Teller Yields, Weekly Digest 01/22

Date: January 22, 2026

Source: Teller on DeFiLlama

Lending yields continued to vary significantly this week. Below is a breakdown of current pool activity and yields.

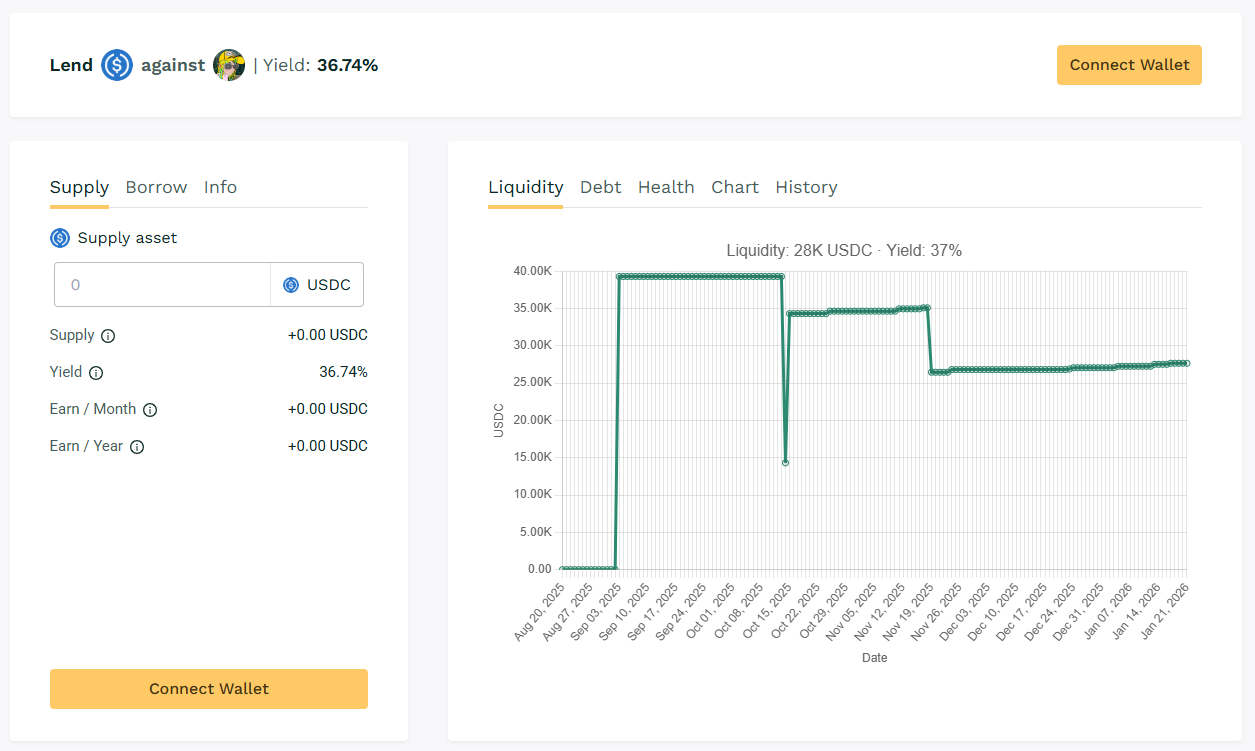

🥇 USDC / $DMT

🧮 APY: 36.74%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Taking the 1st rank, $DMT utilization gained an almost 37% APY range with ongoing engagement from existing borrowers sustaining loan rollover activity.

🎯 Monthly renewals keeping yield above 37%.

