Teller Yields, Weekly Digest 10/02

Date: October 02, 2025

Source: Teller on DeFiLlama

Lending yields continued to vary significantly this week. Pools maintained double-digit APYs.

🏆 Top Lending Pools

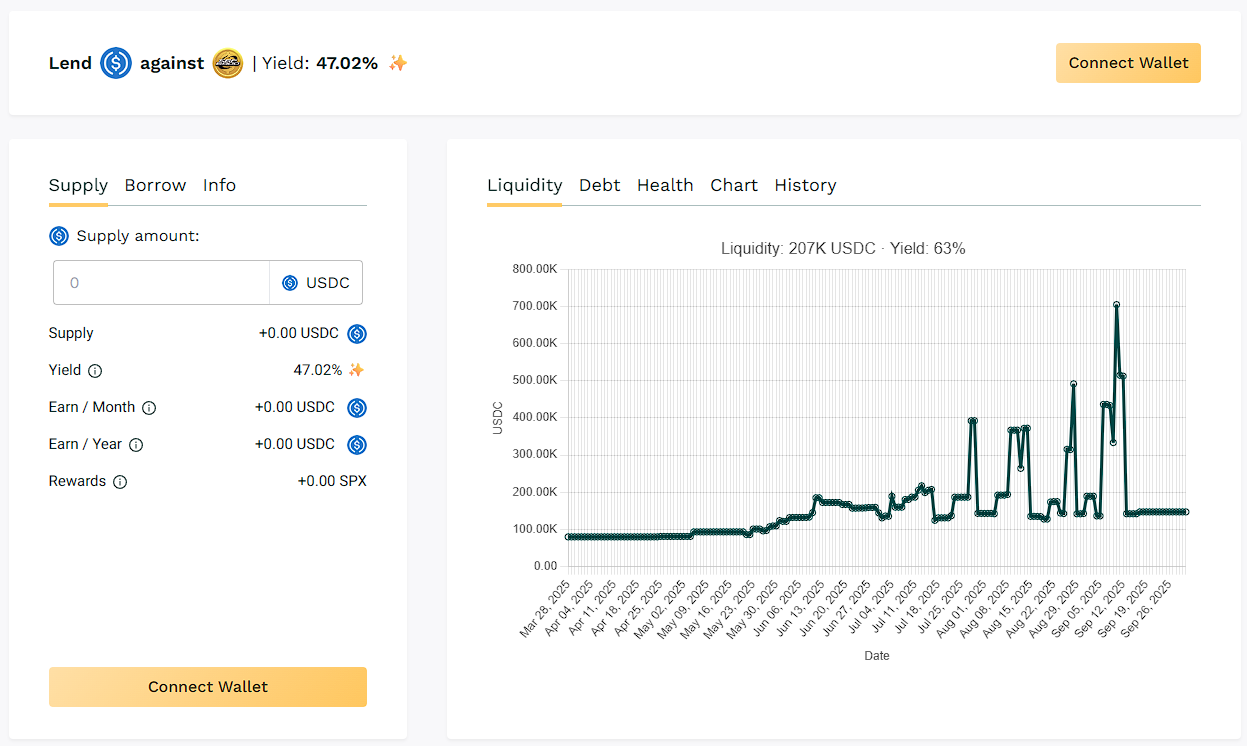

🥇 USDC / SPX

🧮 APY: 47.02%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers actively using SPX collateral maintain demand within this pool. APY remains consistent as loans continue rolling over.

📌 Borrower activity support earning the top 1 spot this week.

