Teller Yields, Weekly Digest 10/09

Date: October 09, 2025

Source: Teller on DeFiLlama

The week’s top-performing USDC pools show steady lending activity and moderate borrower rollover patterns across active pools.

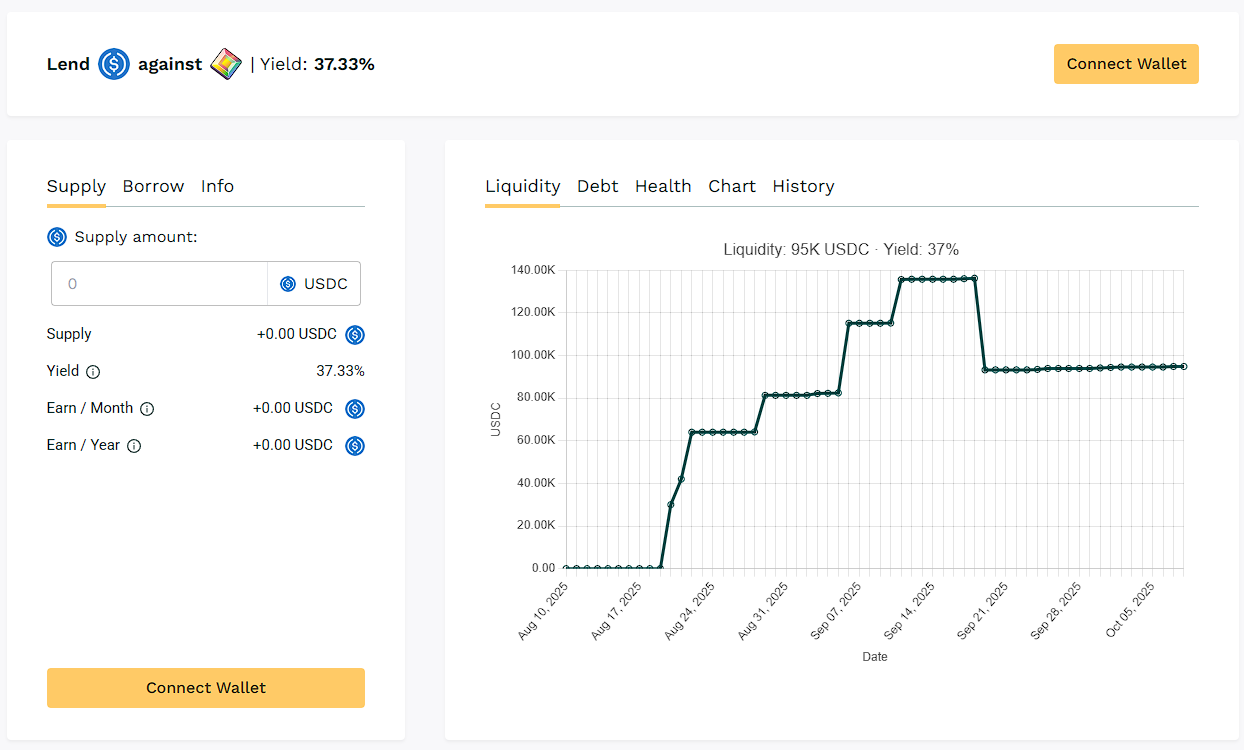

🥇 USDC / $PIXL

🧮 APY: 37.33%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

PIXL pool maintains consistent utilization with active borrower rollovers. Yield driven by steady loan demand and rollover usage.

💡$PIXL pool APY rose after large rollover events taking the first rank this week.

