Teller Yields, Weekly Digest 07/03

Date: July 03, 2025

Source: Teller on DeFiLlama

Tracking the top earning opportunities across Teller’s lending markets.

🔝 Top Performing Pools This Week

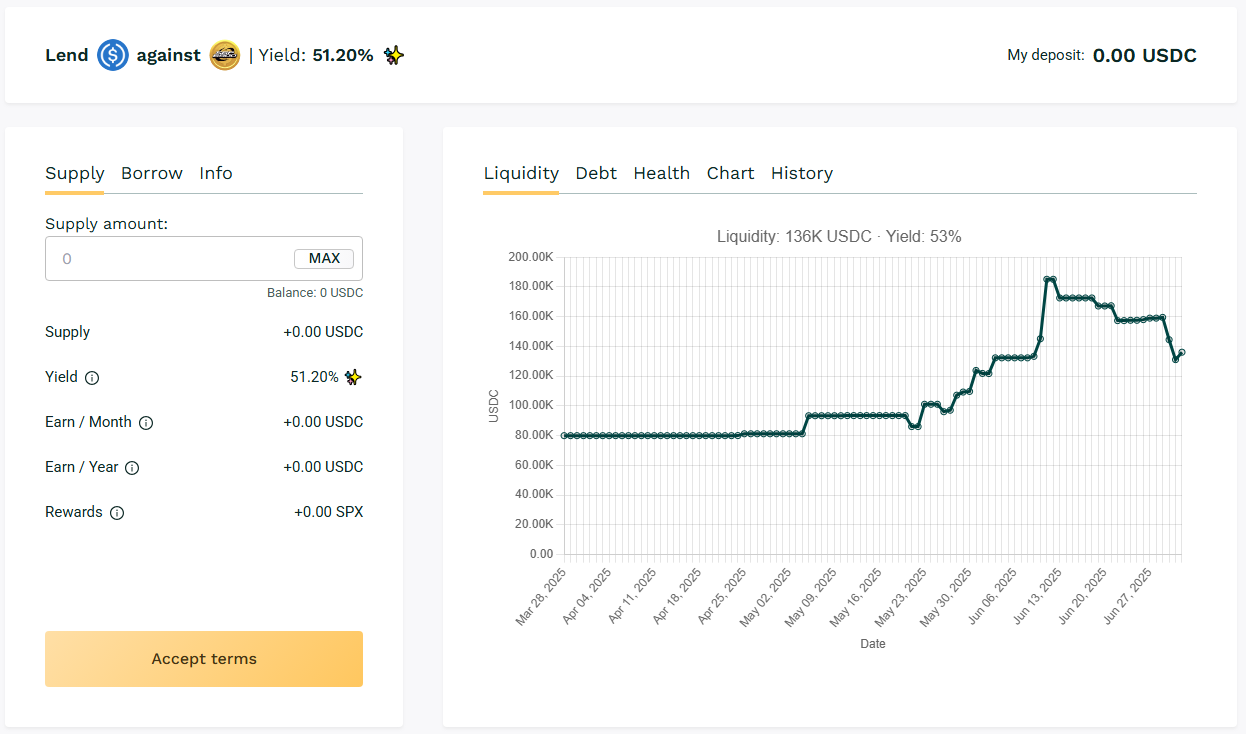

🥇 USDC / SPX

🧮 APY: ~51.20%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

SPX maintains a healthy showing with just over 51.20% APY, boosted by the recent uptick in loan originations. Utilization is hovering at 50%, giving room for new lenders to capture yield while staying below max risk thresholds.

📈 Ideal for moderate-risk, high-yield seekers.

