Teller Yields, Weekly Digest 11/06

Date: November 06, 2025

Source: Teller on DeFiLlama

Borrowing activity across Teller markets held steady this week, with yields concentrated in mid- to high-range pools. Consistent rollover behavior across pools continues to anchor overall yield generation.

🏆 Top Lending Pools

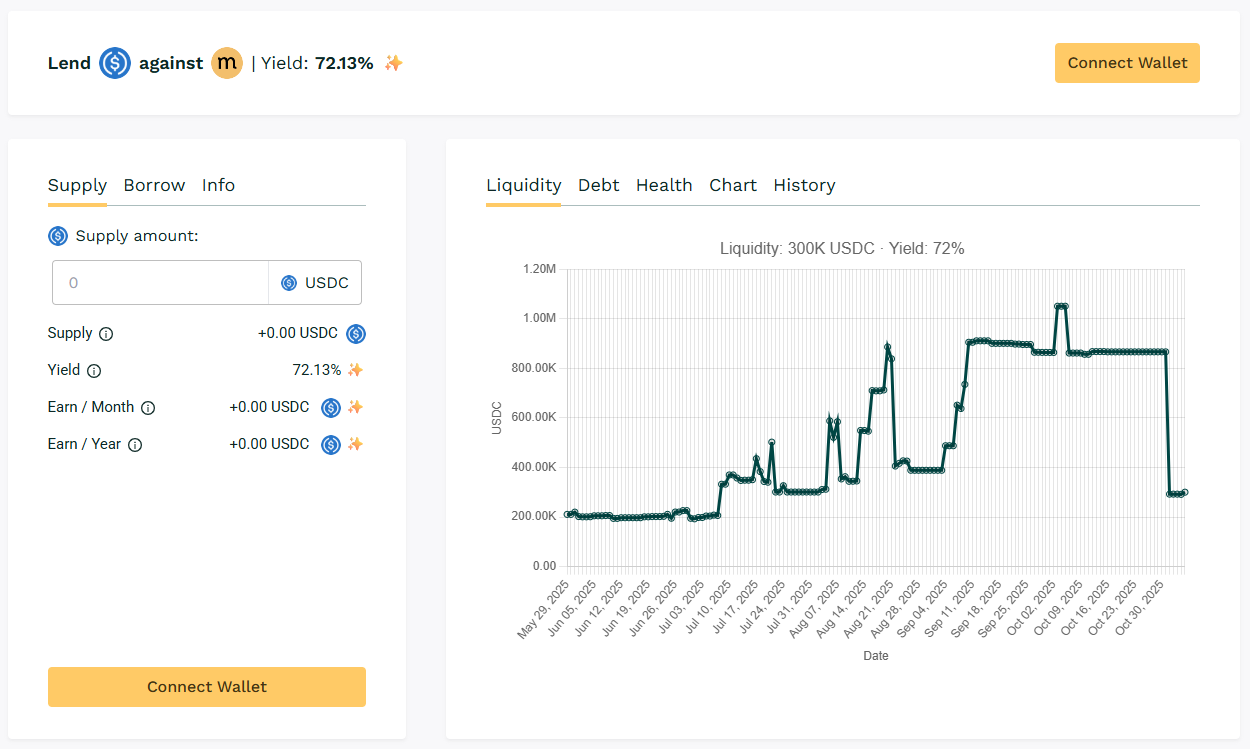

🥇 USDC / $MASA

🧮 APY: 72.13%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

One of the largest active pools this week by liquidity. $MASA takes the top rank this week based on recurring borrowers, reaching yield at above 72% range.

📌 Liquidity inflows offset some utilization with rollover activities maintaining loan growth taking top 1.

