Teller Yields, Weekly Digest 08/21

Date: August 21, 2025

Source: Teller on DeFiLlama

This week’s Teller Digest showcases the latest activity across active pools, with updated lending volumes, liquidity inflows, and borrower trends.

🏆 Top Lending Pools

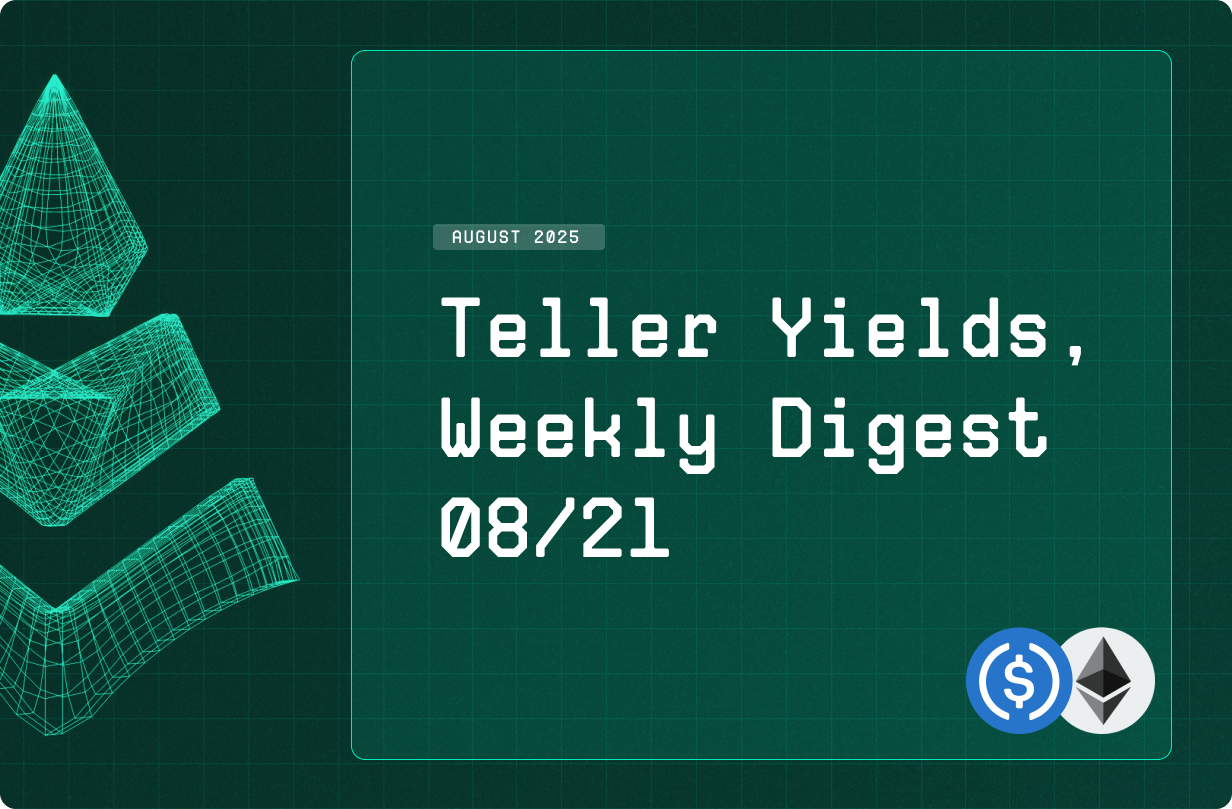

🥇 USDC / SPX

🧮 APY: 79.06%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers actively using SPX collateral maintain demand within this pool. APY remains consistent as loans continue rolling over.

📌 Borrower activity support earning the top 1 spot this week.

