Teller Yields, Weekly Digest 09/25

This week’s pool data shows dynamic APY shifts as rollover activity and borrowing trends moved across multiple pools. The following breakdown captures the latest liquidity, and yields across pools.

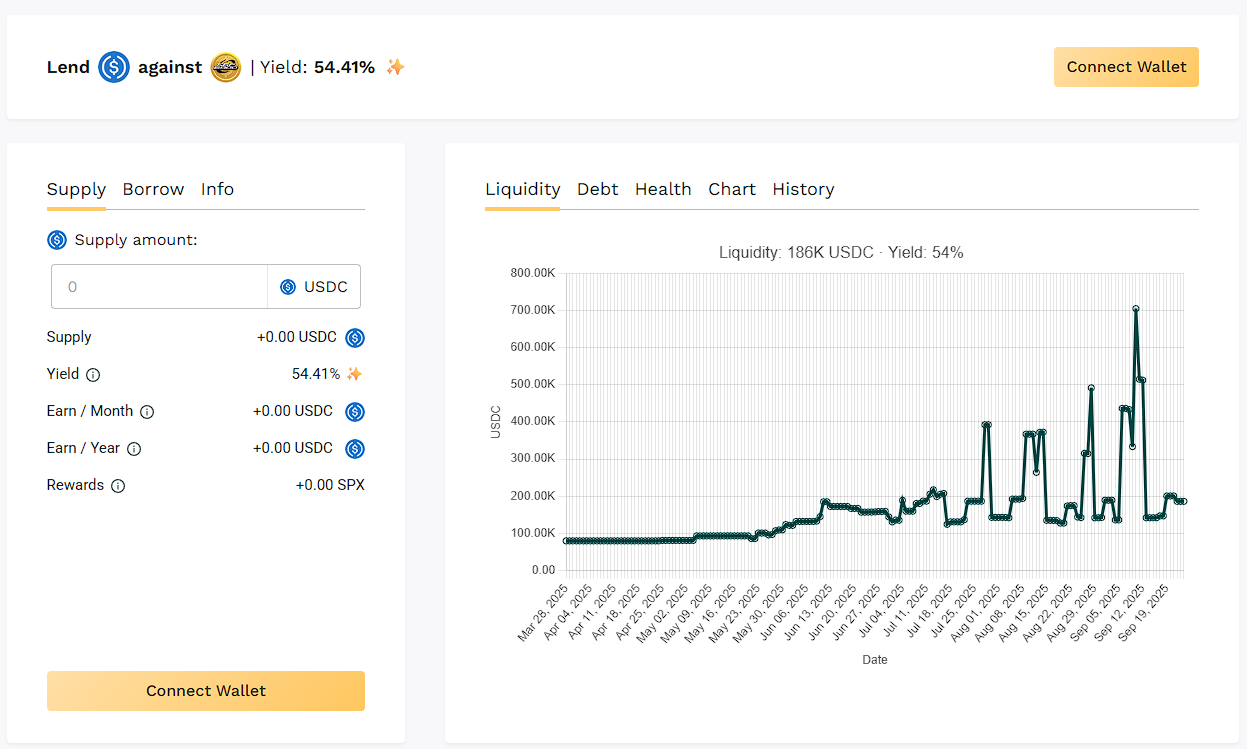

🥇 USDC / SPX

🧮 APY: ~54.41%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers using $SPX collateral are locking in different loan size. With consistent 30-day borrow terms, lenders are seeing returns above ~50%.

💡 Ranked 1st among the highest yield pools.

