Teller Yields, Weekly Digest 11/20

Date: November 20, 2025

Source: Teller on DeFiLlama

This week’s pool data shows dynamic APY shifts as rollover activity and borrowing trends moved across multiple pools.

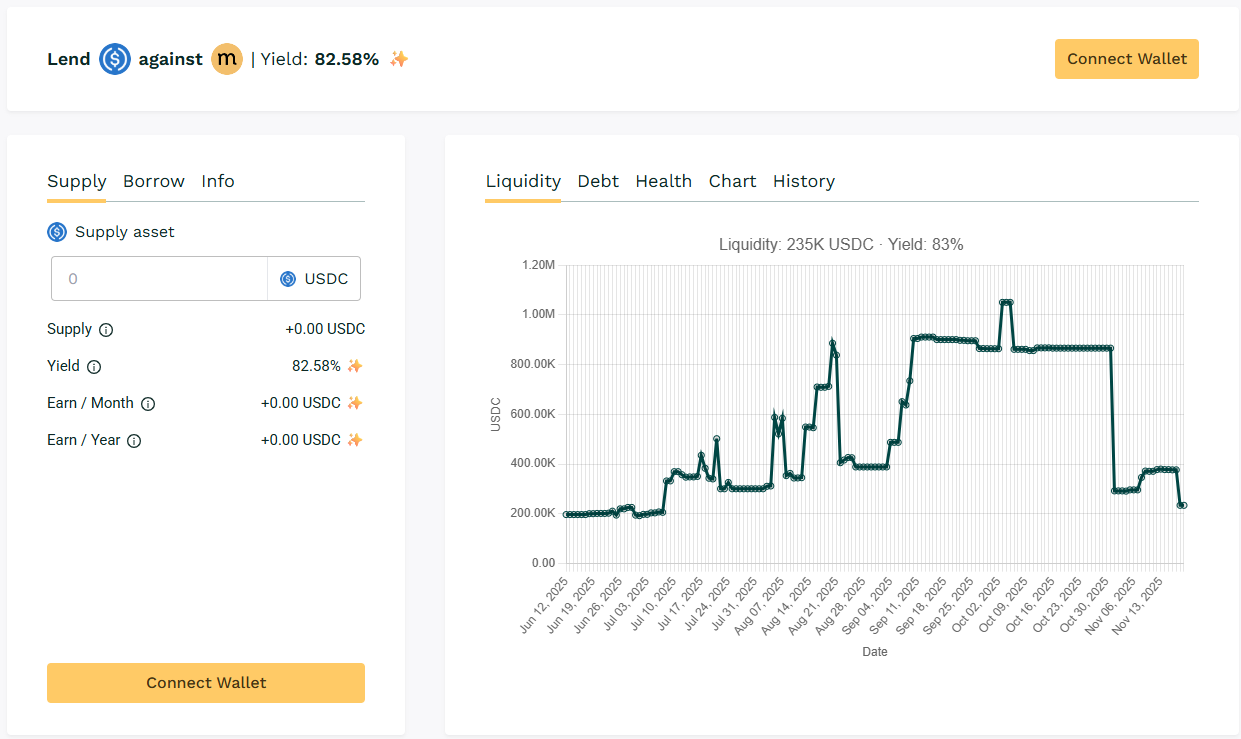

🥇 USDC / $MASA

🧮 APY: 82.58%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Borrower demand for $MASA collateralized loans remained, pushing pool utilization upward. APYs exceeded 80%, positioning $MASA as the top performer this week.

➡️ $MASA anchors the leaderboard with scale and yield.

