Teller Yields, Weekly Digest 08/28

Date: August 28, 2025

Source: Teller on DeFiLlama

Lending on Teller continues to see demand across both meme-token and AI/GameFi pools. Pools maintained double-digit APYs.

Here's the Top Lending pools this week.

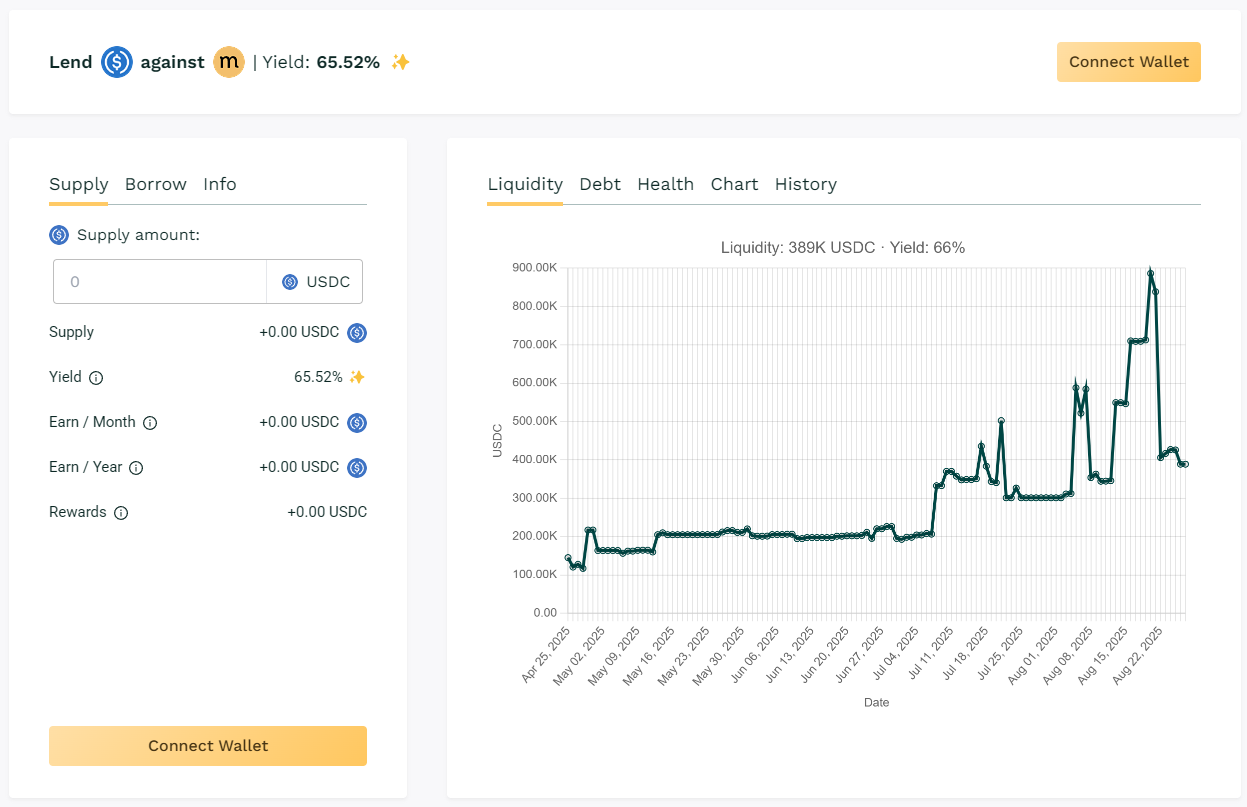

🥇 USDC / $MASA

🧮 APY: 65.52%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Borrower demand for $MASA collateralized loans remained, pushing pool utilization upward. With debt closely matching liquidity, APYs exceeded 65%, positioning $MASA as the top performer this week.

🎯 $MASA topped the charts, crossing the 65% APY mark.