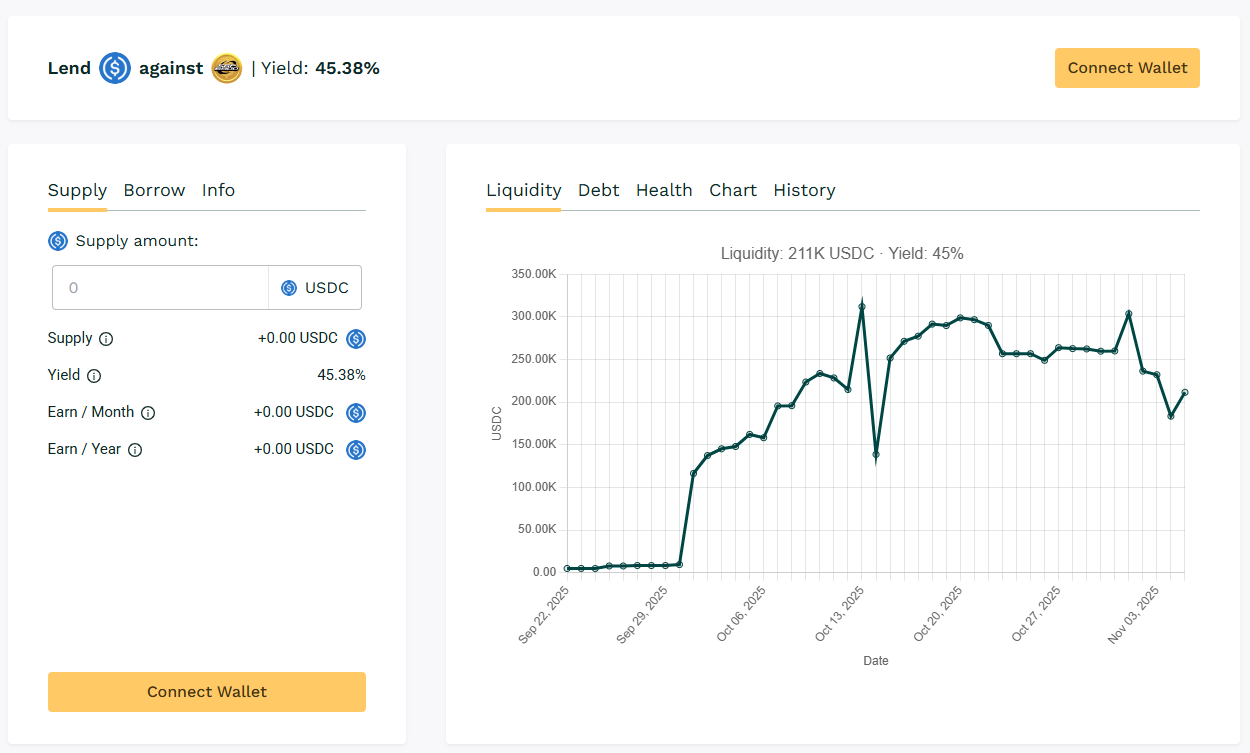

🥈 USDC / $SPX

🧮 APY: 45.38%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX continues as a high-volume lending market with strong loan issuance and repayment frequency, maintaining healthy yield levels above 45% taking rank 2.

📌 Liquidity remains among the highest across Teller, reflecting ongoing borrower participation.