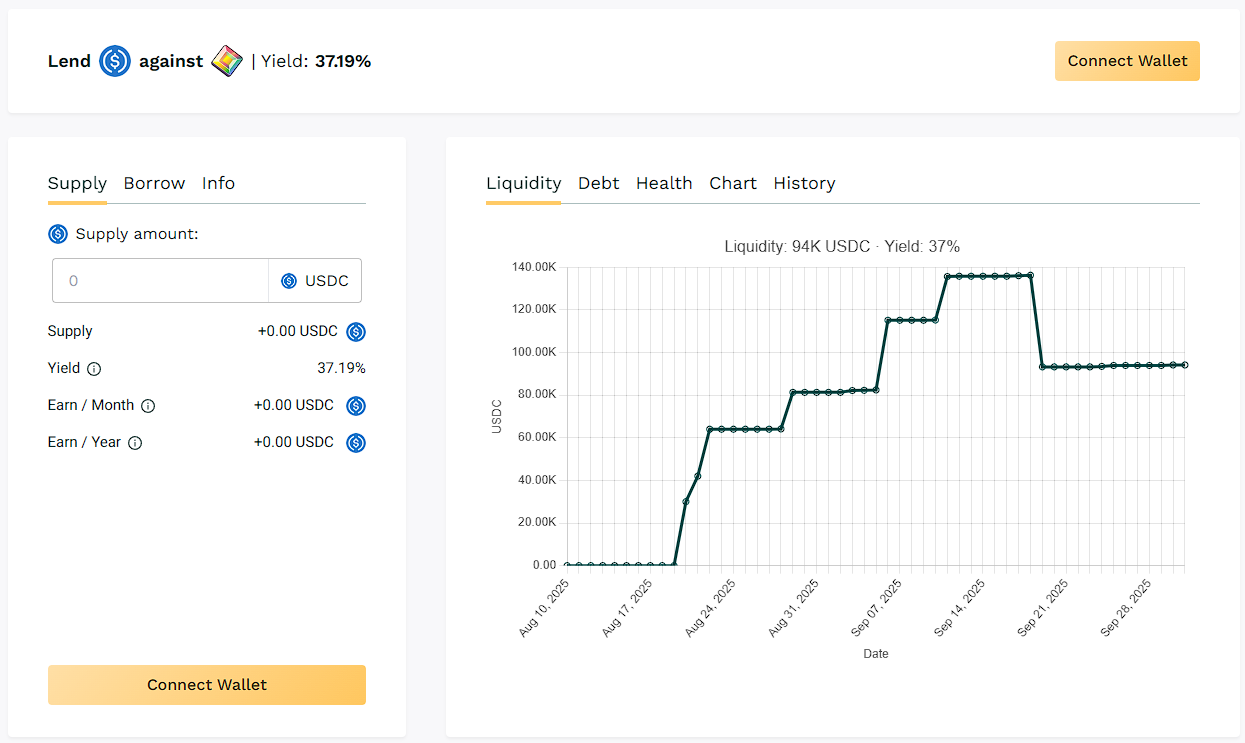

🥈USDC / PIXL

🧮 APY: 37.19%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Short duration lending generated turnovers and APR in higher than 35%. Borrower participation remained consistent throughout the week.

📌 Ranks second this week and borrowing activity shows sustainability with rollover usage.

