Teller Yields, Weekly Digest 10/30

Date: October 30, 2025

Source: Teller on DeFiLlama

This week’s Teller lending data shows continued borrower activity across $SPX, $PIXL, and $WBTC pools, maintaining stable yields above 25%.

Here's the top lending pools this week.

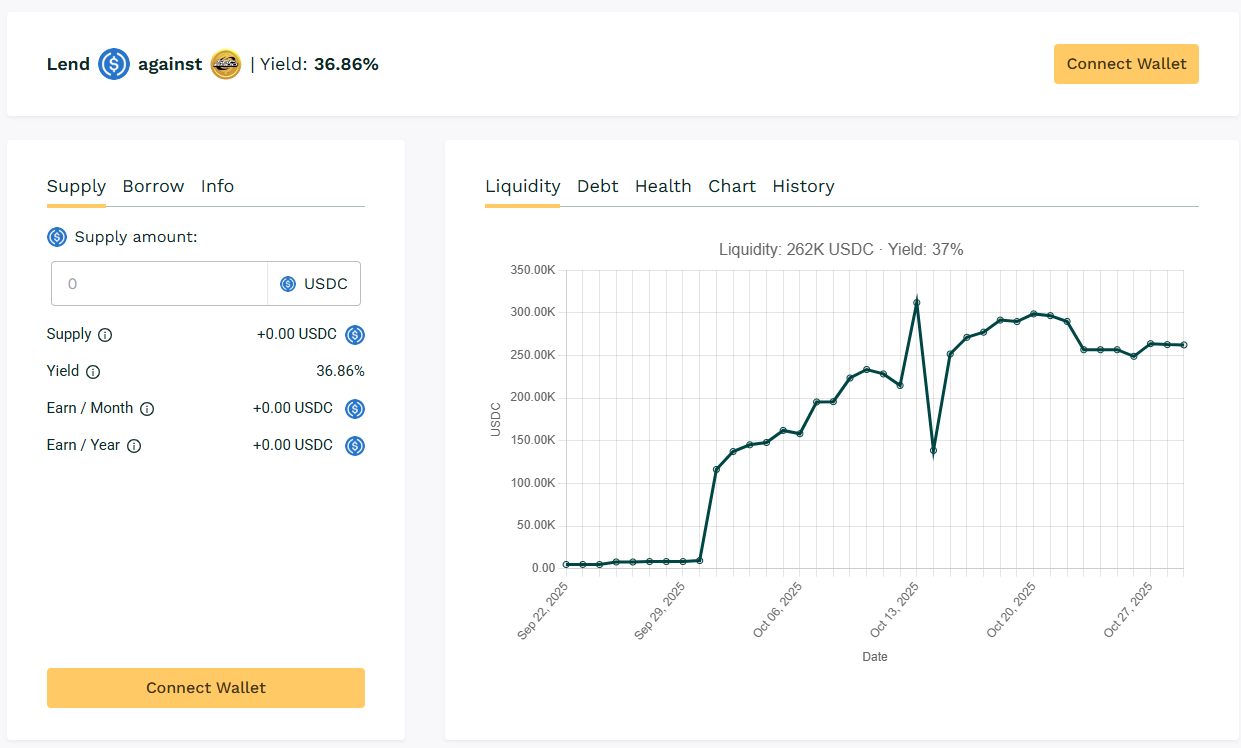

🥇 USDC / SPX

🧮 APY: 36.86%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers using $SPX collateral are locking in different loan size. With consistent 30-day borrow terms, lenders are seeing returns above ~30%.

🎯 Ranked 1st among the highest yield pool, reflecting ongoing borrower participation.

