Teller Yields, Weekly Digest 09/11

Date: September 11, 2025

Source: Teller on DeFiLlama

This week’s top yields on Teller. Borrower demand across USDC lending pools continues to change by collateral type.

Here’s a breakdown of the ranking opportunities:

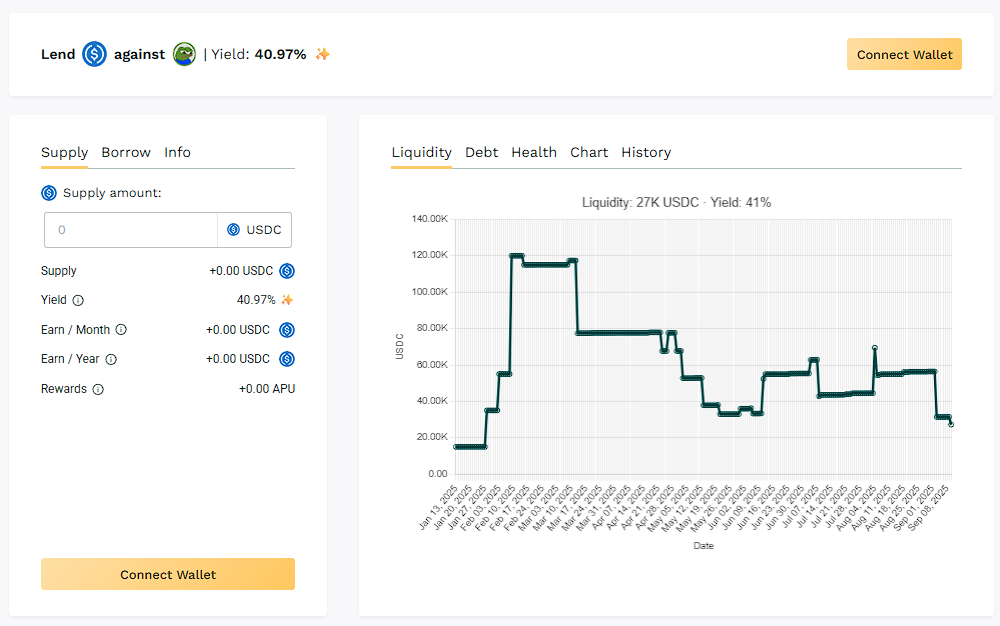

🥇 USDC/APU Pool

🧮 APY: 40.97%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Meme-driven borrowing cycles keep APU’s pool active. Borrowers continue to use $APU as collateral with $30K liquidity at 40% yield.

📌APU takes the first rank delivering 41% yield with active borrower turnover.