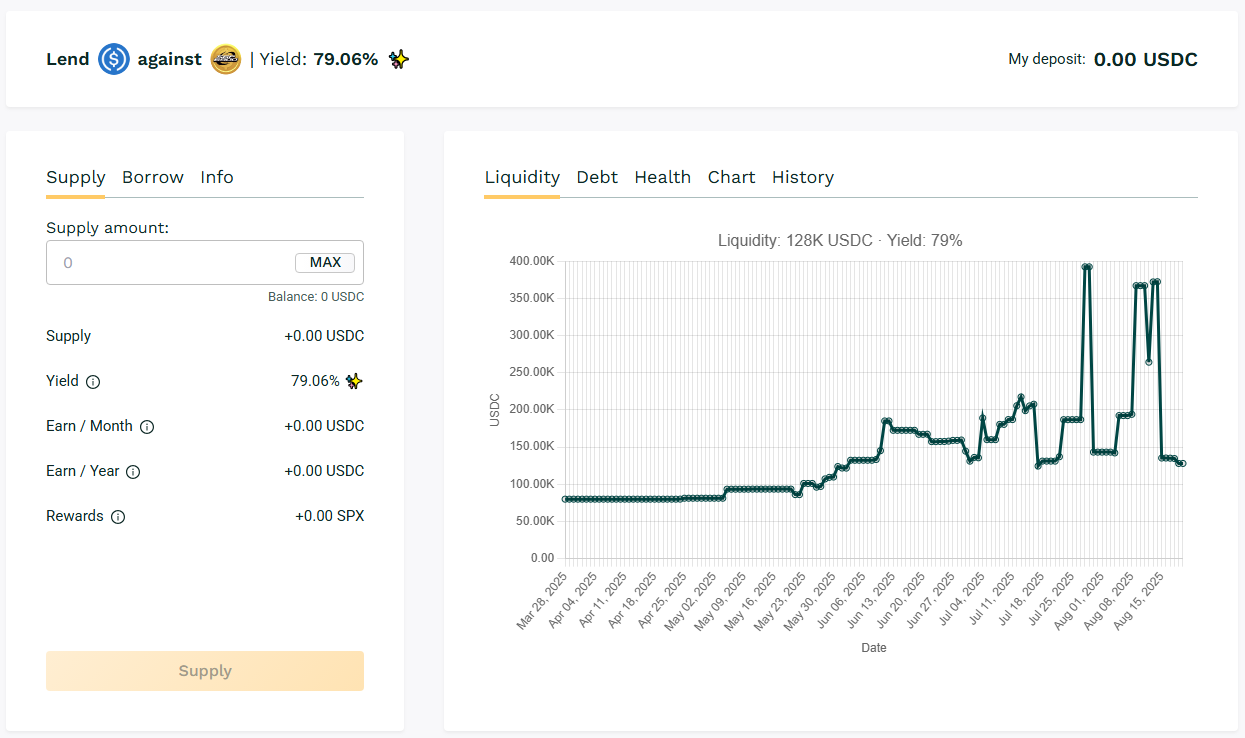

🥈USDC / PIXL

🧮 APY: 52.14%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Borrowers have utilized a significant portion of PIXL liquidity, resulting in elevated APY above 50%.

📌 Ranks second this week and borrowing activity shows sustainability with rollover usage.