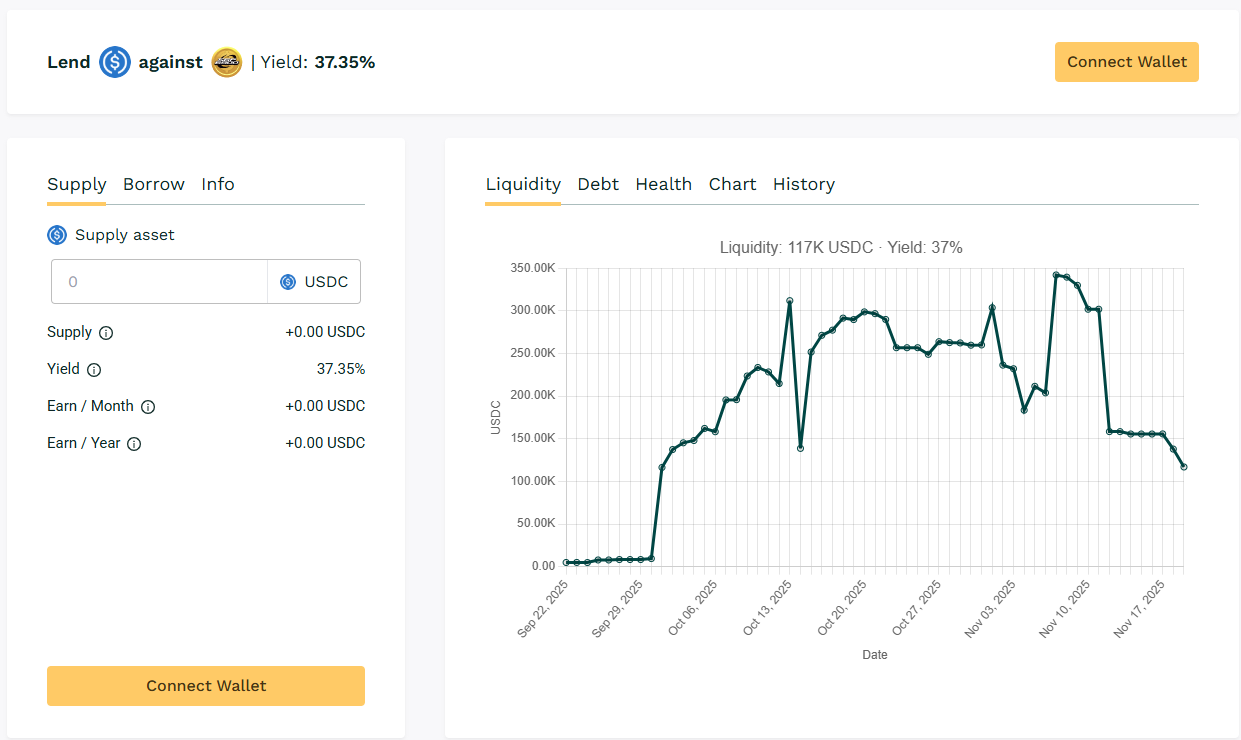

🥈 USDC / $SPX

🧮 APY: 37.35%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers actively using SPX collateral maintain demand within this pool. APY remains consistent as loans continue rolling over.

➡️ $SPX takes the top 2 spot this week with 35%+ returns.

