Teller Yields, Weekly Digest 07/31

Date: July 31, 2025

Source: Teller on DeFiLlama

Lending returns this week driven by a surge in activity in the MASA pool. APYs spanned from low double digits up to 87%.

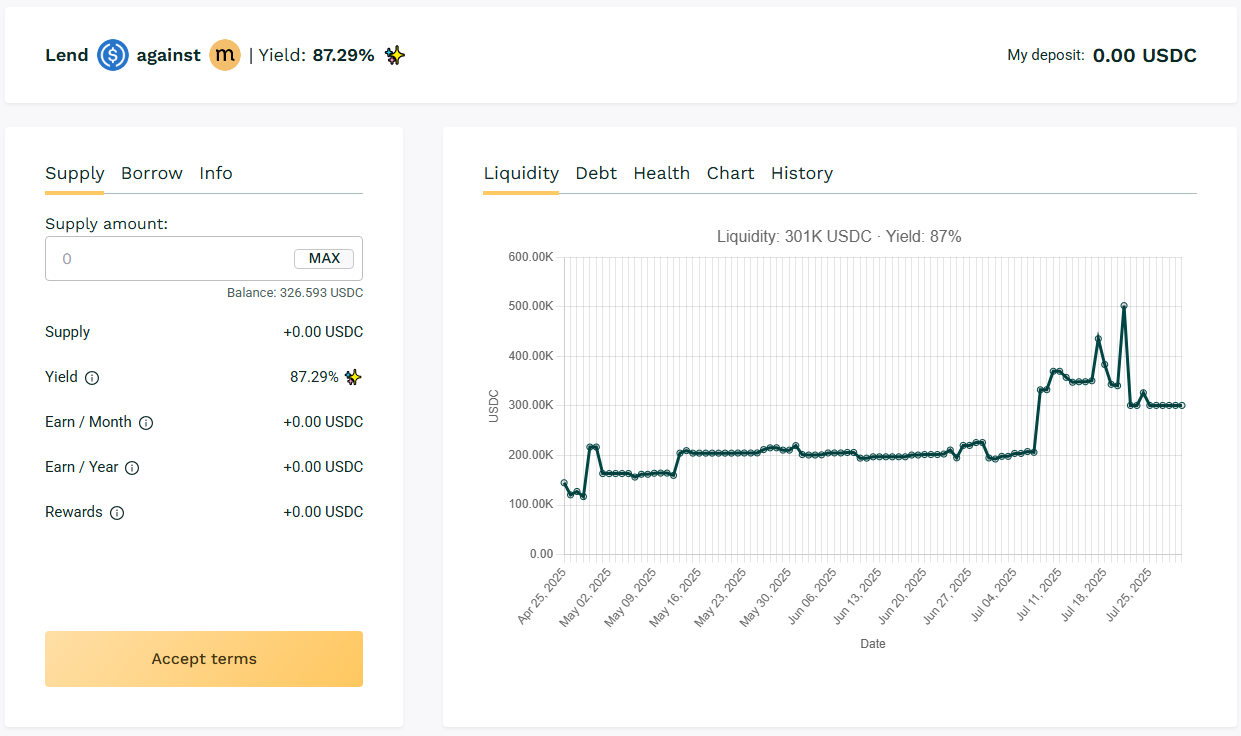

🥇 USDC / MASA

🧮 APY: 87.29%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Borrowing demand for MASA increased, pushing utilization and lending volumes to high levels. Recurring 30‑day loans underpinned the APY jump, marking it as the most active pool this week with yields in the high ~80% APY range.

🎯 MASA surged to a massive APY spike this week.

