Teller Yields, Weekly Digest 11/13

Date: November 13, 2025

Source: Teller on DeFiLlama

Yields across Teller pools showed borrower demand this week, with changes in demand, rollover activity, and supply utilization across six active pools.

Below is a breakdown of current pool activity and yields.

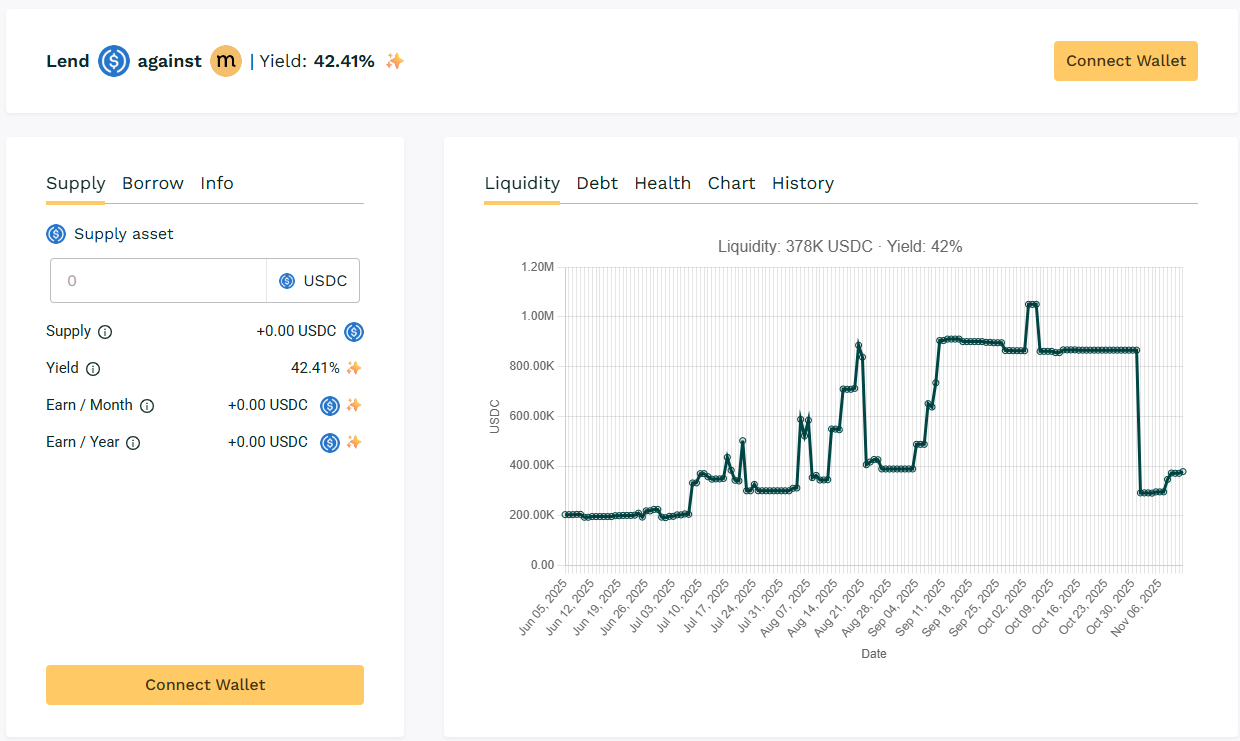

🥇 USDC / $MASA

🧮 APY: 42.41%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Borrower demand for $MASA collateralized loans remained. APY exceeded 40%, positioning $MASA as the top performer this week.

🎯 $MASA topped the charts, crossing the 40% APY mark.

