Teller Yields, Weekly Digest 08/14

Date: August 14, 2025

Source: Teller on DeFiLlama

Lending yields continued to vary significantly this week. Here are the top-performing USDC lending pools on Teller.

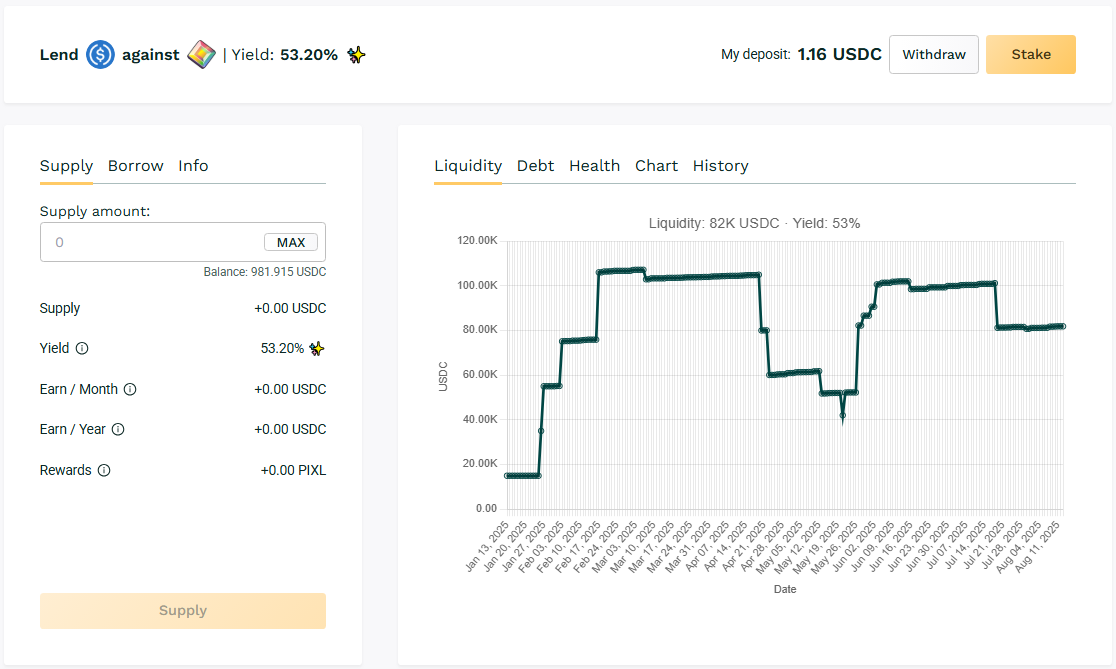

🥇 USDC / PIXL

🧮 APY: 53.20%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Borrowers are utilizing a large share of PIXL liquidity, resulting in 53% APY—reflecting utilization amid pool size.

📌 Top 1 yield this week.

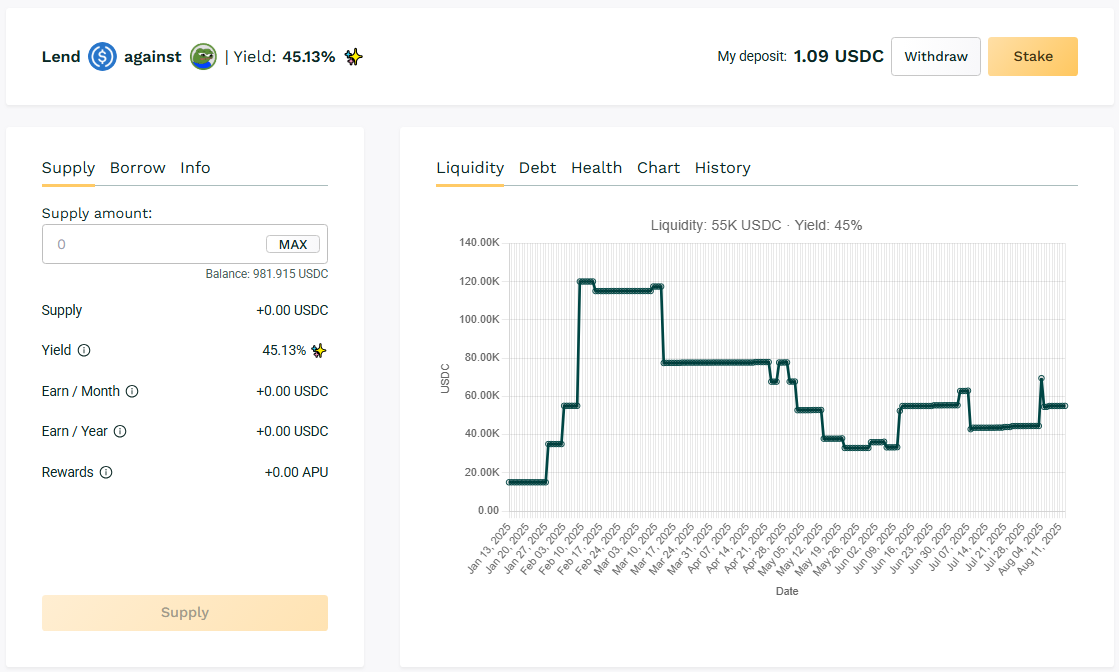

🥈 USDC / APU

🧮 APY: 45.13%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

APU continues to deliver returns atop 40% APY, driven by borrower repays and loan cycles.

📌 Top 2 yield this week.

