Teller Yields, Weekly Digest 08/07

Date: August 07, 2025

Source: Teller on DeFiLlama

A snapshot of the latest lending markets on Teller. APU led the leaderboard, followed by MASA, PIXL, SPX, BEAM and top-tier WBTC/WETH pools.

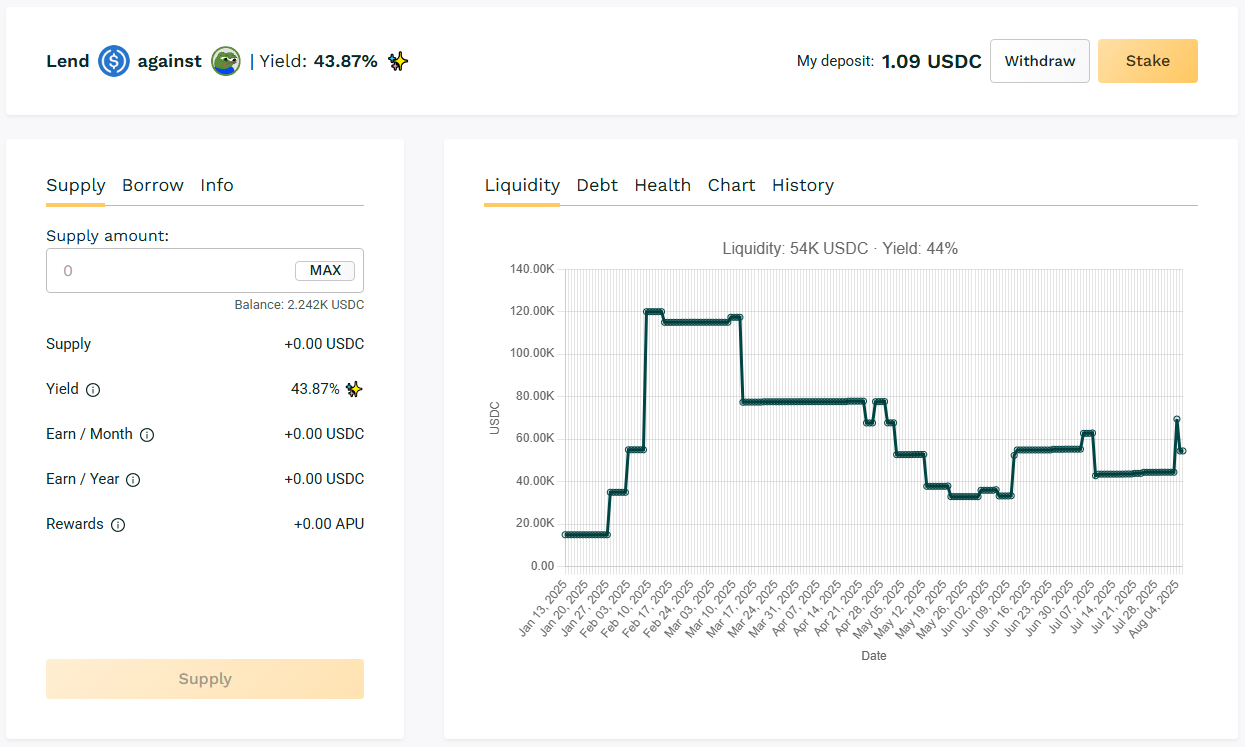

🥇 USDC / APU

🧮 APY: 43.87%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Meme-token borrowing cycles sustained APU yields over 40%, with frequent 30-day loan rollovers despite moderate liquidity.

🎯 APU ranked first for this week maintaining the 40% APY mark.

