Teller Yields, Weekly Digest 07/17

Date: July 17, 2025

Source: Teller on DeFiLlama

USDC lending activity remained strong this week on Teller, with multiple pools generating returns above 30% APY. Borrowers are actively tapping mid-cap, gaming, and meme-aligned collateral, while blue-chip pools maintain a steady floor.

Here’s a breakdown of the highest-yielding opportunities:

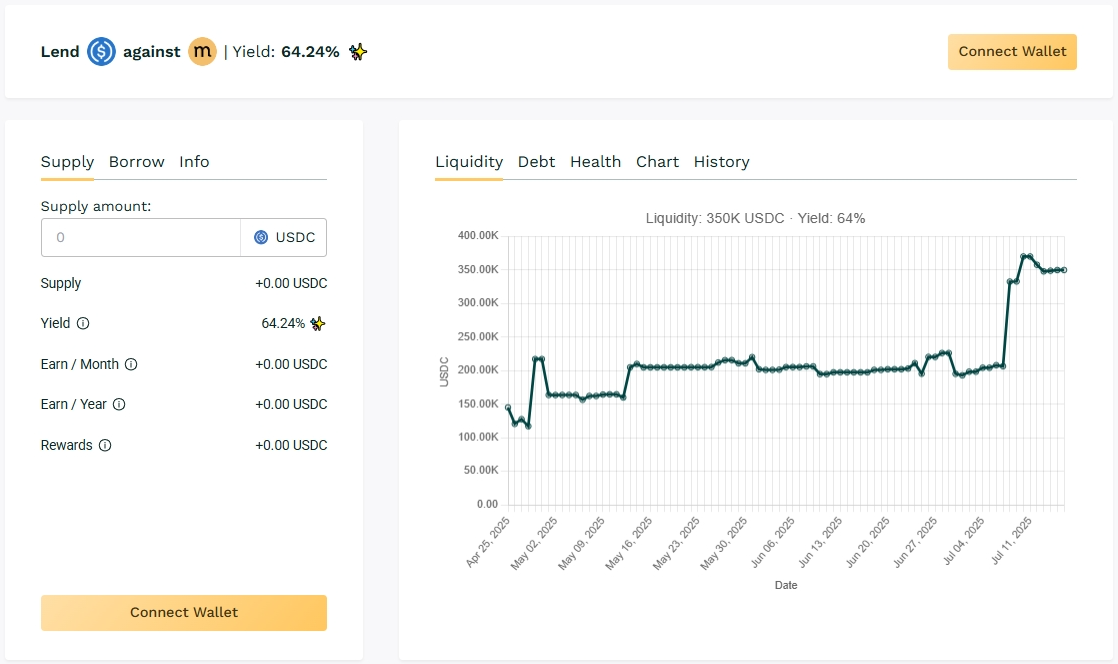

🥇 USDC / MASA

🧮 APY: 64.24%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

This lending pool benefits from high loan volume and frequent recurring activity. Borrowers regularly recycle 30-day loans using $MASA collateral, pushing utilization to efficient levels and sustaining yields that is now above 60%. The pool’s relatively high TVL and stable borrowing trends suggest confidence in the MASA ecosystem and its borrower base.

🎯 MASA maintains one of the deepest and most active pools.

