Teller Yields, Weekly Digest 09/18

Date: September 18, 2025

Source: Teller on DeFiLlama

The latest APYs across Teller pools show how lending and rollover dynamics are shifting across the platform.

This week highlights changes in borrower demand, rollover activity, and supply utilization across six active pools.

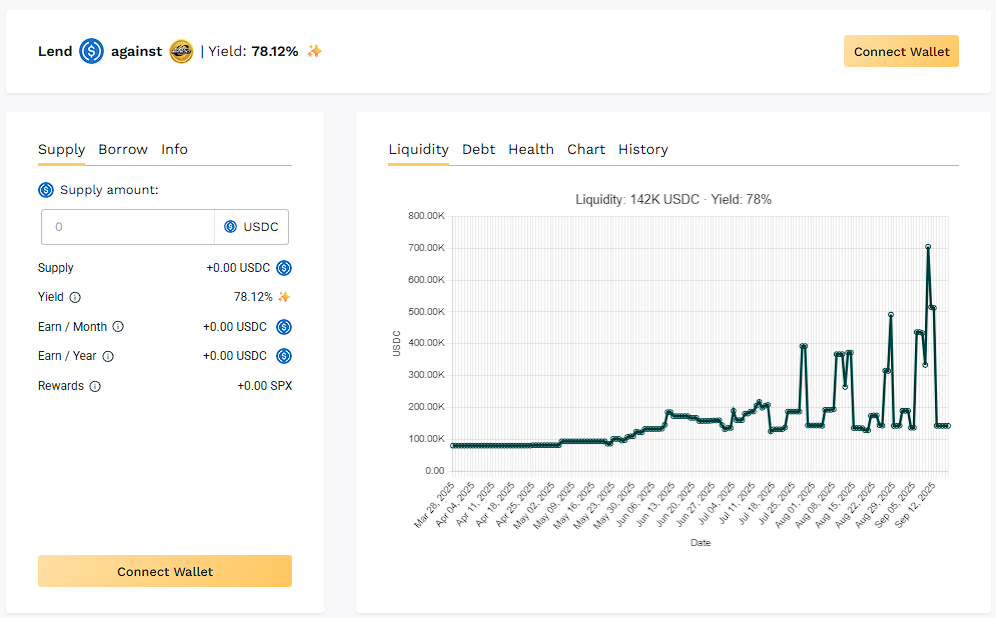

🥇 USDC / $SPX

🧮 APY: 78.12%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers actively using SPX collateral maintain demand within this pool. APY remains consistent as loans continue rolling over.

🎯 $SPX utilization supported near-79% yields.