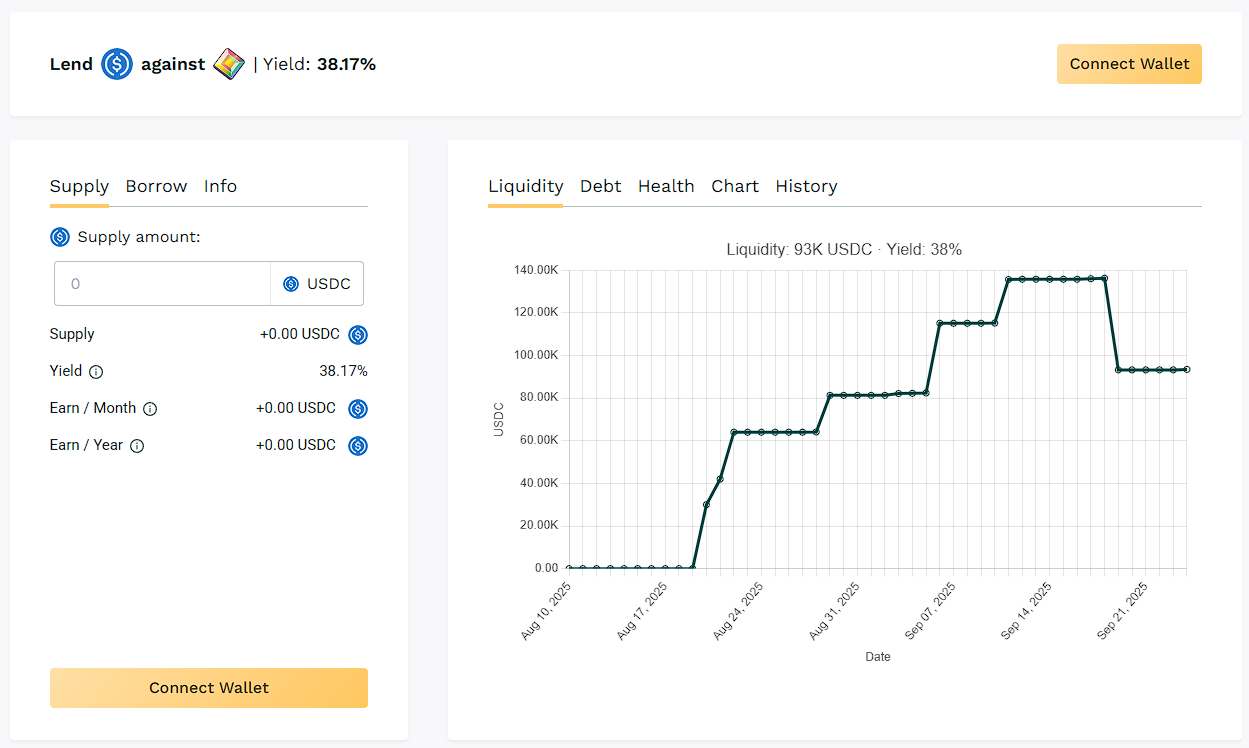

🥈 USDC / PIXL

🧮 APY: ~38.17%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Backed by the gaming ecosystem, this pool continues to deliver above ~30% APY for lenders. Borrowers appear to be leveraging $PIXL for short-term funding needs, maintaining steady debt pressure on the pool.

💡 A play-to-earn gem with real lending demand.