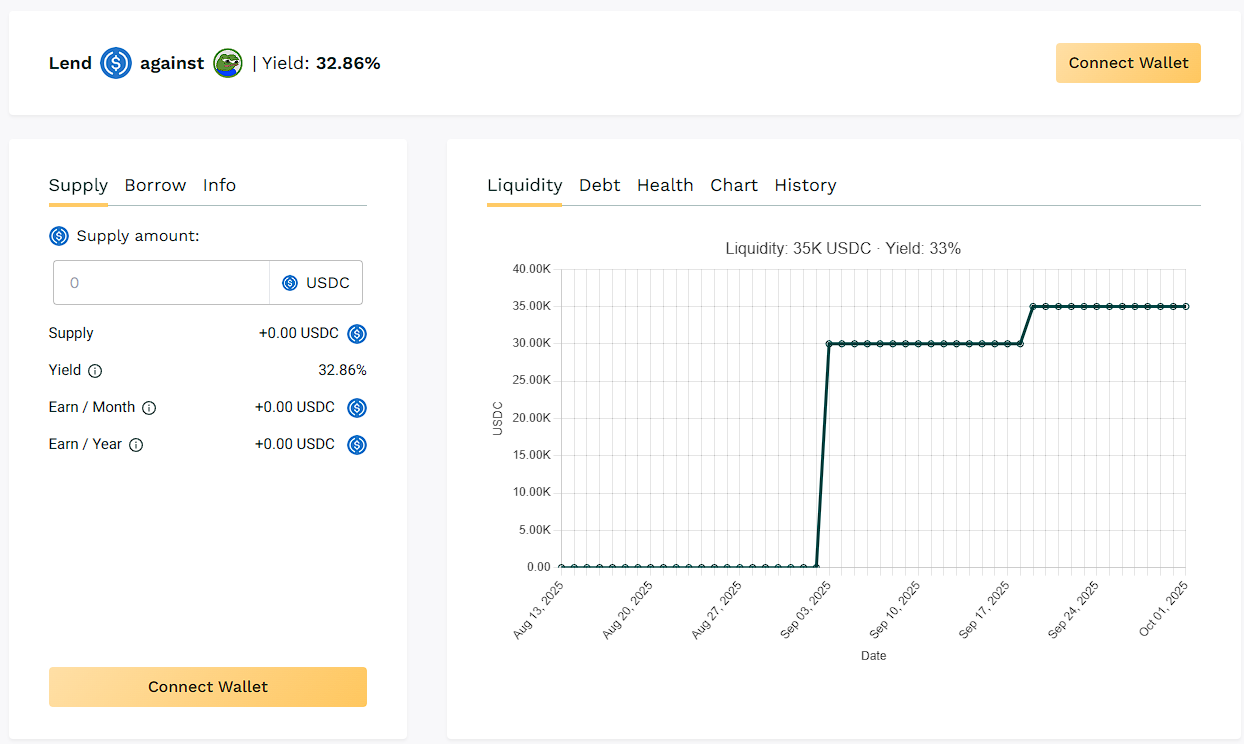

🥉 USDC / APU

🧮 APY: 32.86%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Loan cycles continue to keep utilization and reached an APY above 30%.

📌 APYs are sustained by consistent monthly borrowing volume.

