Teller Yields, Weekly Digest 07/24

Date: July 24, 2025

Source: Teller on DeFiLlama

Lending yields across Teller remained strong this week, particularly in MASA, SPX, and PIXL pools. Meme and mid-cap activity continues to drive 30–45%+ returns.

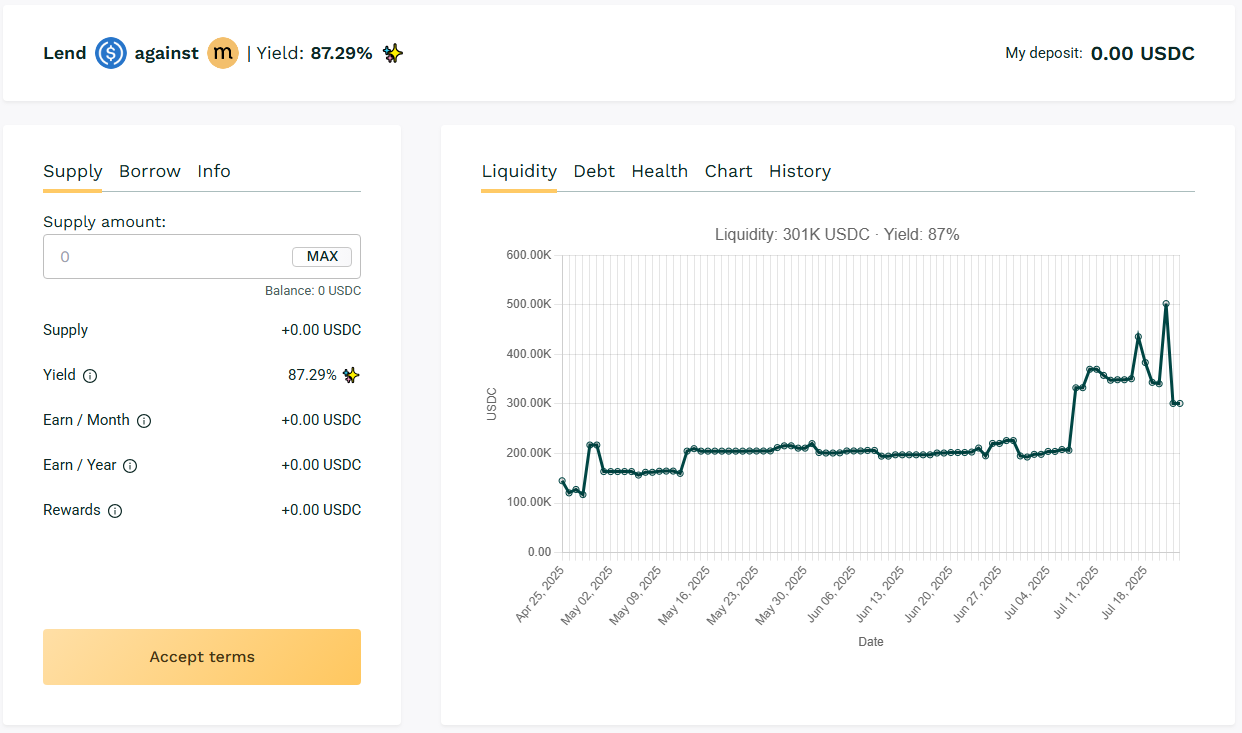

🥇 USDC / MASA

🧮 APY: 87.29%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

MASA continues to attract significant borrowing volume, and the 30-day terms allow for capital stickiness that supports elevated APY. Lenders benefit from reliable, repeating loan cycles that maintain yield momentum over 40-50% range.

📌 Frequent loan cycles with substantial lending volume support.

