Teller Yields, Weekly Digest 10/16

Date: October 16, 2025

Source: Teller on DeFiLlama

Updated yields this week show renewed borrower activity across multiple pools, led by fresh movement in $WBTC positions. Liquidity levels remained stable, and rollover patterns continued to drive ongoing yield performance.

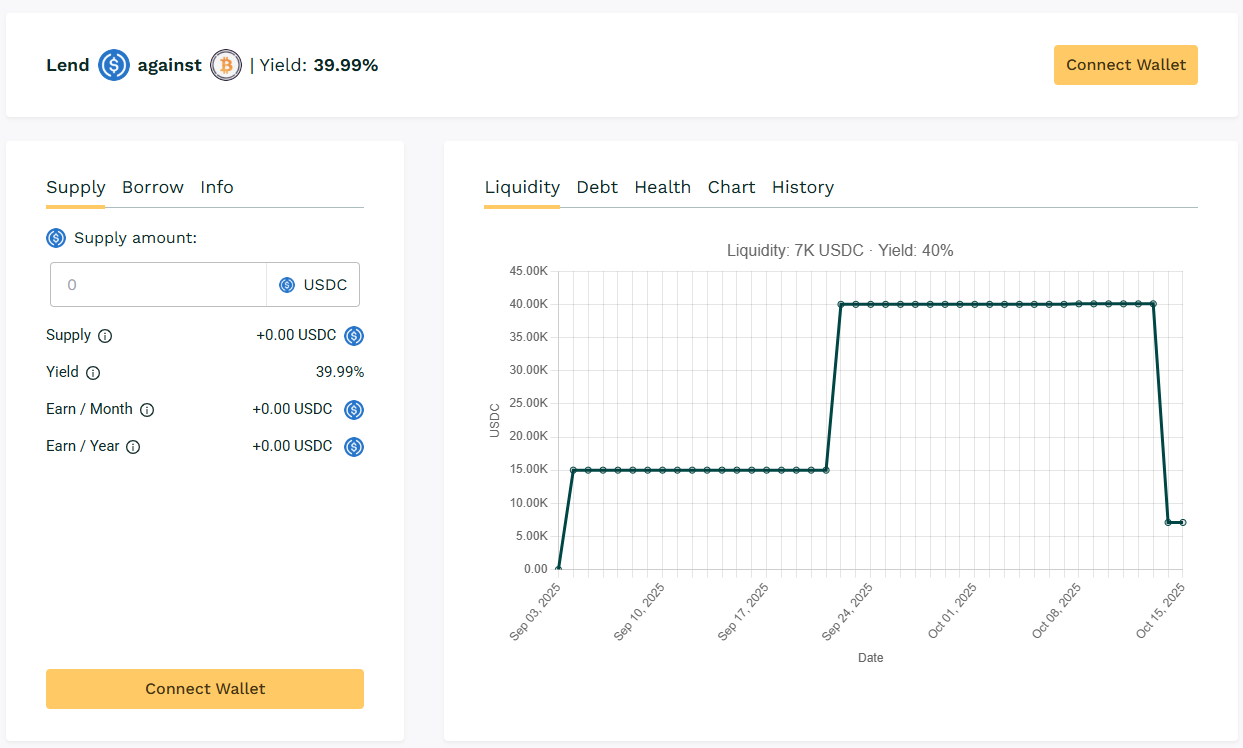

🥇 USDC / WBTC

🧮 APY: 39.99%

📉 Collateral: WBTC (Wrapped BTC)

🔐 Loan Term: 30 days

📊 Collateral Rate: 150%

$WBTC pool reached full utilization this week as recent deposits and withdrawals caused APY to spike.

📌 Yield climbed from last week’s single-digit range, reflecting renewed activity among $WBTC borrowers.