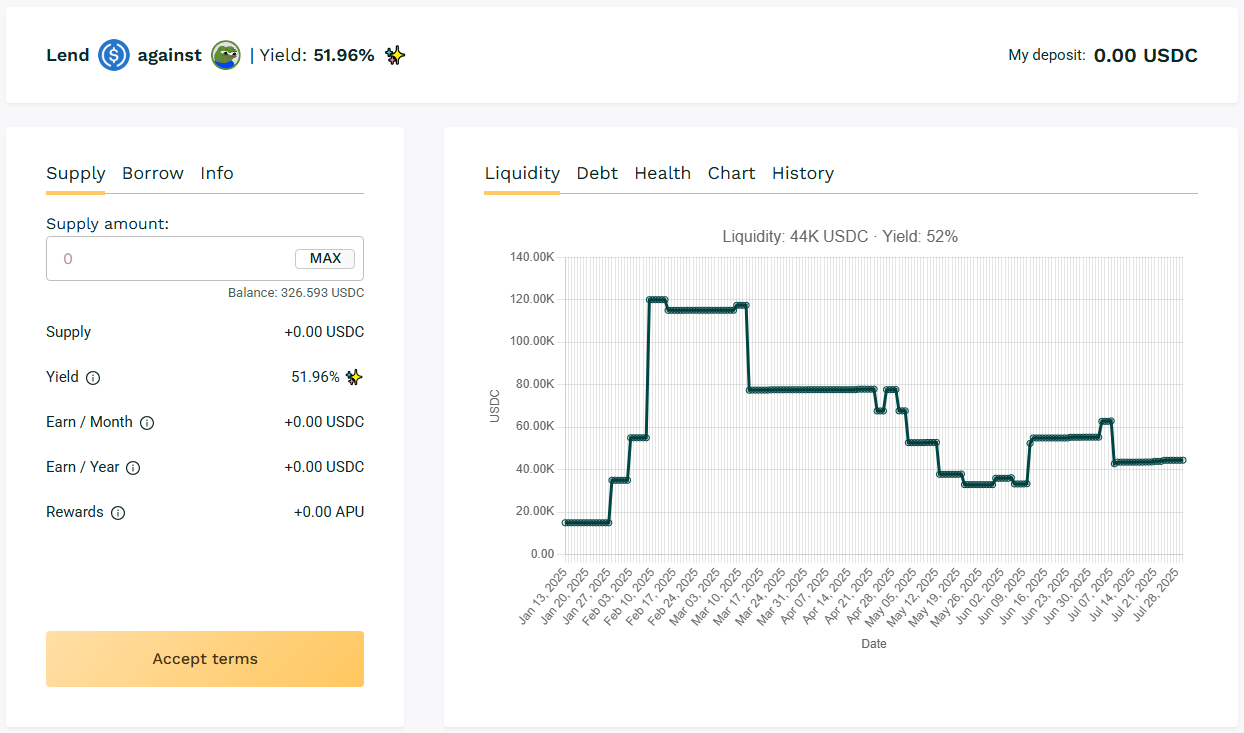

🥈 USDC / APU

🧮 APY: 51.96%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Meme-driven borrowing cycles keep APU’s pool active. Regular 30-day loan turnovers with moderate TVL, holding APY just above 51%.

🎯 APU performs with above 50% APY range.