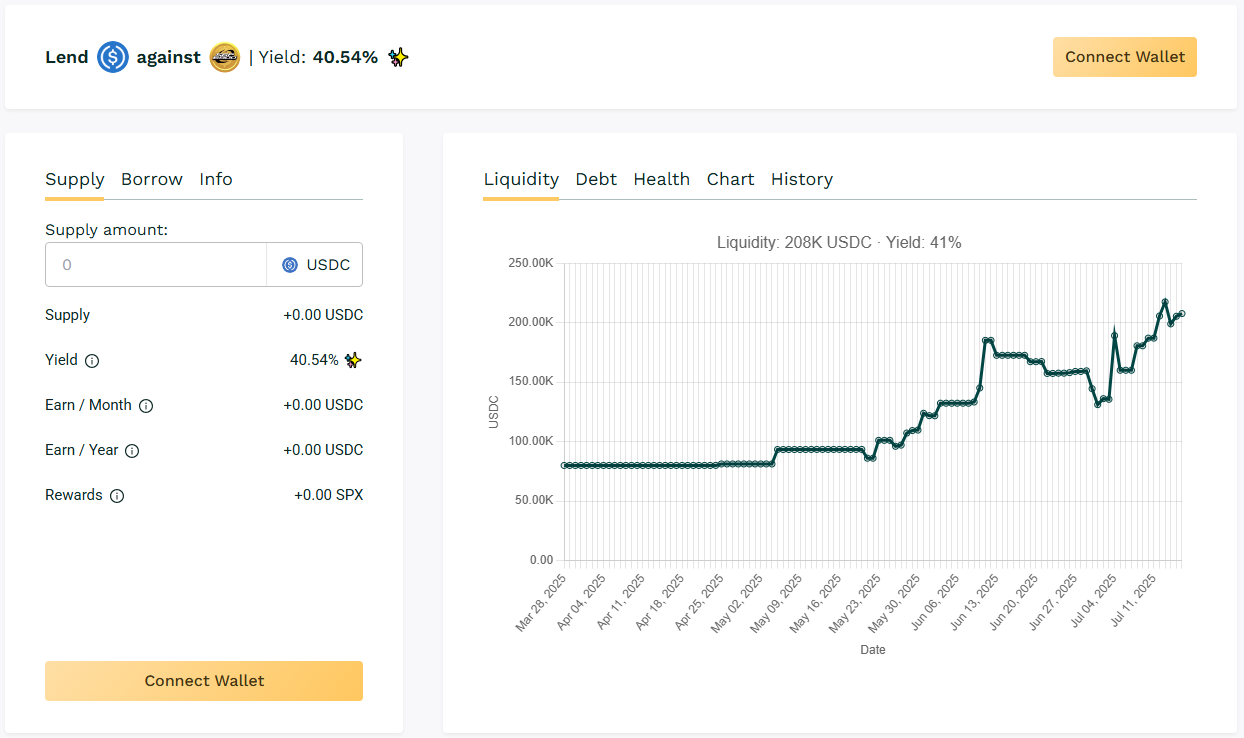

🥈 USDC / SPX

🧮 APY: 40.54%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

This pool consistently tops the leaderboard due to its high collateral ratio and borrower appetite for longer-term capital. With a 30-day loan duration and a 600% collateral factor, it attracts overcollateralized borrowers comfortable locking in capital for sustained periods. Utilization levels are healthy, and rollover activity remains strong—keeping lender yields above 40%.

🎯 SPX-backed loans continue to deliver one of the highest APY returns on Teller.

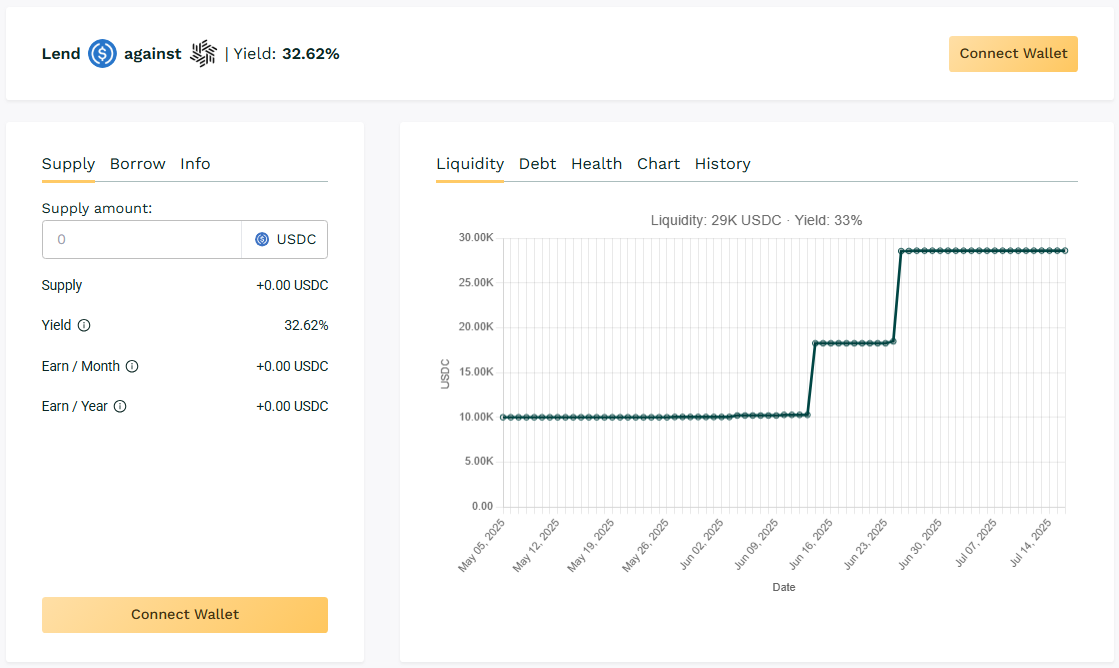

🥉 USDC / CLEAR

🧮 APY: 32.62%

📉 Collateral: CLEAR (Infra)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Though smaller in scale, the CLEAR pool is seeing a noticeable pickup in borrower participation. The 450% collateral rate keeps the pool defensively structured, while the 30-day term helps extend loan cycles. With increasing usage, APY has broken above the 30% threshold, making it a rising option for yield seekers.