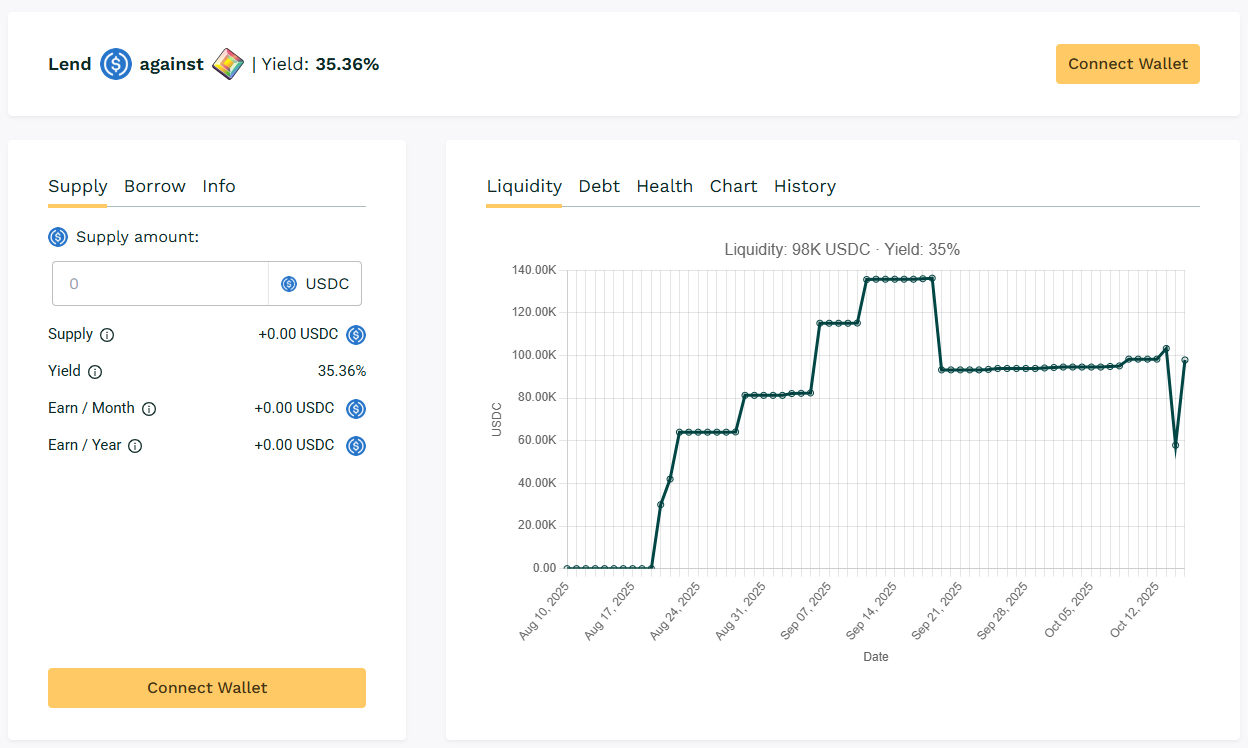

🥈 USDC / PIXL

🧮 APY: 35.36%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

$PIXL continues to draw steady borrowing interest with balanced pool utilization. Loan rollovers keep yield performance consistent.

📌 $PIXL remains one of the most consistently performing pools since, anchored by recurring borrower activity.

