Teller Yields, Weekly Digest 11/27

Date: November 27, 2025

Source: Teller on DeFiLlama

Lending yields continued to vary significantly this week. Pools maintained double-digit APYs.

Below is a breakdown of current pool activity and yields.

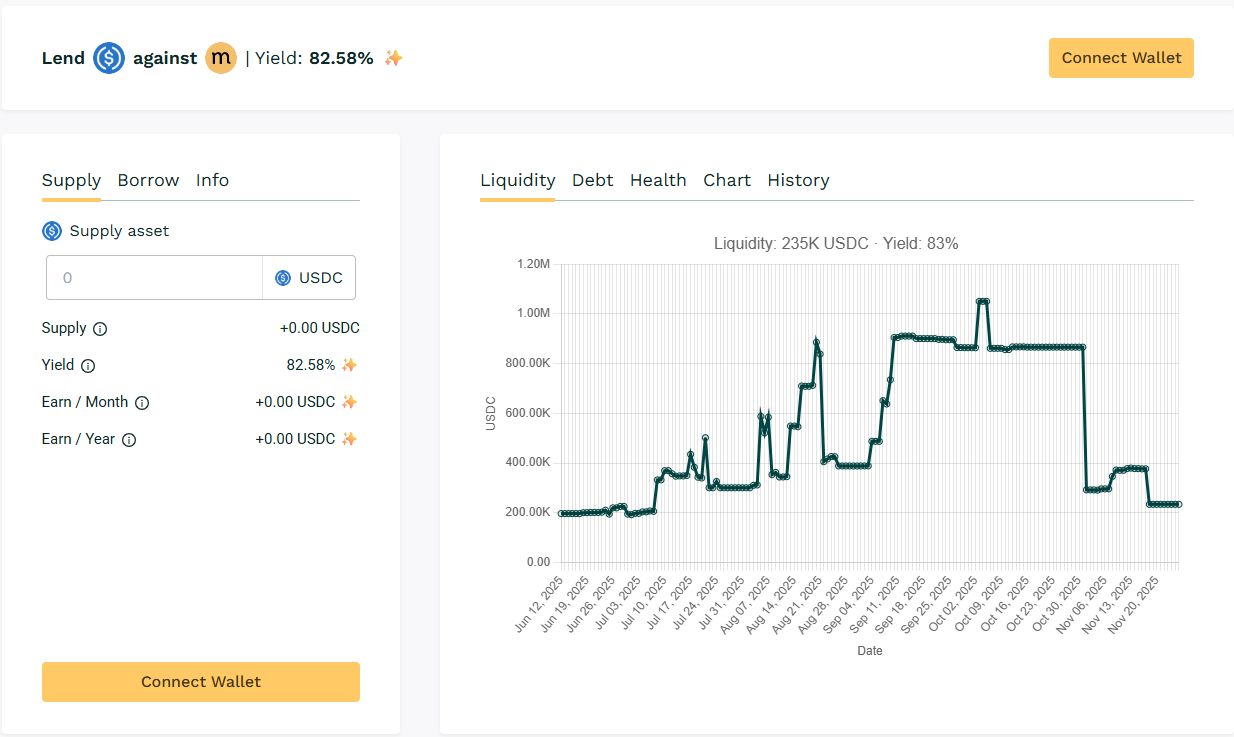

🥇 USDC / $MASA

🧮 APY: 82.58%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

One of the largest active pools this week by liquidity. $MASA takes the lead this week based on recurring borrowers, reaching yield at above 82% range.

📍 Liquidity inflows offset some utilization with rollover activities maintaining loan growth taking top 1.

