Teller Yields, Weekly Digest 10/23

Date: October 23, 2025

Source: Teller on DeFiLlama

This week’s yields reflected moderate borrower rotation, with utilization holding steady across most USDC pairs.

Below is a breakdown of current pool activity and yields.

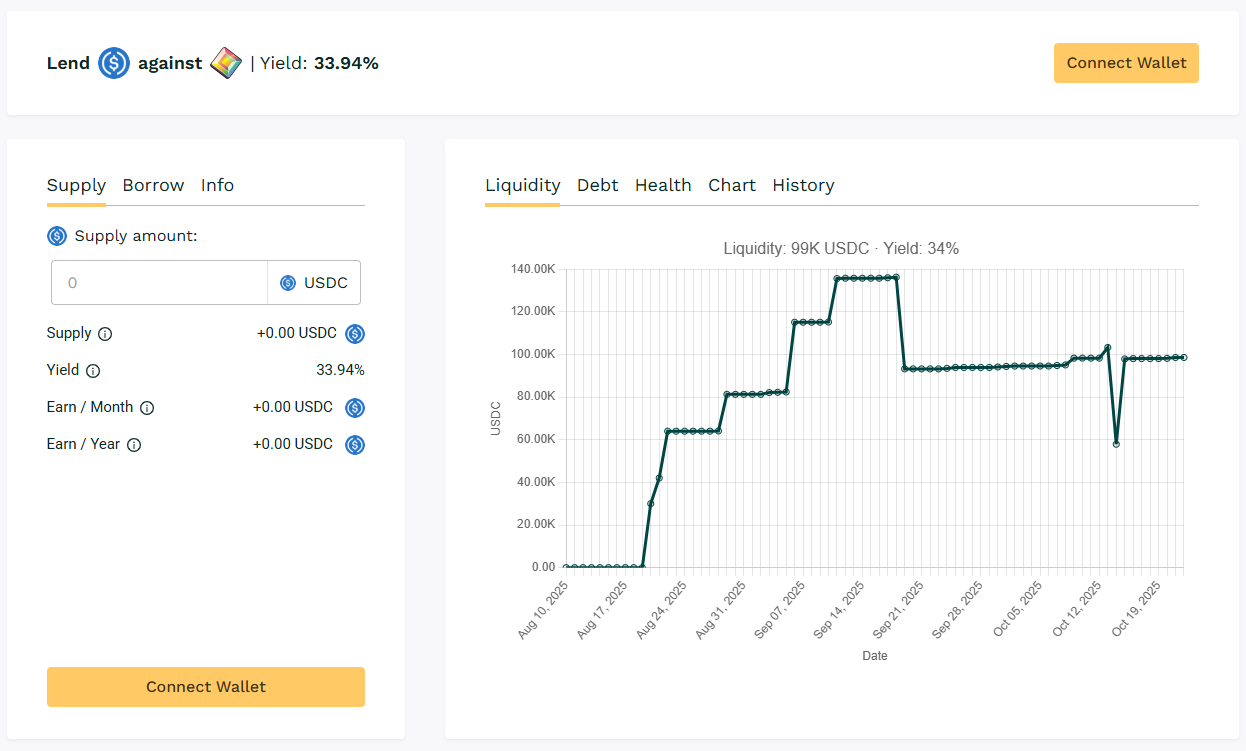

🥇 USDC / $PIXL

🧮 APY: 33.94%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

$PIXL maintained short-term loan cycles with steady borrower participation. This activity kept APY above 33%.

🎯 $PIXL sustained yields above 30% through continuous loan cycles taking the top 1 this week.