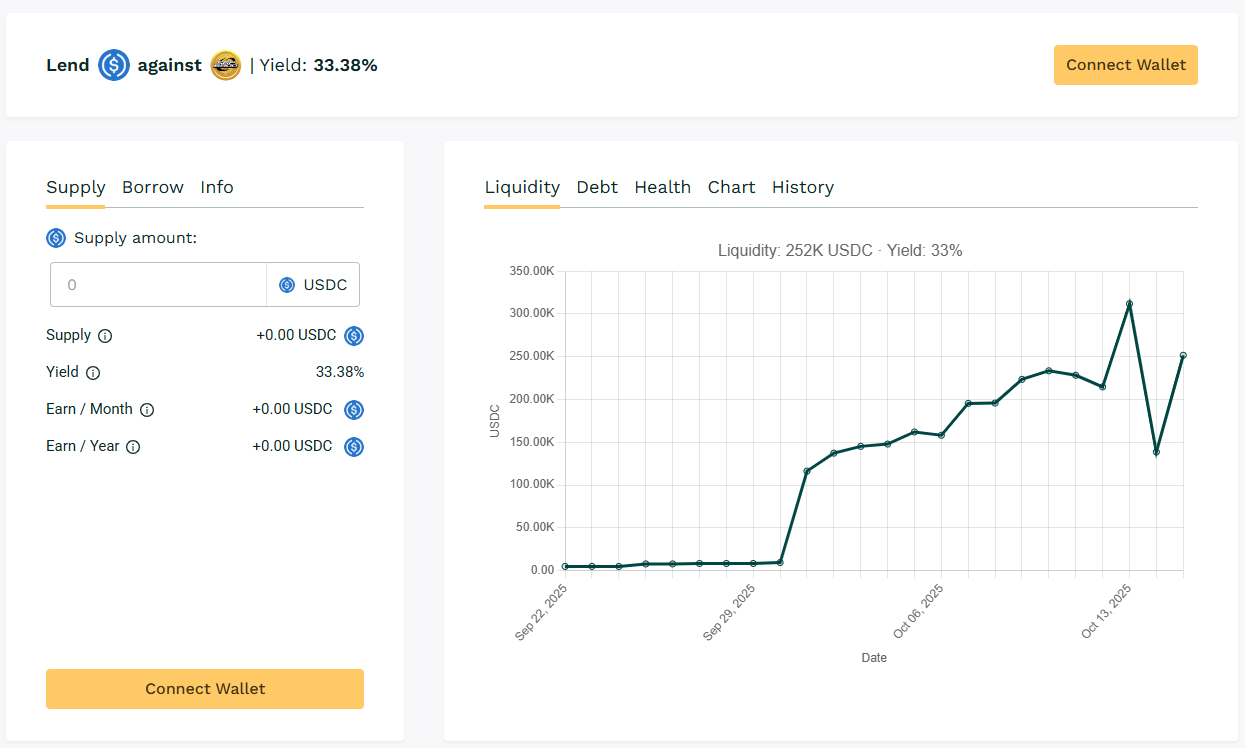

🥉USDC / SPX

🧮 APY: 33.38%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX continues as a high-volume lending market with strong loan issuance and repayment frequency, maintaining healthy yield levels above 30%.

📌 Liquidity remains among the highest across Teller, reflecting ongoing borrower participation.