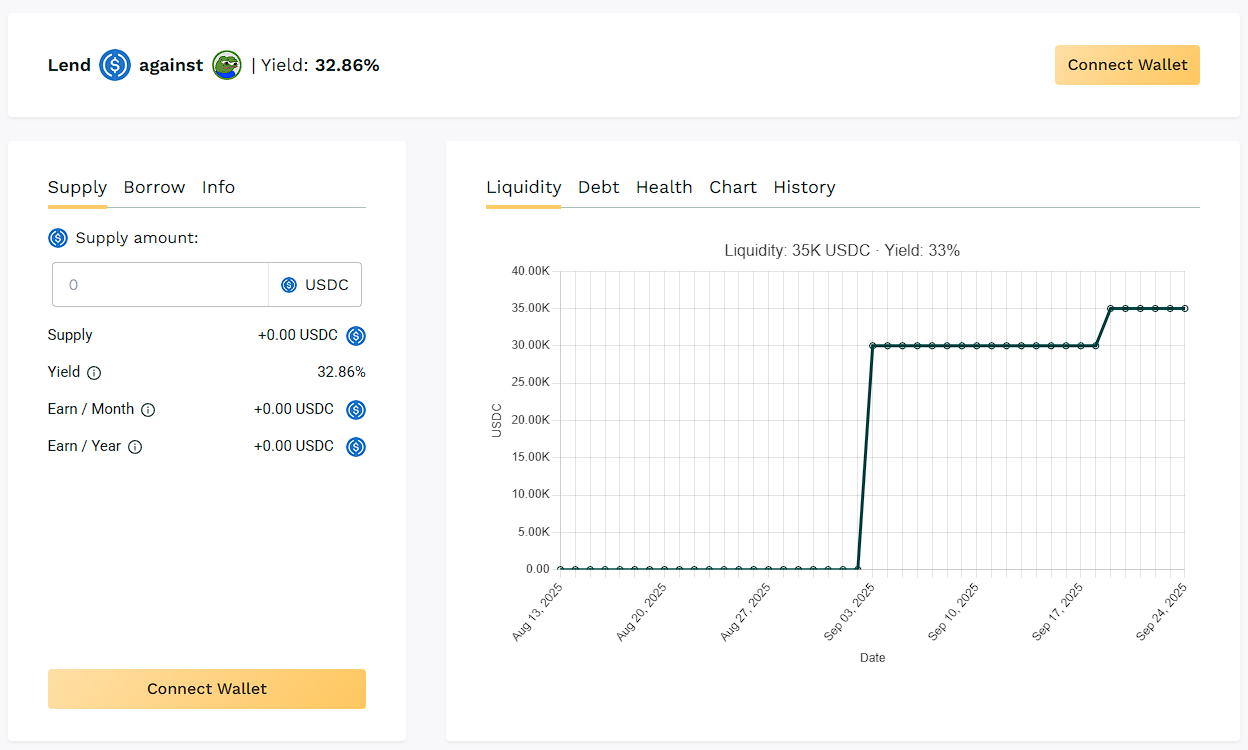

🥉 USDC / APU

🧮 APY: 32.86%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU pool continued to show solid borrowing activity, lifting APY into the 30%+ range. User utilization in this pool is becoming a staple for yield-maxi degens.

💡 Still earning above 30% APY with a loyal borrower base.

