Teller Yields, Weekly Digest 02/05

Date: February 05, 2026

Source: Teller on DeFiLlama

This week’s yields reflected moderate borrower rotation, with utilization holding steady across most USDC pairs.

Below is a breakdown of current pool activity and yields.

🏆 Top Lending Pools

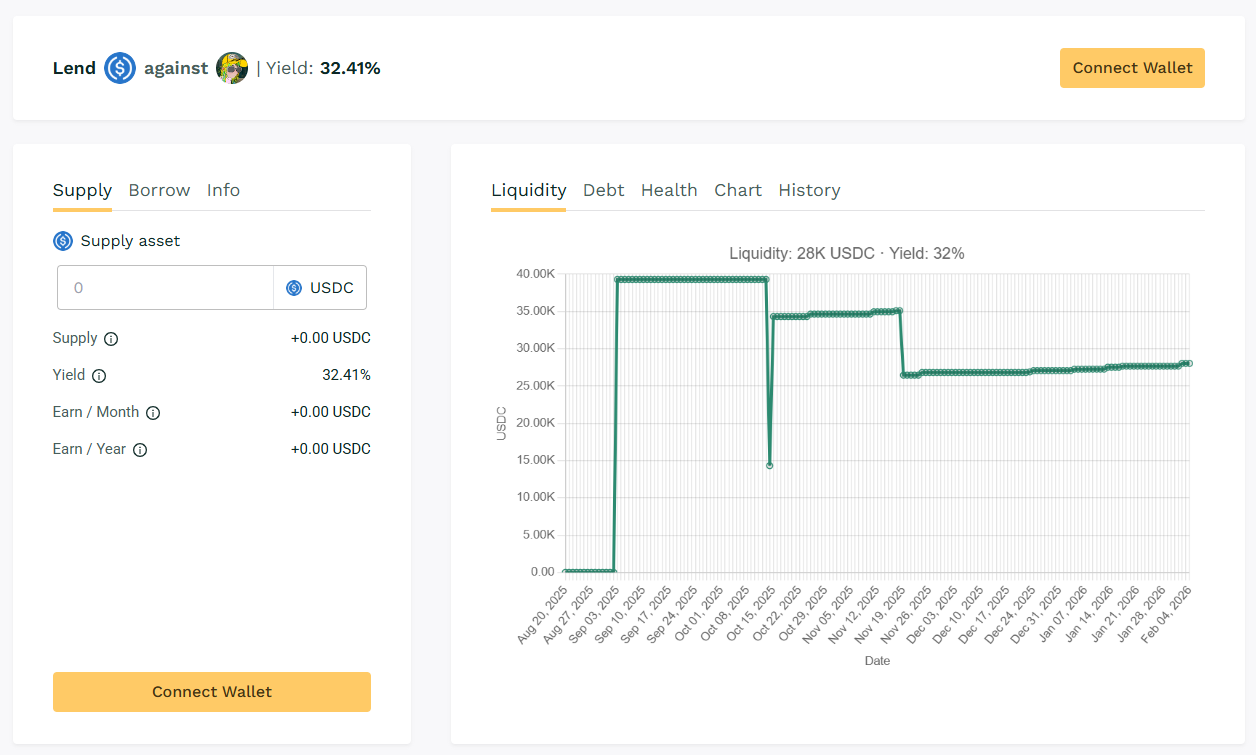

🥇 USDC / $DMT

🧮 APY: 32.41%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Pool at over 32% APY taking one of the lead position this week.

🎯 Borrower rollovers keeping yield above 32%.