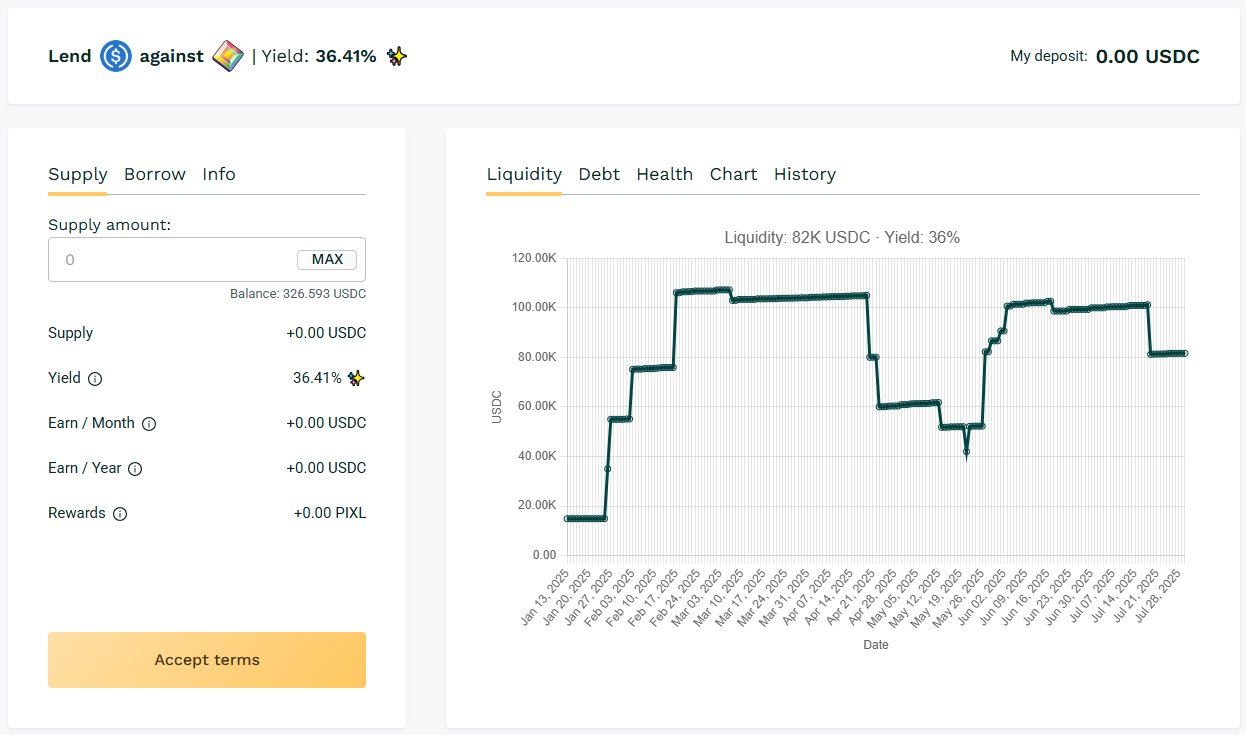

🥉 USDC / PIXL

🧮 APY: 36.41%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

PIXL’s 7-day loan cycle enables frequent loan refreshes and consistent lender earnings. Borrower participation helps sustain the ~35% APY through active usage.

🎯 PIXL fluctuates in the 30% APY range.

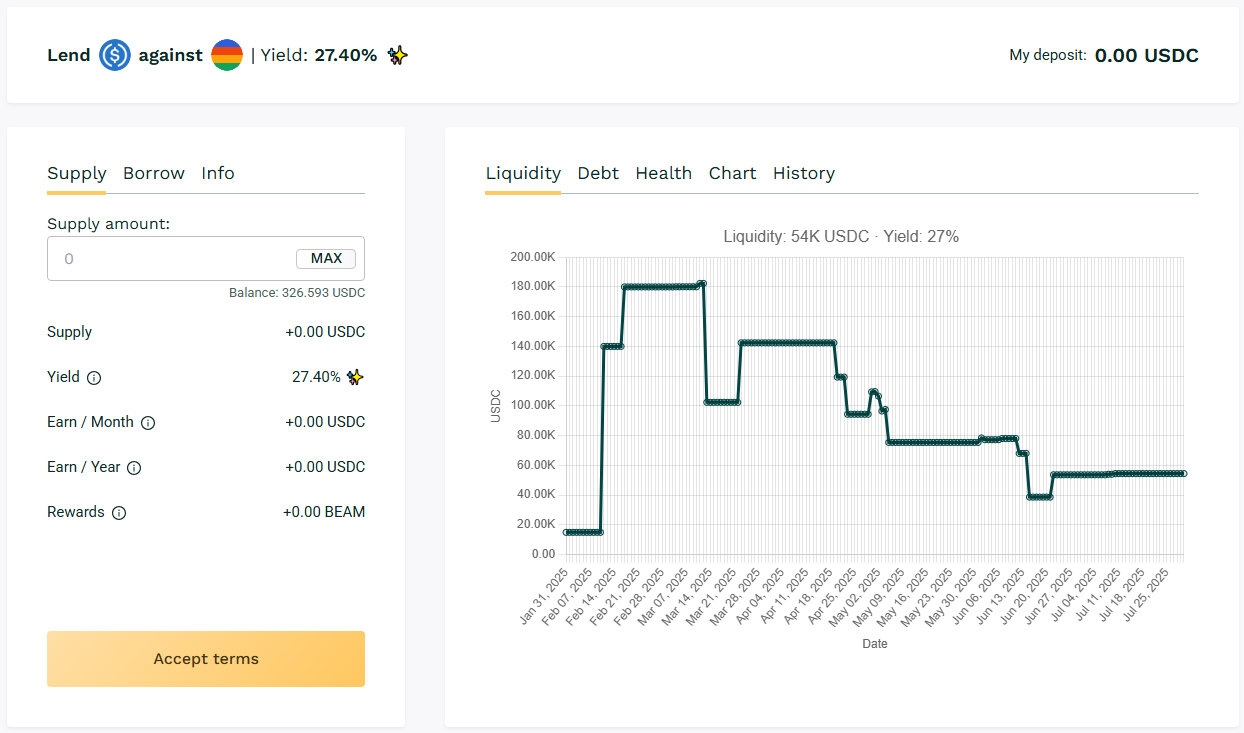

✅ USDC / BEAM

🧮 APY: 27.40%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

While TVL is moderate, utilization supports yields in the upper-20% bracket, offering a predictable mid-tier option.