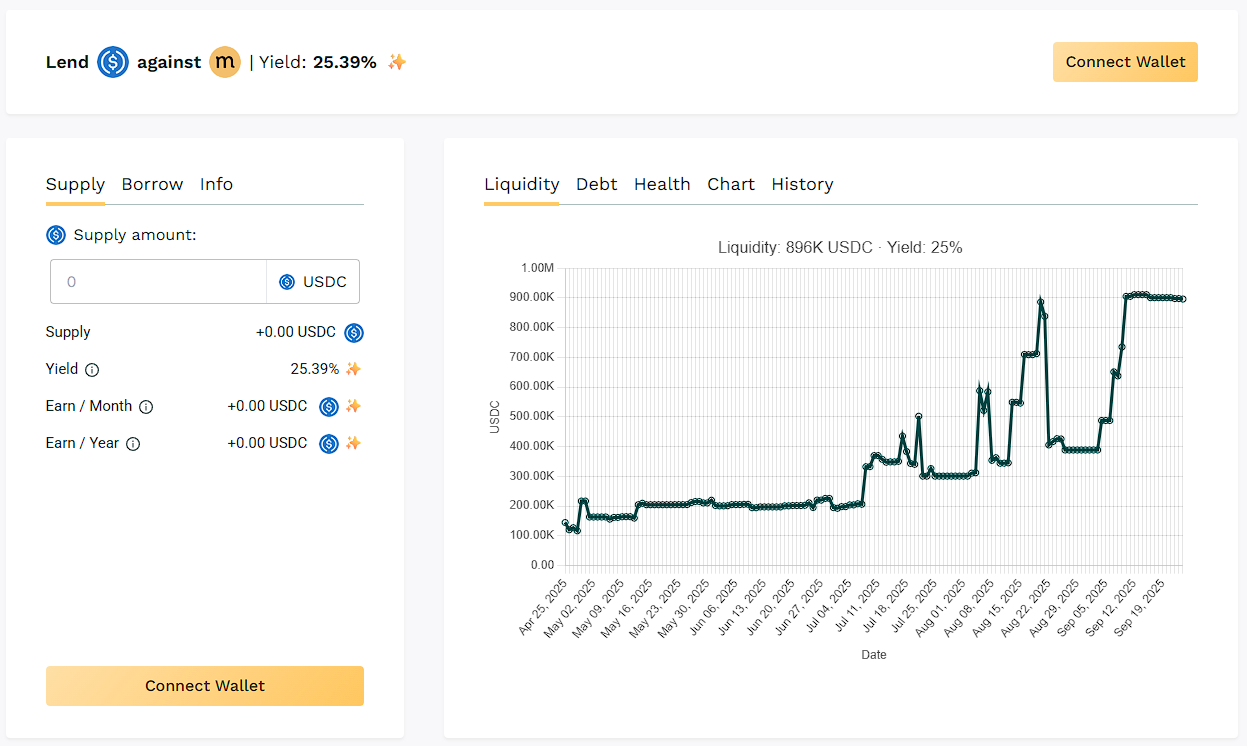

🏅 USDC / MASA

🧮 APY: 25.39%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

This lending pool benefits from high loan volume and frequent recurring activity. Lenders benefit from rollovers that maintain yield momentum over 20% range.

💡 Frequent loan cycles with substantial lending volume support.

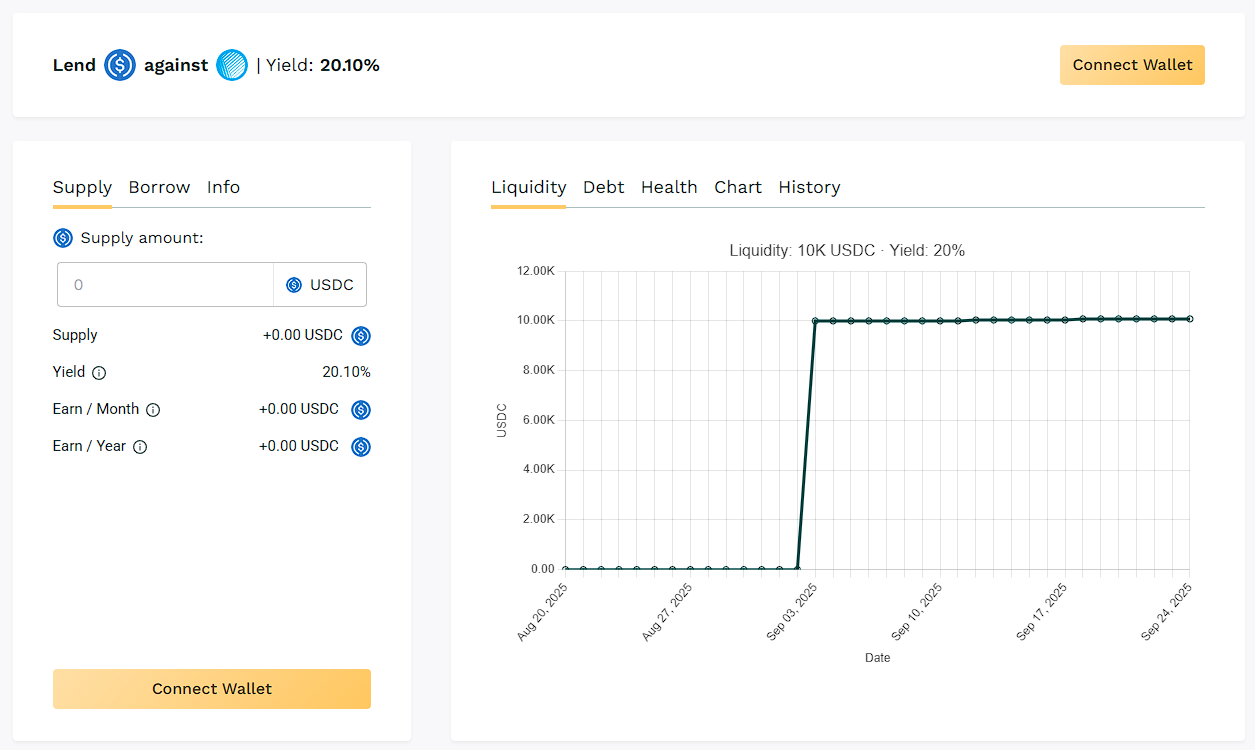

🏅 USDC / ASF

🧮 APY: 20.10%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

$ASF borrowing cycles delivered yields at 20% maintaining mid-range APYs despite smaller liquidity size yet remained stable week-over-week.

