Teller Yields, Weekly Digest 01/29

Date: January 29, 2025

Source: Teller on DeFiLlama

This week’s pool data shows dynamic APY shifts as rollover activity and borrowing trends moved across multiple pools.

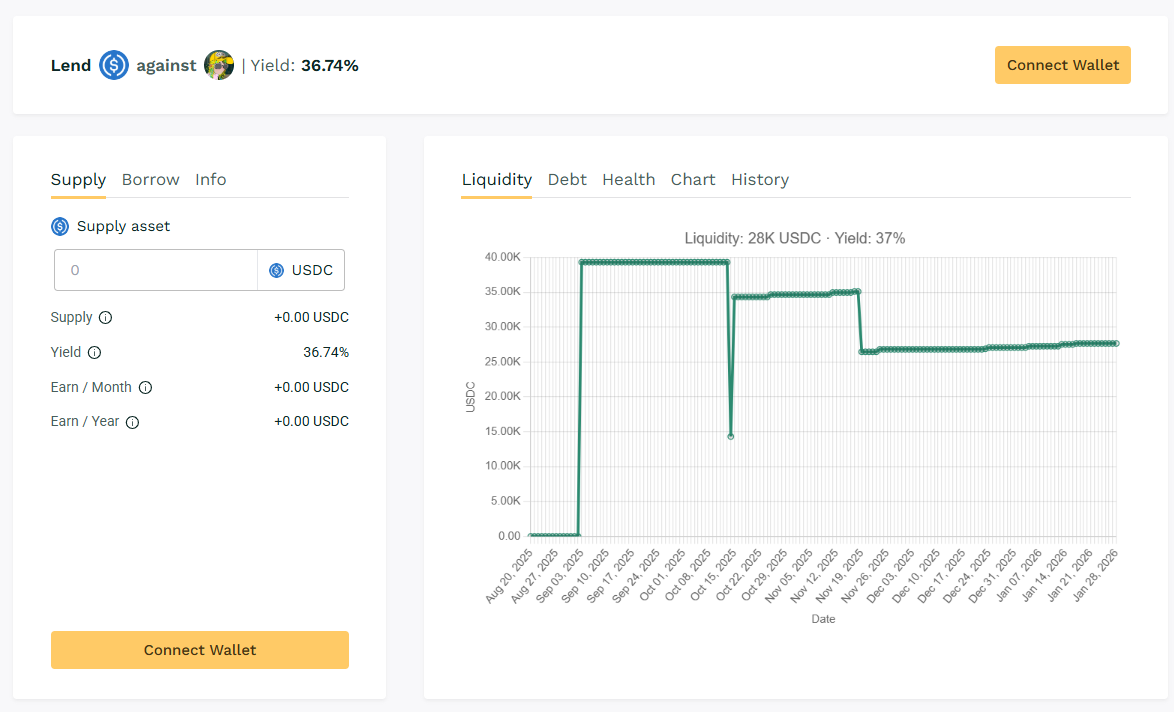

🥇 USDC / $DMT

🧮 APY: 36.74%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper 35% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

➡️ $DMT topped the charts, crossing the 35% APY mark.