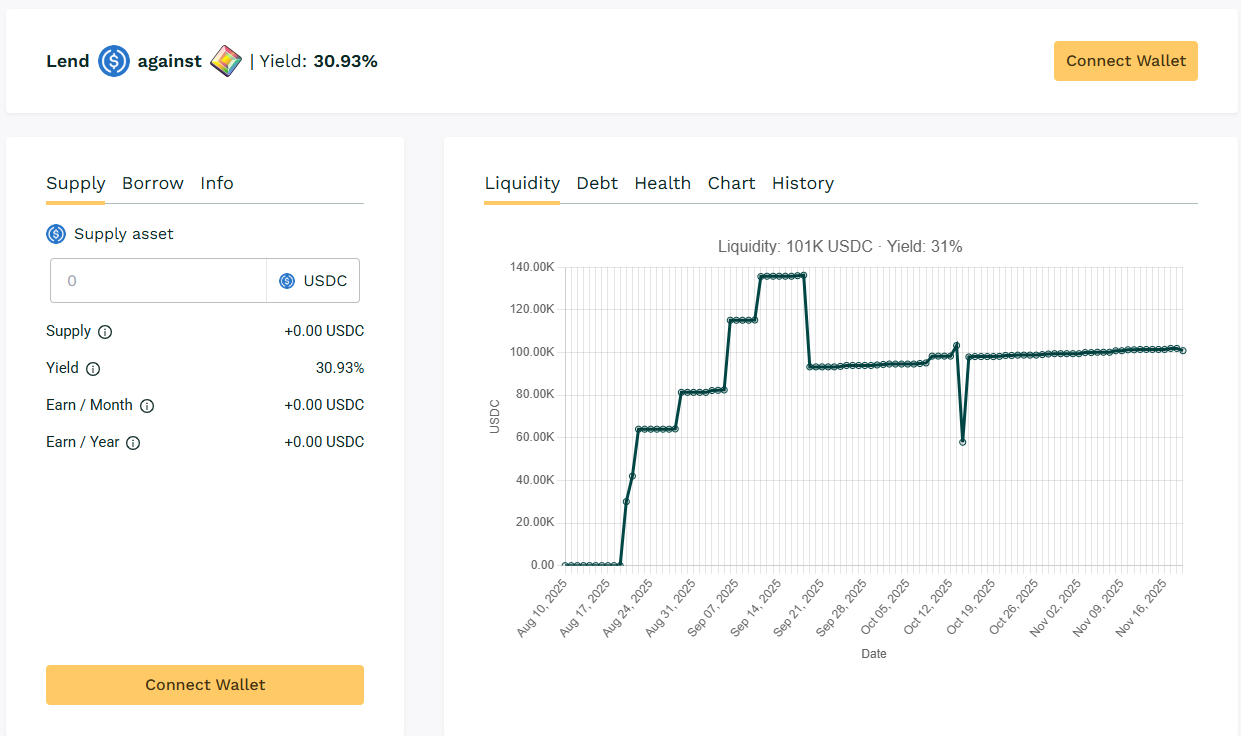

🥉 USDC/ $PIXL

🧮 APY: 30.93%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Short duration lending generated turnovers and APR in higher than 30%. Borrower participation remained consistent throughout the week.

➡️ Compact pool, APY driven by rollover cycles.

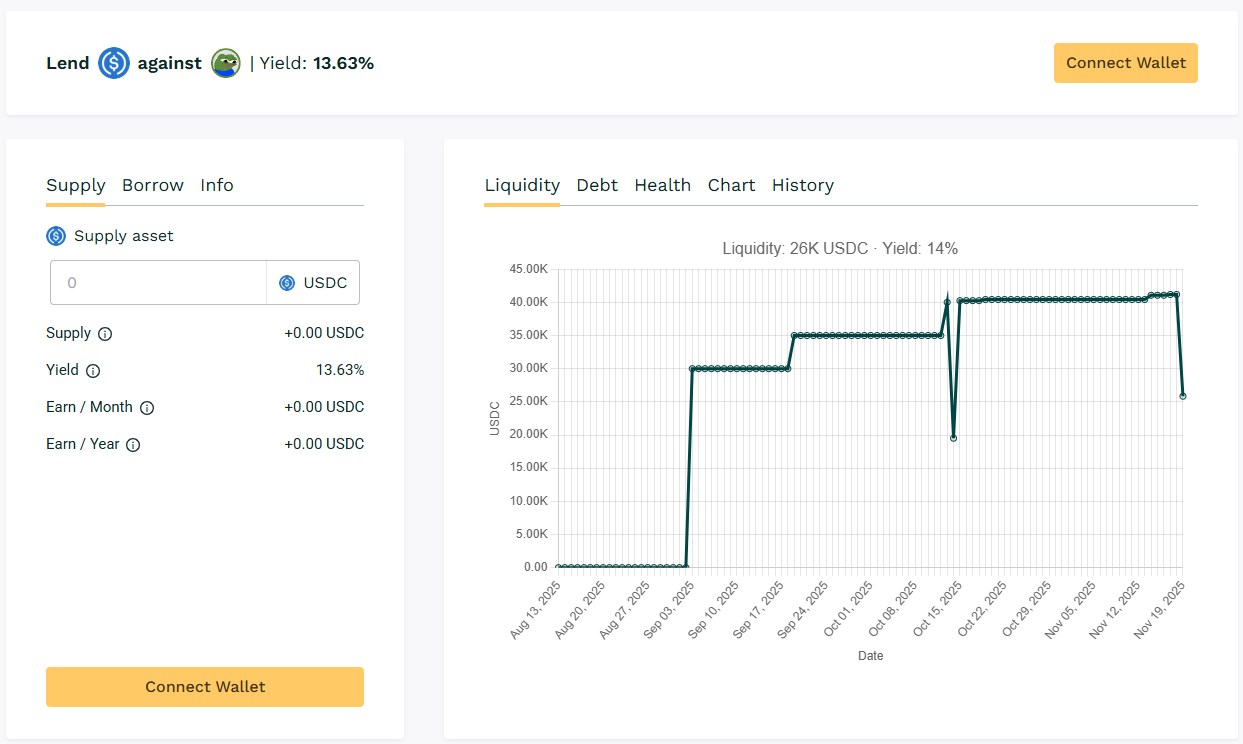

🏅 USDC / $APU

🧮 APY: 13.63%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU collateralized pool accounted for over 26K in liquidity. Borrower engagement sustained yields in the low 15% range.