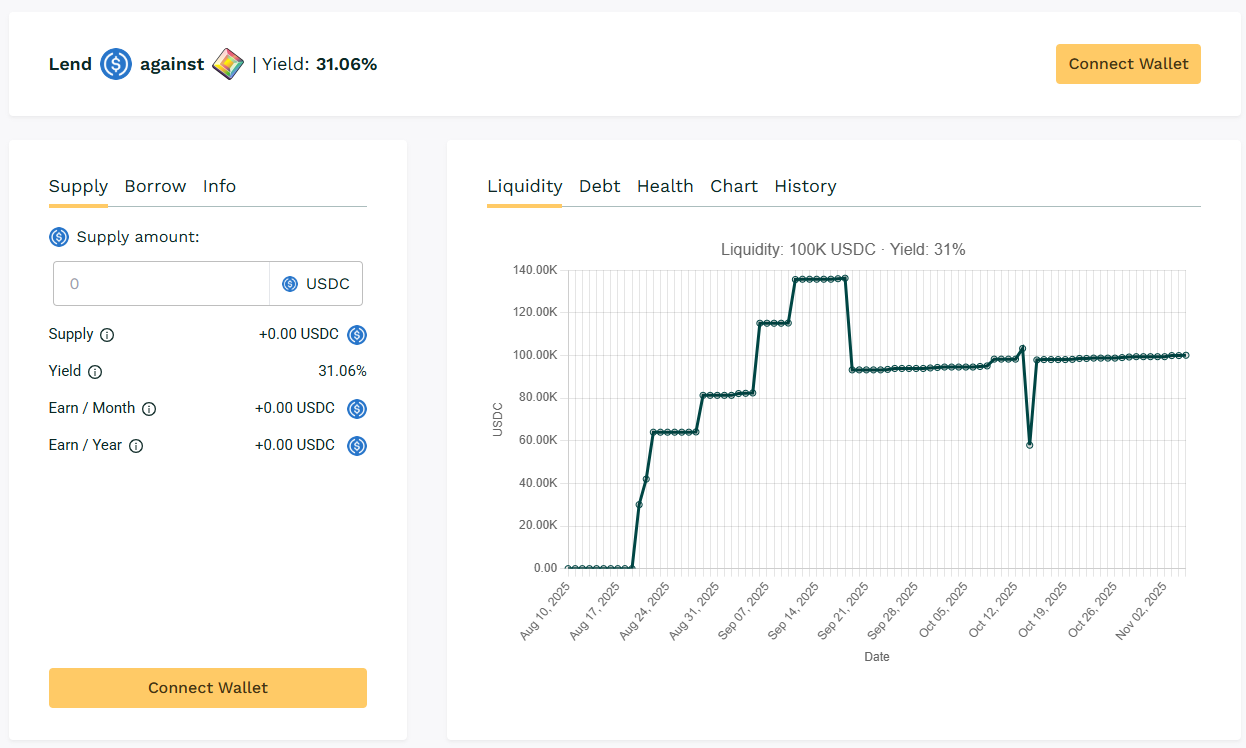

🥉 USDC / $PIXL

🧮 APY: 31.06%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

$PIXL pool maintains consistent utilization with active borrower rollovers. Yield driven by steady loan demand and rollover usage.

📌 Ranks third this week and borrowing activity shows sustainability with rollover usage.