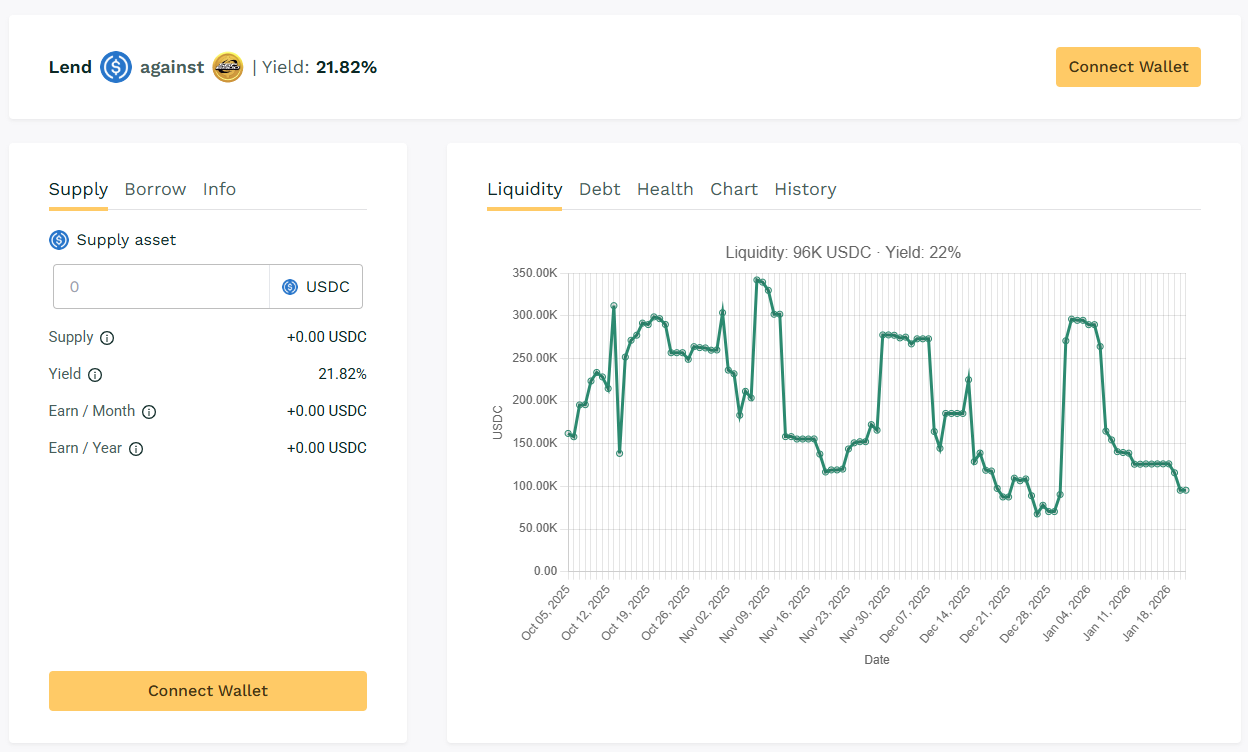

🥈 USDC / $SPX

🧮 APY: 21.82%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

This pool continues to deliver above 21% APY for lenders.

🎯 Liquidity remains among the highest across Teller.