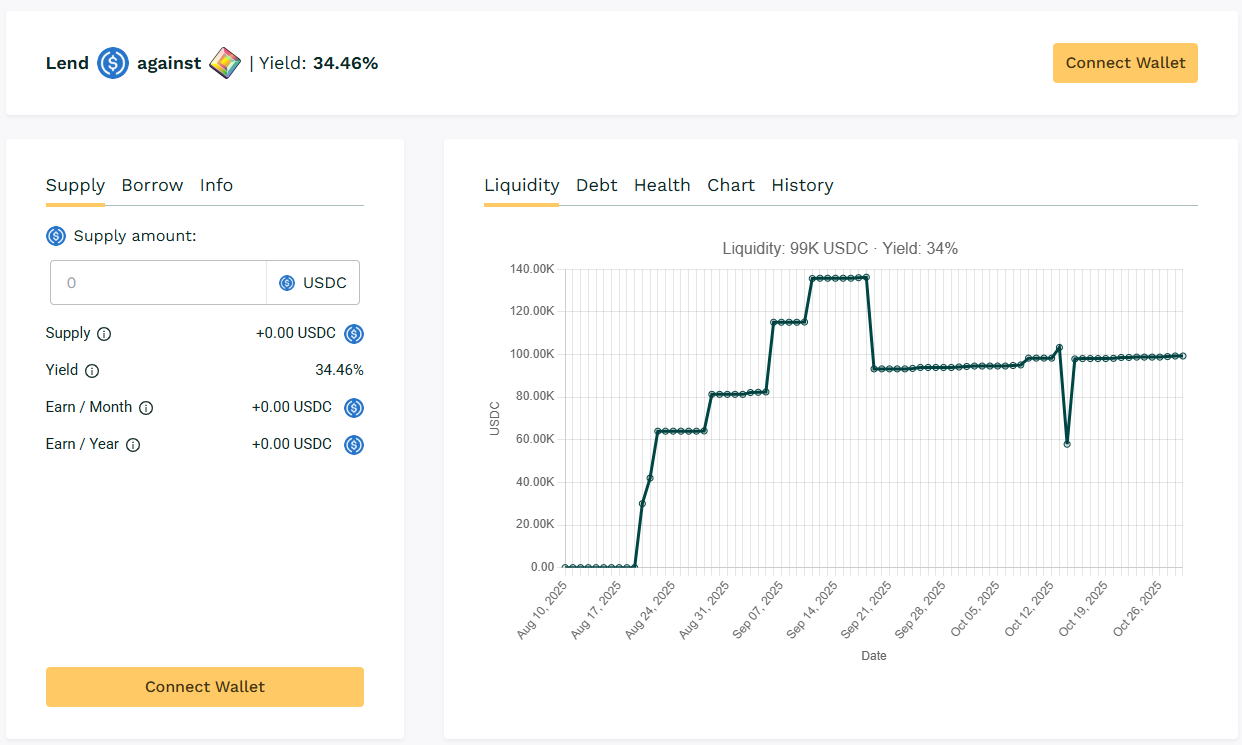

🥈 USDC / PIXL

🧮 APY: 34.46%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

This pool continues to deliver above ~30% APY for lenders. Borrowers appear to be leveraging $PIXL for short-term funding needs, maintaining steady debt pressure on the pool.

🎯 $PIXL remains one of the most consistently performing pools anchored by recurring borrower activity.