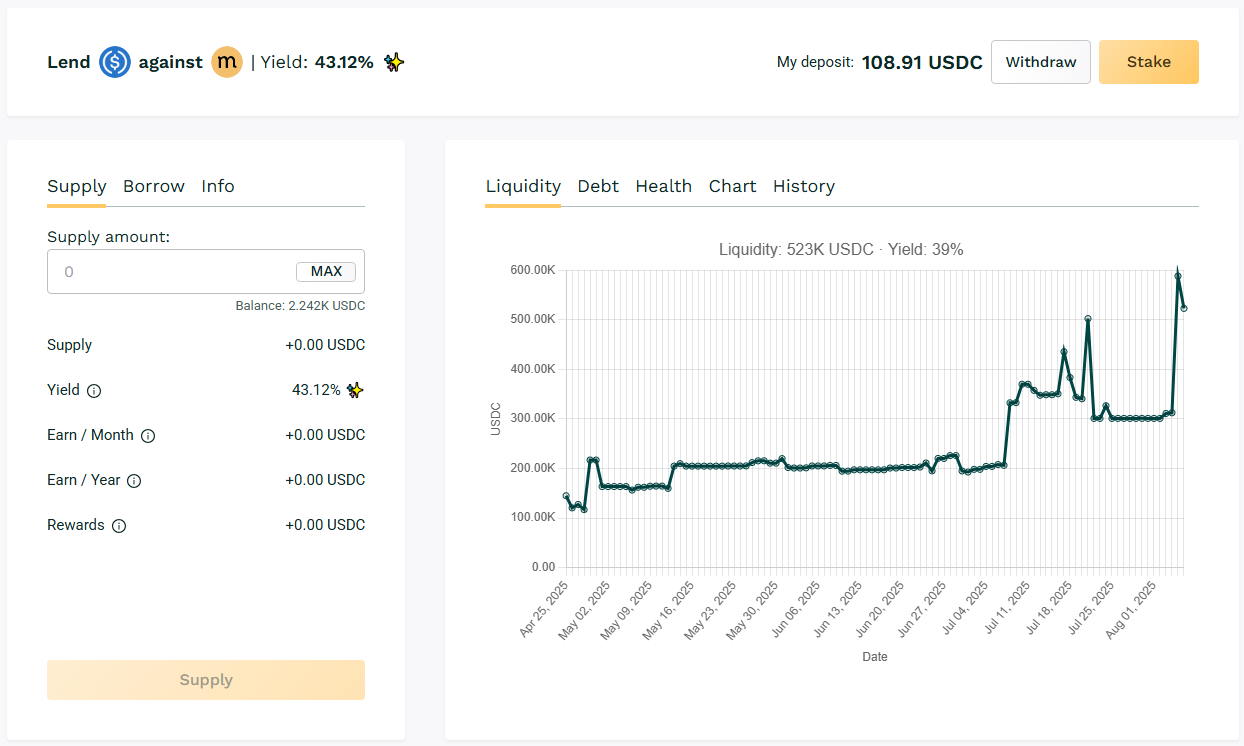

🥈 USDC / MASA

🧮 APY: 43.12%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Surge in borrowing demand led to high utilization and repeat 30‑day loans across the MASA pool.

🎯 MASA remains as one of the top performers on Teller.