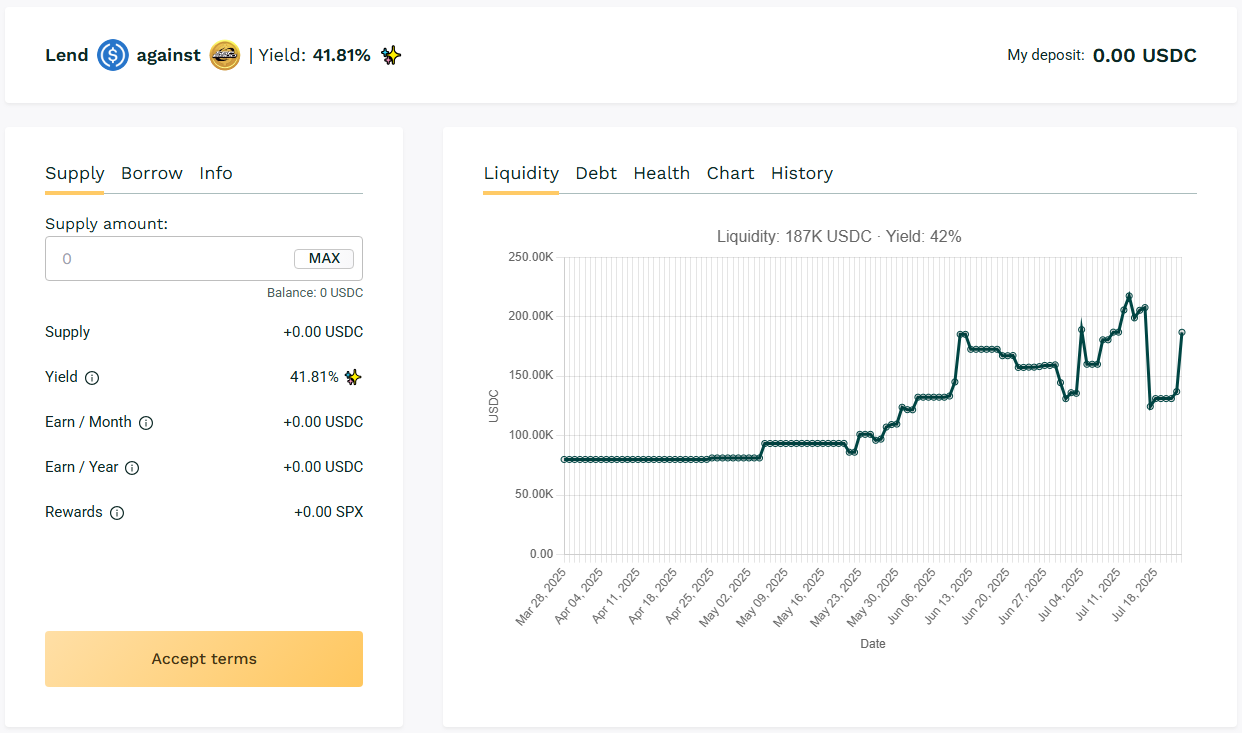

🥈 USDC / SPX

🧮 APY: 41.81%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers using $SPX collateral are locking in high loan sizes due to the elevated collateral factor. With consistent 30-day borrow terms and strong ecosystem traction, lenders are seeing returns at ~40%, marking SPX as one of the sustained top performers.

📌Persistent borrowing demand and lengthy loan durations.

