Teller Yields, Weekly Digest 02/12

Date: February 12, 2026

Source: Teller on DeFiLlama

Lending yields continued to vary significantly this week. Below is a breakdown of current pool activity and yields.

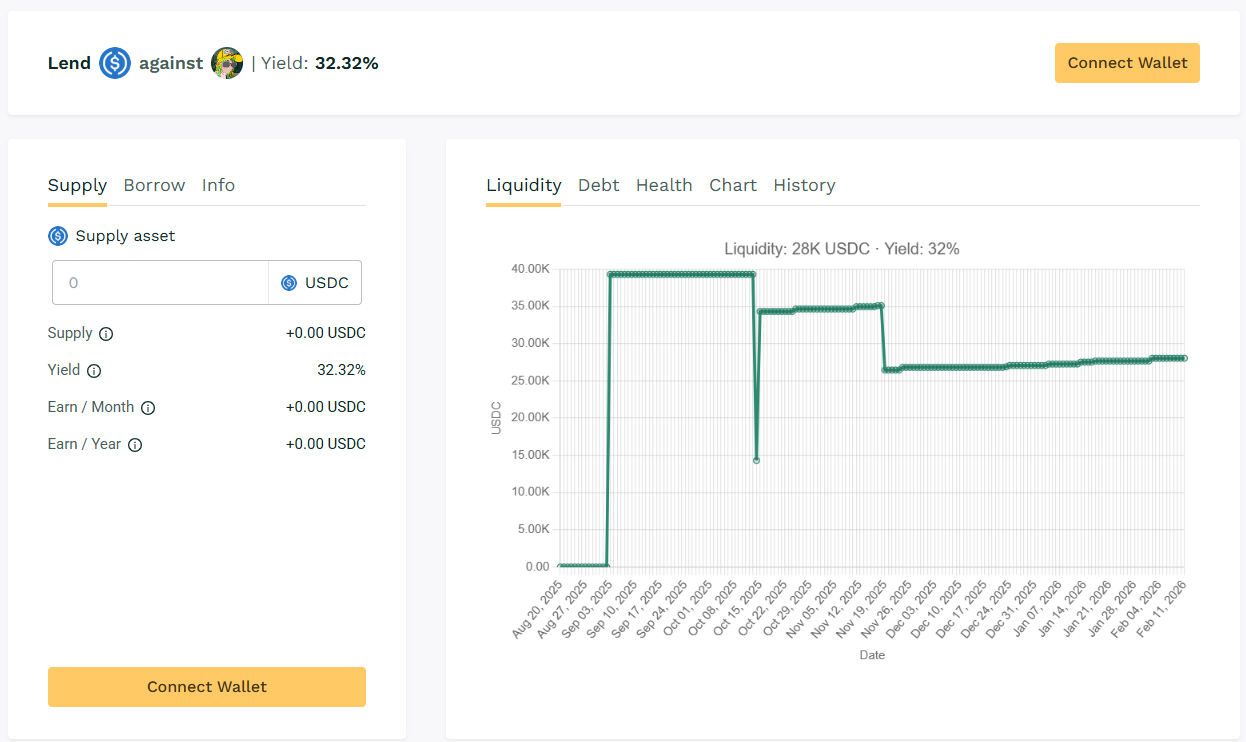

🥇 USDC / $DMT

🧮 APY: 32.32%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Still at the 1st rank, borrowers using DMT collateral maintain demand within this pool.

📌 Borrower rollovers keeping yield above 45%.