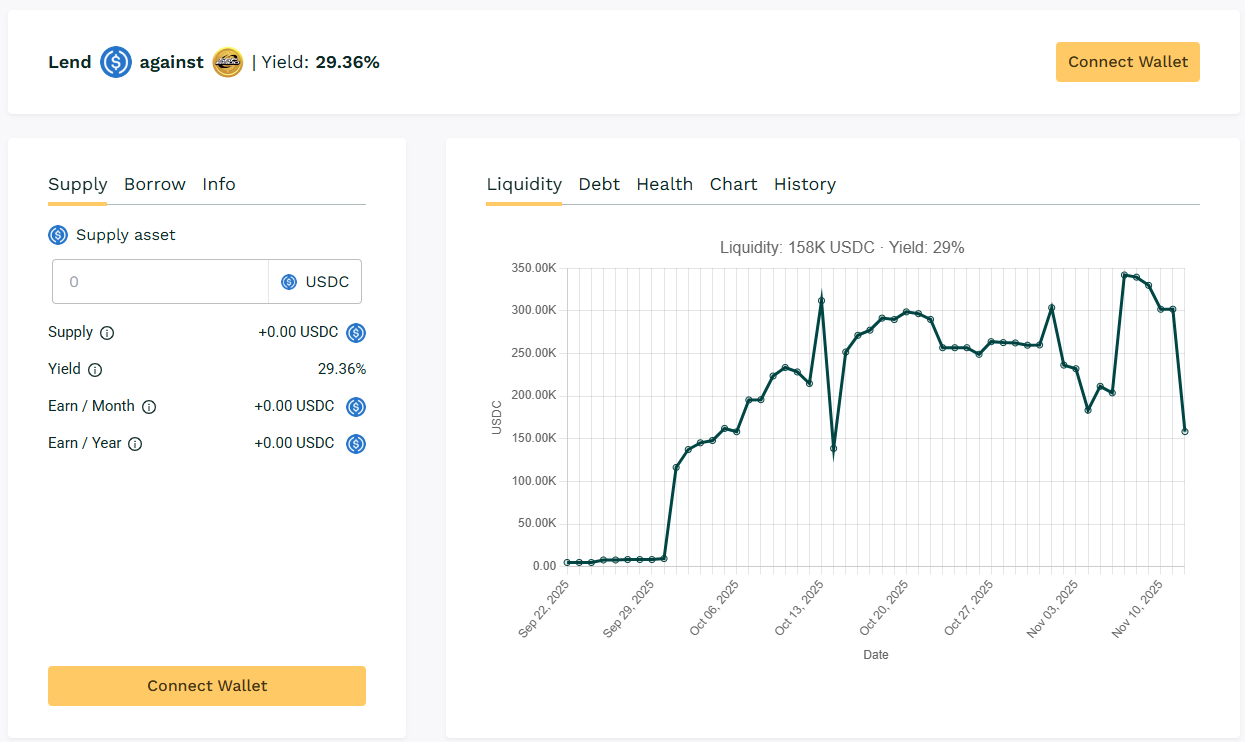

🥈 USDC / $SPX

🧮 APY: 29.36%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers actively using SPX collateral maintain demand within this pool. APY remains consistent as loans continue rolling over.

🎯 Ongoing borrower activity support yields almost reaching the 30% range.

