Teller Yields, Weekly Digest 07/10

Date: July 10, 2025

Source: Teller on DeFiLlama

This week’s top yields on Teller. Here are the six standout pools with active borrowing and elevated returns. Breakdown below 👇

🔝 Top Performing Pools

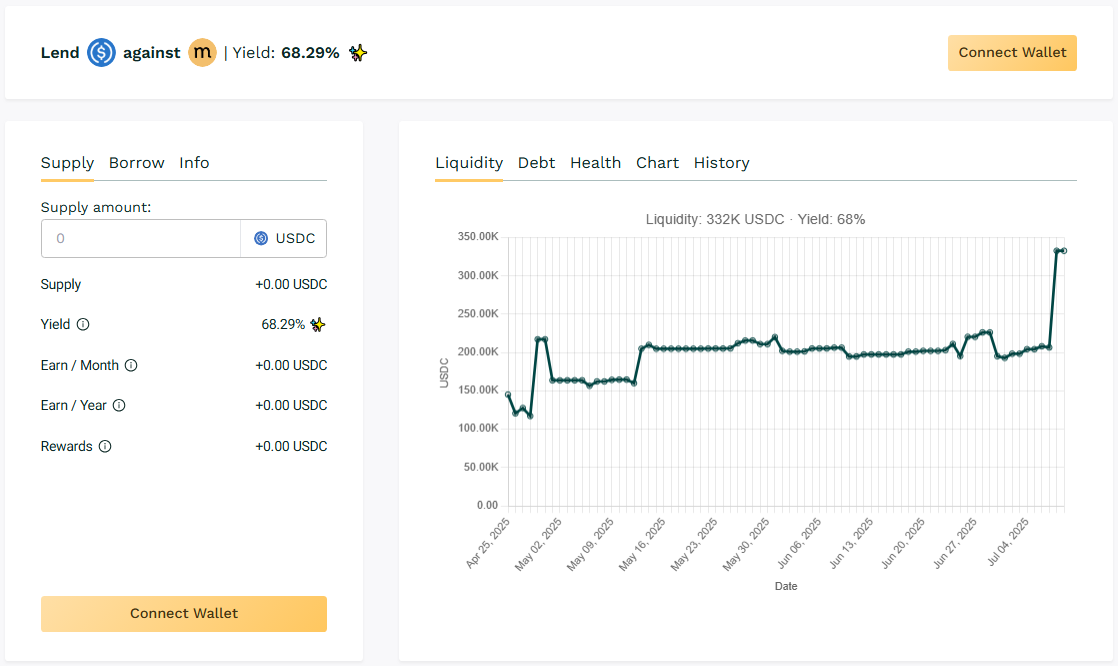

🥇 USDC / MASA

🧮 APY: 68.29%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

The MASA pool continues to attract outsized loan volume. Borrowers are consistently tapping into this pool at long durations and healthy collateralization, keeping the yield firmly near the top despite increased pool size.

➡️ Steady demand keeps MASA at the top of the APY board.