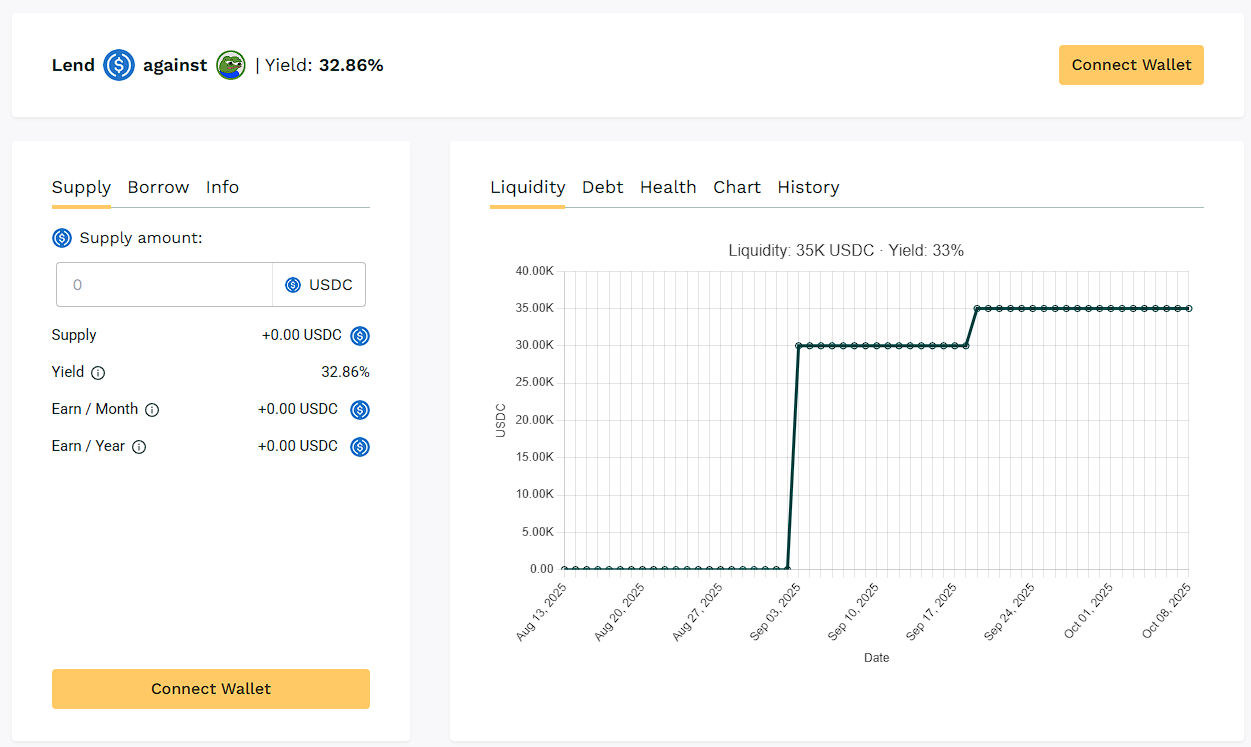

🥈 USDC / $APU Pool

🧮 APY: 32.86%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU borrowing remains active with periodic repayments sustaining double-digit yields. Utilization remains balanced.

💡$APU maintained it's APY standing with active monthly rollover.