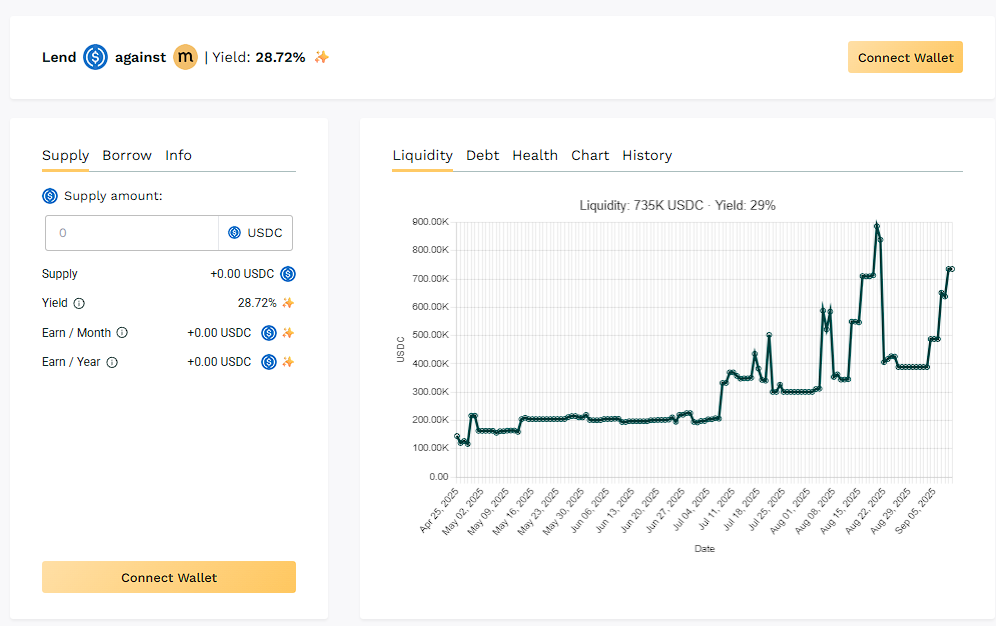

🥈 USDC/MASA Pool

🧮 APY: 28.72%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Borrower demand for $MASA collateralized loans remained, pushing pool utilization upward. Liquidity and borrowing are driving APY above 28% with sustained pool demand.

📌 The pool continues to serve as one of the top options for lenders.

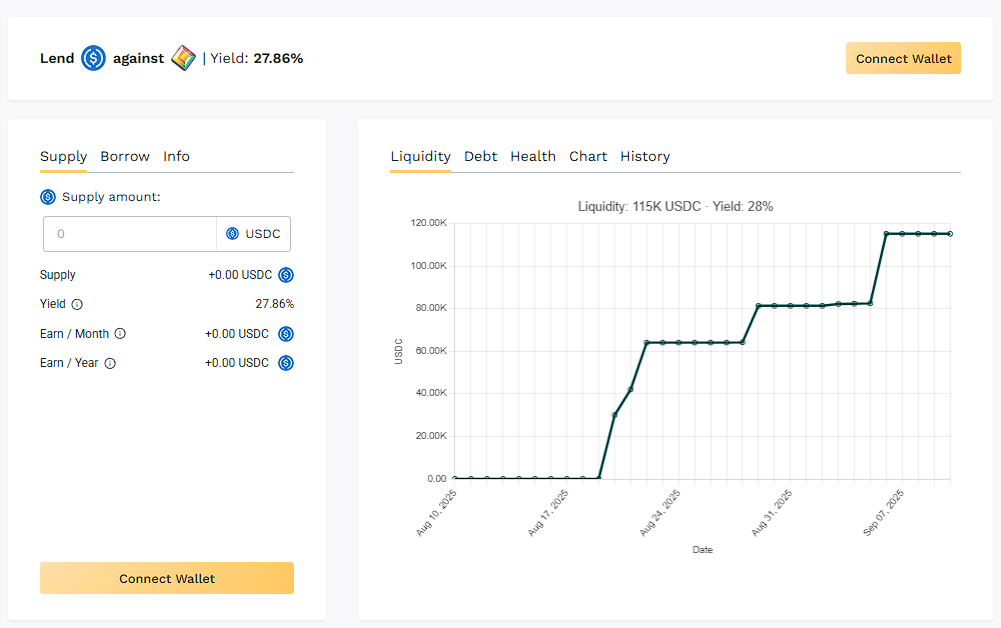

🥉 USDC/PIXL Pool

🧮 APY: 27.86%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Short duration lending generated turnovers and APR in higher than 25%. Borrower participation remained consistent throughout the week.

📌 Borrowing activity shows sustainability with rollover usage.