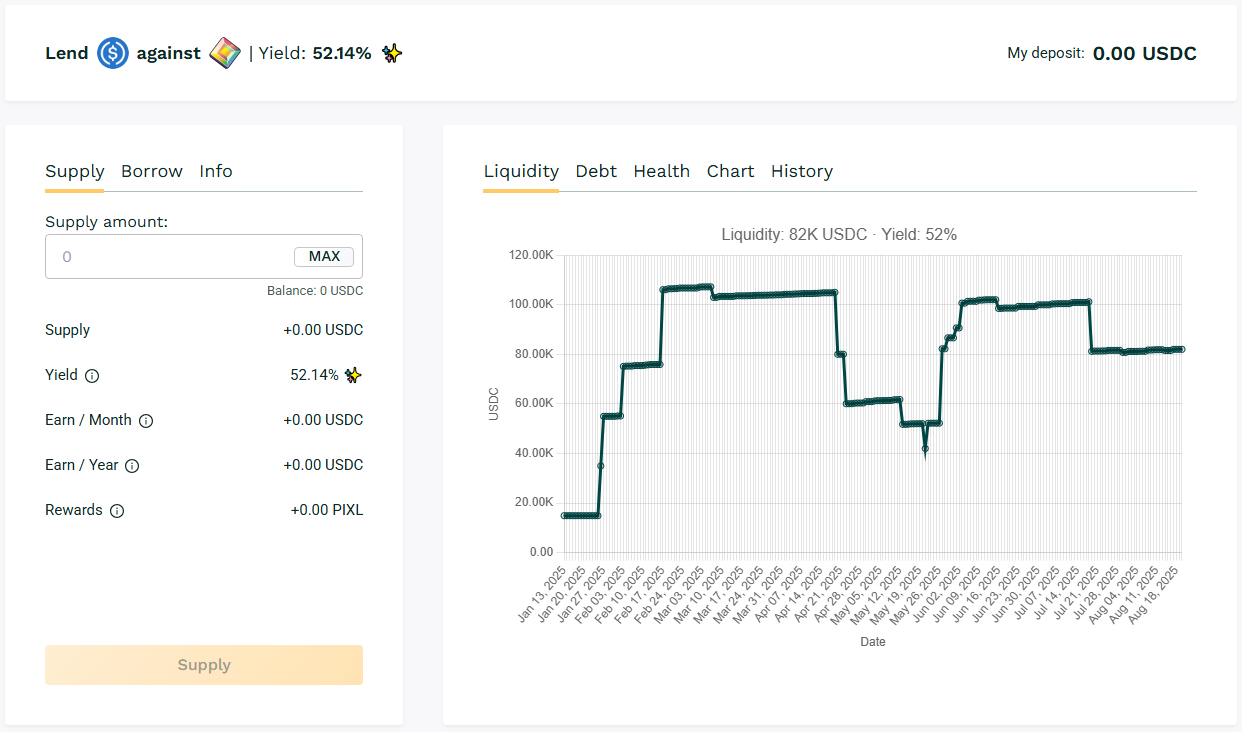

🥉 USDC / APU

🧮 APY: 38.83%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Loan cycles continue to keep utilization and reached an APY above 35%.

📌 APYs are sustained by consistent borrowing volume.