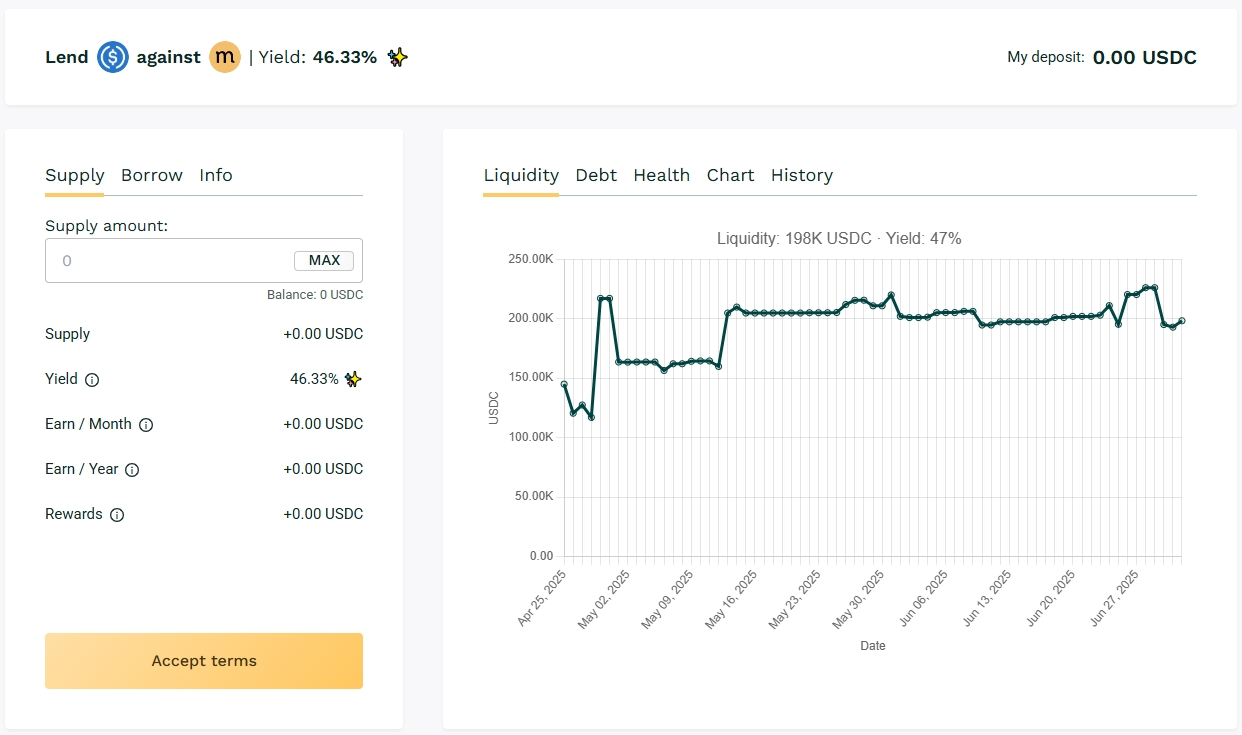

🥈 USDC / MASA

🧮 APY: ~46.33%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

The MASA pool is again the top earner on Teller, delivering a juicy ~46.33% APY. Borrower demand remains strong due to Masa’s ongoing ecosystem growth. The high utilization rate means lenders are close to earning the pool’s maximum APR, which pushes this yield to the top.

📌 Yield boosted by tight supply and consistent borrowing.