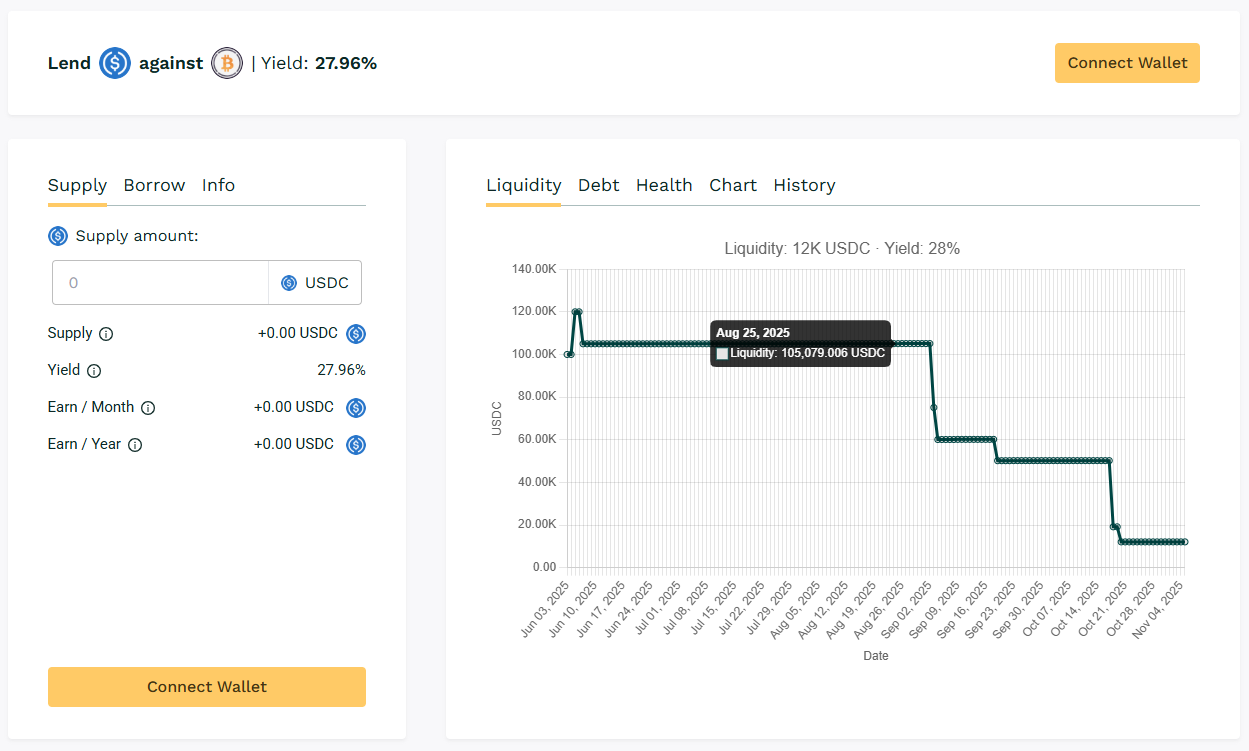

🏅 USDC / $WBTC

🧮 APY: 27.96%

📉 Collateral: WBTC (Wrapped BTC)

🔐 Loan Term: 30 days

📊 Collateral Rate: 150%

$WBTC pool steadies this week as recent deposits, withdrawals and loans caused APY to fluctuate.

📌 BTC pool continue to provide lower-risk lending option, anchoring the platform’s blue-chip segment.

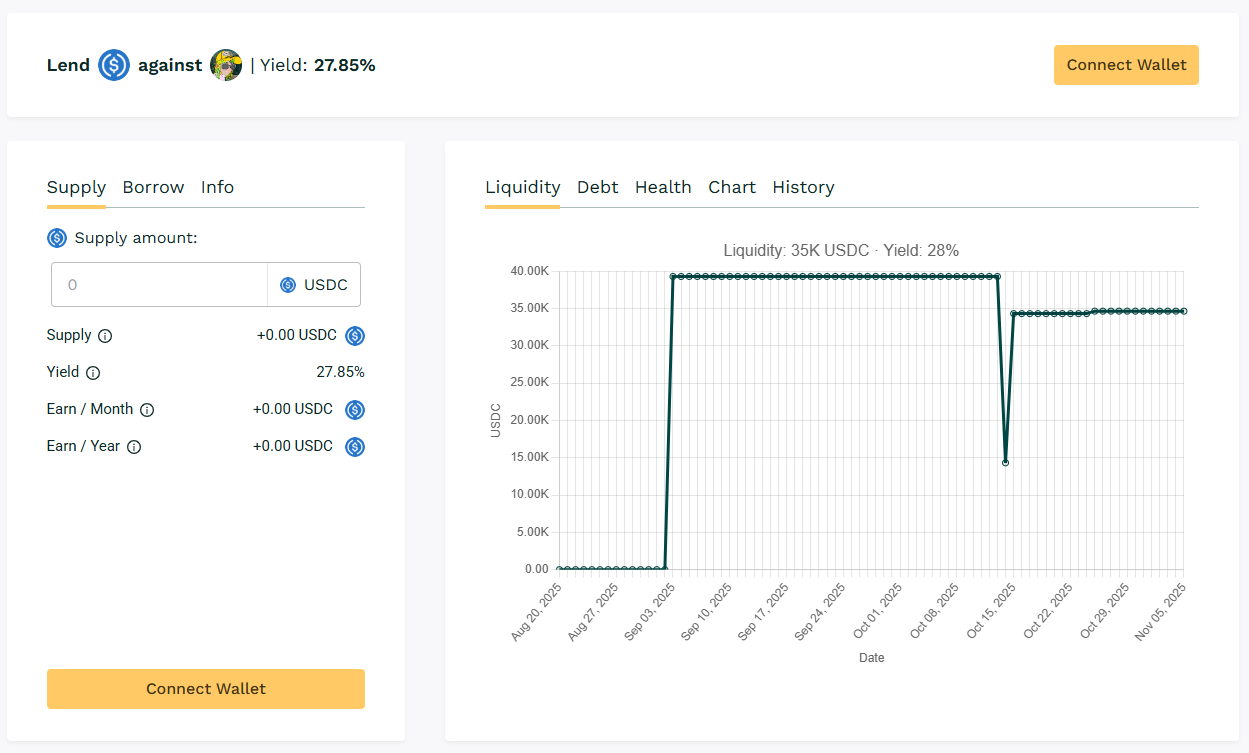

🏅 USDC / $DMT

🧮 APY: 27.85%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper 25% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

📌 Borrower rollovers keeping yield above 25%.