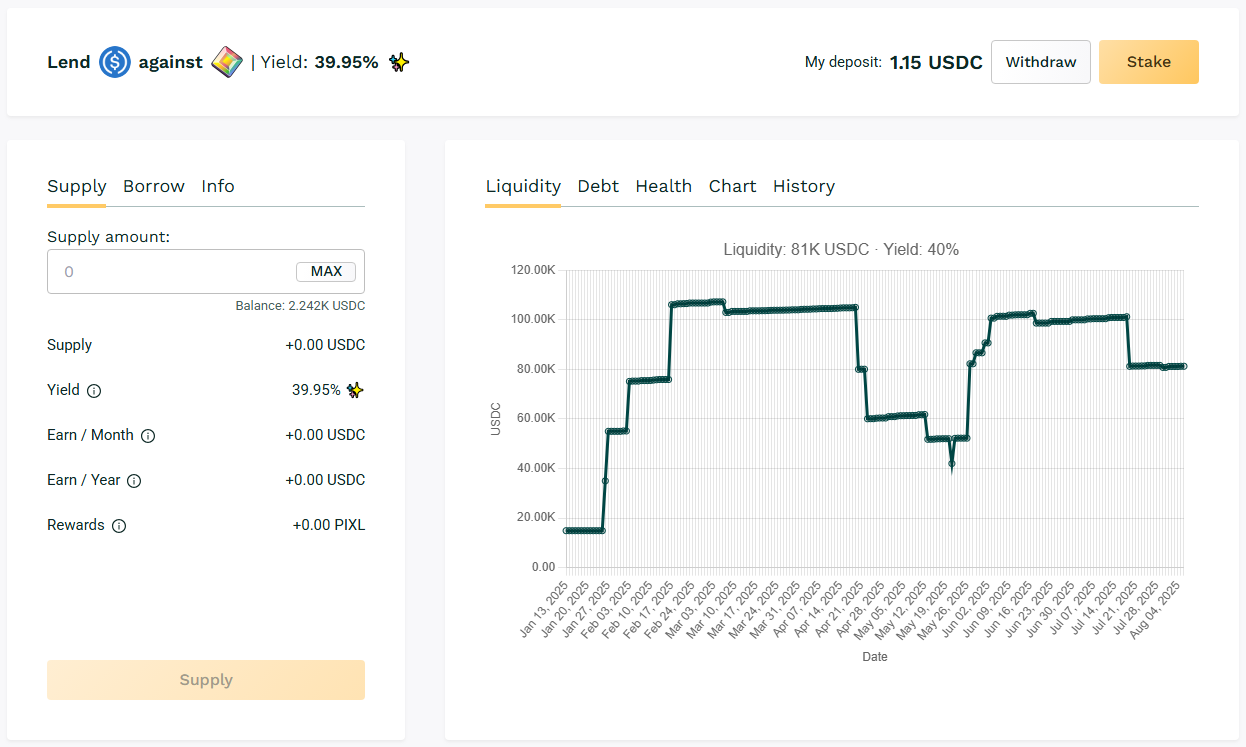

🥉 USDC / PIXL

🧮 APY: 39.95%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Short duration lending generated turnovers and APR in higher than 35%. Borrower participation remained consistent throughout the week.

🎯 Frequent loan renewals boost compound yield for lenders.

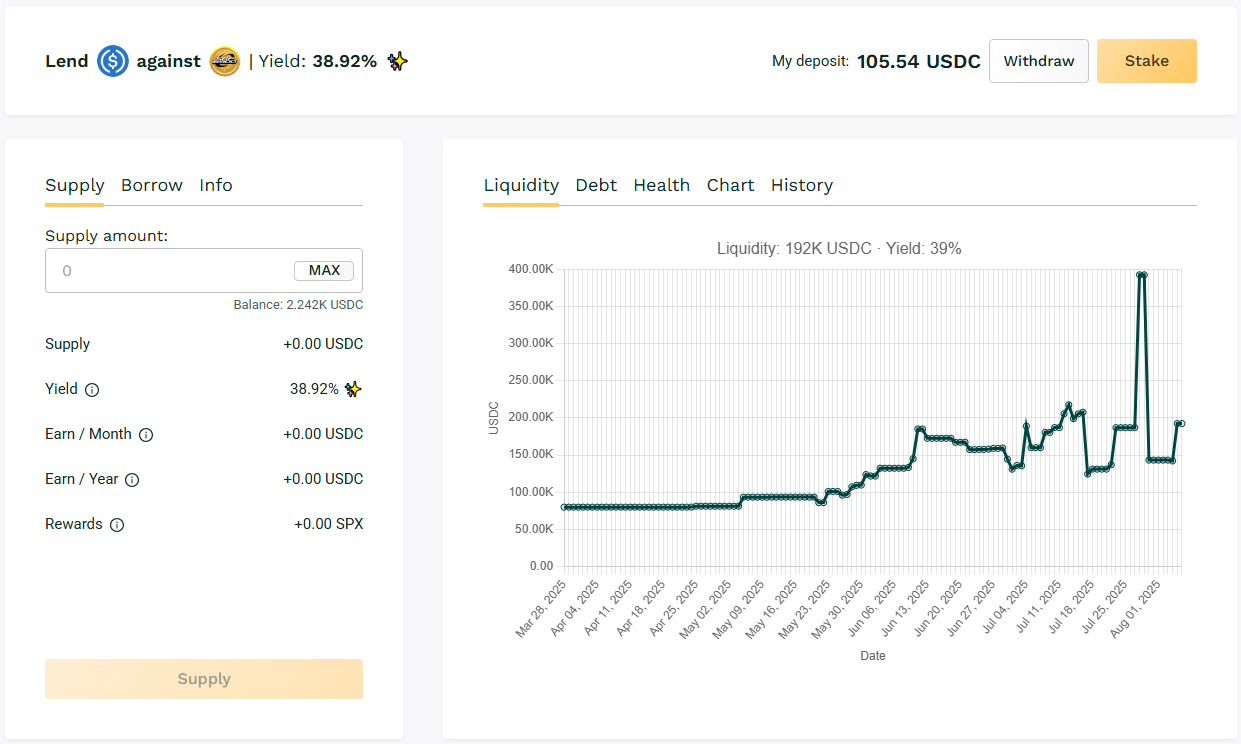

✅ USDC / SPX

🧮 APY: 38.92%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Demand for SPX loans remained consistent. Yields stayed near 35 - 40% range, supported by overcollateralization and borrower rotation.