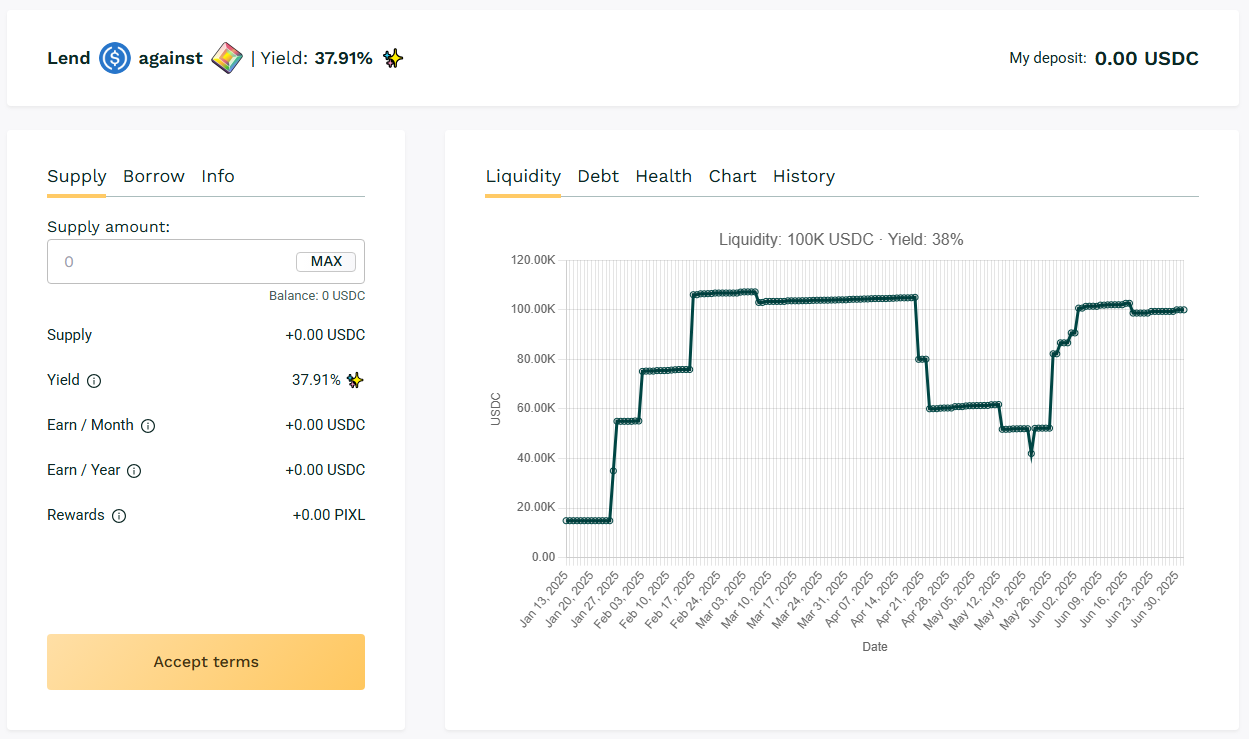

🥉 USDC / PIXL

🧮 APY: ~37.91%

📉 Collateral: PIXL (GameFi)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Backed by the gaming ecosystem of Pixels, this pool continues to deliver ~40% APY for lenders. Borrowers appear to be leveraging PIXL for short-term funding needs, maintaining steady debt pressure on the pool.

🎮 A play-to-earn gem with real lending demand.