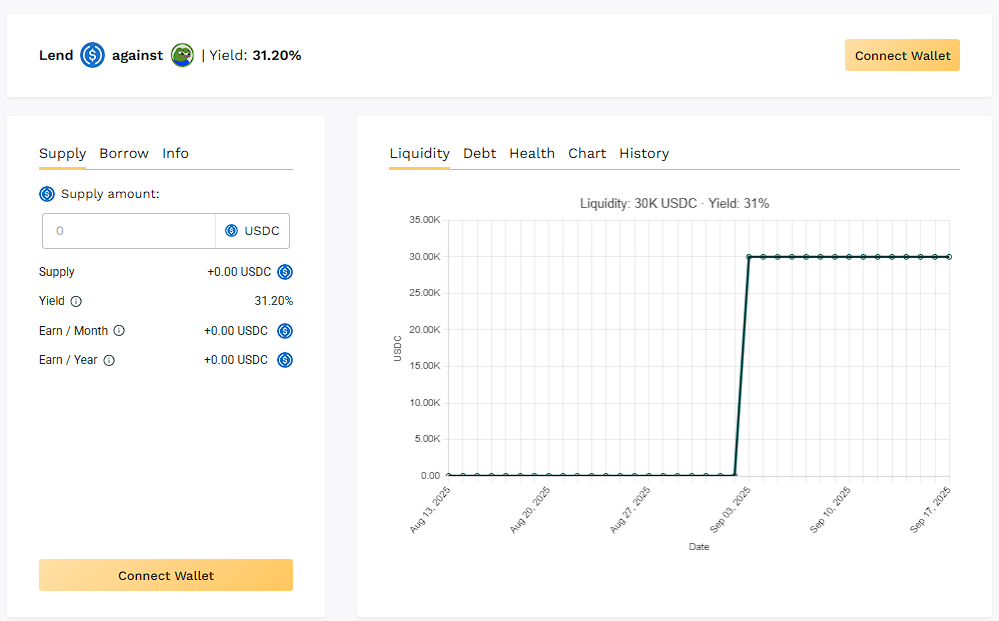

🥈 USDC / $APU

🧮 APY: 31.20%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Meme-token borrowing cycles sustained APU yields over 30%, with frequent 30-day loan rollovers despite lower liquidity.

🎯 Ranks second this week.

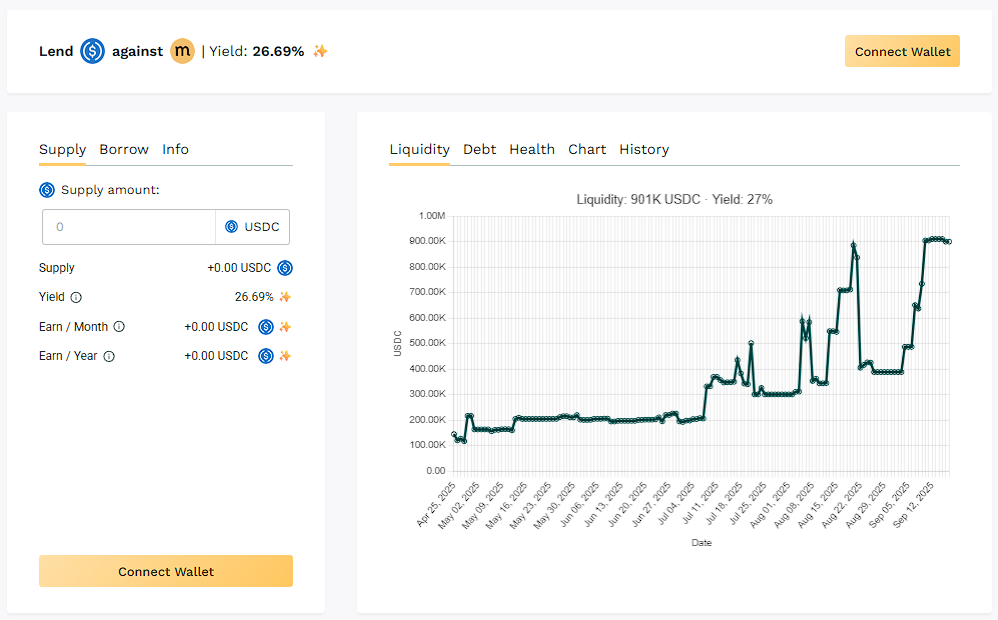

🥉 USDC / $MASA

🧮 APY:26.69%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Following recent deposits, APY decreased to 26.69%, making it the most liquid pool with over $900k USDC in liquidity.

🎯 MASA remains as one of the top performers on Teller.