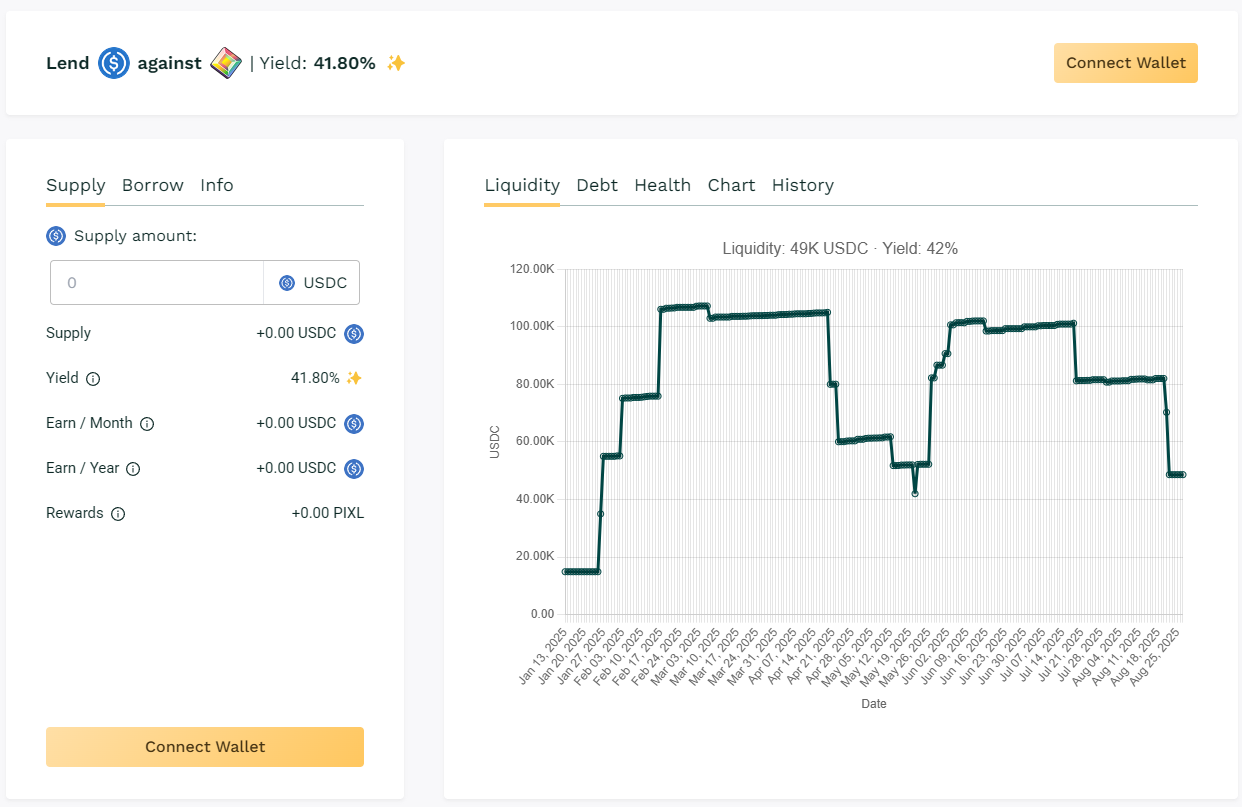

🥈 USDC / $PIXL

🧮 APY: 41.80%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

$PIXL maintained short-term loan cycles with steady borrower participation. This activity kept APY above 40%.

🎯 $PIXL sustained yields above 40% through continuous loan cycles.