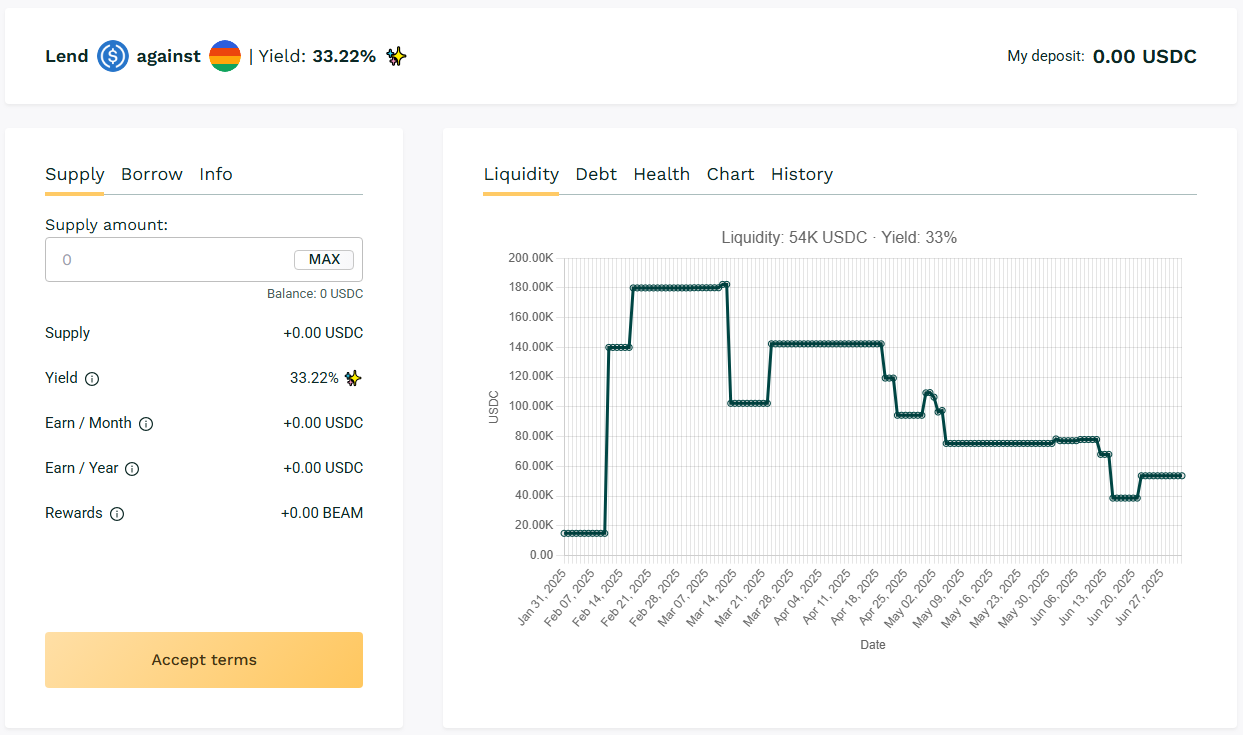

🏅 USDC / BEAM

🧮 APY: ~33.22%

📉 Collateral: BEAM (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

BEAM offers a more measured return for DeFi users aiming for ~20%+ APY without aping into smaller-caps. Steady borrow demand has helped push yields above the average while keeping risk in check.

🌐 Strong for consistent, mid-yield positioning.