🎯 CLEAR pool yield has climbed alongside higher utilization in recent cycles.

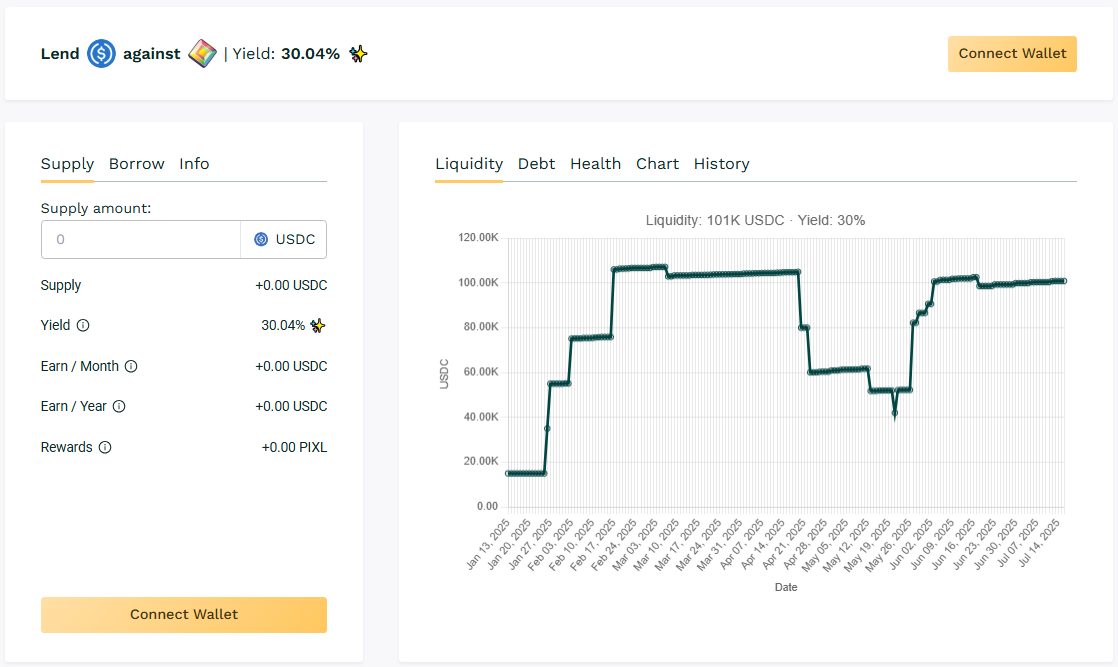

✅ USDC / PIXL

🧮 APY: 30.04%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

The PIXL pool serves short-term borrowers with a 7-day loan term, enabling rapid capital rotation and more frequent compounding for lenders. Despite the shorter durations, the APY remains highly competitive due to steady borrower participation and low idle capital. It’s a go-to pool for lenders looking to capture consistent yield with short-duration risk exposure.

🎯 PIXL pool is favored for its fast loan turnover and attractive yield profile.