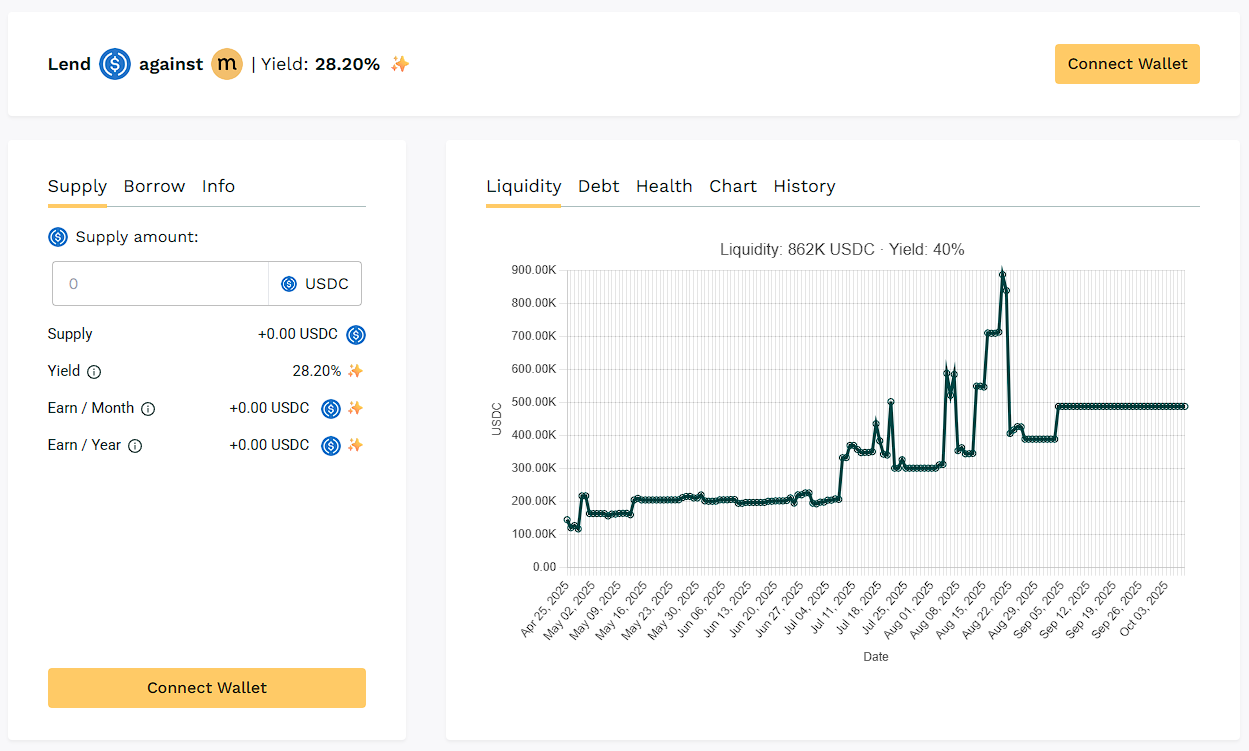

🥉 USDC / $MASA

🧮 APY: 28.20%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

One of the largest active pools this week by liquidity. $MASA maintains a strong base of recurring borrowers, keeping yields at 28% range.

💡Borrower demand for $MASA loans kept APY steady. Liquidity inflows offset some utilization, but steady rollover activity maintained loan growth.