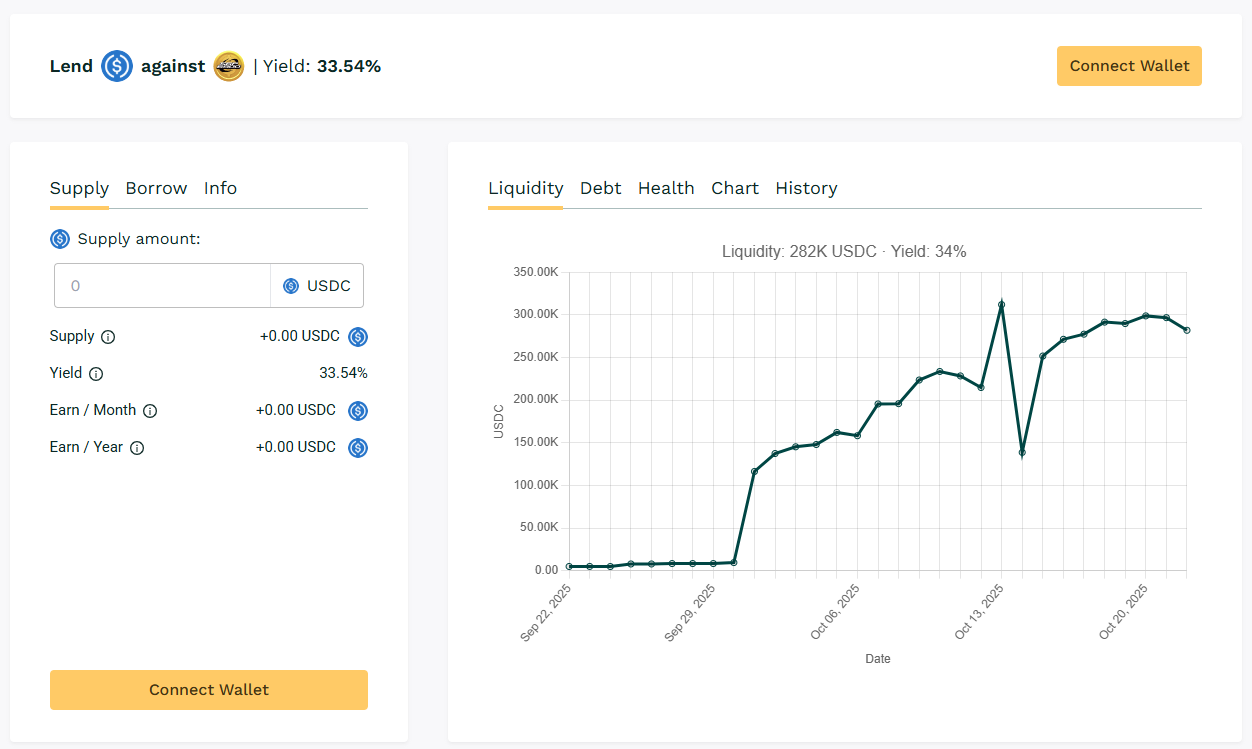

🥈 USDC / $SPX

🧮 APY: 33.54%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX loans remained active with liquidity deployed. Yields approached 33%, supported by borrower rollover activity and collateral ratios.

🎯 $SPX utilization supported 30% yields.