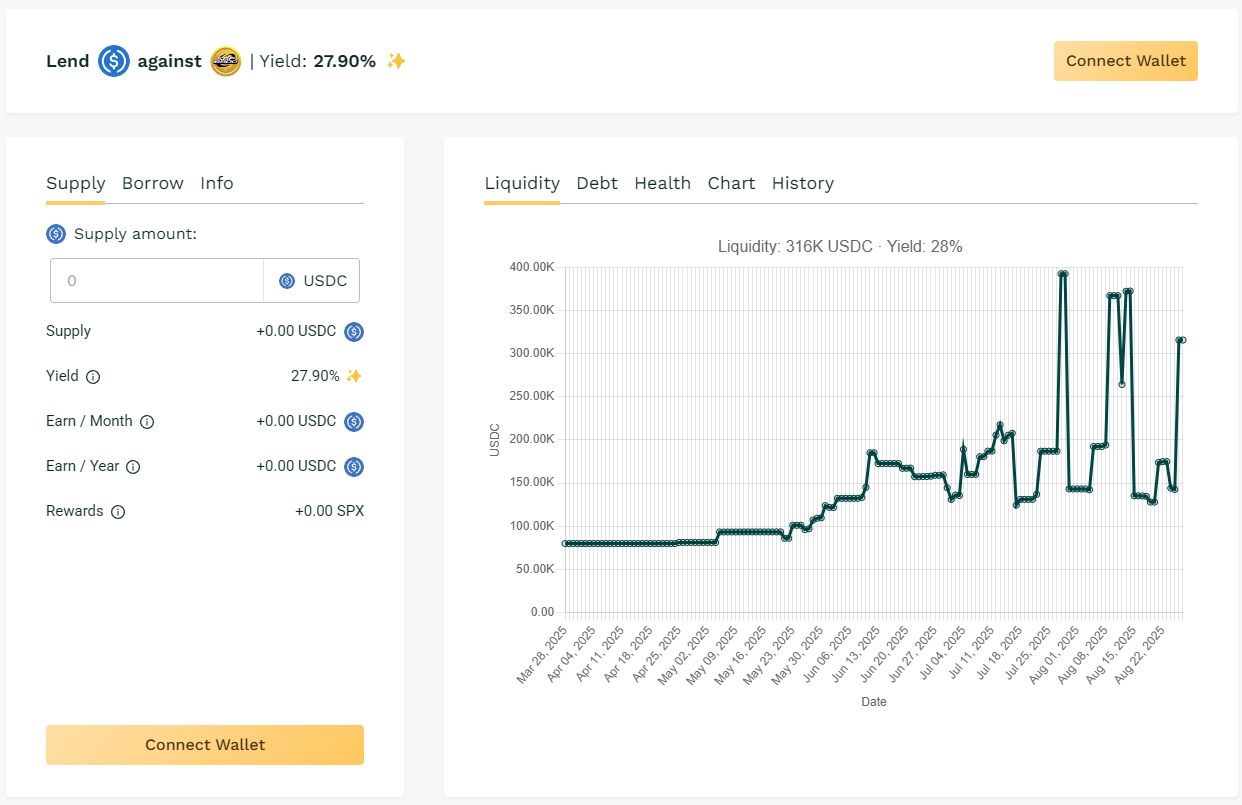

🥉 USDC / $SPX

🧮 APY: 27.90%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX loans remained active with liquidity deployed. Yields approached 28%, supported by borrower rollover activity and collateral ratios.

🎯 $SPX utilization supported near-30% yields.