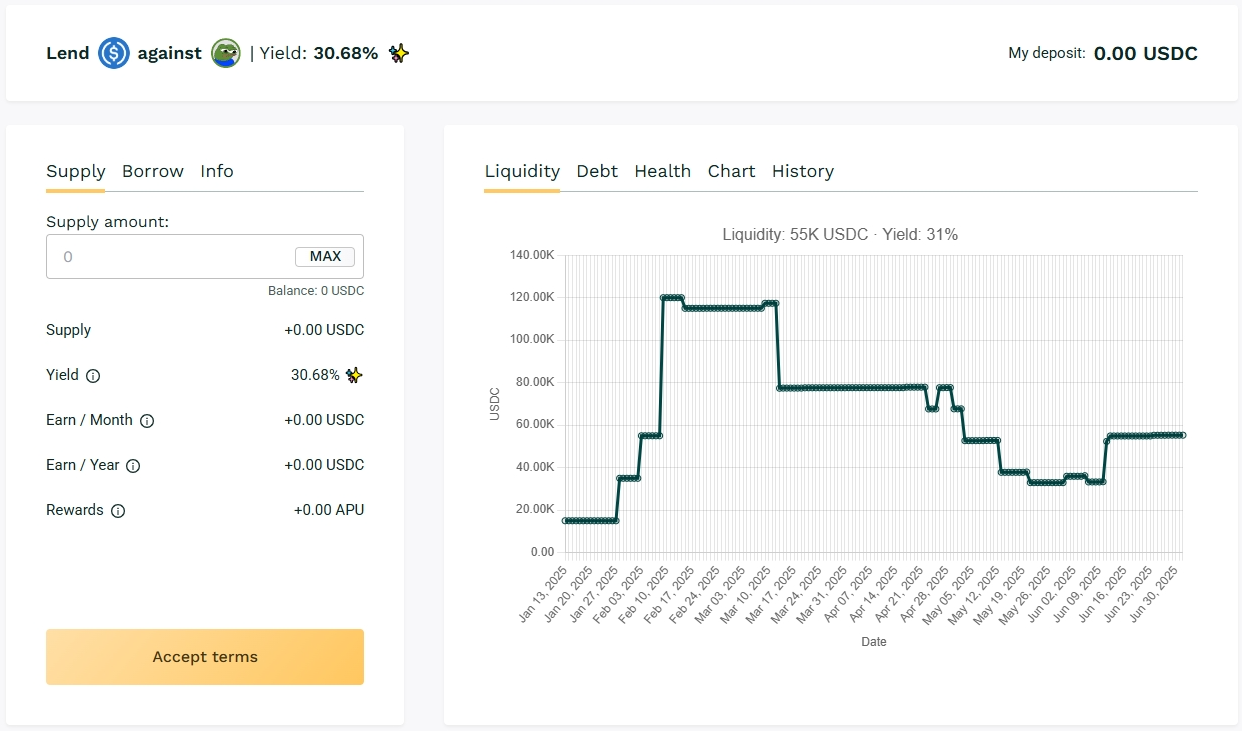

✳️ USDC / APU

🧮 APY: ~30.68%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

This meme-adjacent pool continues to attract risk-tolerant borrowers and adventurous lenders. At ~30.68% APY, it's one of the top mid-cap opportunities.

🔥 High yield, high vibes—with volatility to match.