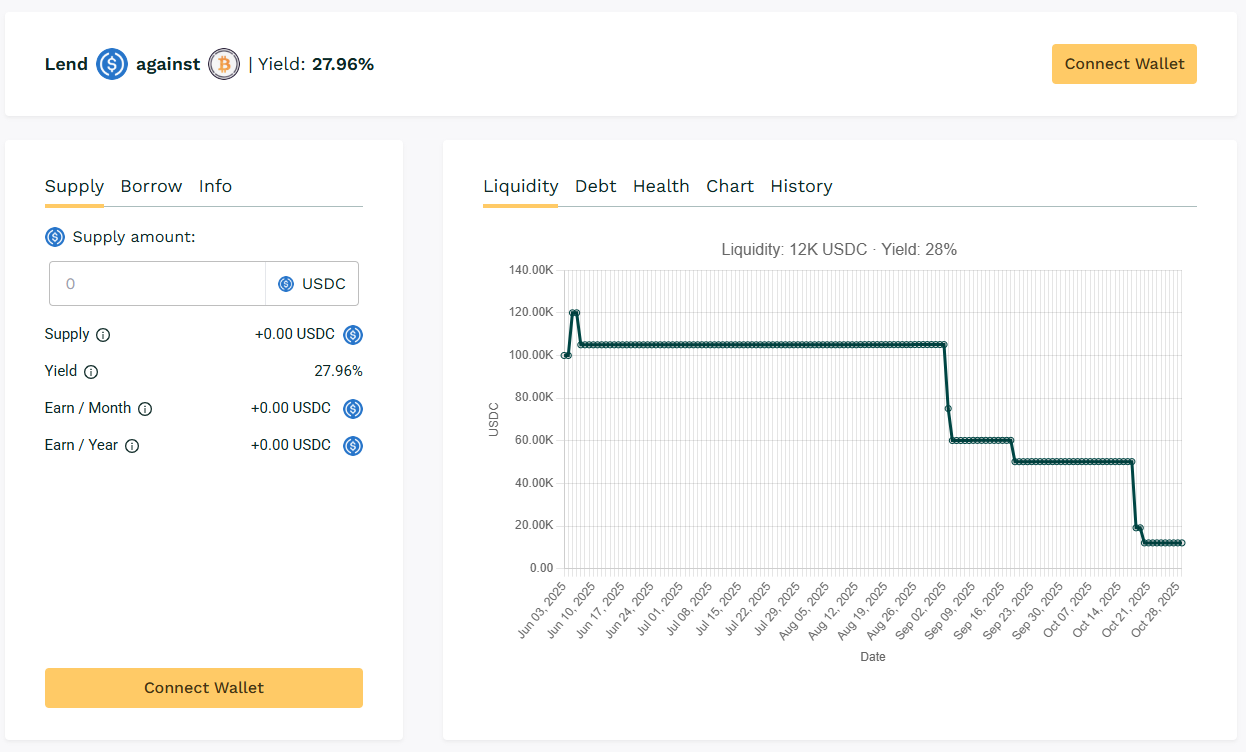

🥉 USDC / WBTC

🧮 APY: 27.96%

📉 Collateral: WBTC (Wrapped BTC)

🔐 Loan Term: 30 days

📊 Collateral Rate: 150%

$WBTC pool reached full utilization this week as recent deposits and withdrawals caused APY to spike.

🎯 Yield climbed from last week, reflecting renewed activity and interest among $WBTC borrowers.

