Teller Yields, Weekly Digest 02/19

This week’s pool data shows dynamic APY shifts as rollover activity and borrowing trends moved across multiple pools.

Below is a breakdown of current pool activity and yields.

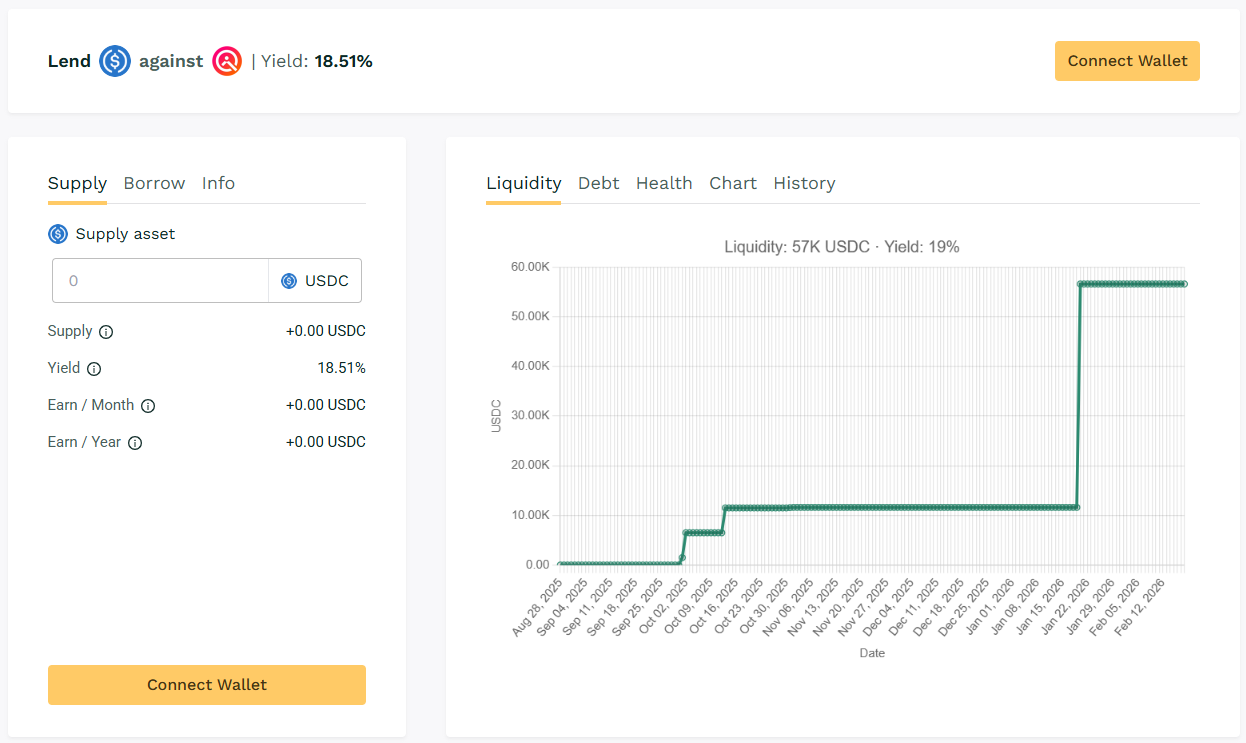

🥇USDC / $wQUIL

🧮 APY: 18.51%

📉 Collateral: wQUIL (Wrapped QUIL)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$wQUIL lending volume jumps towards 1st rank with APY reaching 18% range this week.

📌 $wQUIL's lending in the lower-yield tier on Teller made its way to the top rank on this week's ranking.