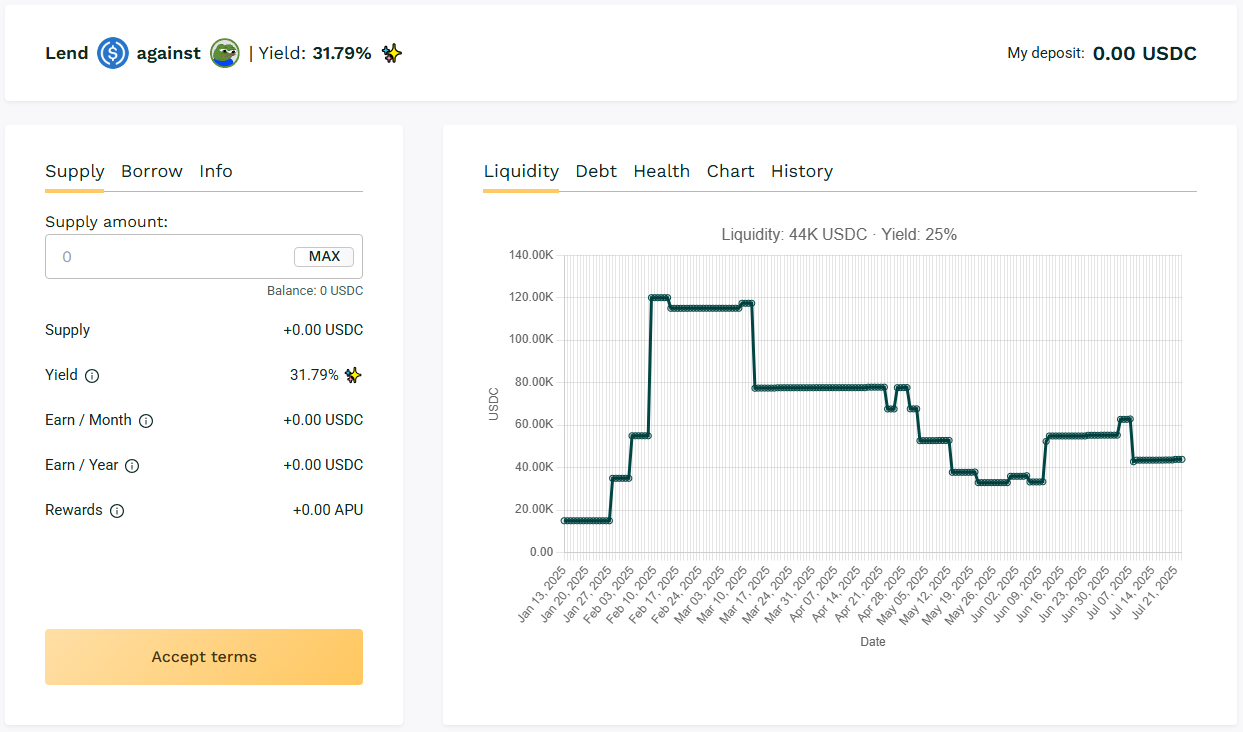

🥉 USDC / APU

🧮 APY: 31.79%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Summary: The APU pool sustains a ~30% APY driven by ongoing meme borrower interest. The 30-day duration allows for a rolling wave of capital inflow and outflow, keeping utilization active and lender returns consistent.

📌 Meme loan cycles stay hot, keeps utilization healthy.

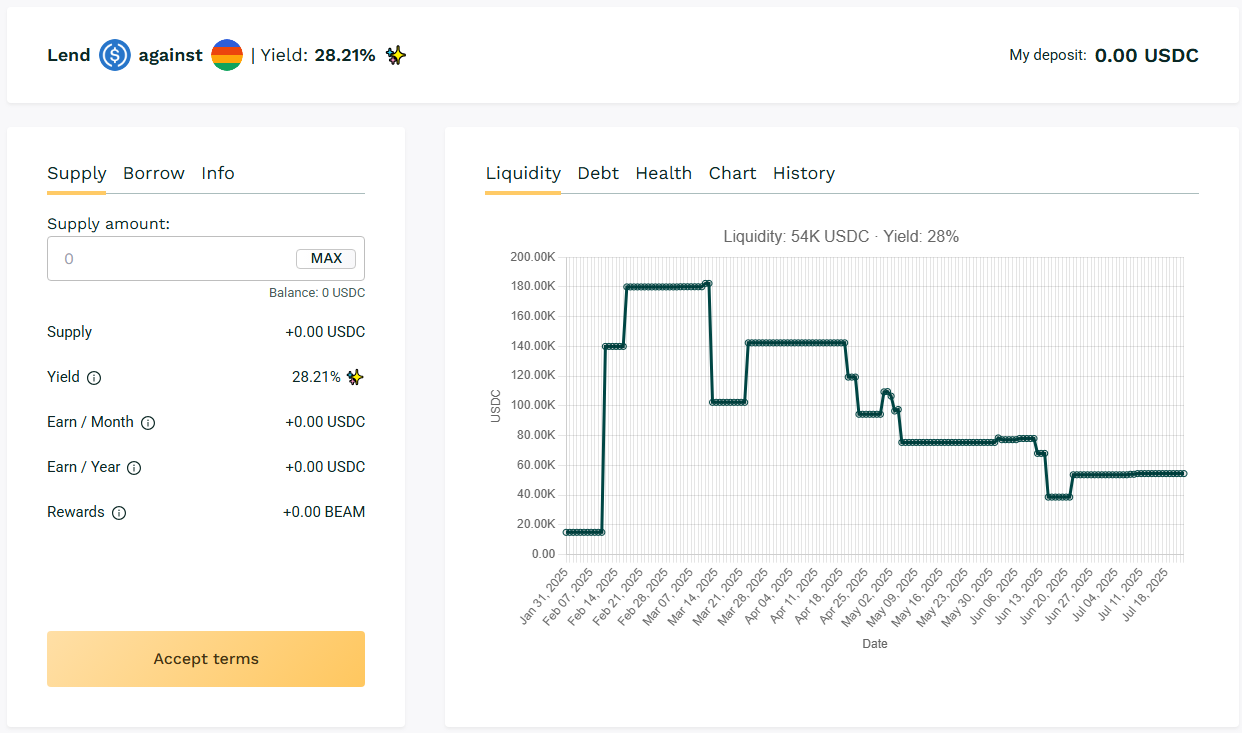

✅ USDC / BEAM

🧮 APY: 28.21%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Summary: BEAM has maintained steady borrowing, contributing to a stable APY above 20%. Lenders gain exposure to a growing ecosystem with healthy demand and moderate collateral requirements, making it one of the more balanced mid-cap pools.