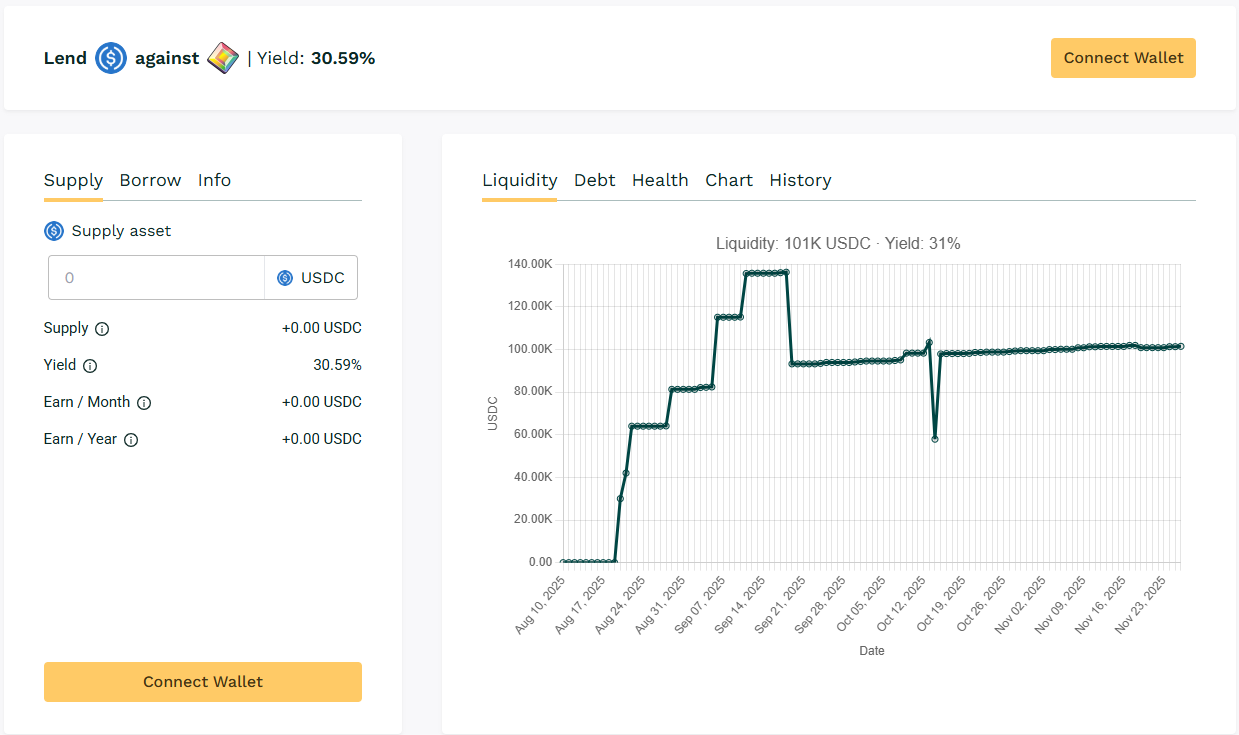

🥈 USDC / $PIXL

🧮 APY: 30.59%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

This pool continues to deliver above ~30% APY for lenders. Borrowers appear to be leveraging $PIXL for short-term funding needs, maintaining steady debt pressure on the pool.

📍 Ranks second this week and borrowing activity shows sustainability with rollover usage.