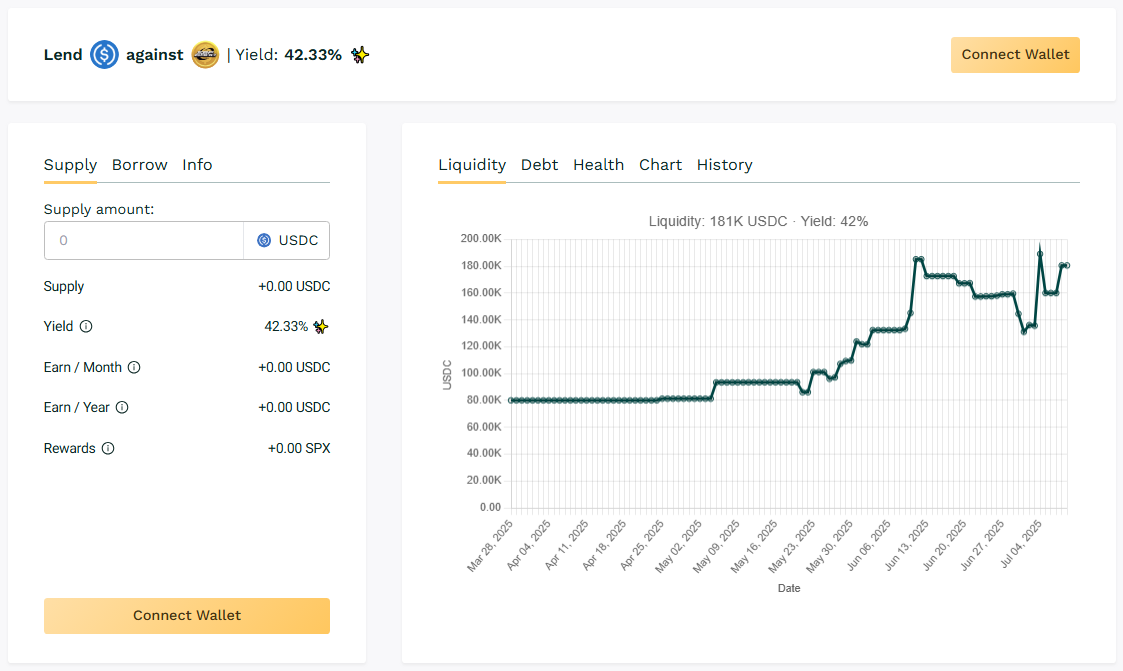

🥈 USDC / SPX

🧮 APY: 42.33%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers are locking SPX for 30-day loans at high collateral ratios, pushing yields past 40%. SPX remains one of the most borrowed assets on Teller, with strong demand sustaining high utilization throughout the week.

➡️ One of the top performers this week with continued borrower activity and tight pool supply.

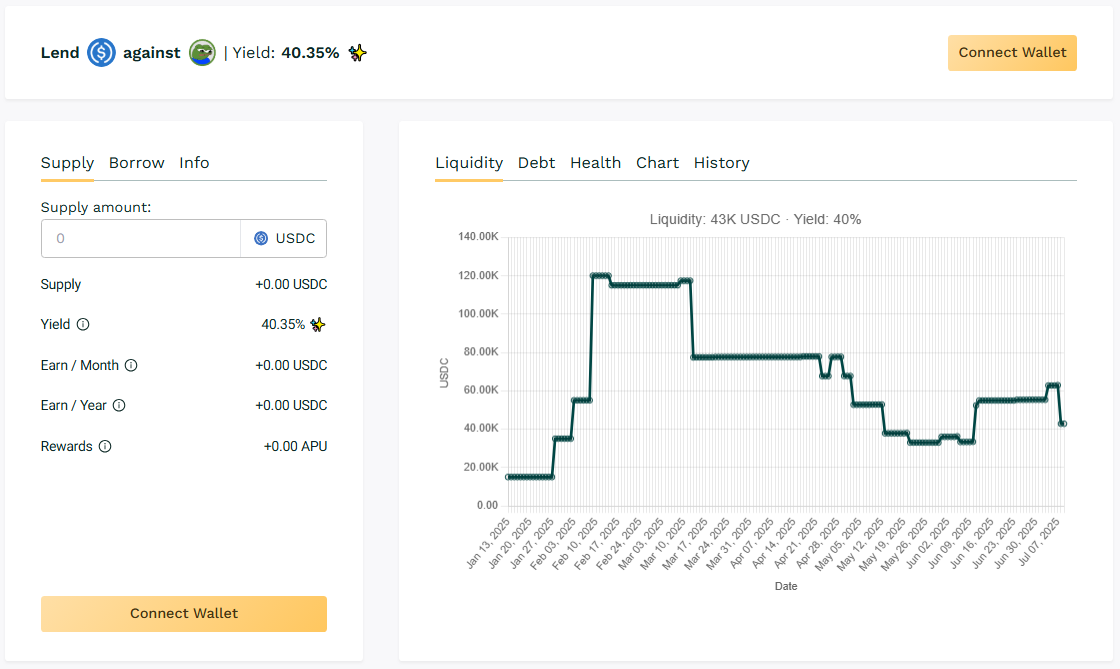

🥉 USDC / APU

🧮 APY: 40.35%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Meme-backed loans continue to generate real returns. APU sits comfortably above 35% APY as borrowers rotate through the pool in moderate volume. Pool health remains stable with recurring repayment cycles.

➡️ Still earning above 35% APY with a loyal borrower base.