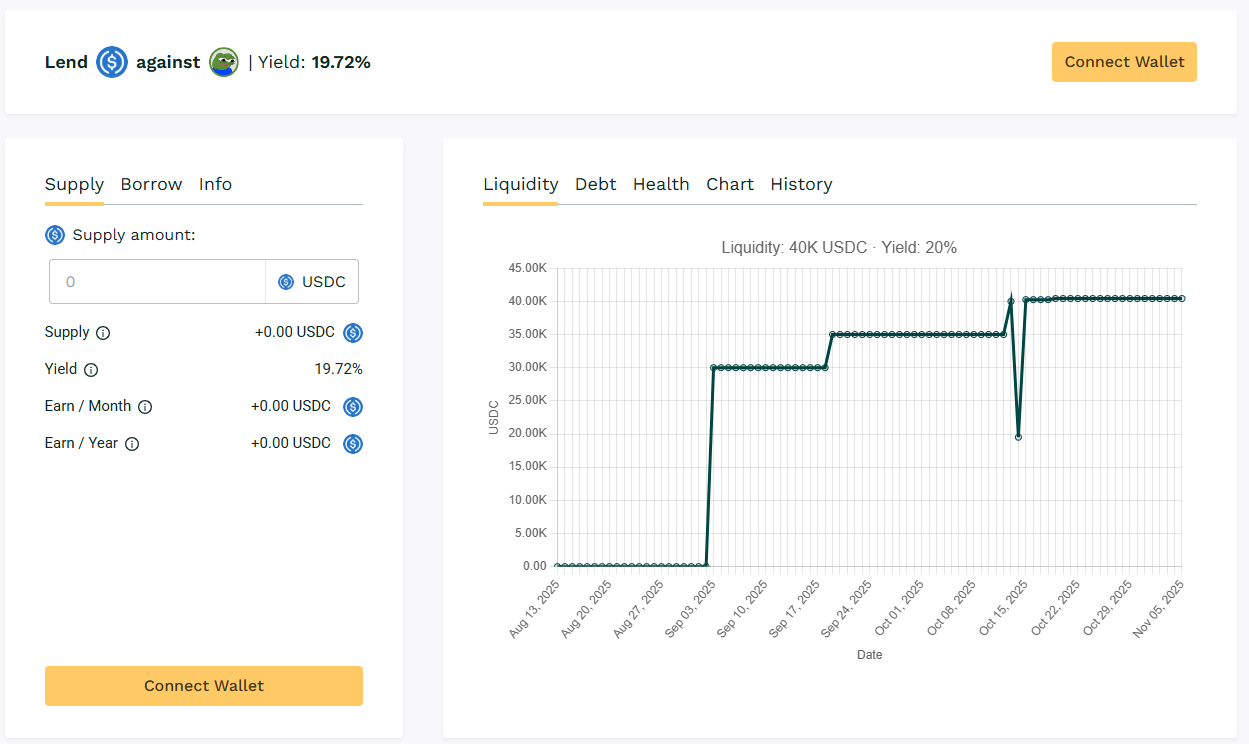

⭐ USDC / $APU Pool

🧮 APY: 19.72%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Borrower engagement across pools sustained yields almost reaching 20% APY and continues to demonstrate active loan rollover behavior

📌 APYs are sustained by consistent monthly borrowing volume.

📈 Yield Summary

$MASA takes the top spot with over 72% yield from full utilization. $SPX follows with high borrower engagement, while $PIXL, $DMT, and $WBTC sustain returns. Overall market behavior points to continued borrower rollover patterns driving mid- to high-tier yields.

📢 Next Week

Stay tuned for next week’s Digest for updated yield movements and borrower trends across Teller markets.

👉 Monitor live APYs anytime at app.teller.org/lend