🎯 SPX loans have maintained yields in the upper‑30% band

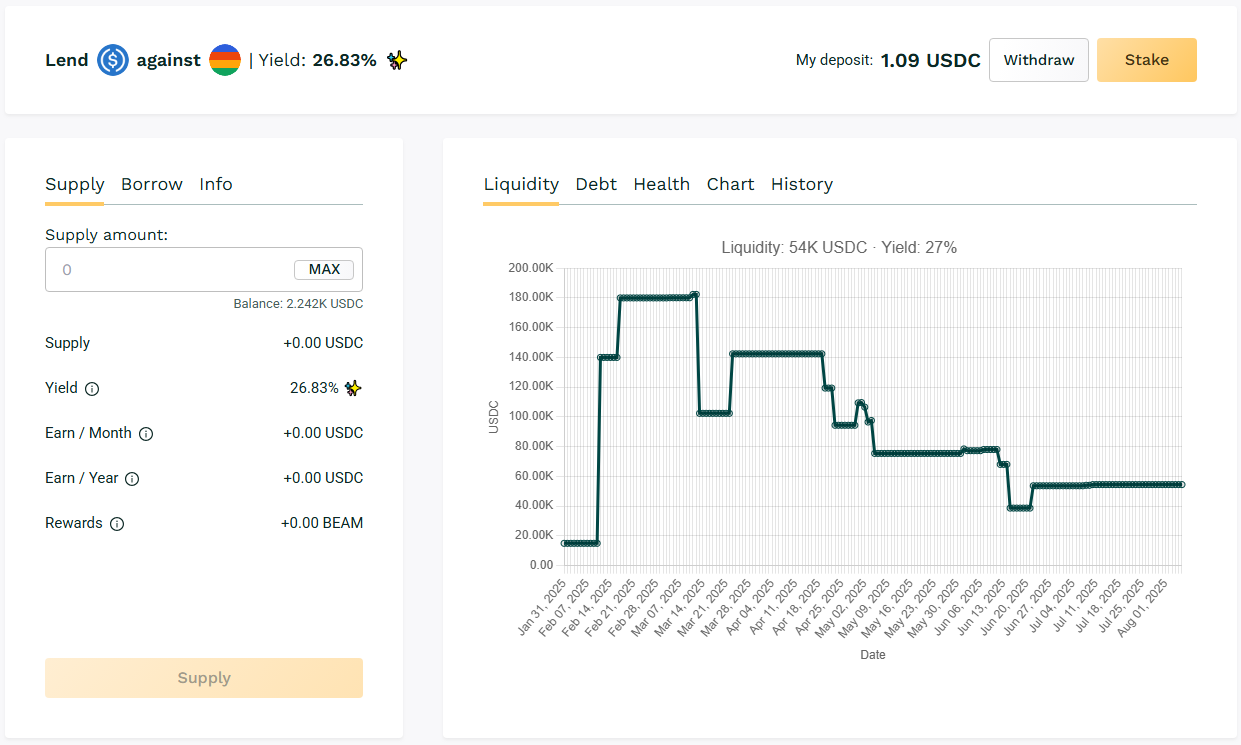

✅ USDC / BEAM

🧮 APY: 26.82%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Borrowers maintained loan cycles that supported utilization justifying upper-20% yield. BEAM remained an active mid-cap pool.

🎯 Pool with consistent borrower activity. Usage has picked up with smaller but steady borrow sizes.

🧊 Blue‑Chip Lending Pools

USDC / WBTC: ~9.6% APY

USDC / WETH: ~10.9% APY

BTC and ETH-collateralized pools provided baseline returns backed by respected tokens and consistent borrow volume.

🎯 Blue‑chip pools returned 9–11%.

📚 Highlights

- $APU led as the highest‑yield pool this week with followed by $MASA.

- $PIXL, $SPX and $BEAM offered returns in the 25–40 APY band.

- Blue‑chip pools remained at ~10%.

🔔 Next Digest

Tracking continues next week with fresh APYs, TVL shifts, and pool ranking leaders.

👉 View live lending data at: https://app.teller.org/lend