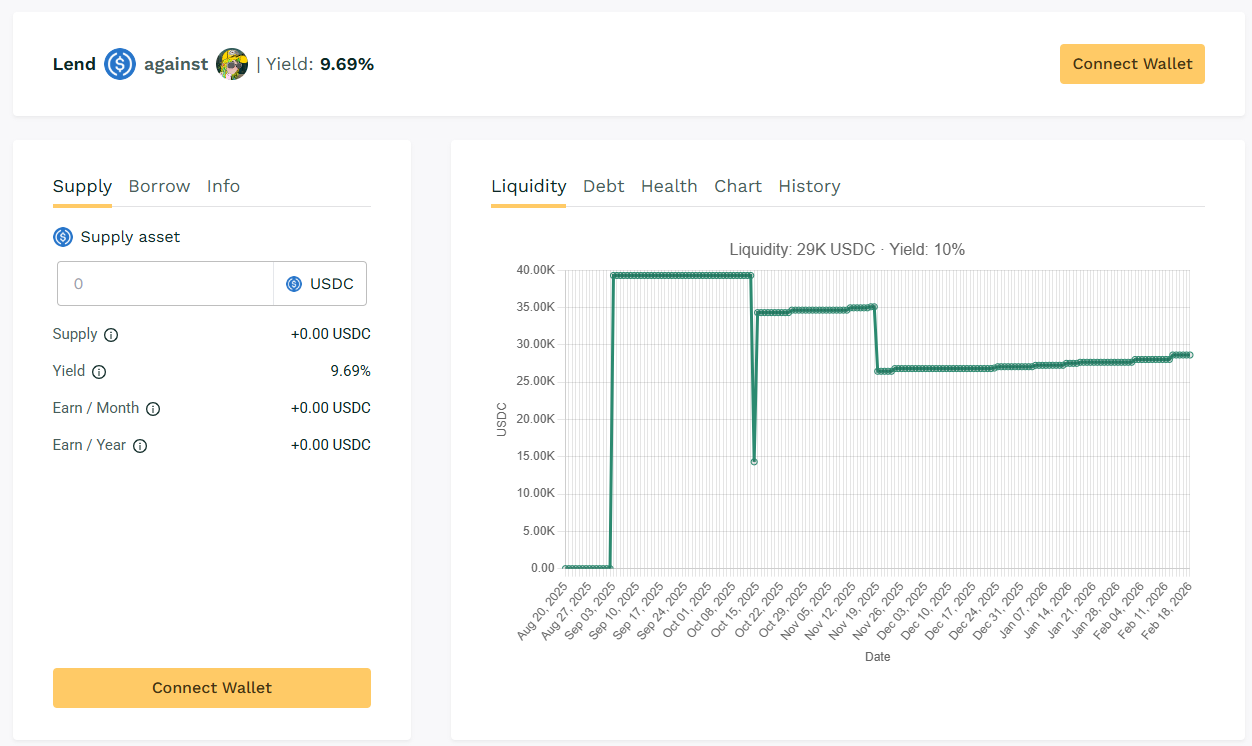

🥈 USDC / $DMT

🧮 APY: 9.69%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Borrowers actively using DMT collateral within this pool. APY remains consistent as loans continue rolling over.

📌 Pool at over 9% APY taking one of the lead positions this week.