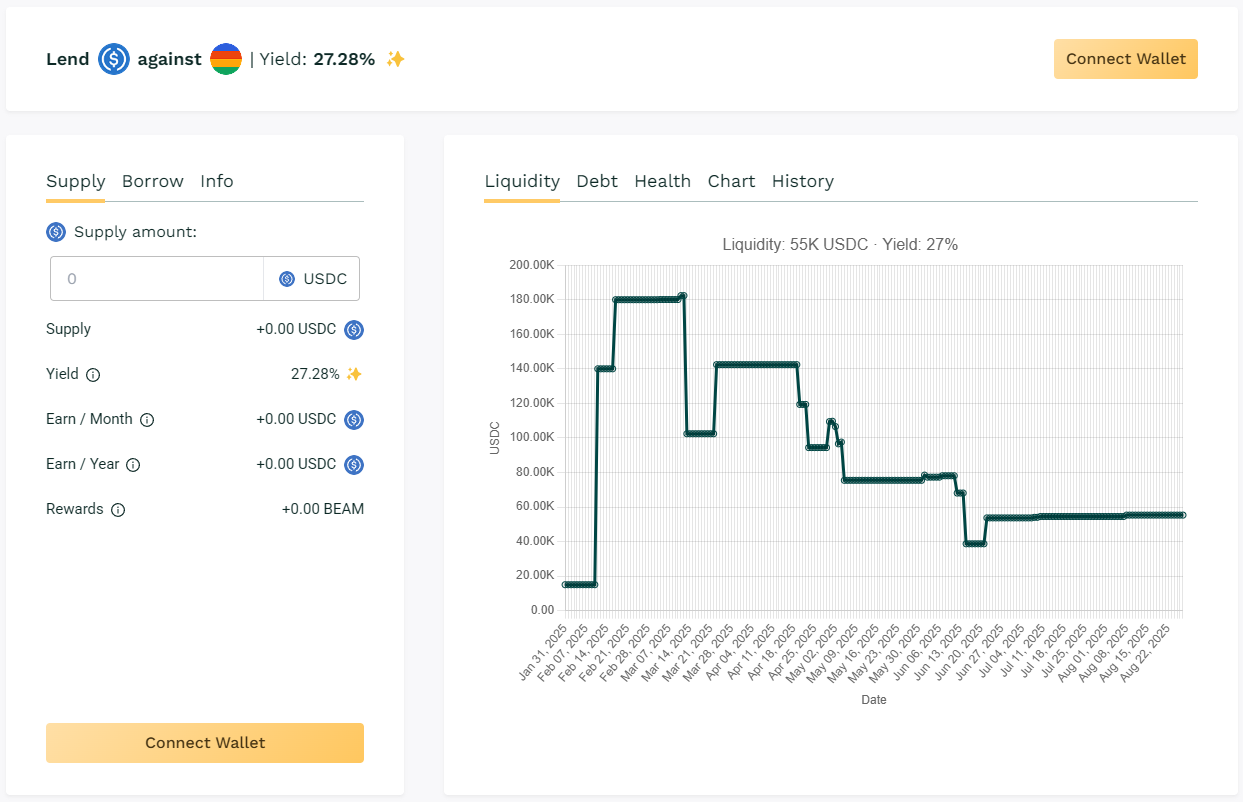

✅ USDC / $BEAM

🧮 APY: 27.28%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$BEAM utilization gained the APY in the upper-20% range. The pool shows activities maintaining its position as a mid-cap option for lenders.

🎯 $BEAM continued to deliver consistent mid-cap returns.

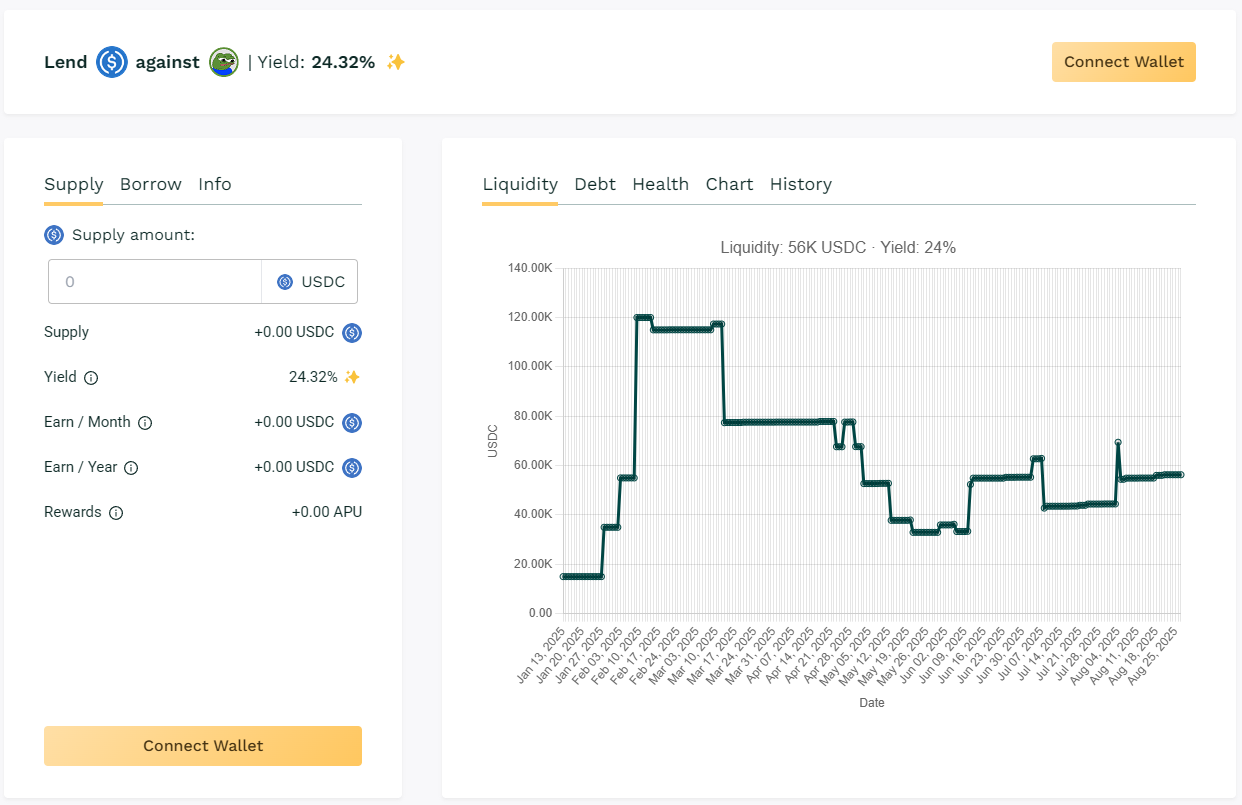

✅ USDC / $APU

🧮 APY: 24.32%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU collateralized pools together accounted for over 120K in liquidity. Borrower engagement across both pools sustained yields in the low-20% range.

