Teller Yields, Weekly Digest 09/04

Date: September 04, 2025

Source: Teller on DeFiLlama

Teller continues to show active borrowing across USDC lending pools, with yields driven by multiple collaterals.

Below is a breakdown of current pool activity and yields.

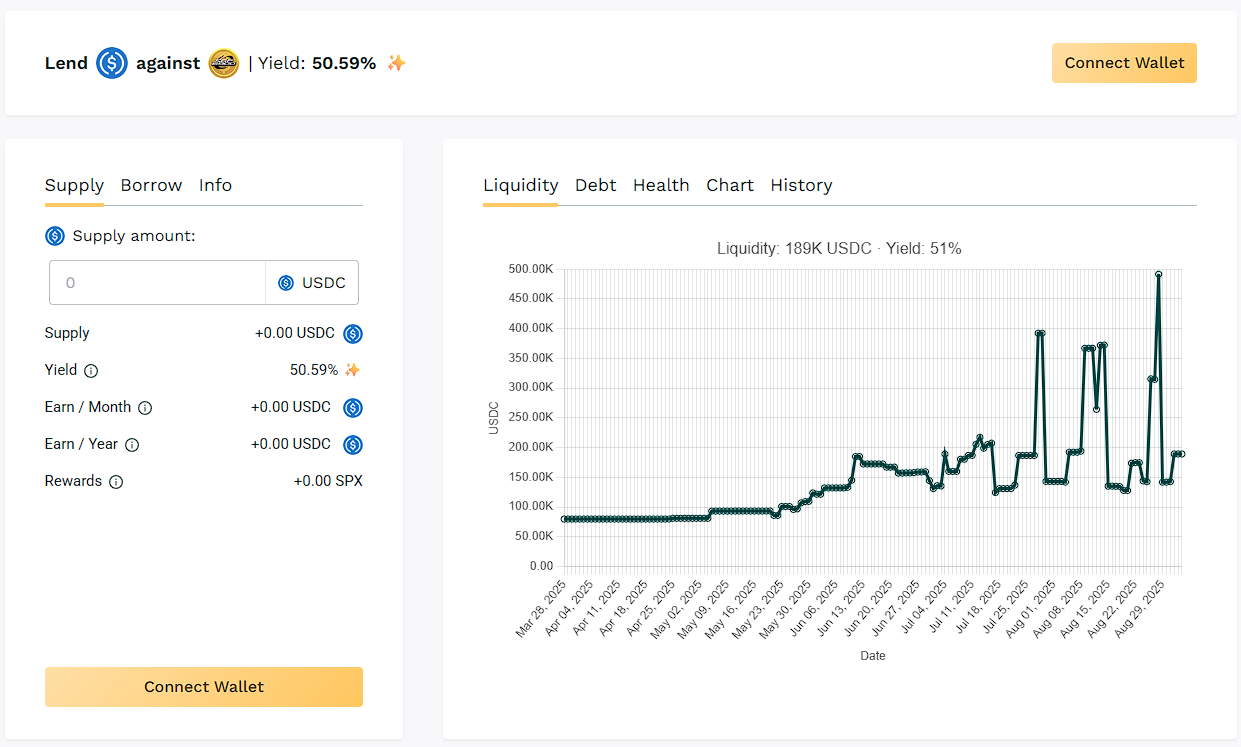

🥇 USDC / $SPX

🧮 APY: 50.59%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX took the 1st position among all yielding pools this week, with utilization pushing APYs above 50%. Borrowers remained active in rolling over loans.

➡️ $SPX takes the leader spot this week with sustained 50%+ returns.