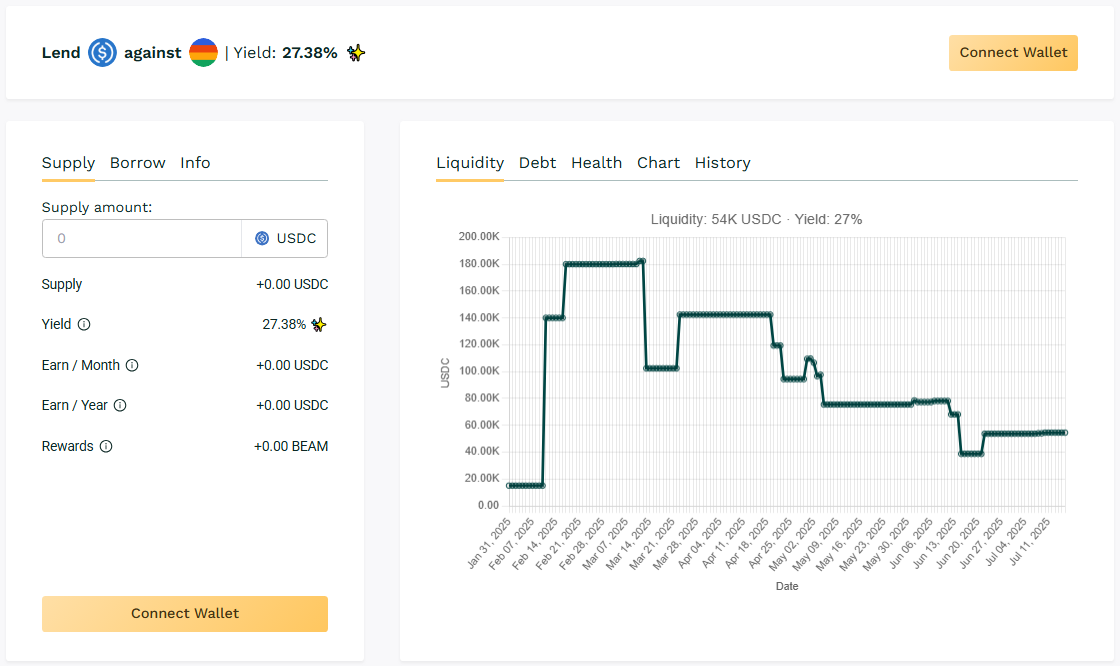

✅ USDC / BEAM

🧮 APY: 27.38%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

BEAM is a consistent performer in the mid-tier range, with borrowers tapping 30-day loans in regular cycles. Its moderate TVL and utilization contribute to stable, if slightly lower, APY outcomes. It appeals to lenders who want to remain exposed to mid-cap tokens while still earning double-digit yield.

🎯 BEAM maintains healthy mid-range returns with modest but stable borrowing.

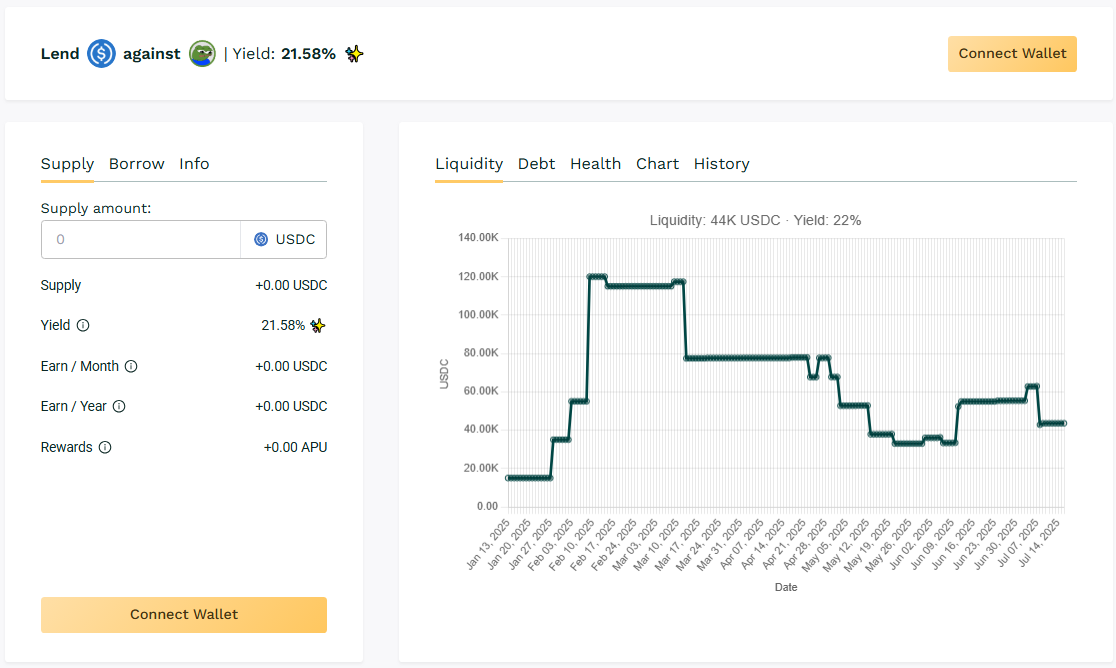

✳️ USDC / APU

🧮 APY: 21.58%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Despite being meme-oriented, APU has built a dependable lending cadence. The borrower group often rolls through 30-day terms, maintaining activity levels that support consistent APY above 20%. While TVL remains relatively moderate, the pool exhibits solid retention and reborrowing behavior among its base.

🎯 APU pool continues to perform reliably with meme-driven borrowing cycles.

🧊 Blue-Chip Lending

USDC / WBTC: 9.60% APY

USDC / WETH: 10.91% APY

Note: Ideal for capital allocators seeking BTC or ETH exposure with stable yields.

Blue-Chip Summary:

Both WBTC and WETH-backed lending pools continue to offer lower but predictable returns, often favored by participants less focused on meme or altcoin volatility. Loan durations are standardized at 30 days, and APYs typically remain in the 9–11% band, reflecting the lower volatility of collateral assets.

🔍 Yield Highlights

SPX and MASA compete for top APY.

PIXL offers fast turnaround yields ideal for active capital.

CLEAR continue to surprise with sudden uptick of 30%+ returns.

Blue-chip options offer stability with APYs just under 11%.

🗓 Next Update

The next digest delivers refreshed APYs, updated liquidity stats, and new borrower activity. Don’t miss it.

👉 Track real-time yields here: app.teller.org/lend