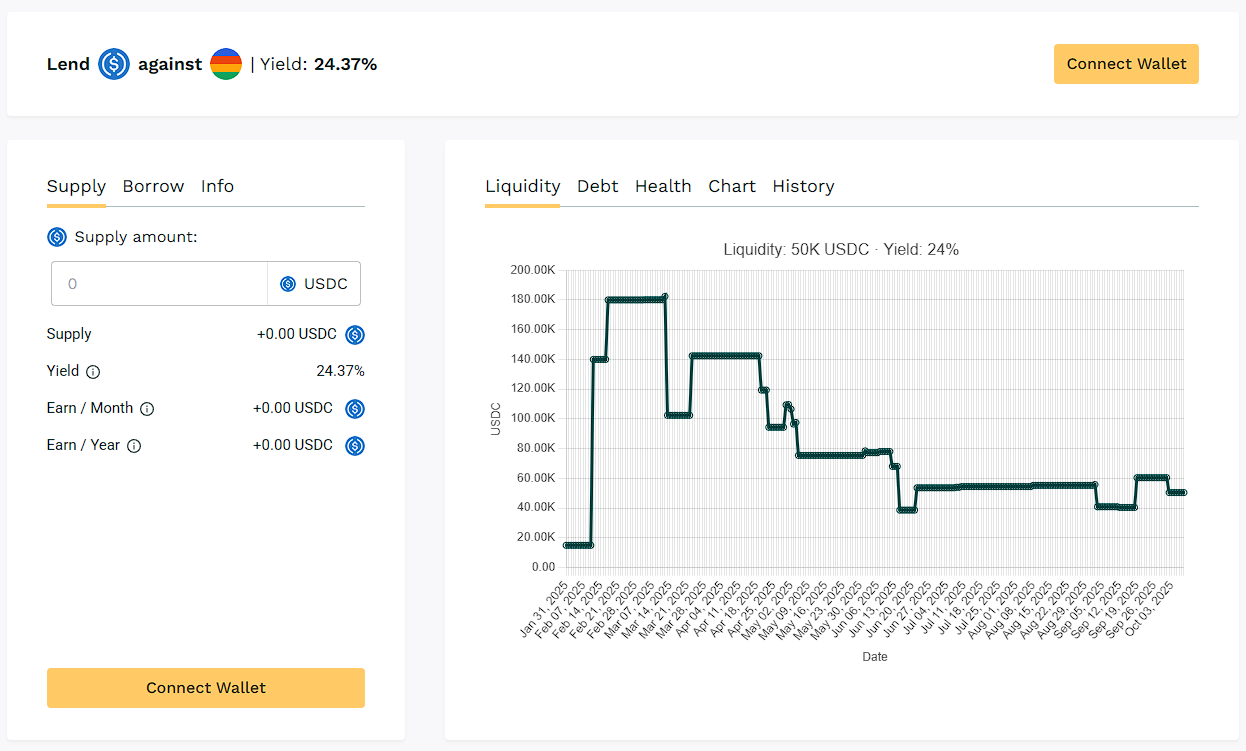

🏅 USDC/ $BEAM

🧮 APY: 24.37%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$BEAM pool shows moderate borrowing and stable yield levels.

💡Borrowers tapped into $BEAM collateral, pushing APY slightly higher compared to last week on monthly loan inflows.

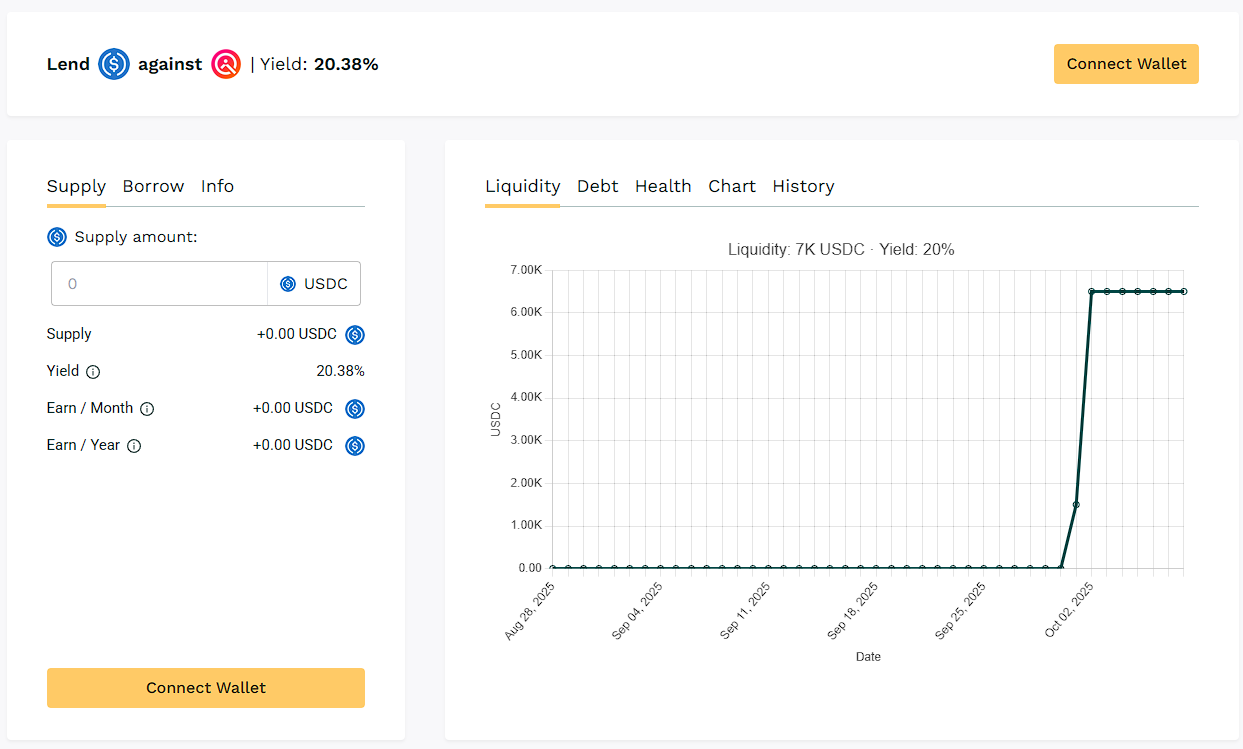

🏅 USDC/ $wQUIL

🧮 APY: 20.38%

📉 Collateral: wQUIL (DeFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$wQUIL lending volume jumps towards top ranks with APYs sustained through monthly borrower demand.