🎯 $APU pools raised over 120K liquidity with above 20% yields.

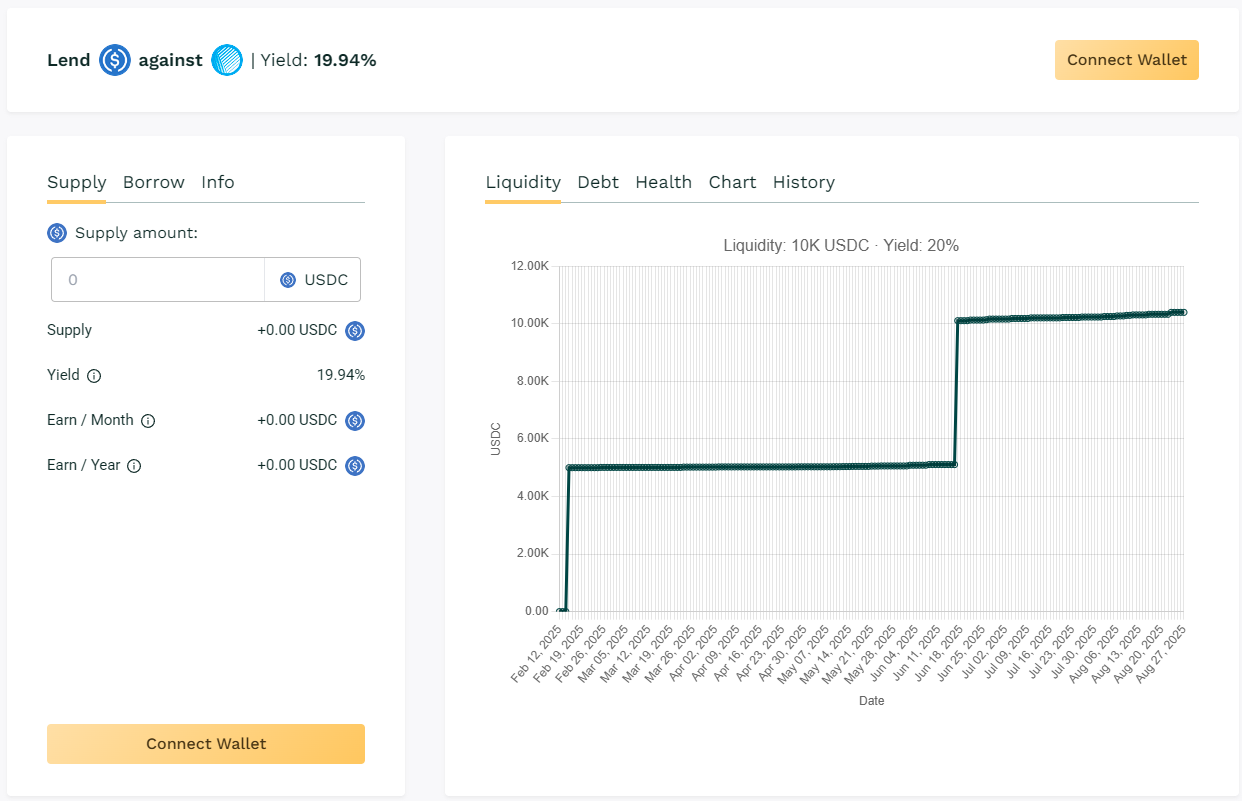

✅ USDC / $ASF

🧮 APY: 19.94%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

$ASF borrowing cycles delivered yields close to 20%. Despite smaller liquidity size, the pool shows continued usage.

🎯 $ASF held close to 20% APY despite smaller liquidity.

🧊 Blue-Chip Pools

USDC / $WBTC: 8.86% APY

USDC / $WETH: 10.54% APY

$WBTC and $WETH pools offered baseline APYs in the 8–11% range. Continued to provide lower-risk lending opportunities.

📊 Highlights

- $MASA leads at 65.5% APY, the top 1 of the week.

- $PIXL, $SPX, and $BEAM ranged between 27–42% APY.

- $APU pools remained active with 22–24% APY.

- $ASF contributed additional yield at nearly 20% APY.

- Blue-chip pools ($WBTC, $WETH) delivered 8–11% APY.

🔔 Next Digest

Tune in for next week’s update as we track shifts in APY, liquidity, and borrower behavior.

👉 Explore live lending data anytime at app.teller.org/lend