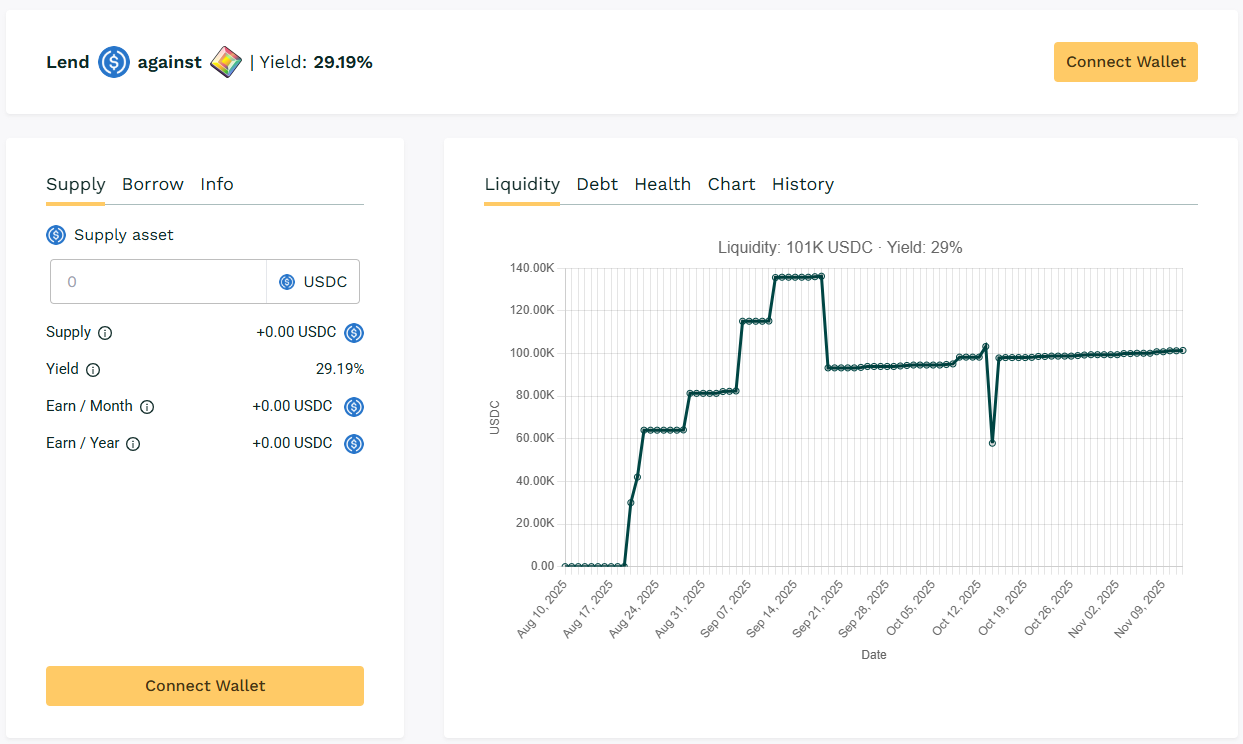

🥉 USDC / $PIXL

🧮 APY: 29.19%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Short duration lending generated turnovers and APR in higher than 25%. Borrower participation remained consistent throughout the week.

🎯 Frequent loan renewals boost compound yield for lenders.