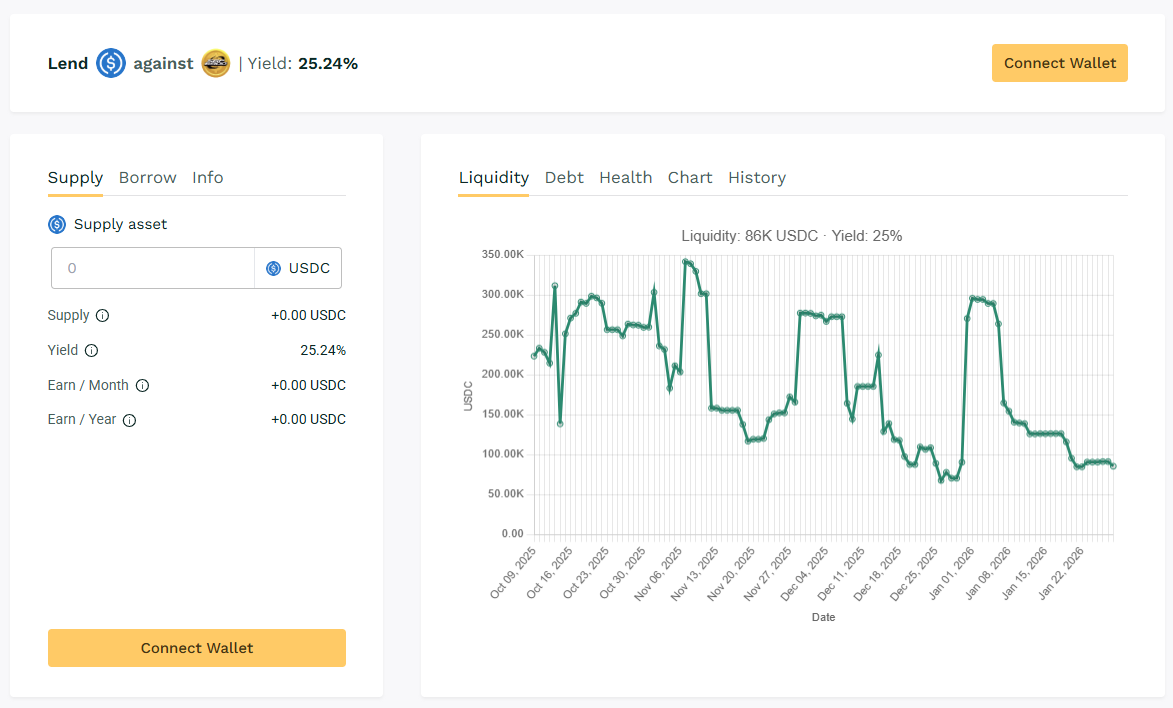

🥈 USDC / $SPX

🧮 APY: 25.24%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX continues as one of the top pools in Teller, maintaining yield levels above 25%.

➡️ $SPX takes the top 2 spot this week with 25%+ returns.