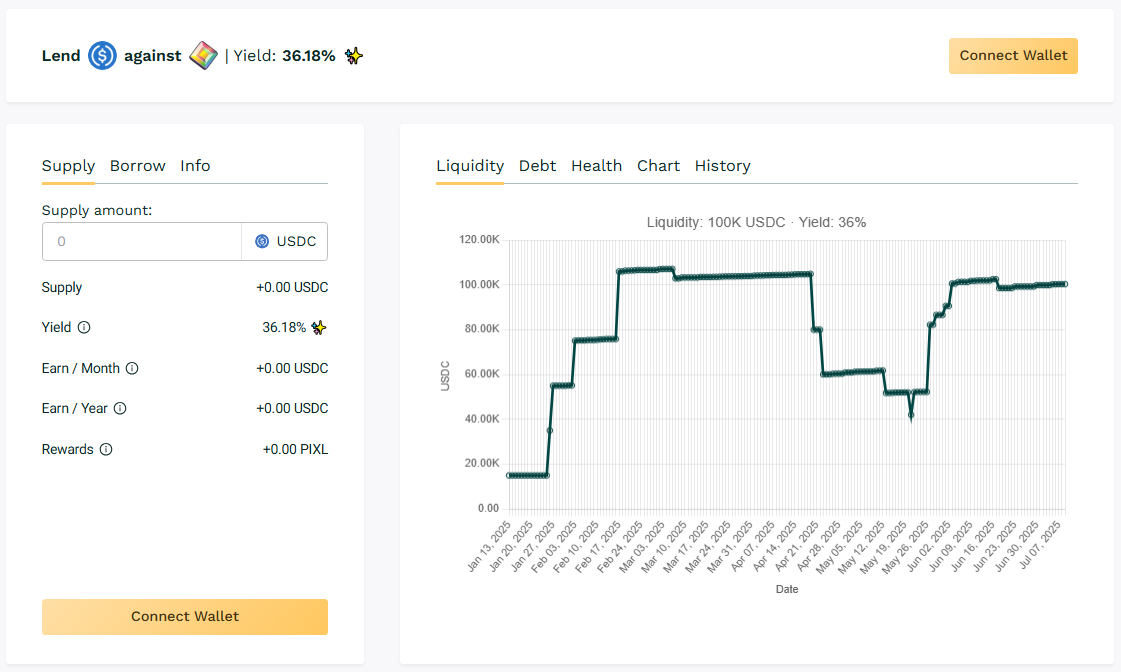

🏅 USDC / PIXL

🧮 APY: 36.18%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

This 7-day pool remains a favorite for fast-cycle borrowing. Lenders benefit from quick interest turnarounds while PIXL-backed loans maintain demand from active participants in gaming ecosystems.

➡️ Strong returns in a short-duration (7d) pool.

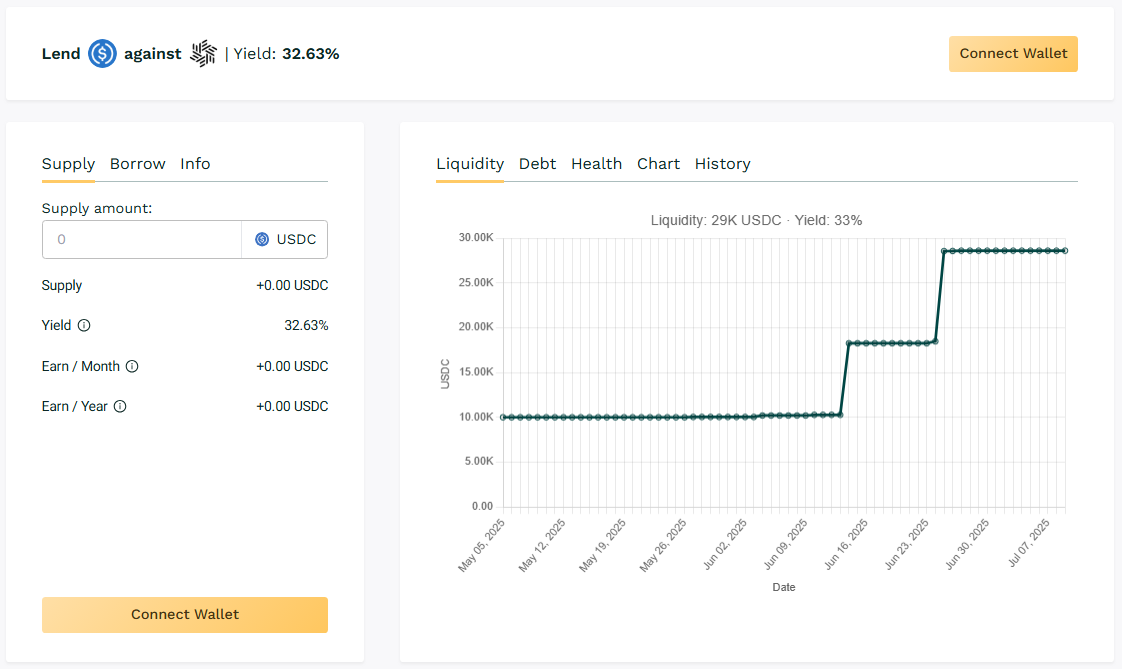

🧊 USDC / CLEAR

🧮 APY: 32.63%

📉 Collateral: CLEAR (Infra)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

A lower-liquidity pool that still delivers 30% APY. CLEAR borrowing activity picked up this week, increasing utilization and pushing APR higher despite the pool’s small size.