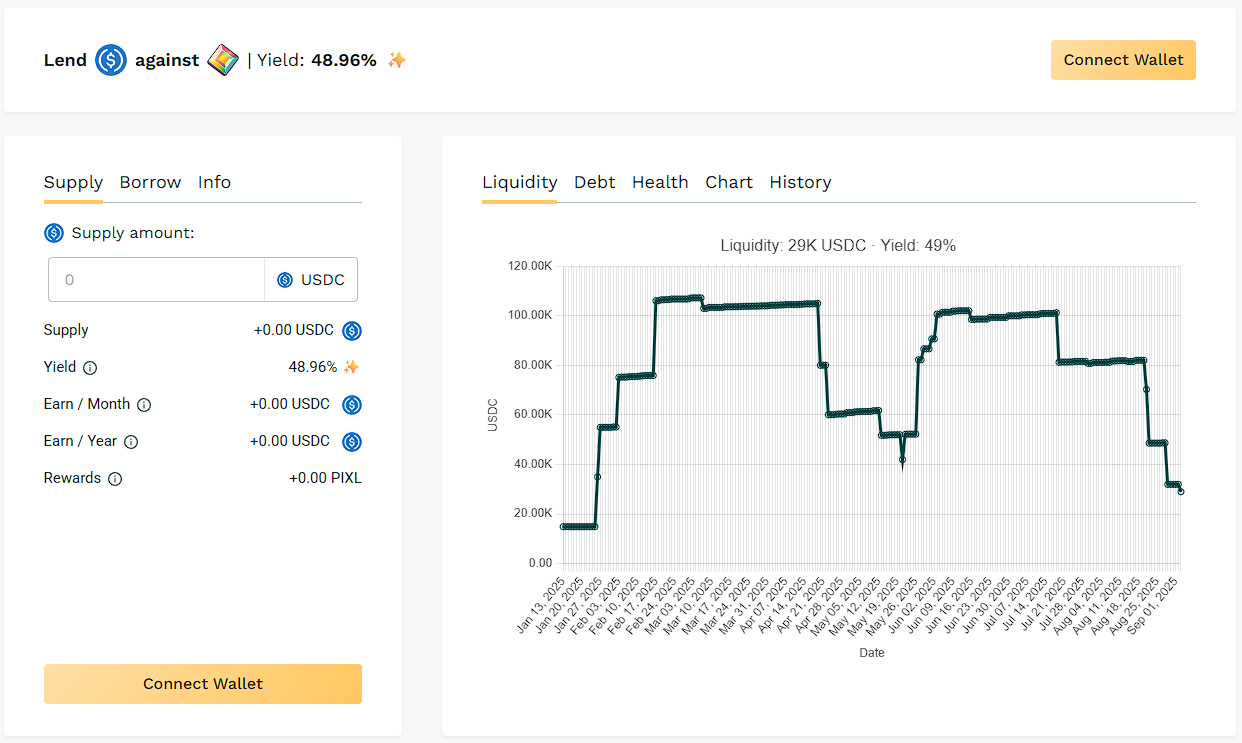

🥈 USDC / $PIXL

🧮 APY: 48.96%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

APY went to almost 49% after a drop in supplied USDC liquidity from recent lender withdrawals.

➡️ Compact pool, APY driven by rollover cycles.