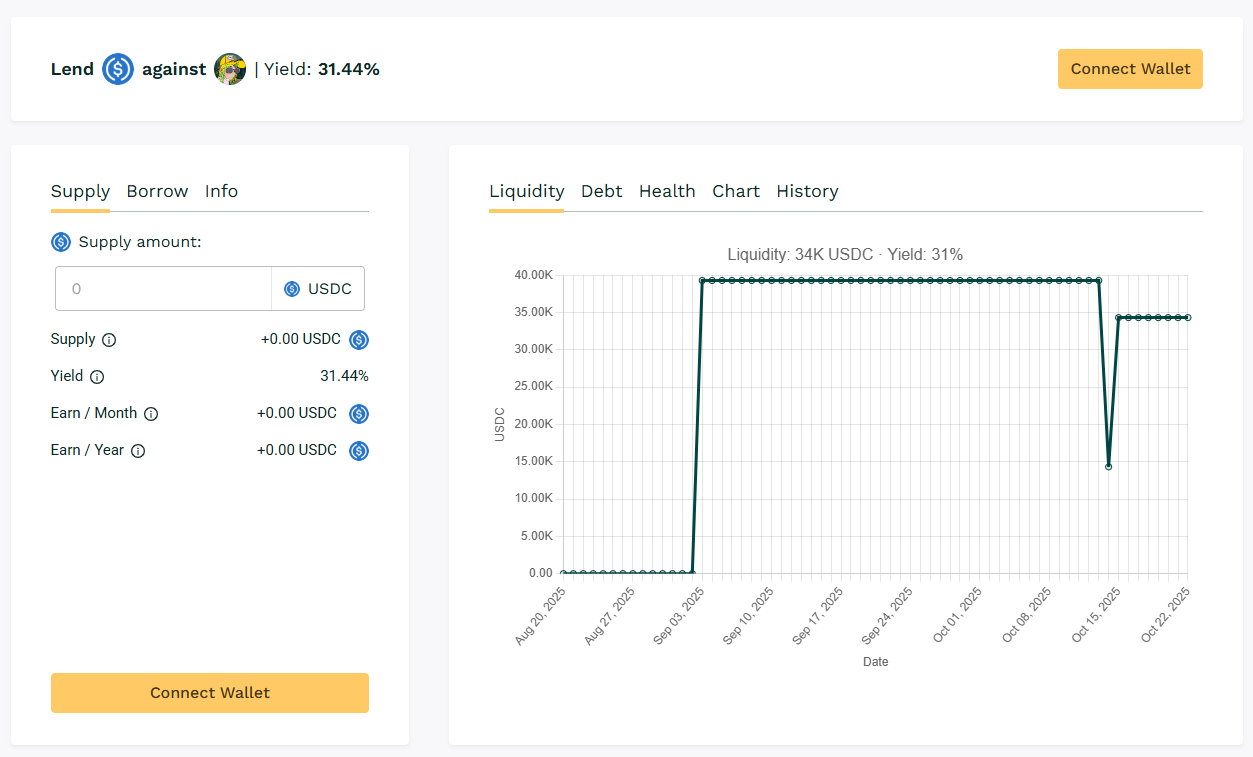

🥉 USDC / $DMT

🧮 APY: 31.44%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper-30% range. The pool shows activities taking the third position this week.

🎯 Borrower rollovers keeping yield above 30%.