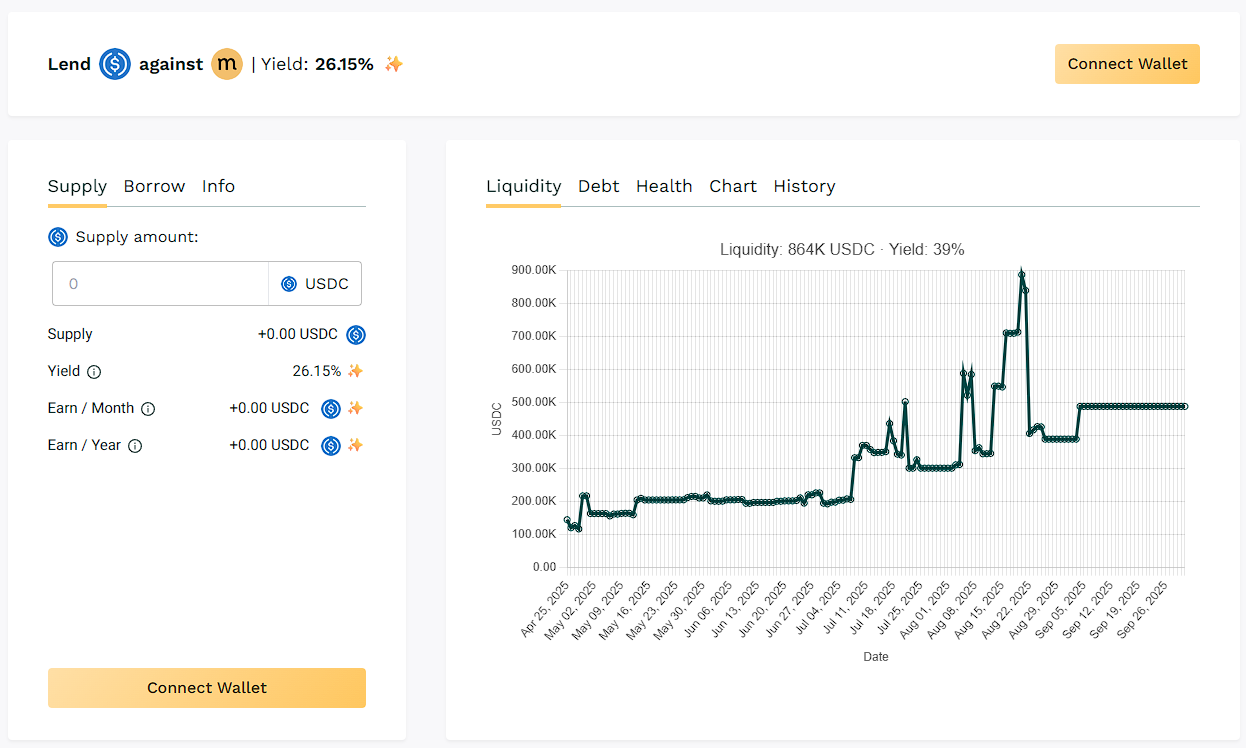

✅ USDC / MASA

🧮 APY: 26.15%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Liquidity and borrowing are driving APY above 25% with sustained pool demand.

📌 The pool continues to serve as one of the top options for lenders.

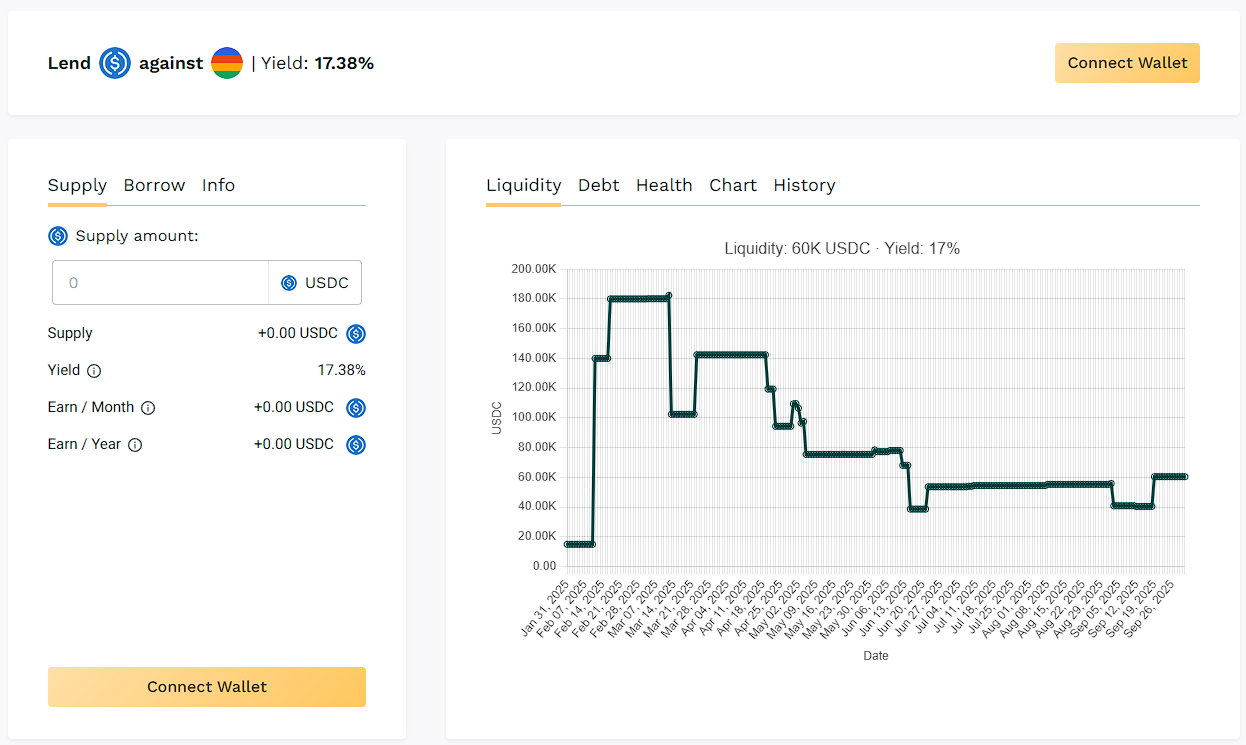

✅ USDC / BEAM

🧮 APY: 17.38%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

The pool shows activities maintaining its position as a mid-cap option for lenders. $BEAM continued to deliver consistent returns.