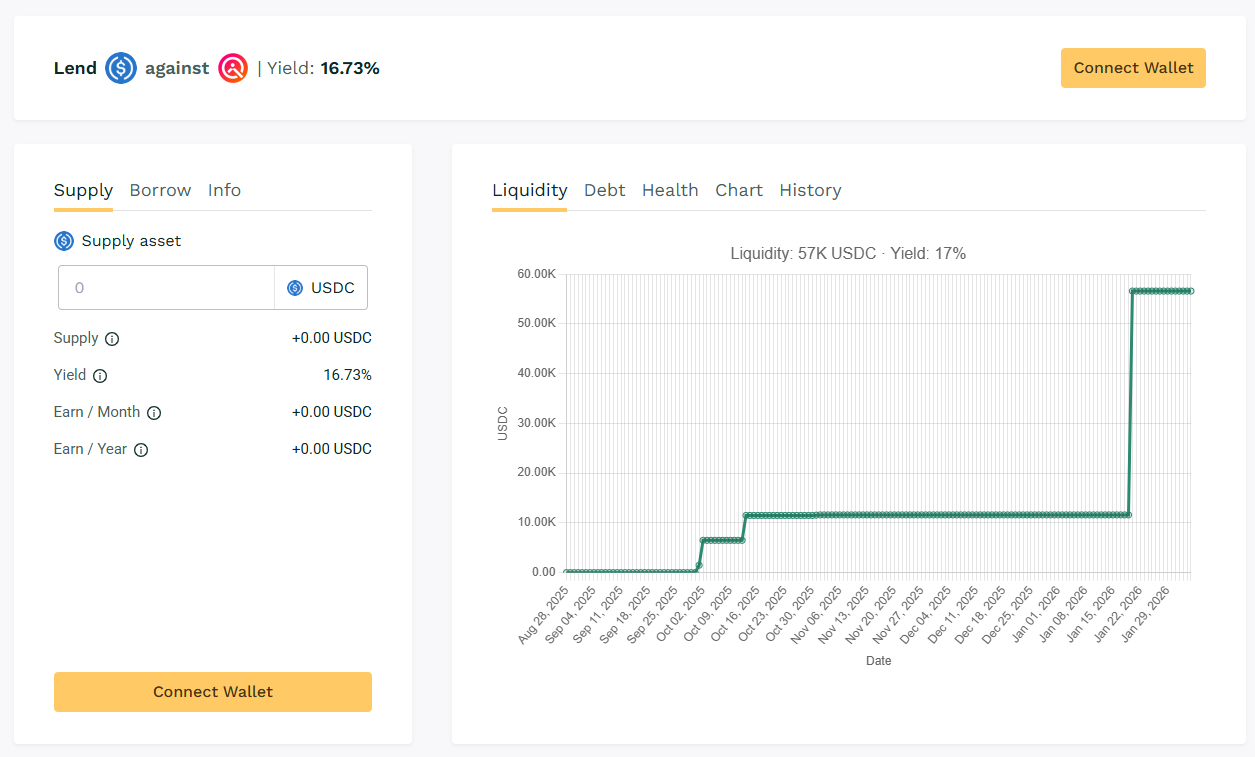

🥈 USDC / $wQUIL

🧮 APY: 16.73%

📉 Collateral: wQUIL (Wrapped QUIL)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$wQUIL lending volume jumps to the top 2 rank with APY reaching 16% range this week.

🎯 $wQUIL's lending pool made its way to this week's top 2 ranking.