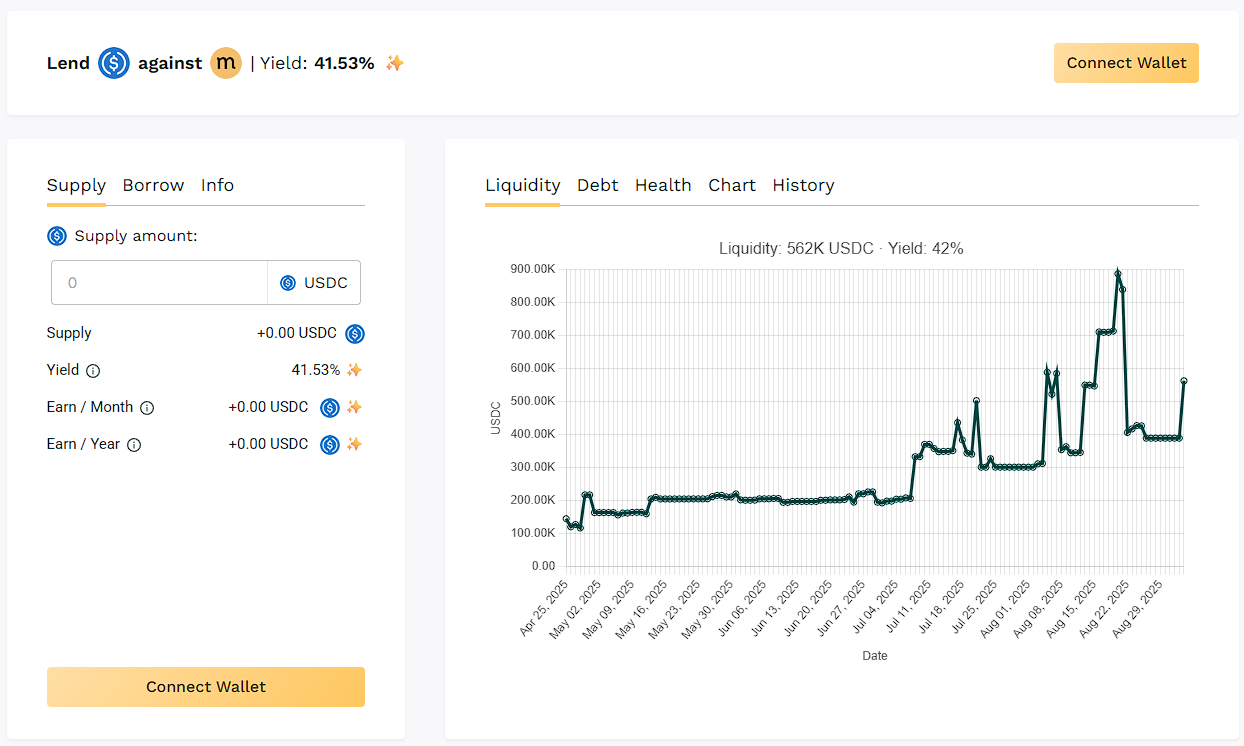

🥉 USDC / $MASA

🧮 APY: 41.53%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

The main $MASA pool continues to draw liquidity, sustaining APYs above 40% with borrower demand.

➡️ $MASA anchors the leaderboard with scale and yield.

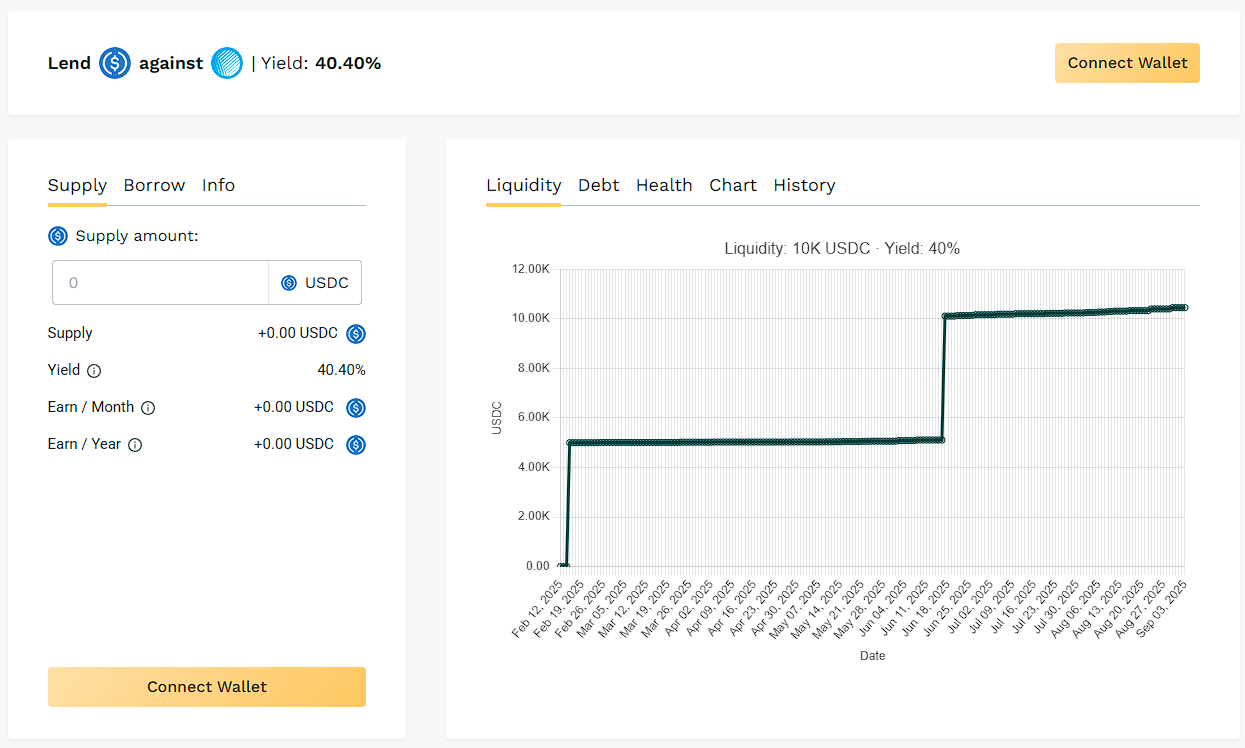

✅ USDC/ASF

🧮 APY: 40.40%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

ASF borrowers maintain a flow of loan demand with the yield of 40.40%.