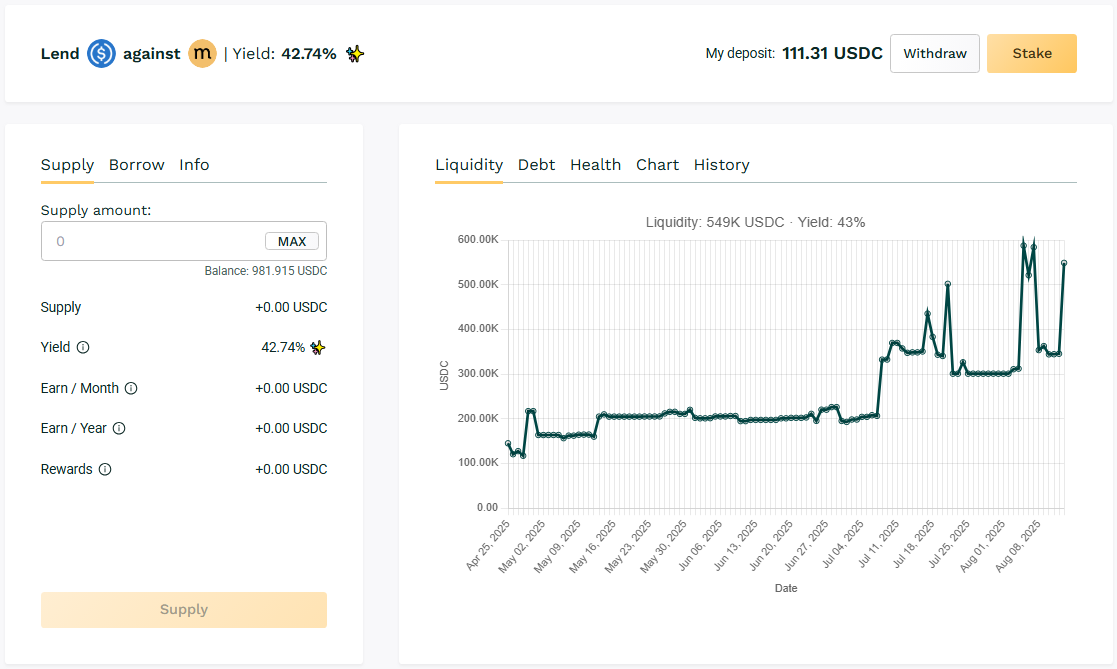

🥉USDC / MASA

🧮 APY: 42.74%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Liquidity paired with significant borrow volume maintains MASA yields above 40% with frequent borrower engagement and pool turnover.

📌 Sustained yield.

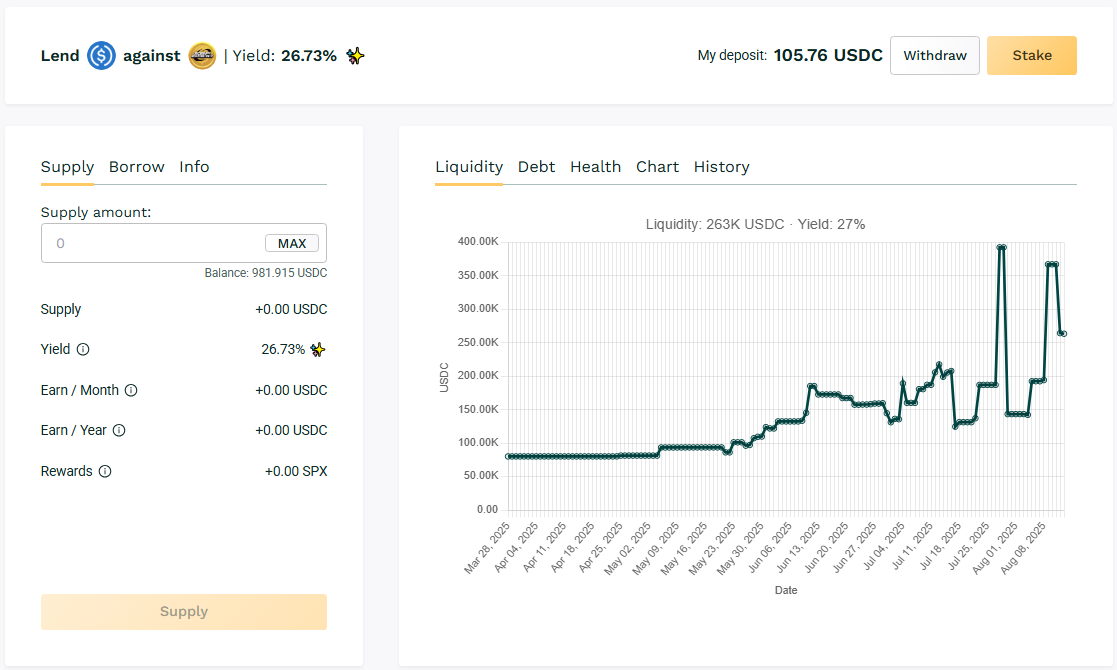

✅ USDC / SPX

🧮 APY: 26.73%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Larger pool size and ongoing borrower activity support yields in the mid-20% range.

📌 Mid-cap yield segment.

🧊 Blue‑Chip Lending Pools

USDC / WETH: 10.59%

USDC / ASF: 8.29%

Limited borrower use keeps utilization and yield in this token pool. Yield baseline returns on ETH-backed loans.

📌 Baseline blue-chip rate and small-scale borrowing activity.

📈 Key Yield Insights

- Top Yield: $PIXL at 53.17%

- Other notable yields: $MASA (42.74%) and $APU (45.13%)

- Mid-tier: $SPX at 26.73%

- Lower yields: Blue-chip and ASF in single-digits or low-teens

🔔 Next Digest

New snapshot expected next week featuring updated yield patterns and pool shifts.

👉 Live data available at: https://app.teller.org/lend