🎯 BEAM shows mid-cap performance.

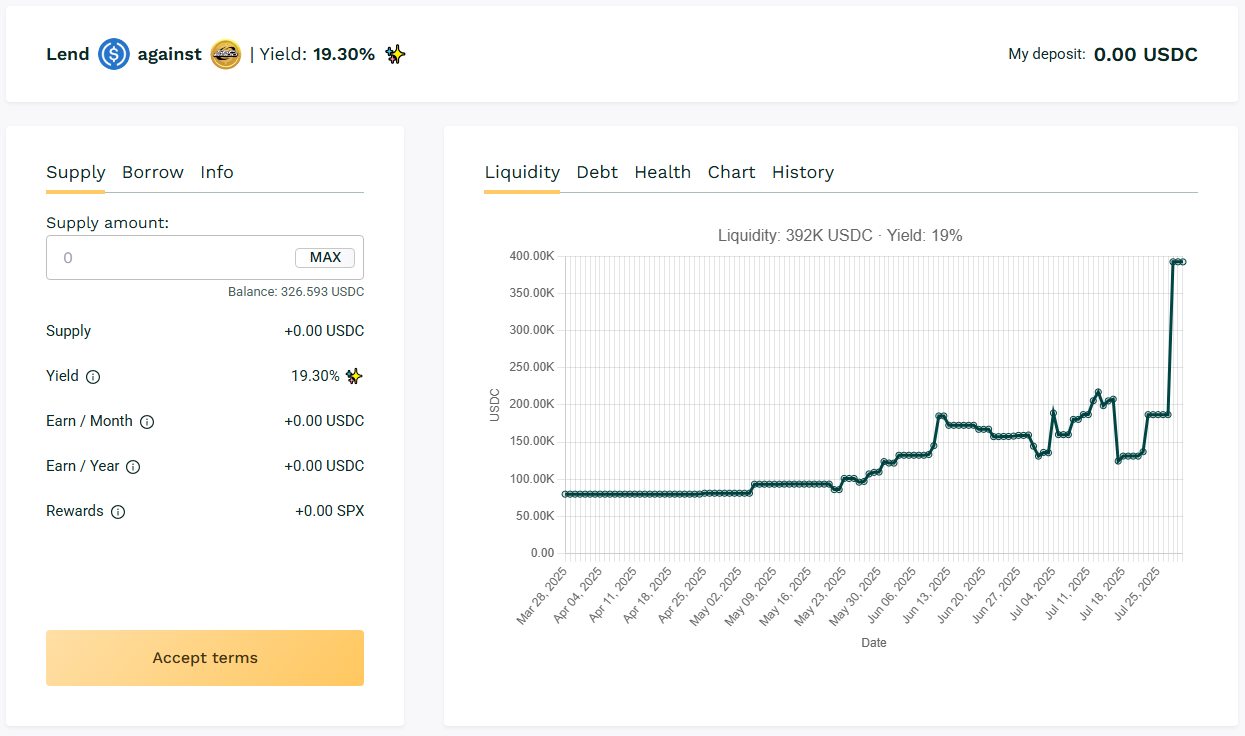

✅ USDC / SPX

🧮 APY: 19.30%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers continue to favor SPX for long-duration loans with a high collateral requirement. Utilization remains, sustaining lender returns near 19%.

🎯 SPX fluctuates in the 19s APY band.

🧊 Blue‑Chip Lending

USDC / WBTC (~9.6%)

USDC / WETH (~10.9%)

BTC and ETH-backed pools maintain predictable yield profiles. Borrowing activity stays consistent, ensuring APYs around 10%, preferred by participants focused on mainstream token collateral.

🎯 Blue-chip collateral loans support yields in the 10% APY range.

📊 Yield Highlights:

- MASA’s surprising 87% surge dominates this week’s yield board.

- PIXL, and APU jumps in the 30-50% range with active borrower cycles.

- BEAM comes in with a reliable mid‑20s APY option while SPX fluctuates.

- Blue-chip pools continue to offer stable returns.

📢 Next Digest

Tune in for the next issue featuring updated stats and new borrowing trends.

👉 For live pool yields and lending data, visit: https://app.teller.org/lend