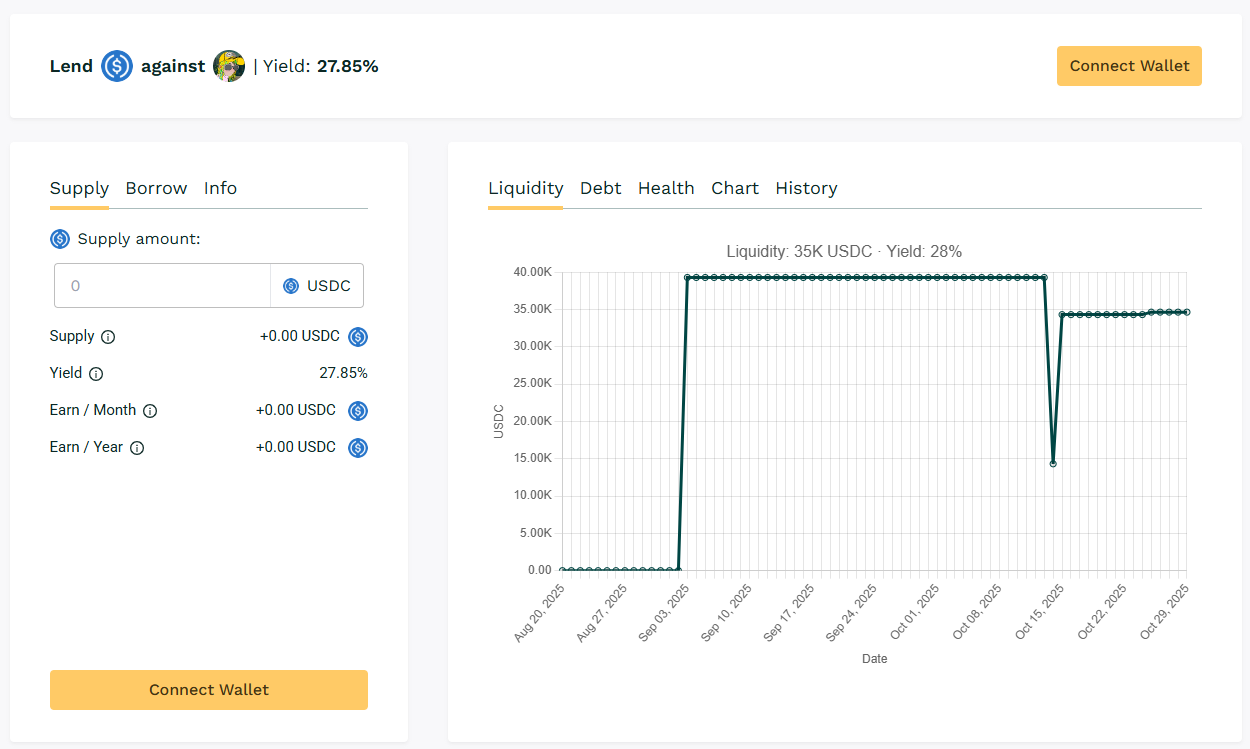

🏅 USDC / $DMT

🧮 APY: 27.85%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained APY in the upper-20% range. The pool shows activities taking one of the lead pools position this week.

🎯 Borrower rollovers keeping yield above 25%.

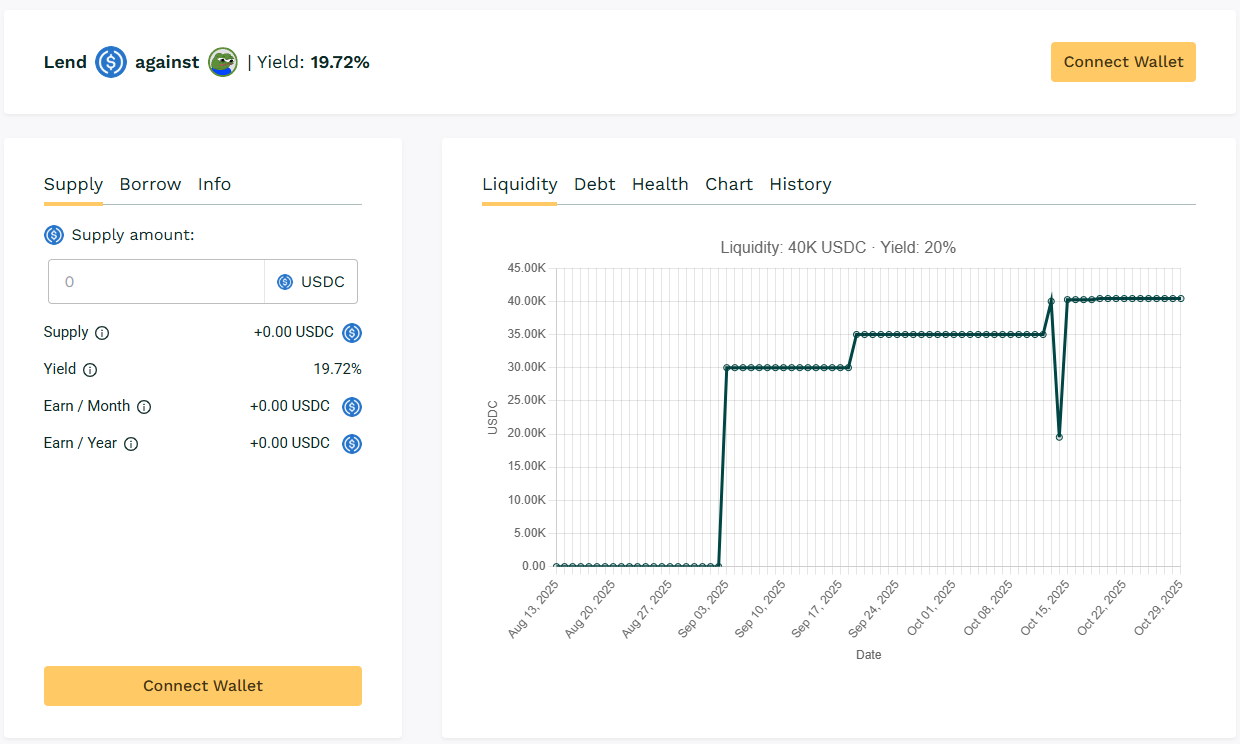

🏅 USDC / APU

🧮 APY: 19.72%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU borrower and lender activity keeping the APY in the 20% range.