📌 Strong mid-cap performance, ideal for yield-focused participants.

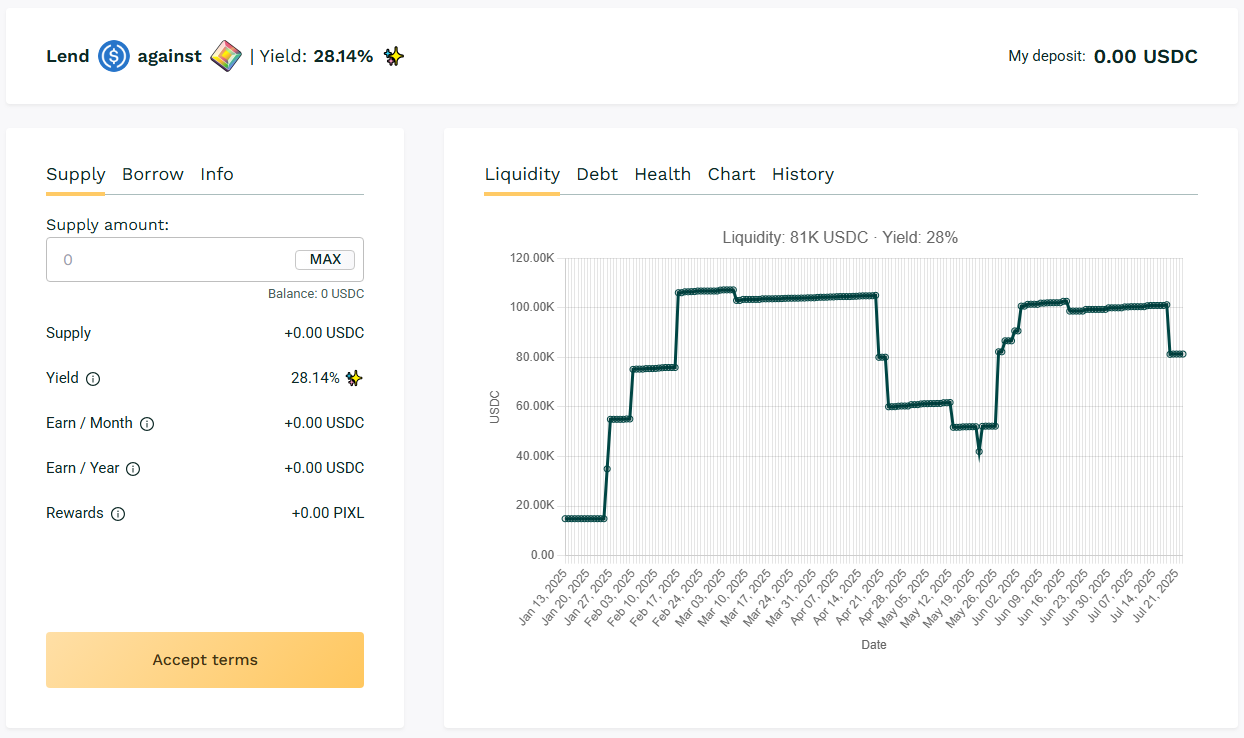

✅ USDC / PIXL

🧮 APY: 28.14%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Summary: Short 7-day borrow durations create frequent loan recycling, which keeps pool utilization high and reward flows consistent. PIXL remains a standout among gaming tokens, and lenders continue to earn over 20% APY due to high turnover and demand.

📌 High turnover boosts yield, enables quick capital redeployment.

🧊 Blue-Chip Pools

USDC / WBTC: ~9.6%

USDC / WETH: ~10.9%

BTC- and ETH-backed loans remain active and continue delivering reliable yield without the volatility seen in meme or mid-cap assets. These pools serve as a consistent option for conservative lending strategies.

📈 Yield Trends:

SPX and MASA continue dominating with top-tier APYs. PIXL, CLEAR, and APU pools sustain strong mid-30% returns, while BEAM and blue-chip assets maintain consistent performance for lenders. Total value locked remains steady, reflecting overall borrower confidence.

🔔 Next Update:

Catch the next digest featuring updated TVL and pool-specific yield insights.

👉 Explore all live rates at: https://app.teller.org/lend