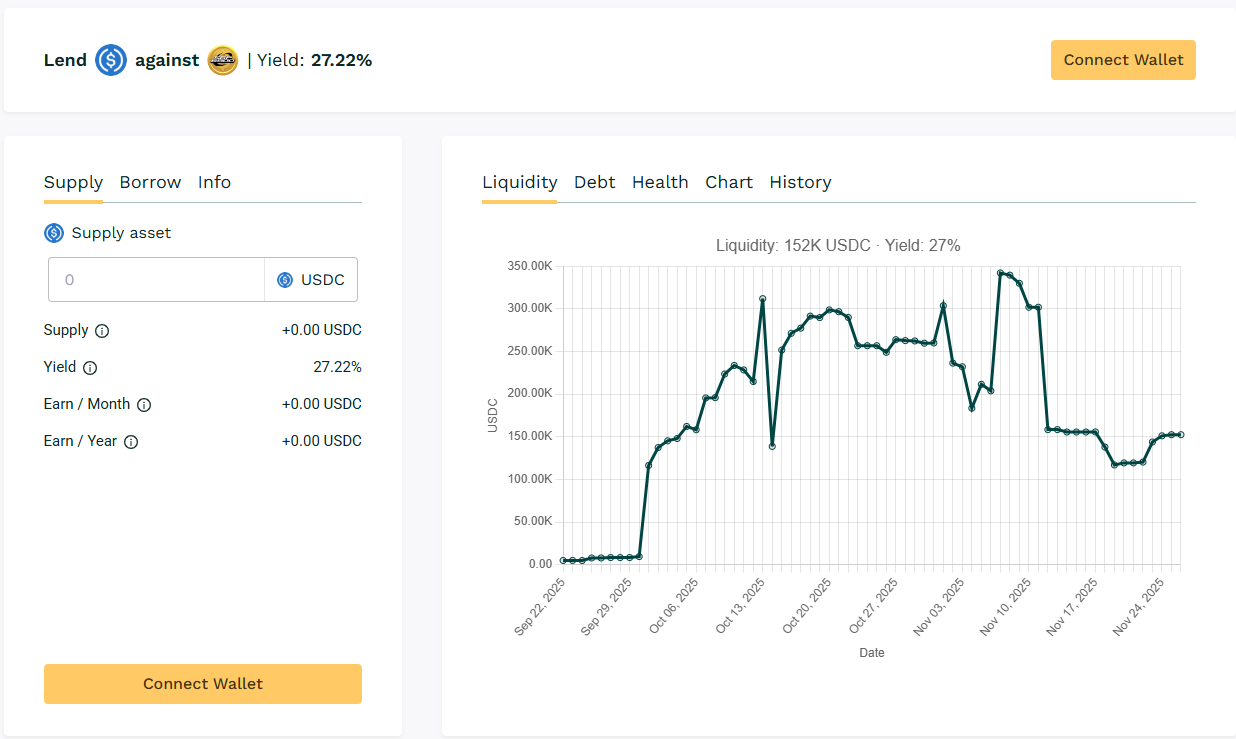

🥉USDC / $SPX

🧮 APY: 27.22%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX continues as a high-volume lending market with strong loan issuance and repayment frequency, maintaining healthy yield levels above 25%.

📍 Liquidity remains among the highest across Teller, reflecting ongoing borrower participation.

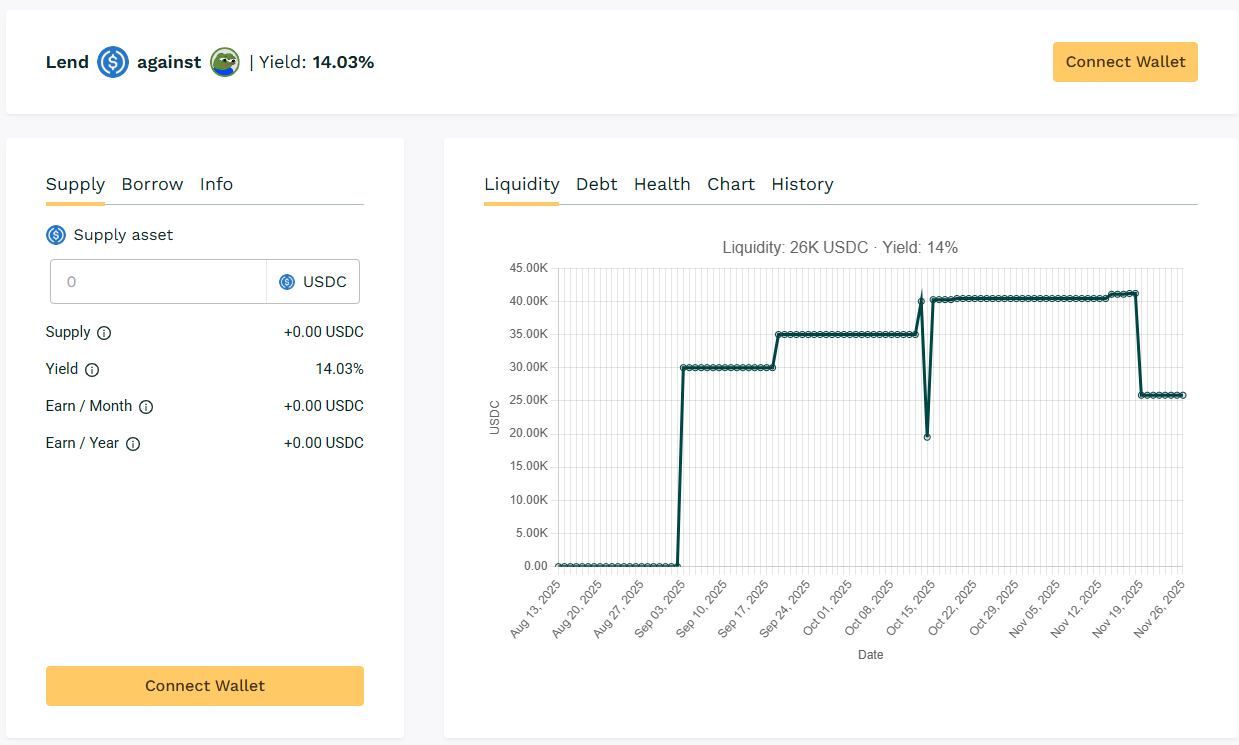

🏅 USDC / $APU

🧮 APY: 14.03%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU demonstrates active loan rollover behavior, maintaining yield levels at 14%.