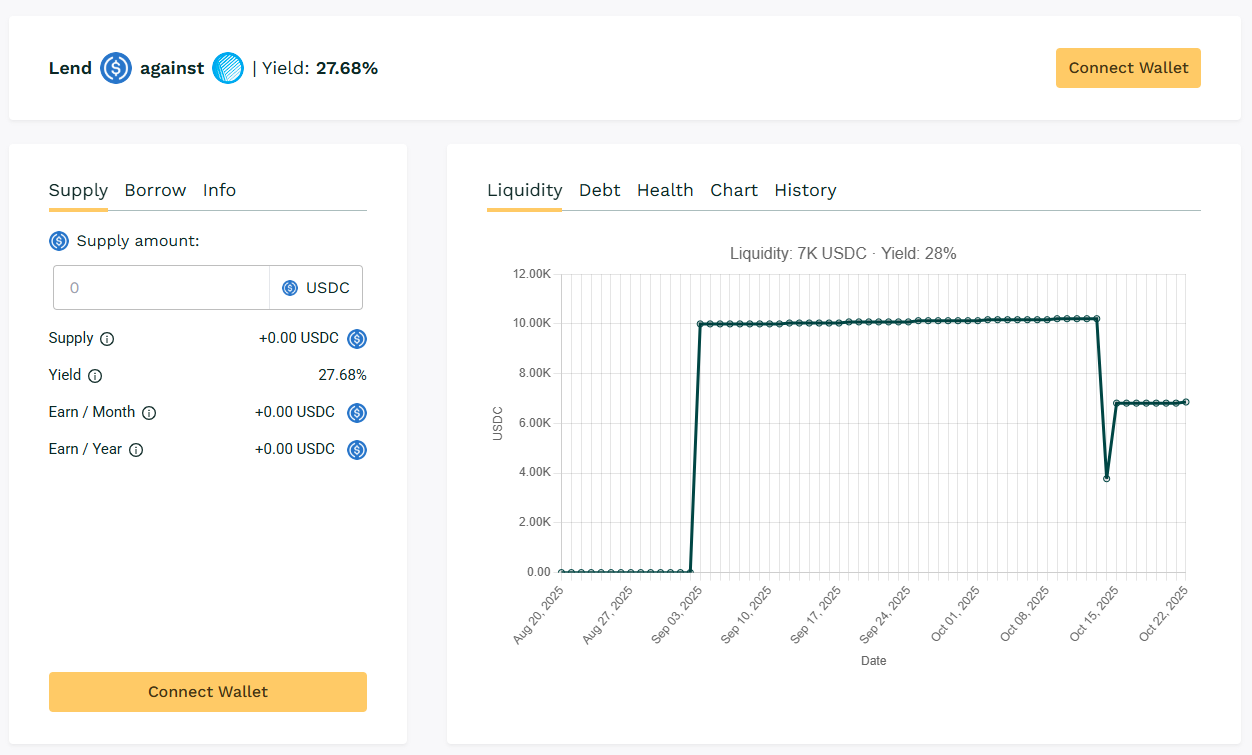

🏅 USDC/ $ASF

🧮 APY: 27.68%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

$ASF borrowing cycles delivered yields close to 28%. Despite smaller liquidity size, the pool shows continued usage.

🎯 $ASF held close to 28% APY despite smaller liquidity.

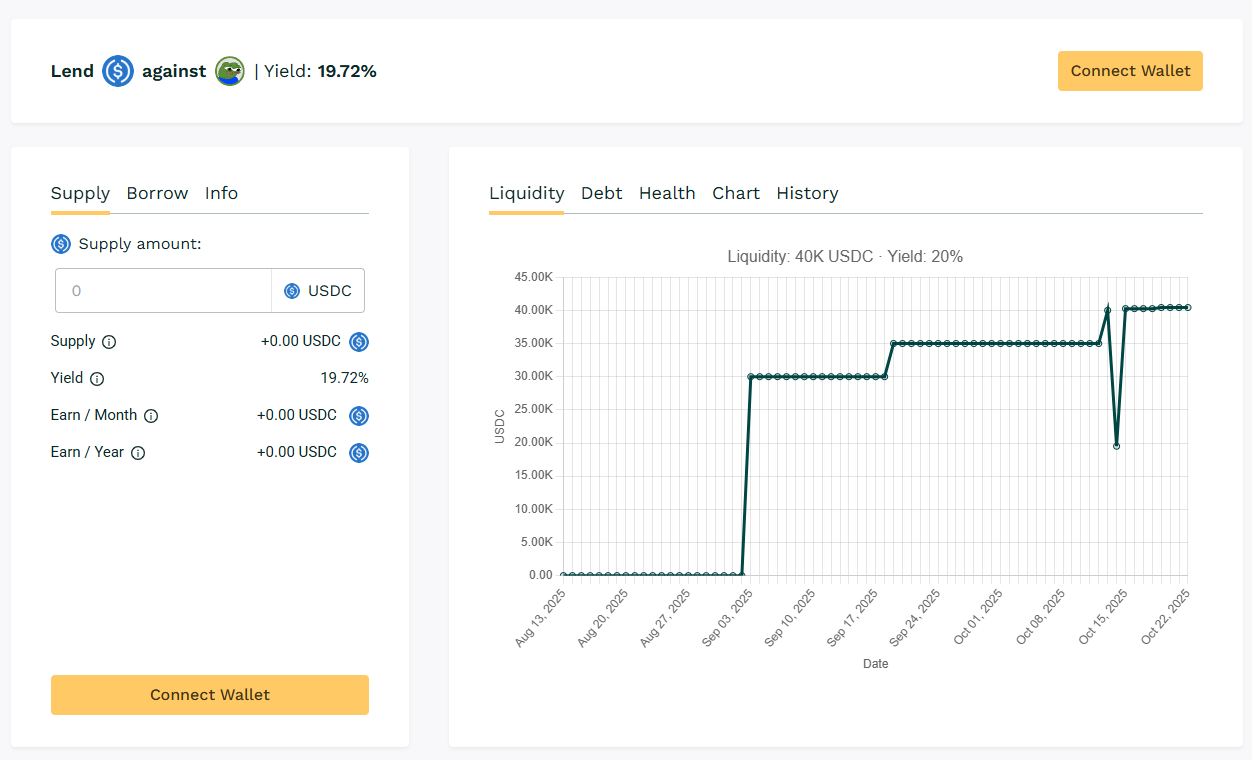

🏅 USDC / $APU

🧮 APY: 19.72%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU collateralized pools together accounted for over 120K in liquidity. Borrower engagement across pools sustained yields in the low-20% range.

