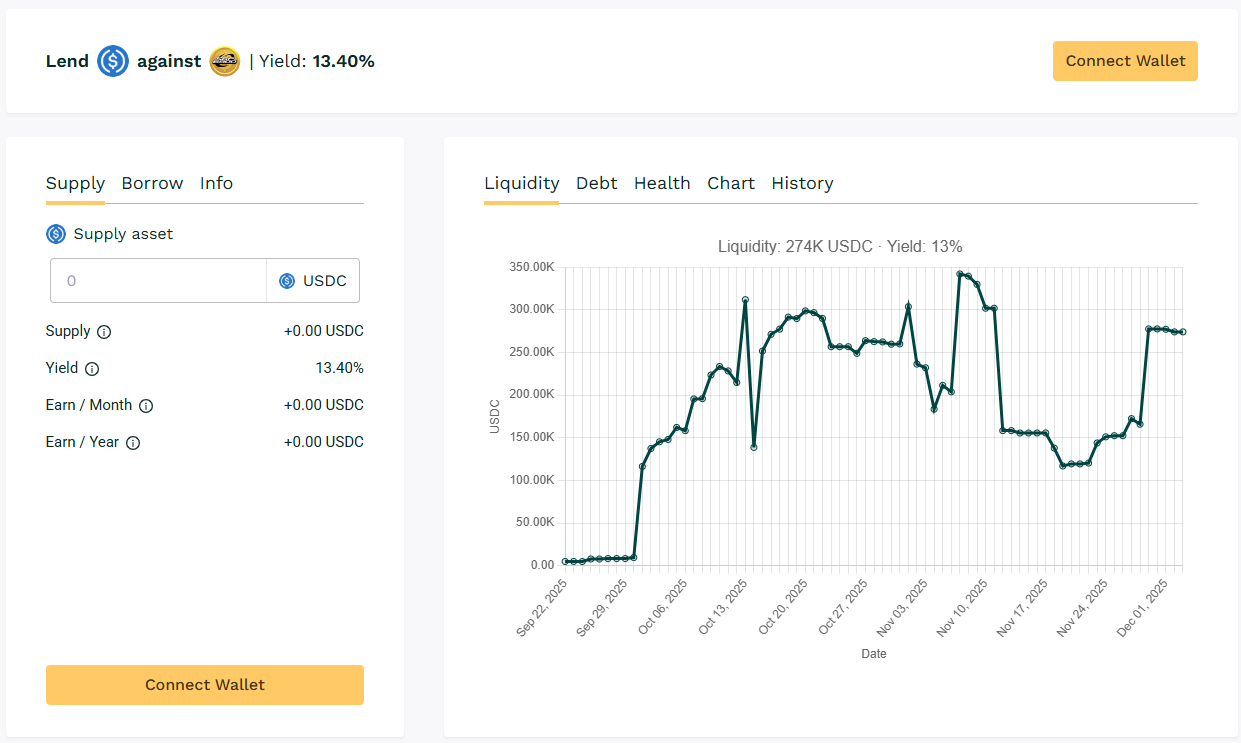

🏅 USDC / $SPX

🧮 APY: 13.40%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX pool collateral ratios and rollover activity supported yield level at 13%.

🎯 $SPX utilization supported 13% yields.

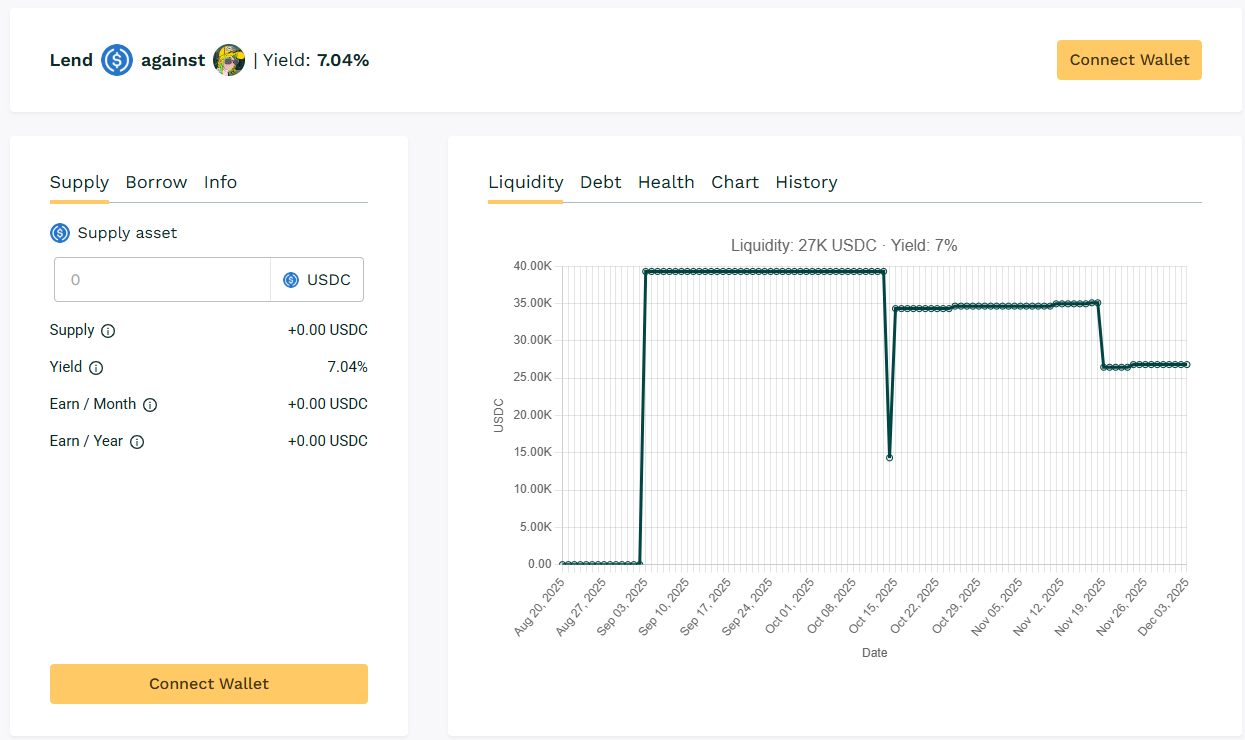

🏅 USDC / $DMT

🧮 APY: 7.04%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained APY at 7% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

🎯 Borrower rollovers keeping yield above 7%.

🧊 Blue‑Chip Lending

USDC / WBTC (~3.06%)

BTC backed pools continue to provide lower-risk lending options, anchoring the platform’s blue-chip segment with predictable APYs.

📈 Yield Takeaway:

APYs across active pools continue to reflect organic borrower behavior, with rollover-driven earnings shaping yield distribution week to week.

📢 Next Week

Tracking continues next week as pool dynamics shift with new borrower demand.

View live data here 👉 https://app.teller.org/ethereum/lend