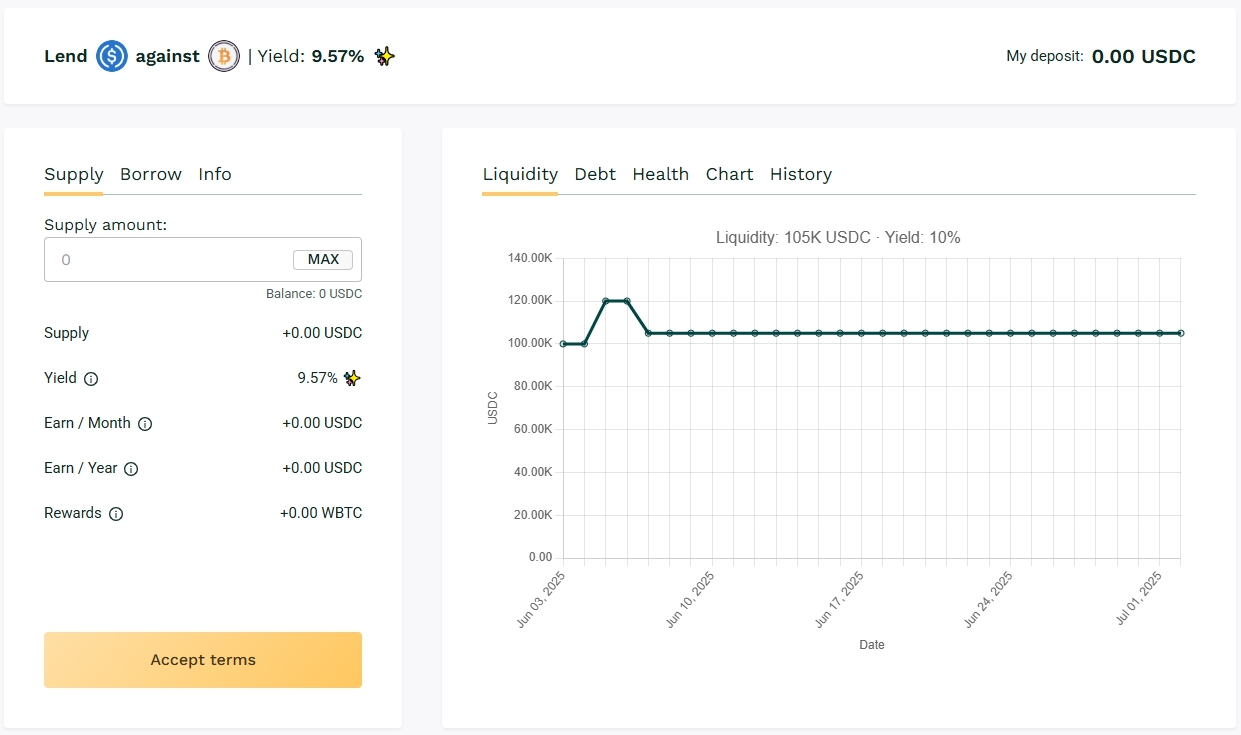

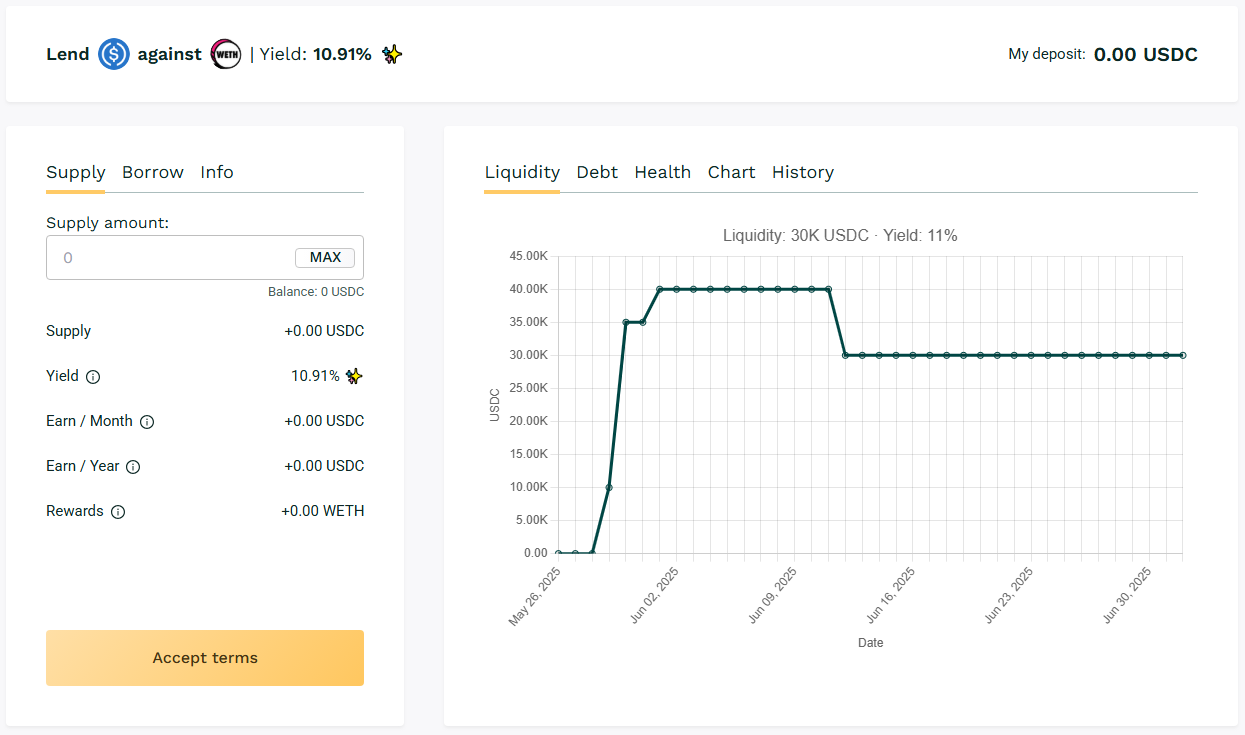

🧊 USDC / WETH & WBTC

→ APY: ~9.57–10.91%

→ Collateral: ETH & BTC

These pools offer the lowest risk exposure with reasonable yields. While APY is below 12%, they’re backed by the most established crypto assets, making them great for more conservative strategies.

🛡️ For lenders seeking steady, blue-chip exposure.

📉 Yield Watchlist: Underperformers

Pools like USDC / PROMPT, USDC / PRIME, and USDC / ASF have yields <10% that shows lower borrower utilization.

These are best watched for future spikes in borrow activity before entering.

🧭 Strategy Tips of the Week

Follow utilization: Higher utilization → higher yield.

Short durations = faster compounding: Most loans on Teller are 7–14 days. Reinvesting quickly boosts real APY.

Check pool health before lending: Use the "Health" tab in each pool for borrow concentration and repayment trends.

📅 Next Update

We’ll be back with fresh rankings, usage stats, and updated APYs.

Until then, happy lending. Stay yield-aware. 🧠💸

👉 Teller App: View Pools