📌 Recurring rollover behavior among BEAM borrowers.

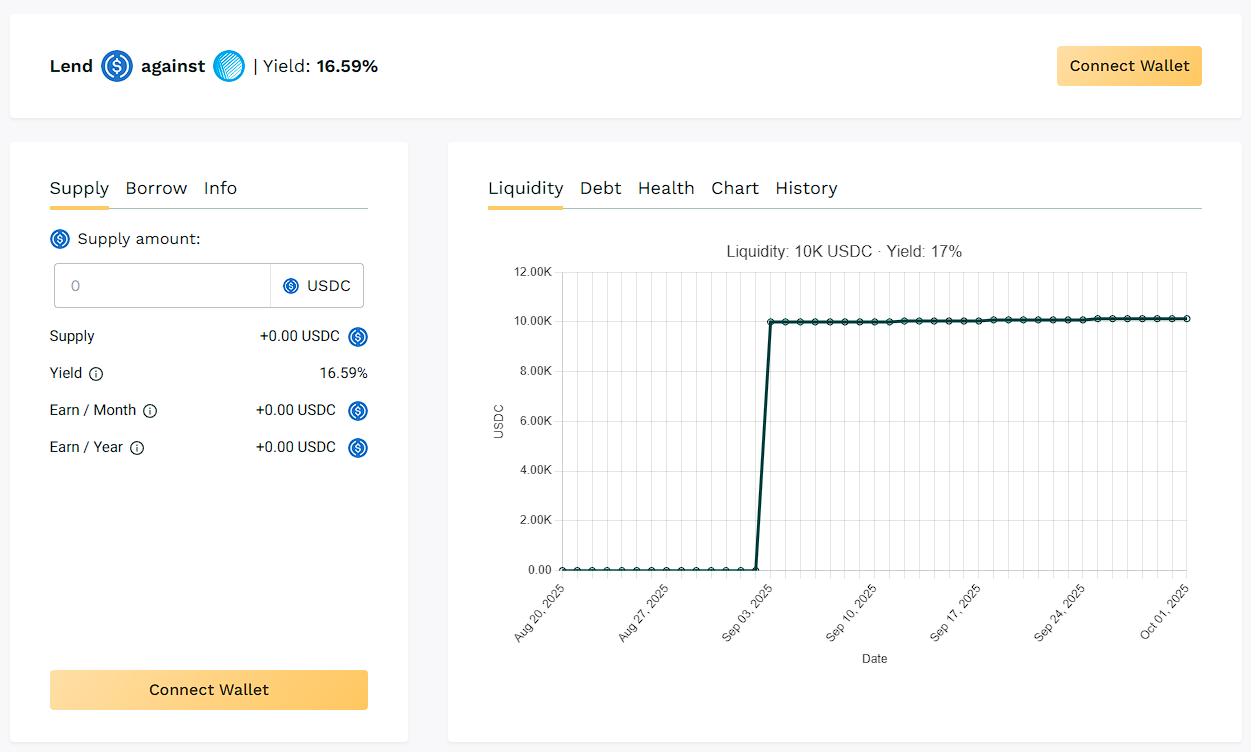

🟠 Bonus: USDC / ASF

🧮 APY: 16.59%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

Limited borrower use keeps utilization and yield in this token pool producing returns for above 15% APY.

📌 Despite smaller liquidity size, $ASF remained stable week-over-week.

🧊 Blue‑Chip Lending

USDC / WBTC (~4.99%)

USDC / WETH (~9.86%)

BTC and ETH-backed pools continue to provide lower-risk lending options, anchoring the platform’s blue-chip segment with predictable APYs.

🎯 Blue-chip collateral loans support yields in the 4-10% APY range.

📢 Next Digest

Stay tuned for next week’s Teller Digest as loan demand and lending opportunities continue to evolve across pools.

Follow along to track borrower activity, liquidity shifts, and new yield opportunities.

👉 Live data available at: app.teller.org/lend