🎯 $APU pools raised over 40K liquidity with above 20% yields.

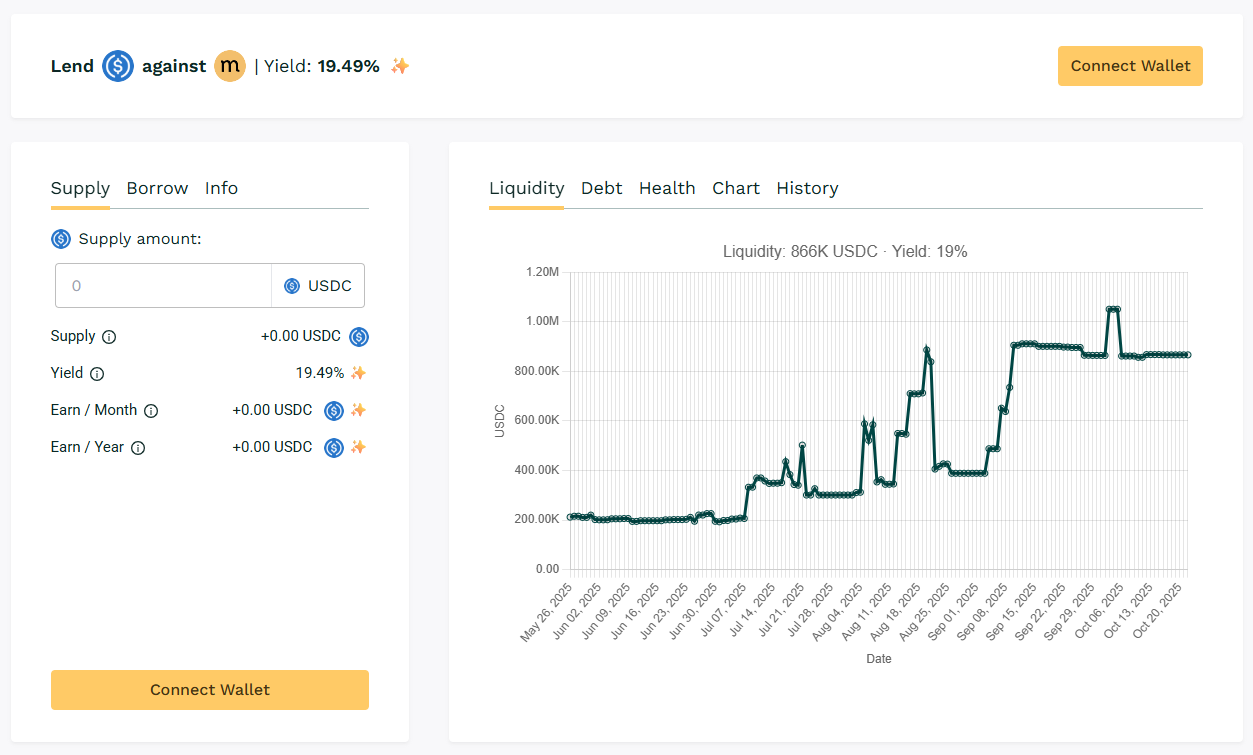

✅ USDC / $MASA

🧮 APY: 19.49%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%.

The main $MASA pool continues to draw liquidity, sustaining APYs above 19% with borrower demand.

🎯 $MASA anchors the leaderboard with scale and yield.

🧊 Blue‑Chip Lending

USDC / WBTC: 12.03% APY

USDC / WETH: 10.56% APY

$WBTC and $WETH pools offered baseline APYs in the 10–13% range. Continued to provide lower-risk lending opportunities.

📸 Snapshot

- Top APYs this week: $PIXL (33.94%), $SPX (33.54%), $DMT (31.44%)

- New entry: $DMT joined the board with nearly 35K USDC in total liquidity.

- $WBTC and $WETH pools offer 10–13% APYs, acting as a blue-chip anchor.

🔔 Next Digest

Tune in for next week’s update as we track shifts in APY, liquidity, and borrower behavior.

👉 Explore live lending data anytime at app.teller.org/lend