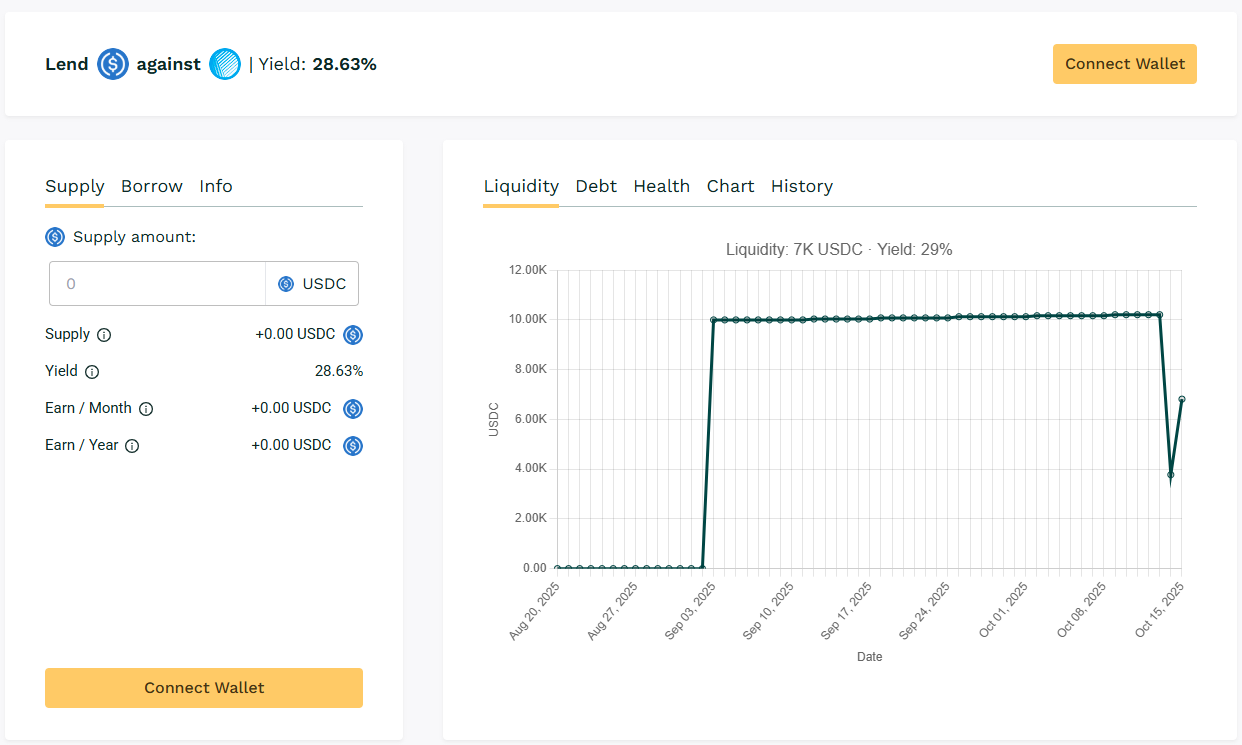

🏅 USDC / ASF

🧮 APY: 28.63%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

$ASF maintains moderate activity with consistent monthly rollover cycles and borrowing trends have remained even.

📌 Regular monthly repayments support consistent pool performance with minimal variance.

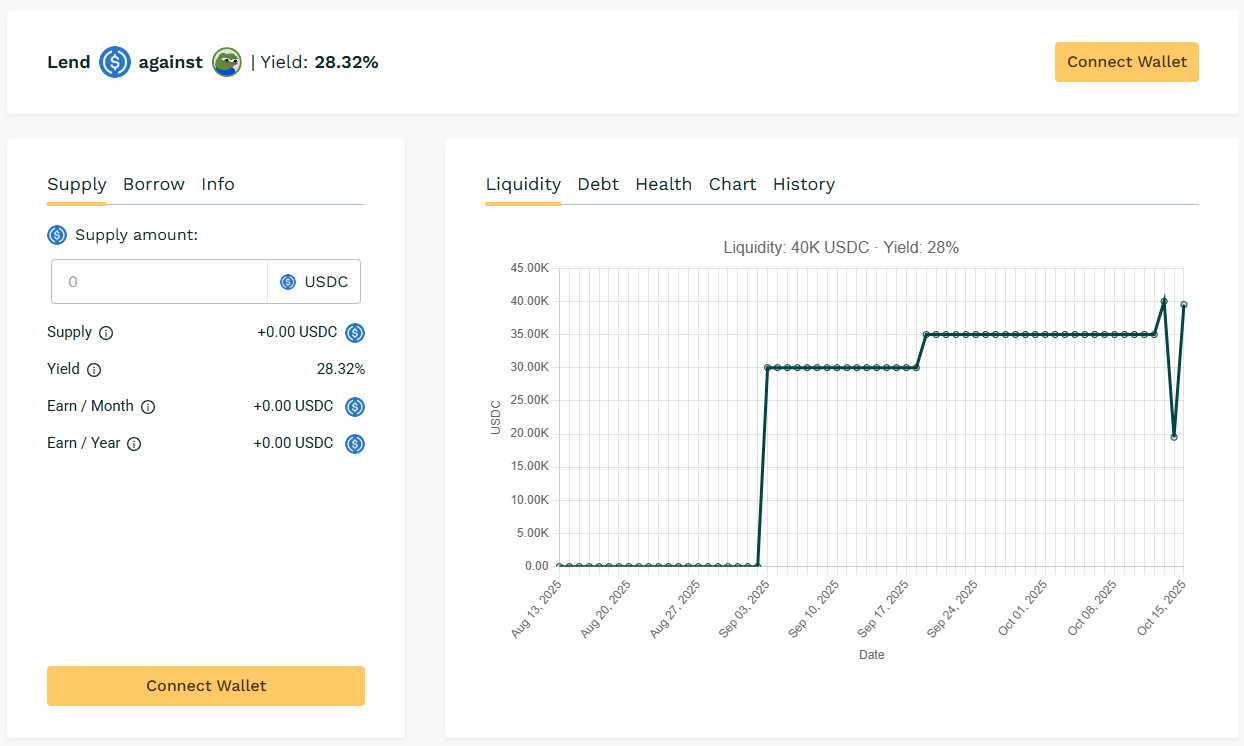

🏅 USDC / APU

🧮 APY: 28.32%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU continues to demonstrate active loan rollover behavior, maintaining yield levels near 30%.