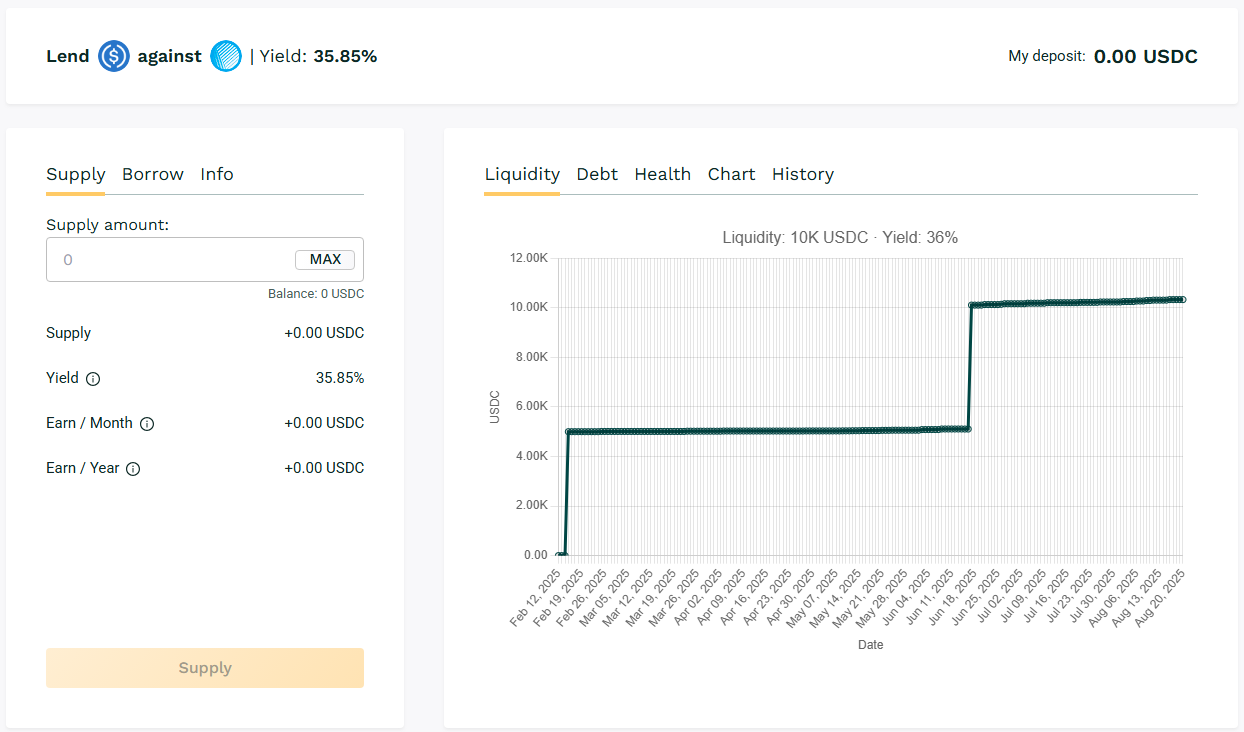

✅ USDC / ASF

🧮 APY: 35.85%

📉 Collateral: ASF (DeFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

ASF produced returns for above 30% APY, showing borrower demand and usage.

📌 Above 30% APY in emerging token pool.

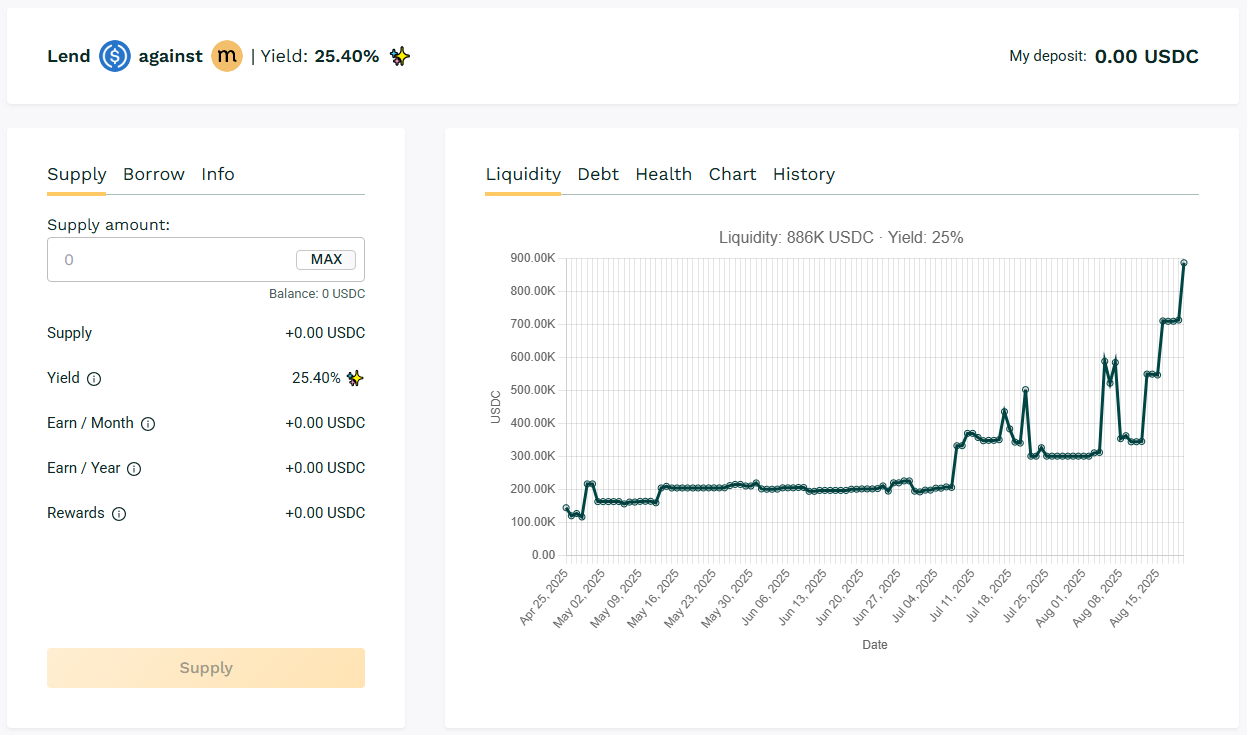

✅ USDC / MASA

🧮 APY: 25.40%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Liquidity and borrowing are driving APY above 20% with sustained pool demand.