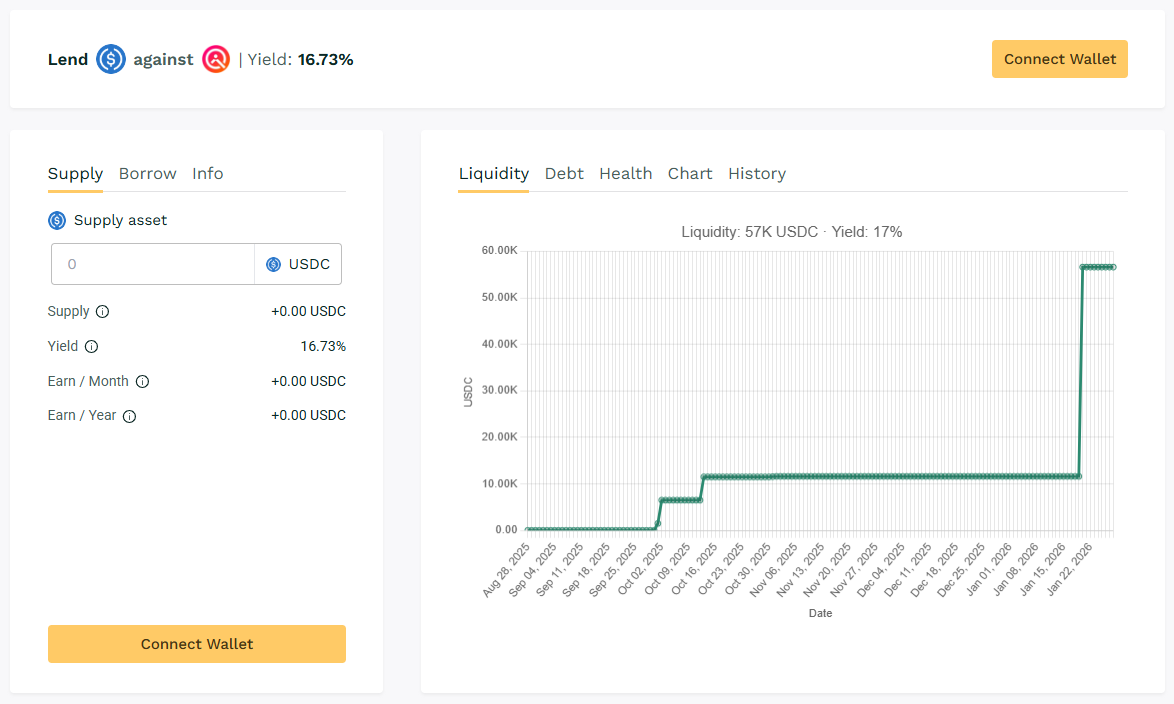

🥉 USDC / $wQUIL

🧮 APY: 16.73%

📉 Collateral: wQUIL (Wrapped QUIL)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$wQUIL lending volume jumps towards top 3 rank with APY reaching 16% range this week.

➡️ $wQUIL's lending went up tier on Teller made its way to this week's ranking.

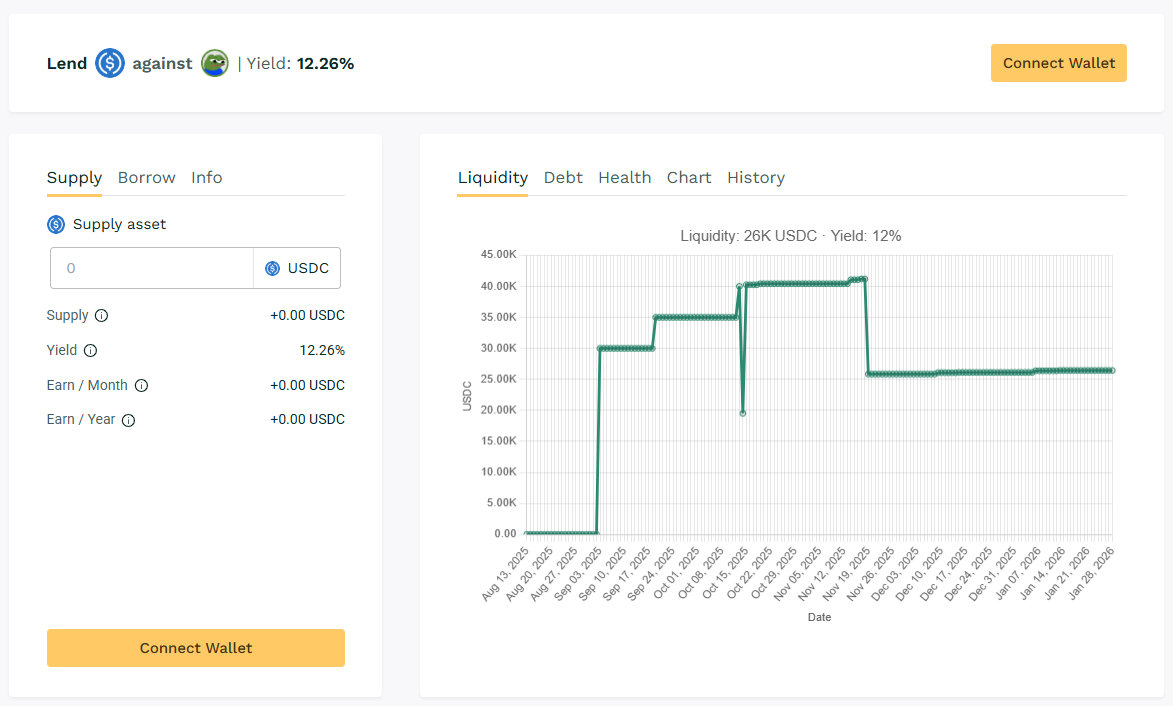

🏅 USDC / $APU

🧮 APY: 12.26%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

Another top pools on Teller with 26K in liquidity, keeping yield levels above 12% APR.

➡️ $APU pools raised over 26K liquidity with near 12% range yields.

💰 Spotlight Pools

- USDC / $CORP-AMC: 7.97%

- USDC / $ONDO: 7.18%

Teller pools offering baseline APYs in the 7-8% range.

📢 Next Digest

Stay tuned for next week’s Teller Digest as loan demand and lending opportunities continue to evolve across pools.

Until then, happy lending. Stay yield-aware.

👉 Live data available at: app.teller.org/lend