📌 $APU borrower patterns remain one of the steadiest on Teller, with continuous lending cycles.

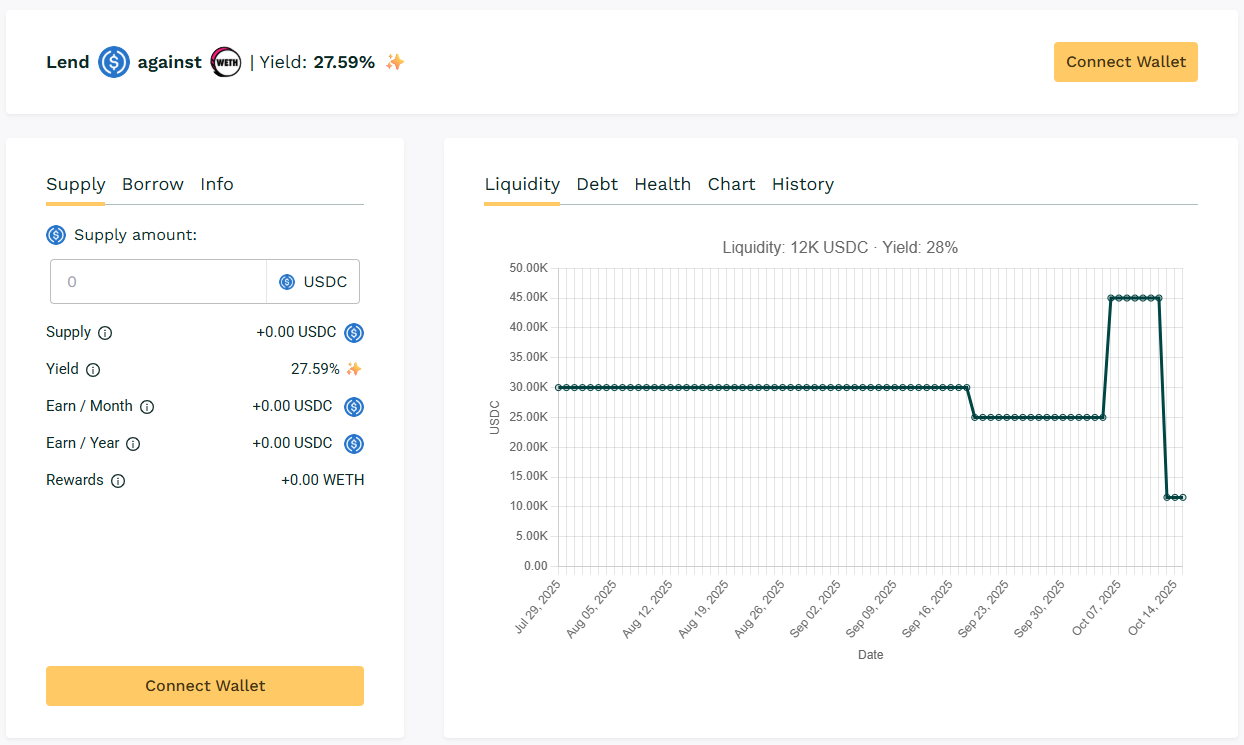

⭐ USDC / WETH

🧮 APY: 27.59%

📉 Collateral: WETH (Wrapped ETH)

🔐 Loan Term: 30 days

📊 Collateral Rate: 200%

$WETH shows full pool utilization this week, with APY fluctuations driven by recent deposits and withdrawals.

📌 Utilization metrics suggest borrowers remain consistent with perpetual-style lending cycles.

📸 Weekly Snapshot

- $WBTC leads with 39.99% taking the first rank this week.

- Utilization across $WBTC and $WETH pools pushed weekly yield averages upward.

- Large-cap borrower activity remains concentrated in $SPX and $PIXL, keeping overall liquidity deployment efficient.

📆 Next Digest

Next week’s digest will track how current high-yield pools sustain performance amid active rollovers and new borrower entries across the Teller ecosystem.

👉 Monitor live APYs anytime at app.teller.org.