➡️ Quietly climbing. Solid return from a low-TVL pool.

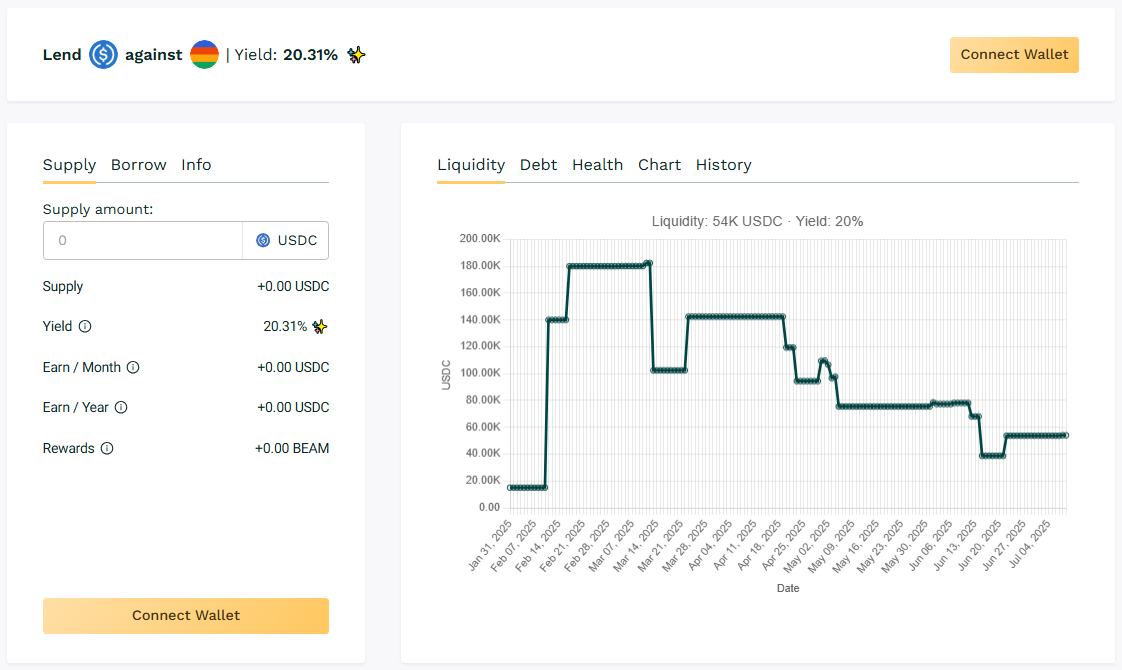

✳️ USDC / BEAM

🧮 APY: 20.31%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

BEAM lending holds steady as new borrowers tap into 30-day loans. With mid-tier TVL and solid usage, the pool offers consistent returns for lenders looking beyond meme or micro-cap markets.

➡️ Yield momentum continues as BEAM borrowing remains active.

🔍 Yield Watchlist

Pools like ASF (9.35% APY) and PROMPT (4.93% APY) sit below the protocol average. Volume pickup could move these back into higher-yield territory.

🧊 Blue-Chip Pools

USDC / WBTC: 9.60% APY | $105.0K TVL

USDC / WETH: 10.91% APY | $30.0K TVL

Note: These pools offer exposure to BTC and ETH-backed loans with moderate APY, typically favored by lenders seeking familiar collateral.

🧩 Snapshot Insights

Niche collateral pools are delivering APYs in the 30–50% range, standing out from the protocol average (~12%).

Mid-cap collateral like CLEAR and BEAM yield over 30%, while well-known assets (WETH/WBTC) yield ~10%.

Borrowing demand across top pools remains strong, driving yields higher.

🗓 Next Update

Will return with a fresh snapshot, featuring updated APYs, TVL changes, and pool rankings. Track yields in real time → app.teller.org/lend