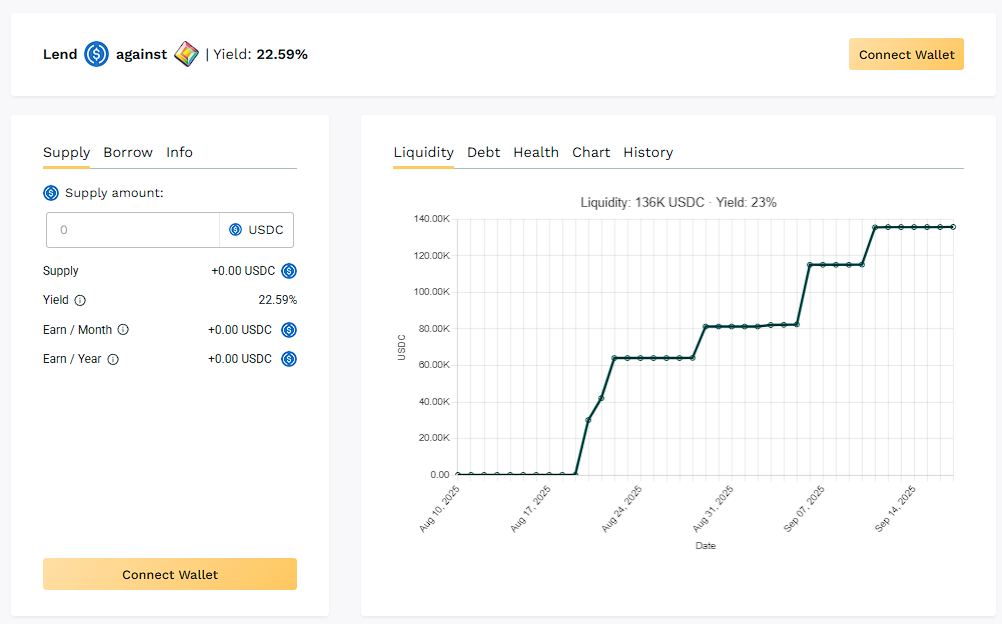

✅ USDC / $PIXL

🧮 APY: 22.59%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

$PIXL maintained short-term loan cycles with steady borrower participation. This activity kept APY above 20%.

🎯 Frequent loan renewals boost compound yield for lenders.

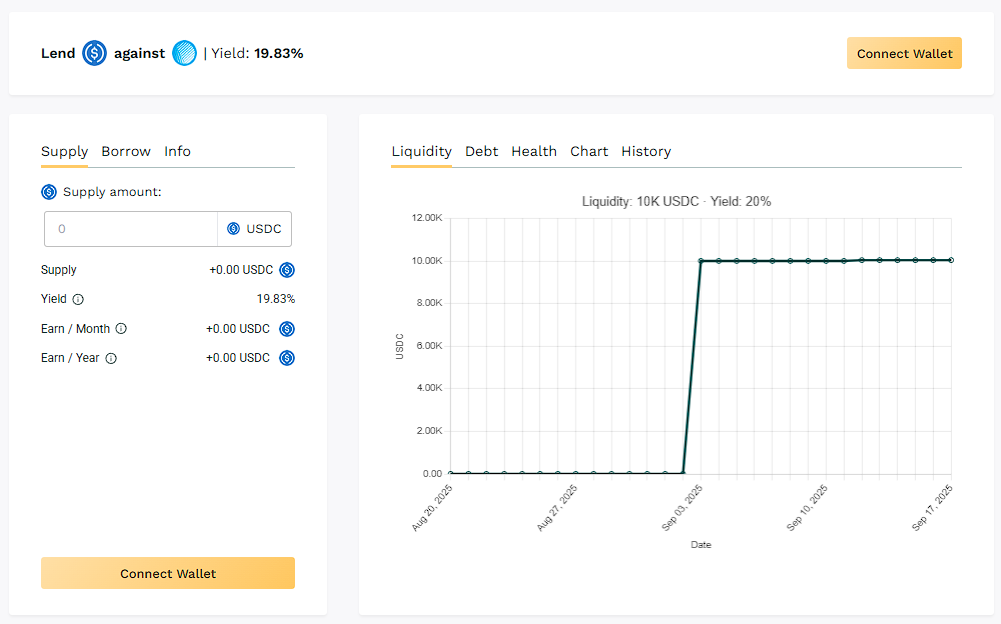

✅ USDC / $ASF

🧮 APY: 19.83%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

$ASF borrowing cycles delivered yields close to 20%. Despite smaller liquidity size, the pool shows continued usage.

🎯 Limited borrower use keeps utilization and yield in this token pool.

🧊 Blue-Chip Pools

- USDC / $WBTC:14.51%

- USDC / $WETH: 10.22%

$WBTC and $WETH pools continue offering baseline APYs.

🎯 Blue‑chip pools returned 10–15%.

📊 Highlights

- $SPX led at 78.12% APY, top 1 this week.

- Other notable yields: $APU at 31.20% APY and $MASA with 26.69% APY.

- Pools like $PIXL and $ASF offer yield exposure.

- Lower yields: $WBTC and $BEAM in single-digits or low-teens

🔔 Next Digest

Tune in for next week’s update as we track shifts in APY, liquidity, and borrower behavior.

👉 Explore live lending data anytime at app.teller.org/lend