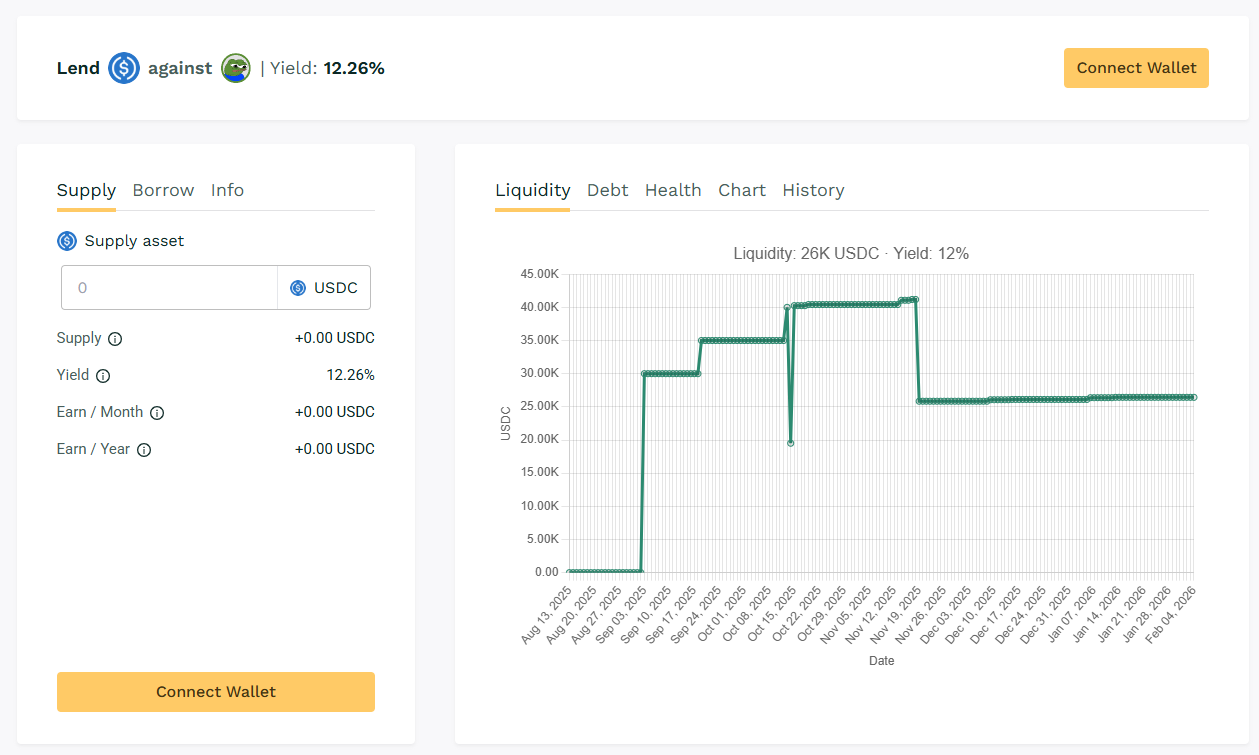

🥉 USDC / $APU

🧮 APY: 12.26%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

One of the top pools on Teller with 26K in liquidity, keeping yield levels above 12% APY.

🎯 APYs are sustained by monthly borrowing volume.

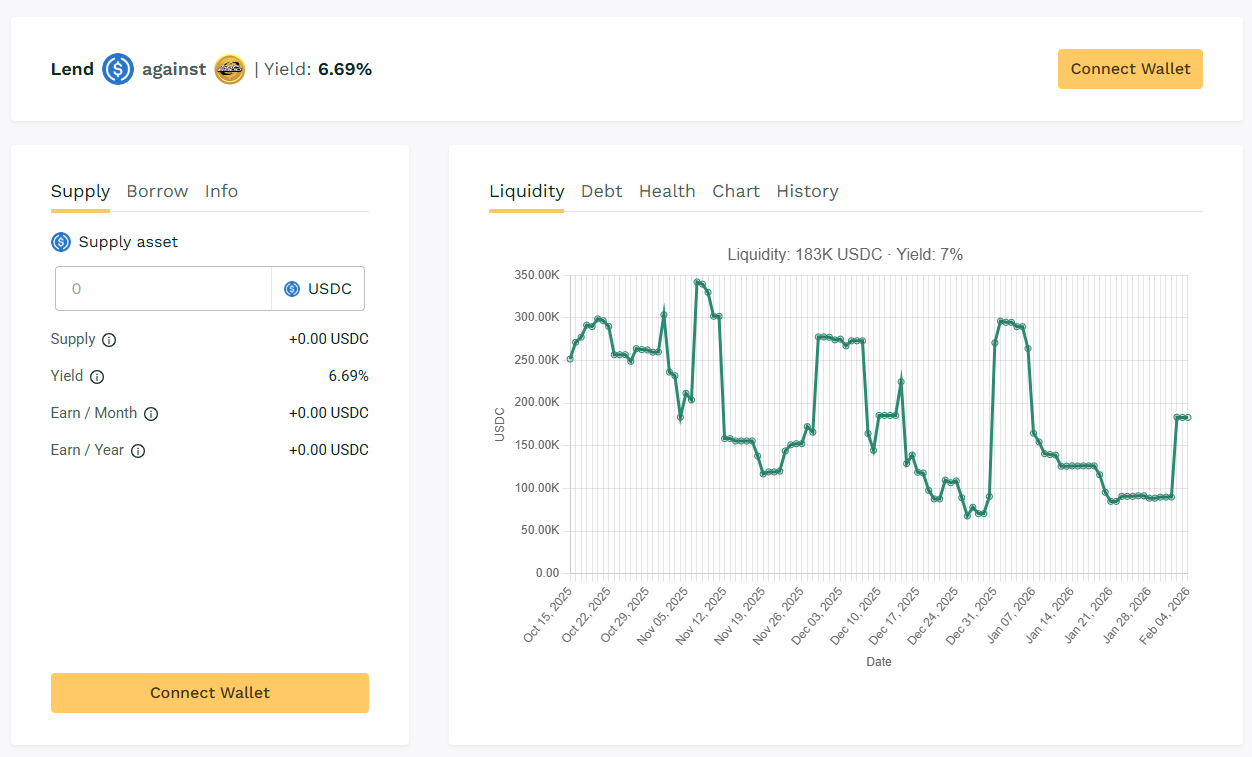

🏅USDC / $SPX

🧮 APY: 6.69%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX pool's borrowing delivered yields close to 7% with 183K liquidity size.

🎯 Borrower rollovers keeping yield above 6%.

💰 Spotlight Pools

- USDC / $CORP-AMC: 7.97%

- USDC / $COPR-ORACLE: 3.94%

- USDC / $COPR-NATL-BANK-CANADA: 3.94%

Teller's newly launched pools offering baseline APYs in the 3-8% range.

📢 Next Week

Stay tuned for next week’s Digest for updated yield movements and borrower trends across Teller markets.

Track live data here 👉 https://app.teller.org/ethereum/lend