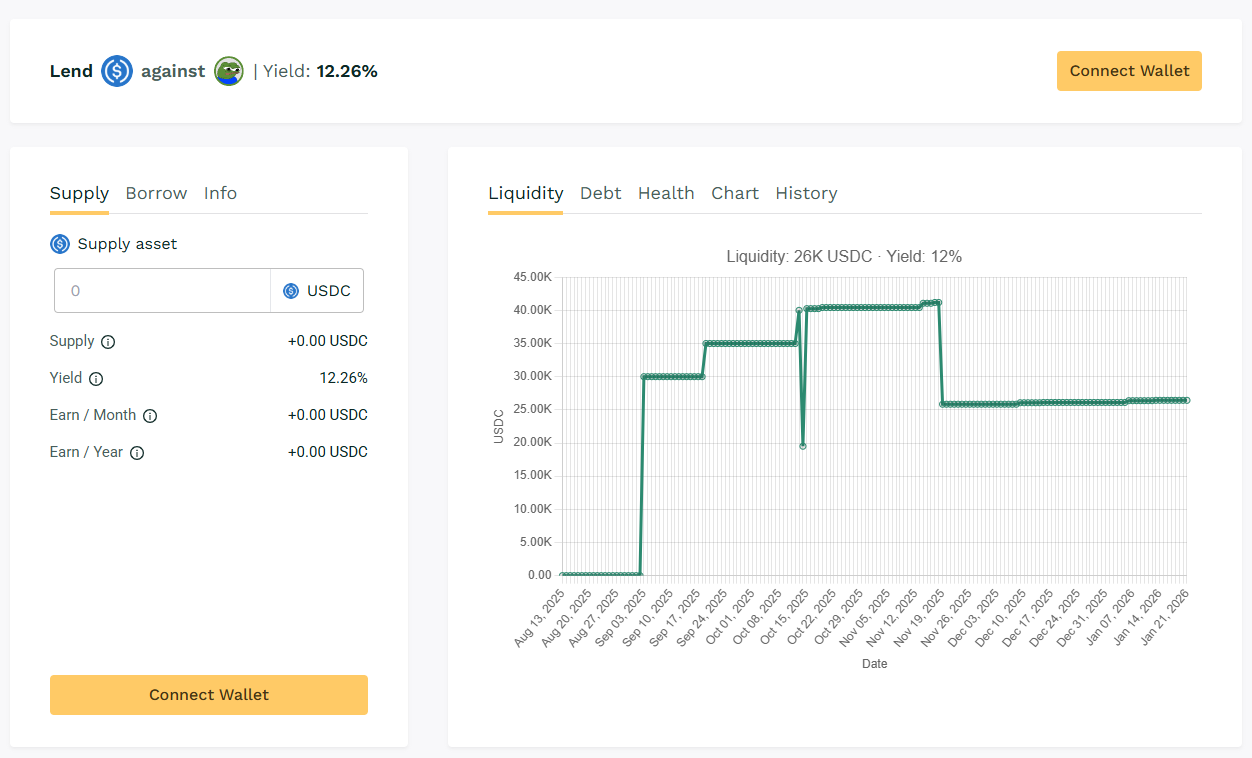

🥉 USDC / $APU

🧮 APY: 12.26%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU collateralized pool accounted for over 26K in liquidity. Borrower engagement sustained yields in the low 12% range.

🎯 APYs are sustained by monthly borrowing volume.

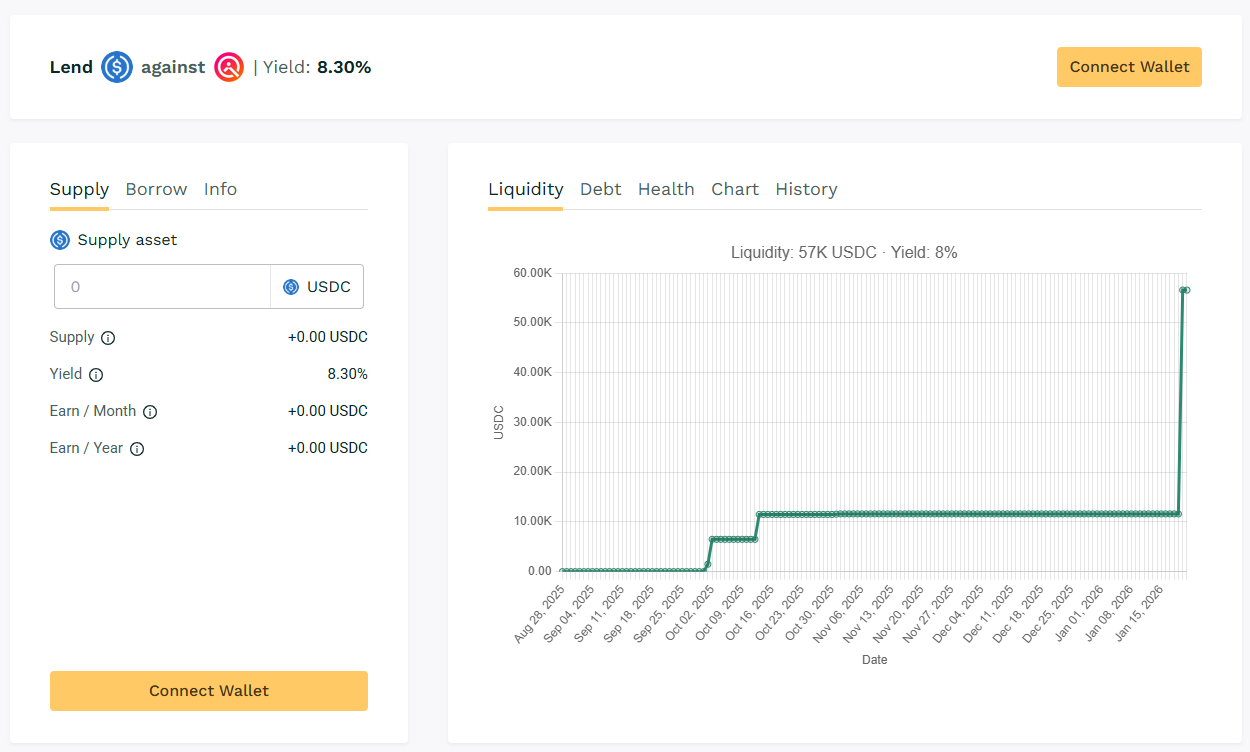

🏅 USDC / $wQUIL

🧮 APY: 8.30%

📉 Collateral: wQUIL (Wrapped QUIL)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$wQUIL lending volume jumps towards top ranks with APY reaching 8% range this week.

🎯 $wQUIL's lending in the lower-yield tier on Teller made its way to this week's ranking.

💰 Spotlight Pools

- USDC / $CORP-AMC: 7.97%

- USDC / $COPR-ORACLE: 3.94%

- USDC / $COPR-NATL-BANK-CANADA: 3.94%

Teller's newly launched pools offering baseline APYs in the 3-8% range.

🛎️ Next Digest

Next week’s update will track rollover trends and analyze whether utilization shifts toward high-yield pairs continue.

Track live data here 👉 https://app.teller.org/ethereum/lend