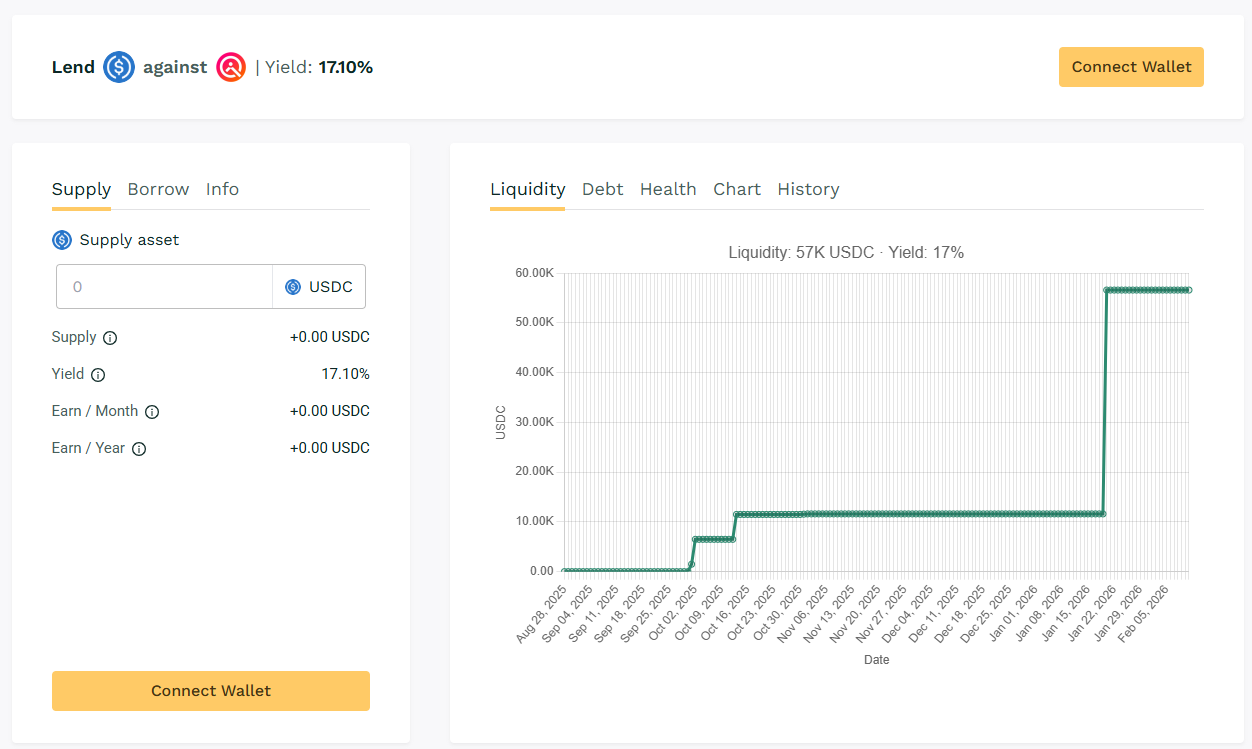

🥈 USDC / $wQUIL

🧮 APY: 17.10%

📉 Collateral: wQUIL (Wrapped QUIL)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$wQUIL lending volume stays at top 2 rank with APY reaching 17% range this week.

📌 $wQUIL's lending pool kept it's rank this week at top 2.