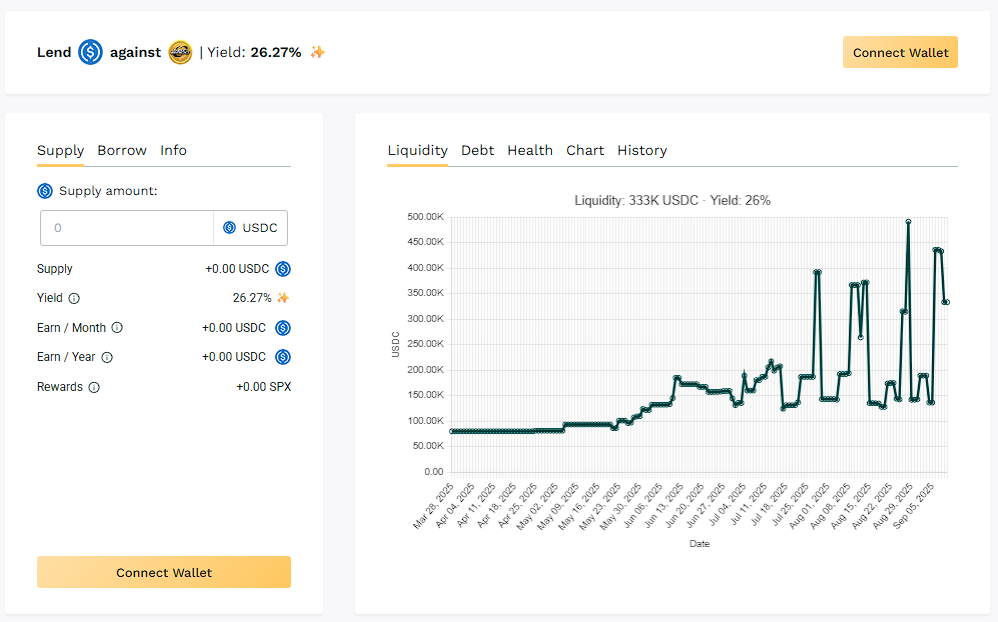

✅ USDC/SPX Pool

🧮 APY: 26.27%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

With consistent 30-day borrow terms and ecosystem traction, lenders are seeing returns as $SPX pool carries $333K liquidity at 26% yield.

📌 $SPX utilization supported near⁓27% yields.

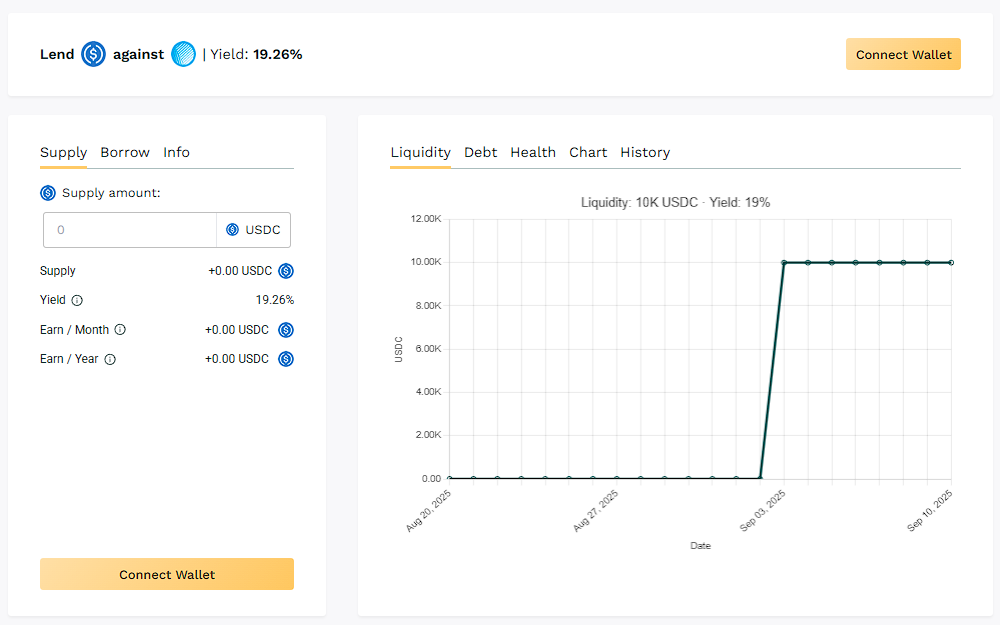

✅ USDC/ASF Pool

🧮 APY: 19.26%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

$ASF borrowing cycles delivered yields close to 20%. Despite smaller liquidity size, the pool shows continued usage.

📌 $ASF held close to 20% APY despite smaller liquidity.

🧊 Blue‑Chip Lending

USDC / WBTC (~14.40%)

USDC / WETH (~9.89%)

BTC and ETH-backed pools continue to provide lower-risk lending options, anchoring the platform’s blue-chip segment with predictable APYs.

🎯 Blue-chip collateral loans support yields in the 10% APY range.

📊 Highlights

- $APU leads this week at 41.02% APY, with utilization relative to liquidity.

- $MASA and $SPX remain major pools with double-digit yields and liquidity bases.

- $ASF sustains near⁓20% yields despite scale.

- $WBTC and $WETH pools offer 9–14% APYs, acting as a blue-chip anchor.

🛎️ Next Update

Pool dynamics and APYs will be revisited as new borrower demand emerges.

👉 Live pool data can be viewed anytime at app.teller.org/lend