🎯 Pool earning near 20% APY with a loyal borrower base.

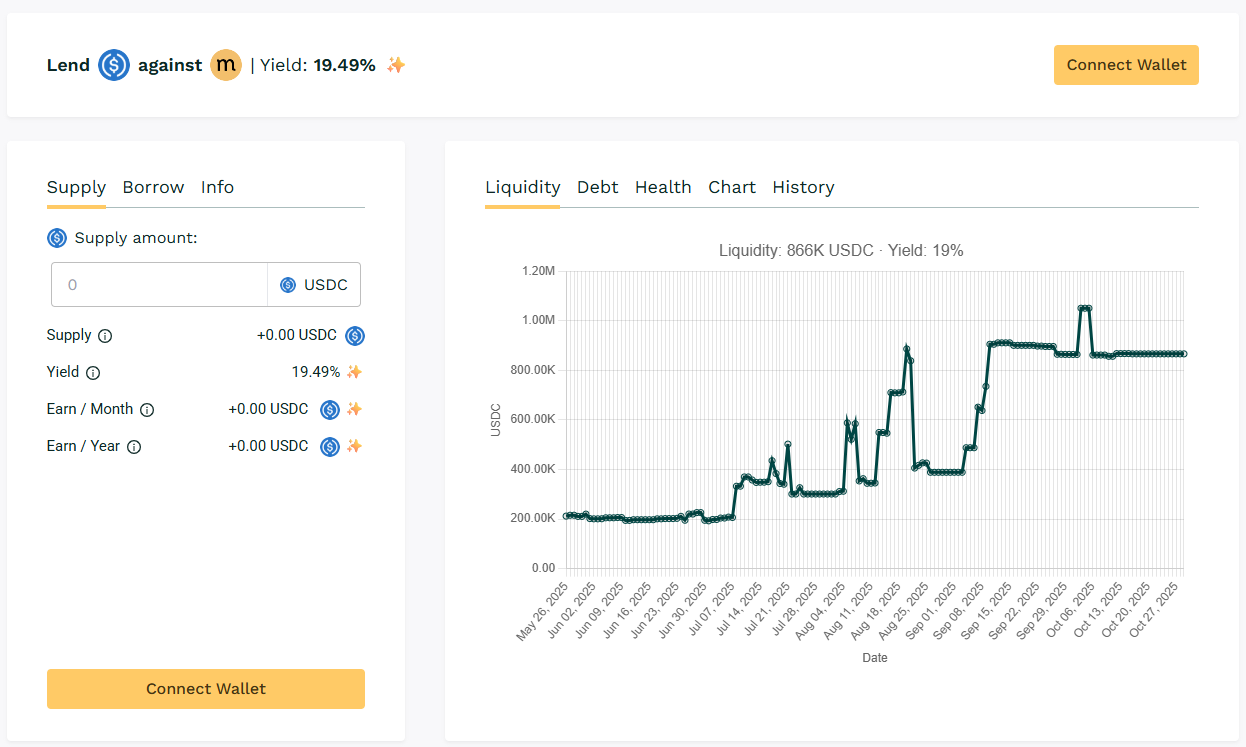

⭐ USDC / $MASA

🧮 APY: 19.49%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%.

Pool APY is in the 20% range, still it is one of the most liquid pools with over $850K USDC in liquidity.

🎯 $MASA anchors the leaderboard with scale and yield.

📸 Snapshot

- Top performing pools: $SPX, $PIXL, and $WBTC

- Highest liquidity: $MASA (866.47K USDC)

- Across these pools, borrower demand and rollover behaviors continue to shape APYs.

🛎️ Next Digest

Next week’s update will track rollover trends and analyze whether utilization shifts toward high-yield pairs continue into November.

Track live data here 👉 https://app.teller.org/ethereum/lend