📍 $APU borrower patterns remain one of the steadiest on Teller, with continuous lending cycles.

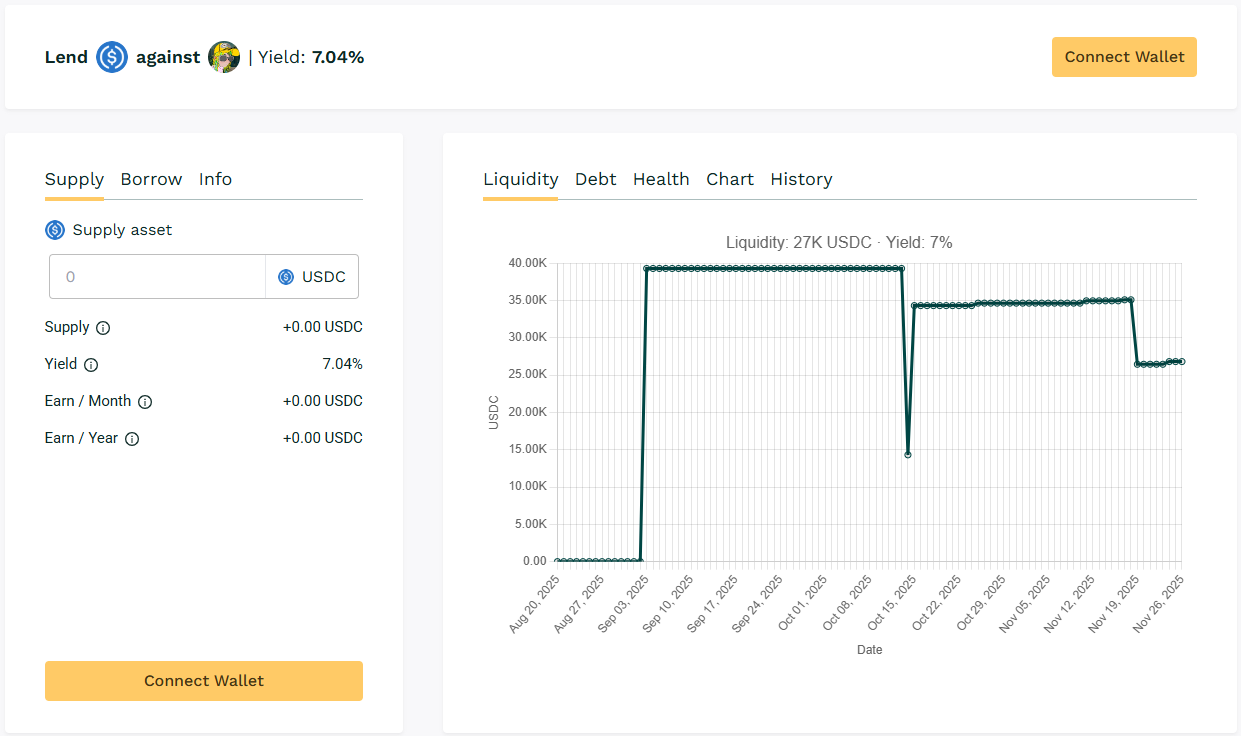

🏅 USDC / $DMT

🧮 APY: 7.04%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper 5% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

🎯 Borrower rollovers keeping yield above 5%.

🧊 Blue‑Chip Lending

USDC / WBTC (~3.05%)

USDC / WETH (~3.12%)

$WBTC and $WETH pools offered baseline APYs in the 10–13% range. Continued to provide lower-risk lending opportunities.

🛎️ Next Digest

Next week’s update will track rollover trends and analyze whether utilization shifts toward high-yield pairs continue into November.

Track live data here 👉 https://app.teller.org/ethereum/lend