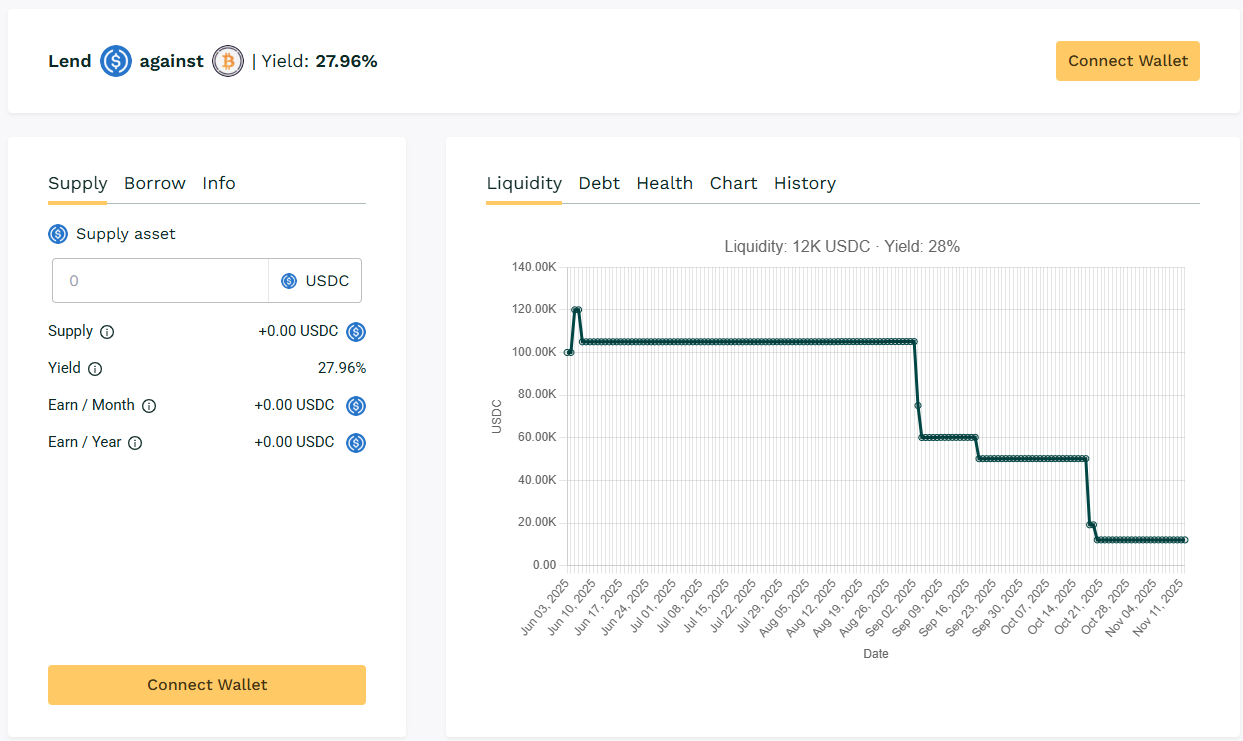

🏅 USDC / $WBTC

🧮 APY: 27.96%

📉 Collateral: WBTC (Wrapped BTC)

🔐 Loan Term: 30 days

📊 Collateral Rate: 150%

WBTC collateral loans support yields keeping the 27% APY from last week.

🎯$BTC pool remains a key driver in the platform’s blue-chip segment.

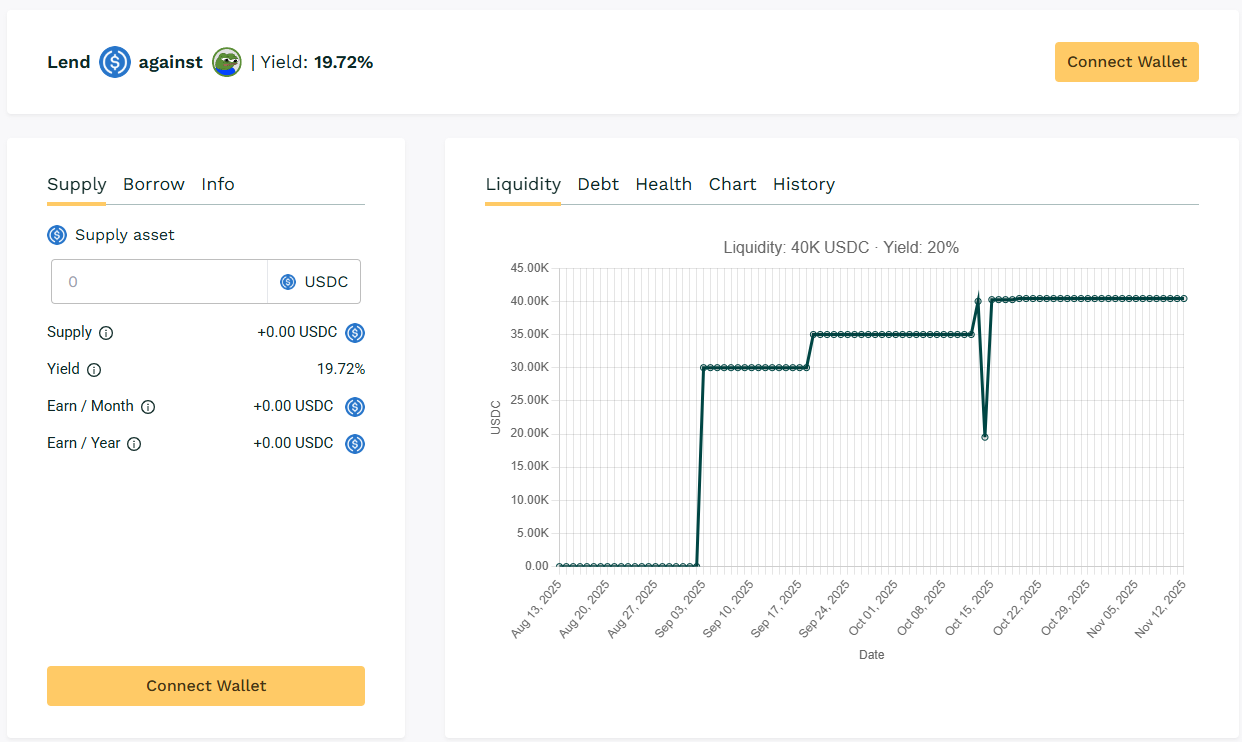

🏅 USDC / $APU

🧮 APY: 19.72%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Meme-token borrowing cycles sustained APU yields over 15%, with 30-day loan rollovers despite moderate liquidity.