➡️ $APU sustains 13% yield with users borrowing.

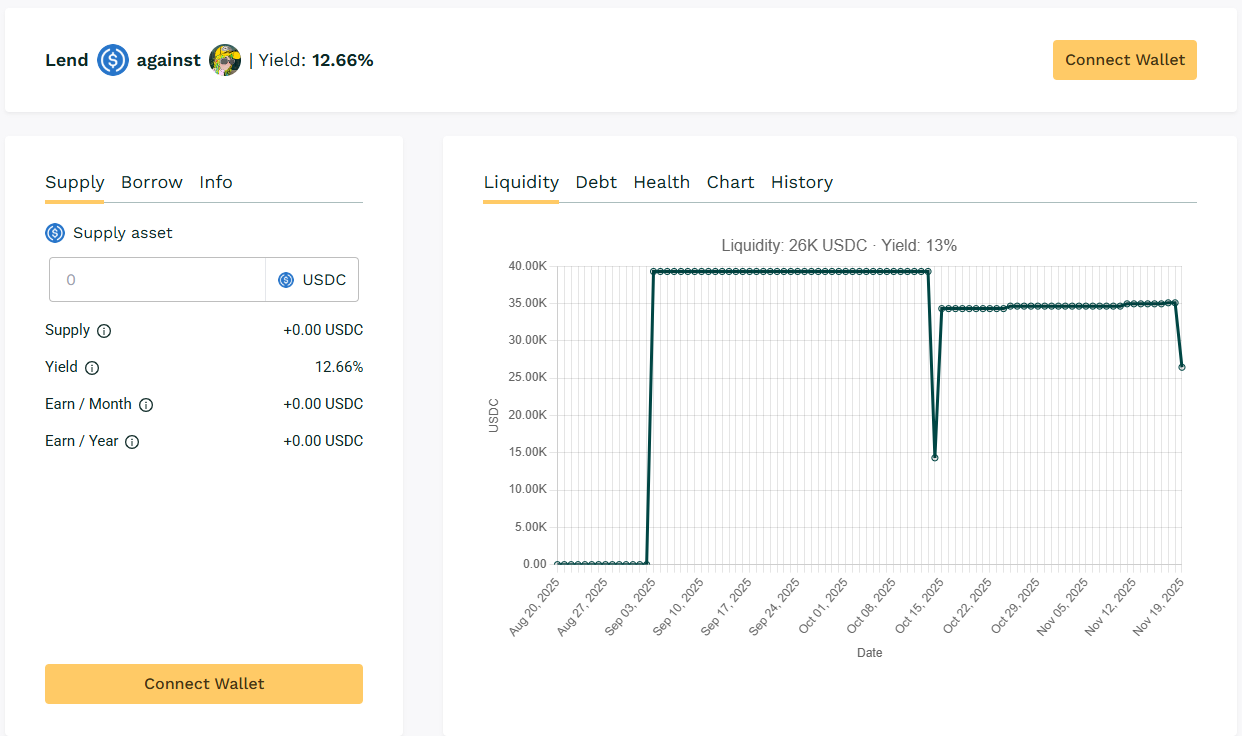

🏅 USDC / $DMT

🧮 APY: 12.66%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper 10% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

➡️ Borrower rollovers keeping yield above 10%.

🧊 Blue-Chip Pools

- USDC / $WBTC:2.63%

- USDC / $WETH: 3.12%

Pools offered baseline APYs in the 2-4% range. Continued to provide stable APY zones for ETH/BTC-backed lending.

📢 Next Digest

Stay tuned for next week’s Teller Digest as loan demand and lending opportunities continue to evolve across pools.

Until then, happy lending. Stay yield-aware.

👉 Live data available at: app.teller.org/lend