💡wQUIL maintains moderate lending with 20.38% APY on low liquidity.

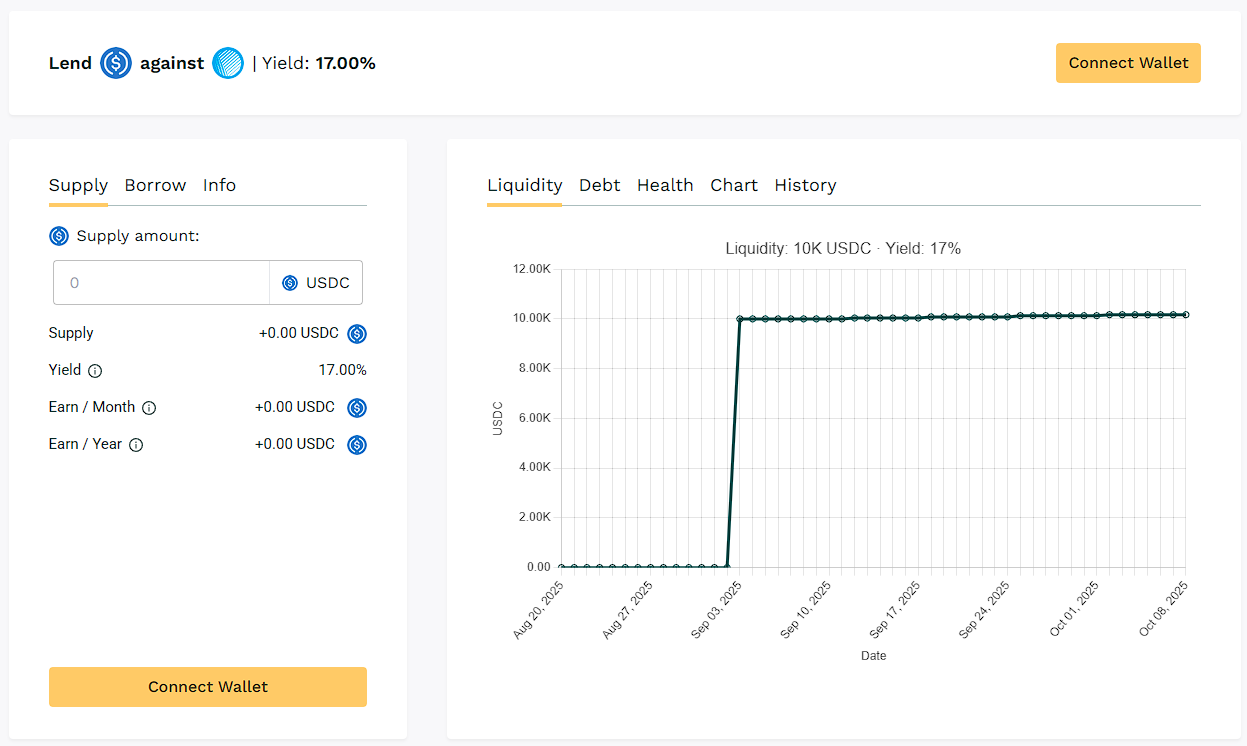

🏅 USDC / ASF

🧮 APY: 17.00%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

$ASF pool remains lightly utilized but continues to deliver 17% APY from ongoing loan rollovers.

💡$ASF lending remains in the lower-yield tier on Teller.

🧊 Blue‑Chip Lending

USDC / WBTC (~4.99%)

USDC / WETH (~11.76%)

BTC and ETH-backed pools continue to provide lower-risk lending options, anchoring the platform’s blue-chip segment with predictable APYs.

💡 Blue-chip collateral loans support yields in the 4-12% APY range.

📈 Yield Takeaway:

APYs across active pools continue to reflect organic borrower behavior, with rollover-driven earnings shaping yield distribution week to week.

📢 Next Week

Tracking continues next week as pool dynamics shift with new borrower demand.

👉 Explore live data anytime at https://app.teller.org/ethereum/lend