📌 APYs are sustained by consistent borrowing volume.

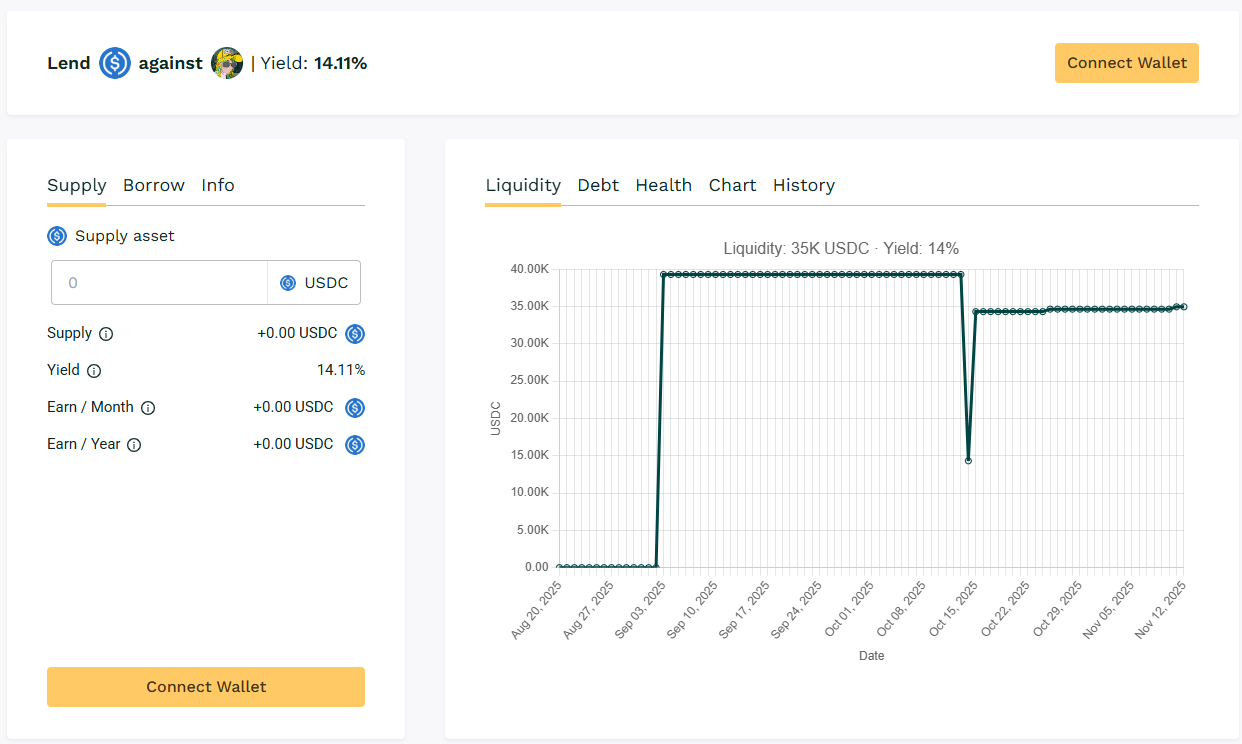

✅ USDC / $DMT

🧮 APY: 14.11%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper 10% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

🎯 Borrower rollovers keeping yield above 10%.

📊 Yield Summary

Borrowing activity remains stable across all Teller pools. $MASA retains the top position with 42% yield from full utilization, while $SPX, $PIXL, and $WBTC sustain consistent borrower rollover behavior. $APU and $DMT maintain activity in shorter lending cycles.

📣 Next Digest

Stay tuned for next week’s Teller Yields Digest for updated pool movements and borrower dynamics across markets.

👉 View live lending data at: https://app.teller.org/lend