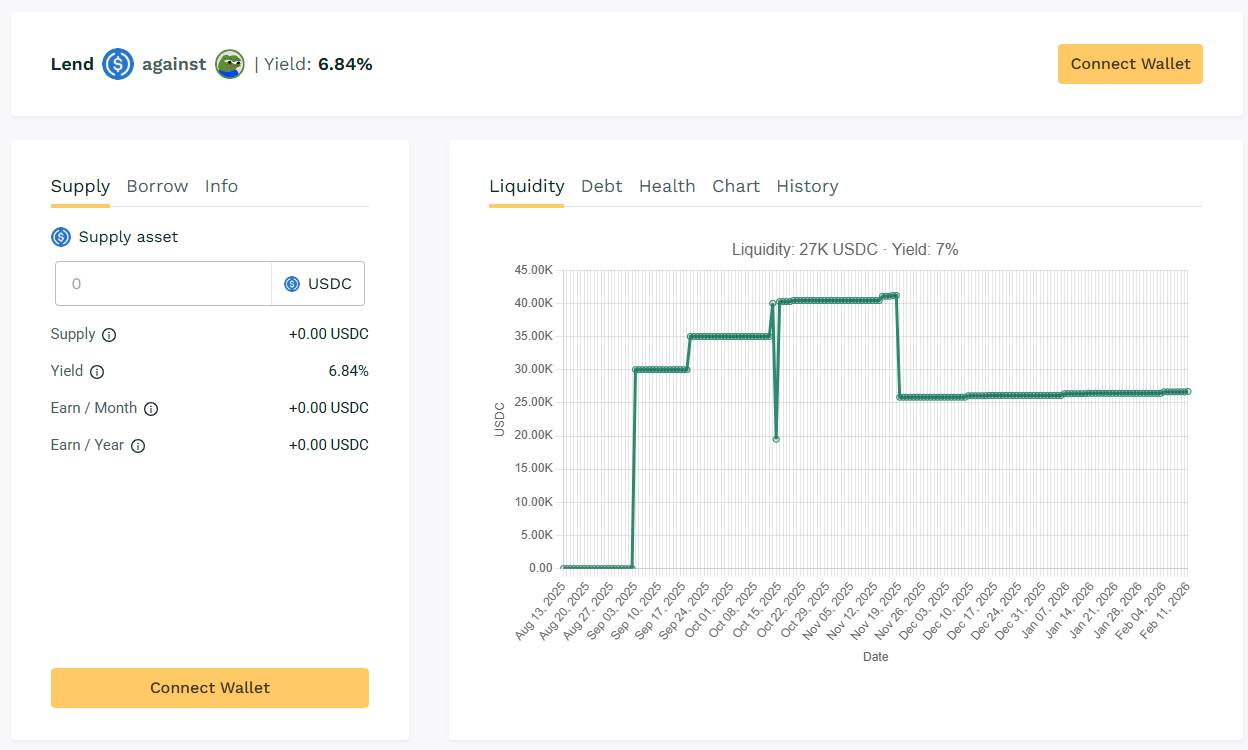

🥉 USDC / $APU

🧮 APY: 6.84%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU collateralized pool accounted for over 27K in liquidity. Borrower engagement sustained yields at almost 7% range.

📌 $APU pool raised over 27K liquidity with near 7% range yields.

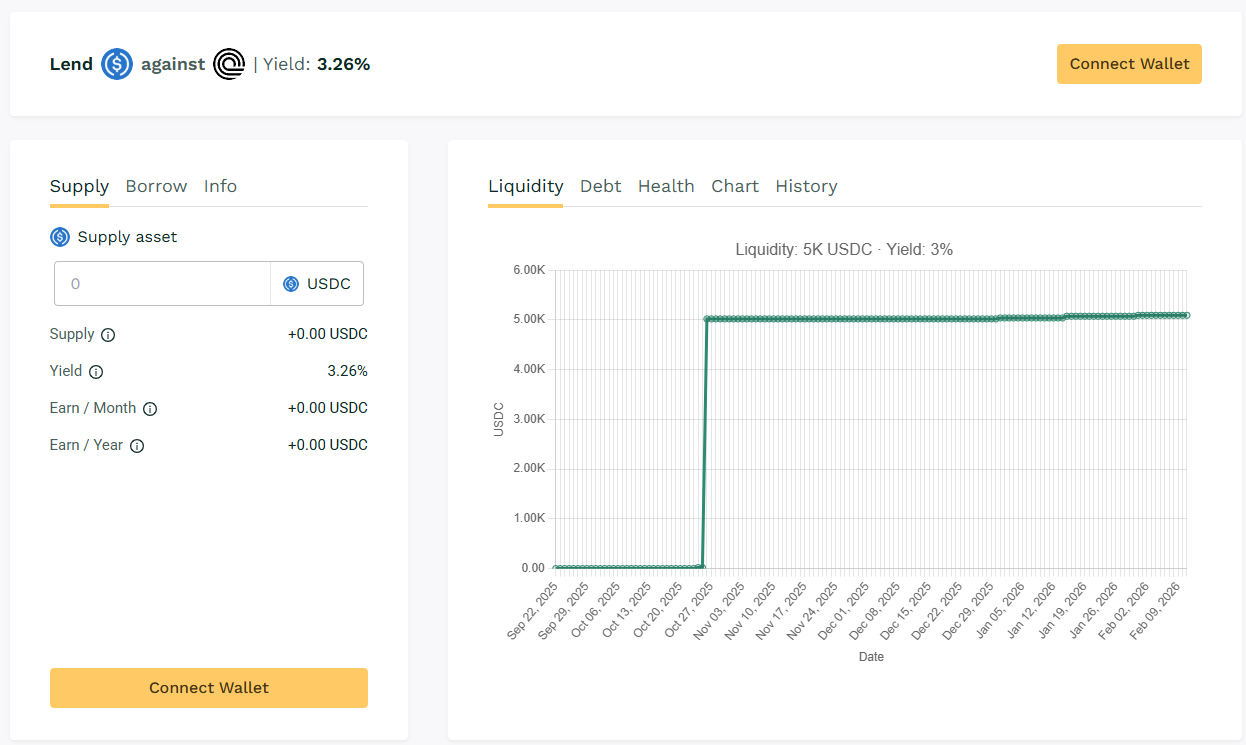

🏅 USDC / $ONDO

🧮 APY: 3.26%

📉 Collateral: ONDO (DeFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 350%

Even with limited borrower use, utilization and yield in this token pool produced returns for above 3% APY.

📌 $ONDO held 3.26% APY despite smaller liquidity.

💰 Spotlight Pools

- USDC / $CORP-AMC: 7.97%

- USDC / $CORP-ORACLE: 3.94%

- USDC / $CORP-NATL-BANK-CANADA: 3.94%

Teller's newly launched pools offering baseline APYs in the 3-8% range.

🛎️ Next Digest

Next week’s update will track rollover trends and analyze whether utilization shifts toward high-yield pairs continue into November.

Track live data here 👉 https://app.teller.org/ethereum/lend