💡 $ASF held the 20% APY despite smaller liquidity.

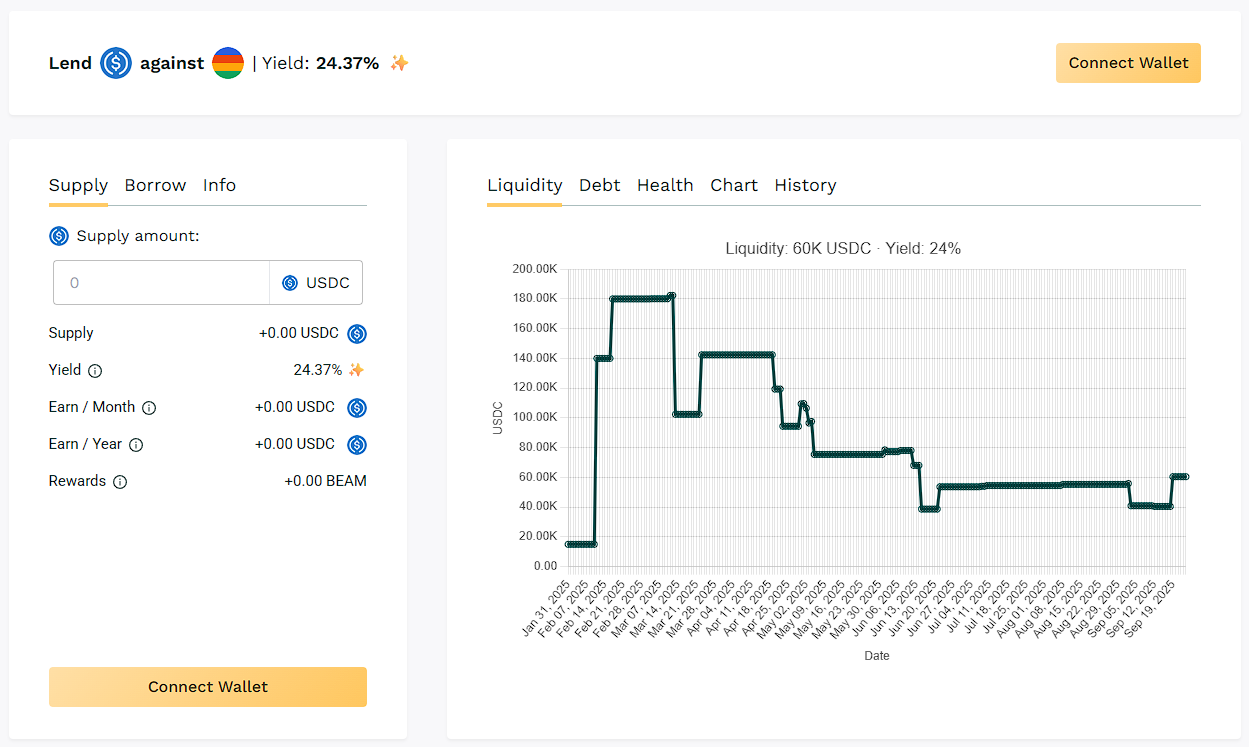

⭐ USDC / BEAM

🧮 APY: 24.37%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Borrowers rollovers supported upper-20% yield. BEAM remained an active mid-cap pool.

💡 Moderate APY backed by monthly loan activity.

🧊 USDC / WETH & WBTC

→ APY: ~9.50–12.81%

→ Collateral: ETH & BTC

Pools offered baseline APYs in the 9-13% range. Continued to provide stable APY zones for ETH/BTC-backed lending.

📈 Yield Takeaway:

Across these pools, borrower demand and rollover behaviors continue to shape APYs. Pools with higher utilization rates saw APYs rise, while fresh liquidity inflows held back yields in lower-utilization pools.

📅 Next Update

We’ll be back with fresh rankings, usage stats, and updated APYs.

Until then, happy lending. Stay yield-aware.

👉 Teller App: View Pools