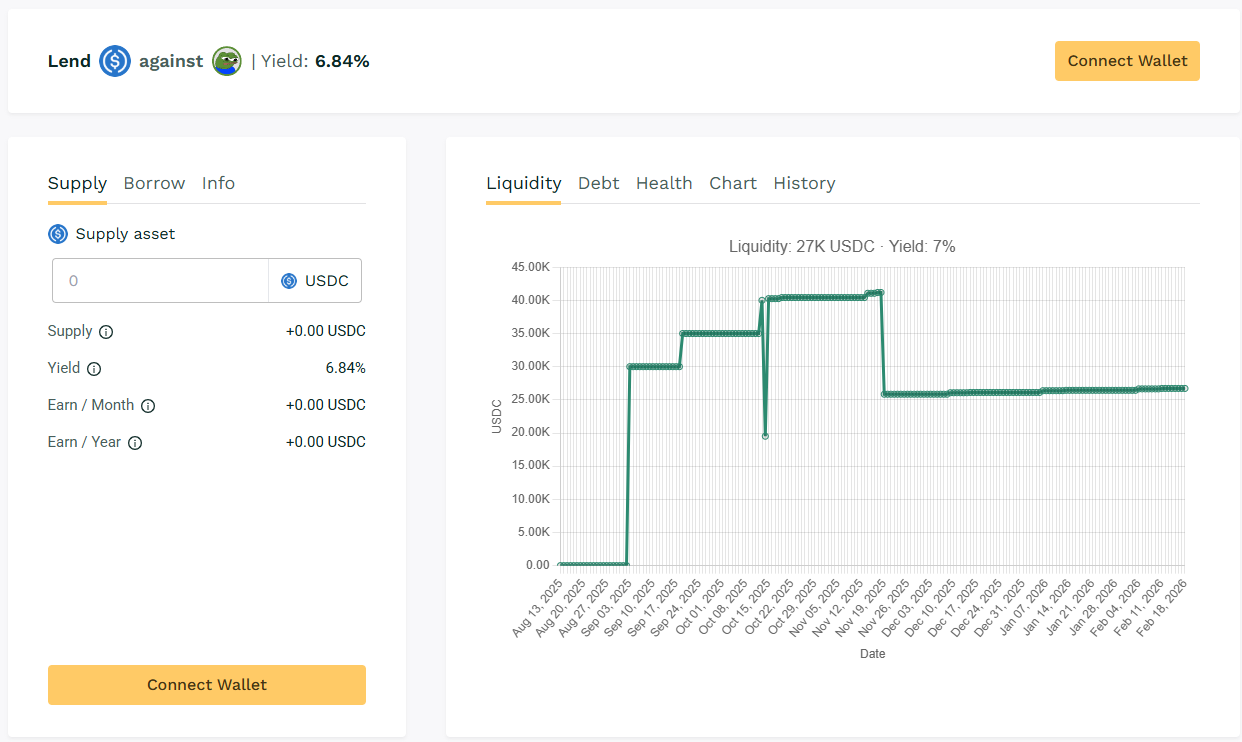

🥉 USDC / $APU

🧮 APY: 6.84%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU collateralized pool accounted for over 27K in liquidity. Borrower engagement sustained yields almost at 7% range.

📌 $APU pools raised over 27K liquidity with near 12% range yields.

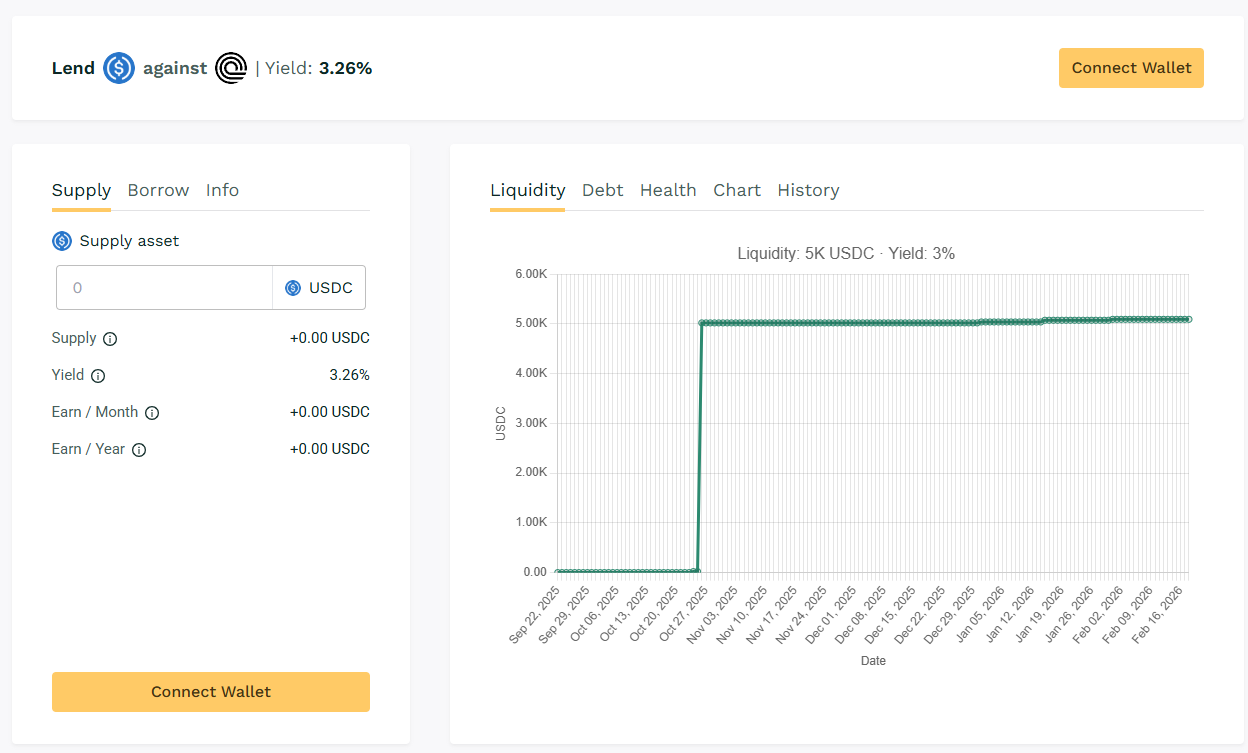

🏅 USDC / $ONDO

🧮 APY: 3.26%

📉 Collateral: ONDO (DeFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 350%

Even with limited borrower use, utilization and yield in this token pool produced returns for above 3% APY.

📌 $ONDO held 3% APY despite smaller liquidity.

📈 Yield Takeaway:

APYs across active pools continue to reflect organic borrower behavior, with rollover-driven earnings shaping yield distribution week to week. Borrowers can also find free USDC liquidity for WBTC, AAVE. SHIB, APE and other pools.

📢 Next Week

Tracking continues next week as pool dynamics shift with new borrower demand.

View live data here 👉 https://app.teller.org/ethereum/lend