➡️ ASF sees loan activities keeping yields positive.

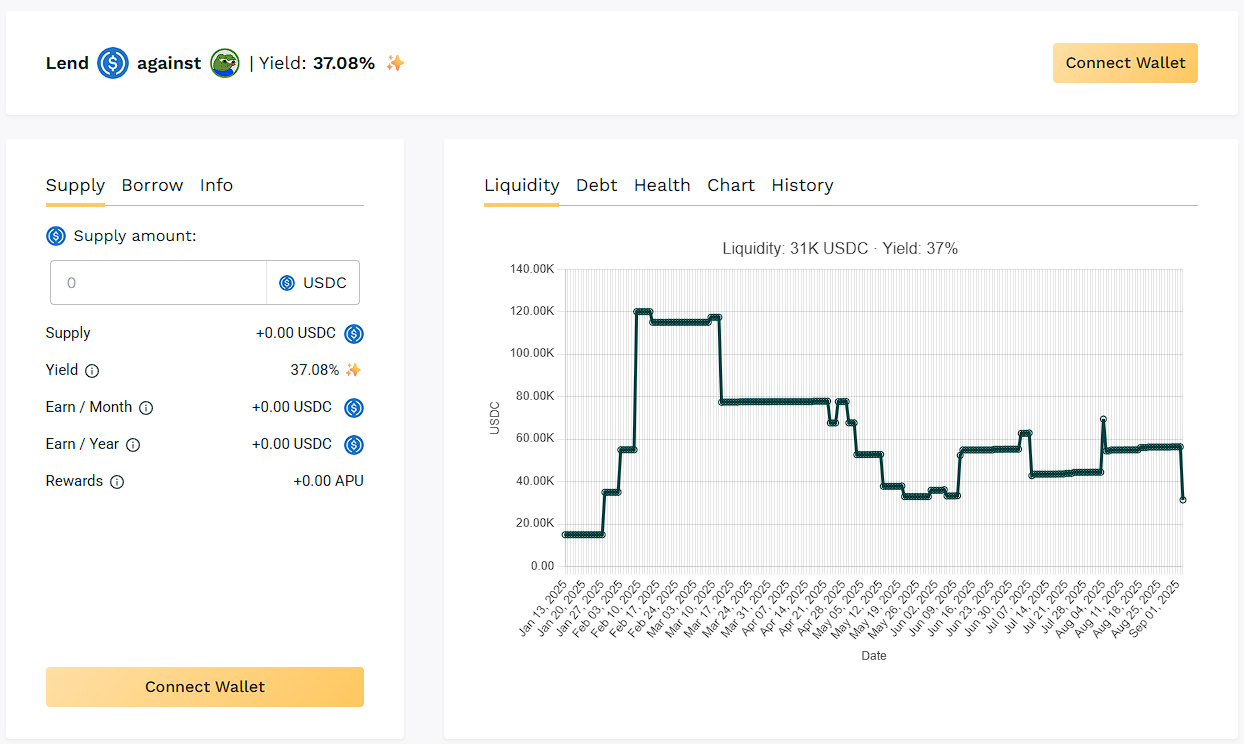

✅ USDC / APU

🧮 APY: 37.08%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Borrowers maintained participation in $APU, keeping returns above 35% despite current USDC liquidity.

➡️ $APU sustains mid-30% yields with users borrowing.

🧊 Blue-Chip Pool

USDC / $WBTC: 9.38% APY

WBTC pool baseline lending returns with lower-risk lending opportunities.

📊 Highlights

- $SPX led at 50.59% APY, reaching the top this week.

- $PIXL pools delivered a 48.96% APY ranking second.

- $MASA pool together with $APU managed to hold double-digit returns near 38 - 41% APY.

📢 Next Week

Tracking continues next week as pool dynamics shift with new borrower demand.

👉 Explore live data anytime at app.teller.org/lend