📌 The pool continues to serve as one of the top options for lenders.

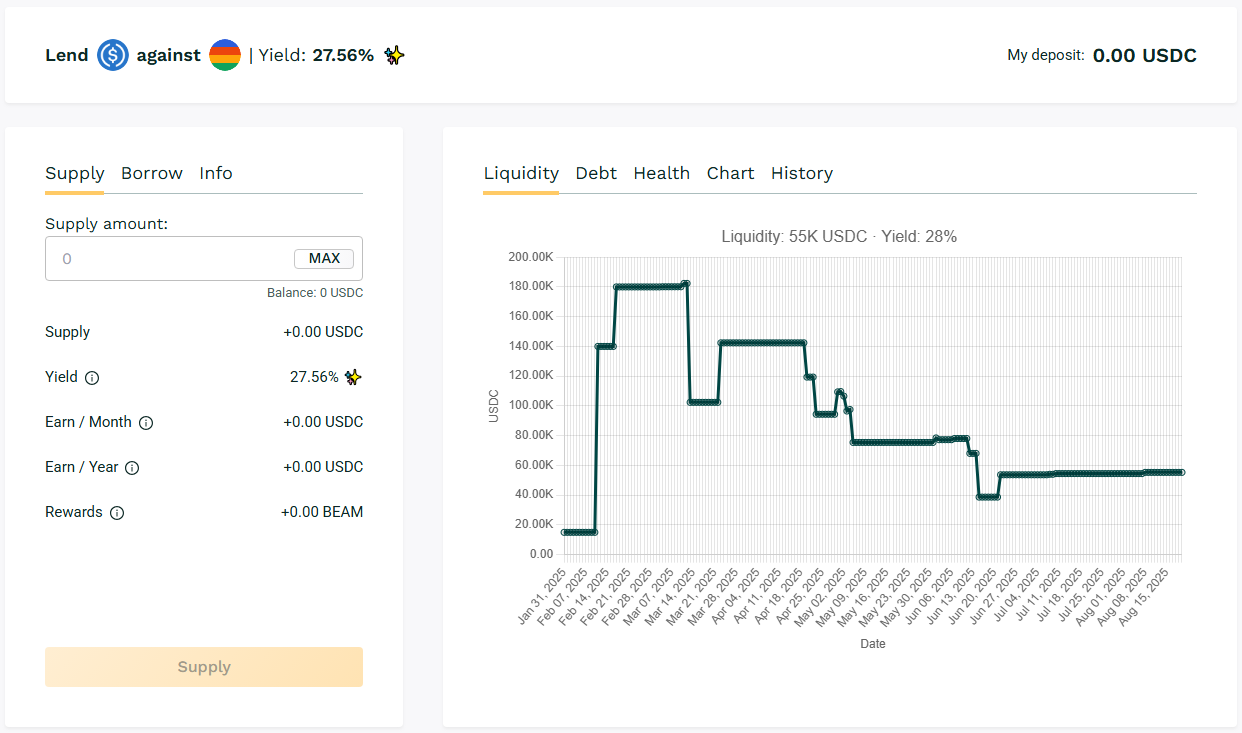

🟠 Bonus: USDC / BEAM

🧮 APY: 27.56%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

BEAM sustained upper-20s yield through consistent loan activity.

📌 Recurring rollover behavior among BEAM borrowers.

📷 Yield Tip:

- Meme collateral pools such as SPX and APU are driving APYs.

- Stable pools like PIXL and MASA offer more yield exposure.

Monitoring rollover activity helps gauge which pools will sustain yield momentum over the coming week.

📢 Next Digest

Stay tuned for next week’s Teller Digest as loan demand and lending opportunities continue to evolve across pools.

Follow along to track borrower activity, liquidity shifts, and new yield opportunities.

👉 Live data available at: app.teller.org/lend