Teller Yields, Weekly Digest 01/15

Date: January 15, 2026

Source: Teller on DeFiLlama

This week’s pool data shows dynamic APY shifts as rollover activity and borrowing trends moved across multiple pools. The following breakdown captures the latest liquidity, and yields across pools.

🏆 Top Lending Pools

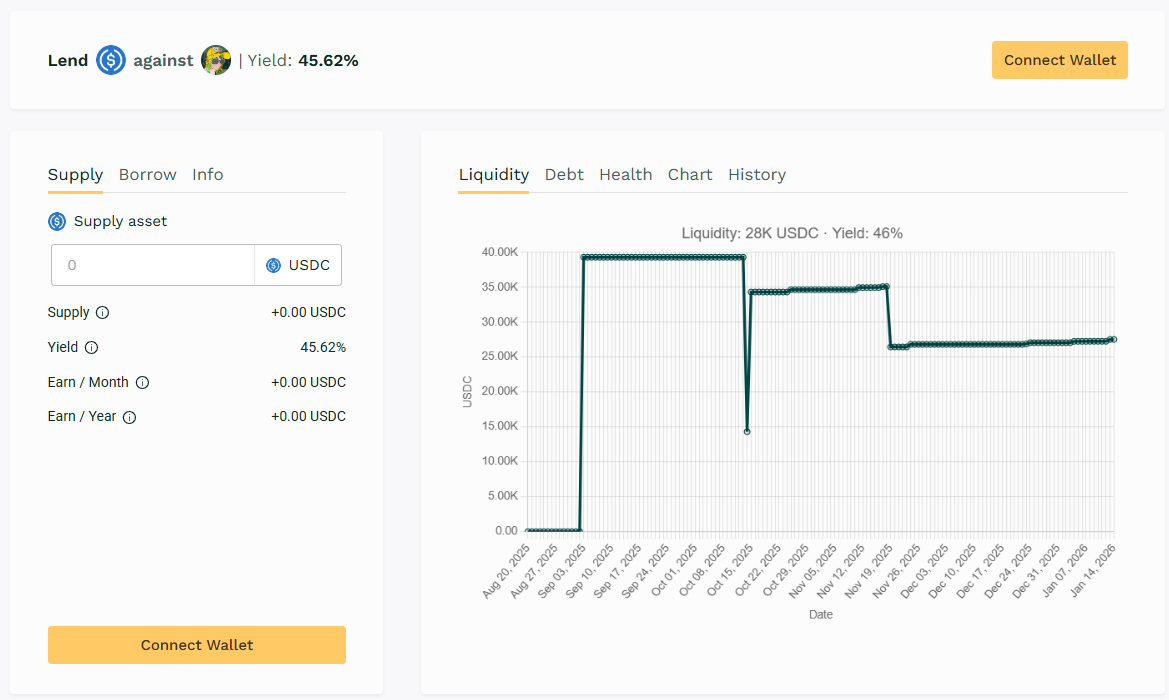

🥇 USDC / $DMT

🧮 APY: 45.62%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained APY at 45% range with ongoing engagement from existing borrowers sustaining loan rollover activity.

📌 Borrower rollovers keeping yield above 45%.

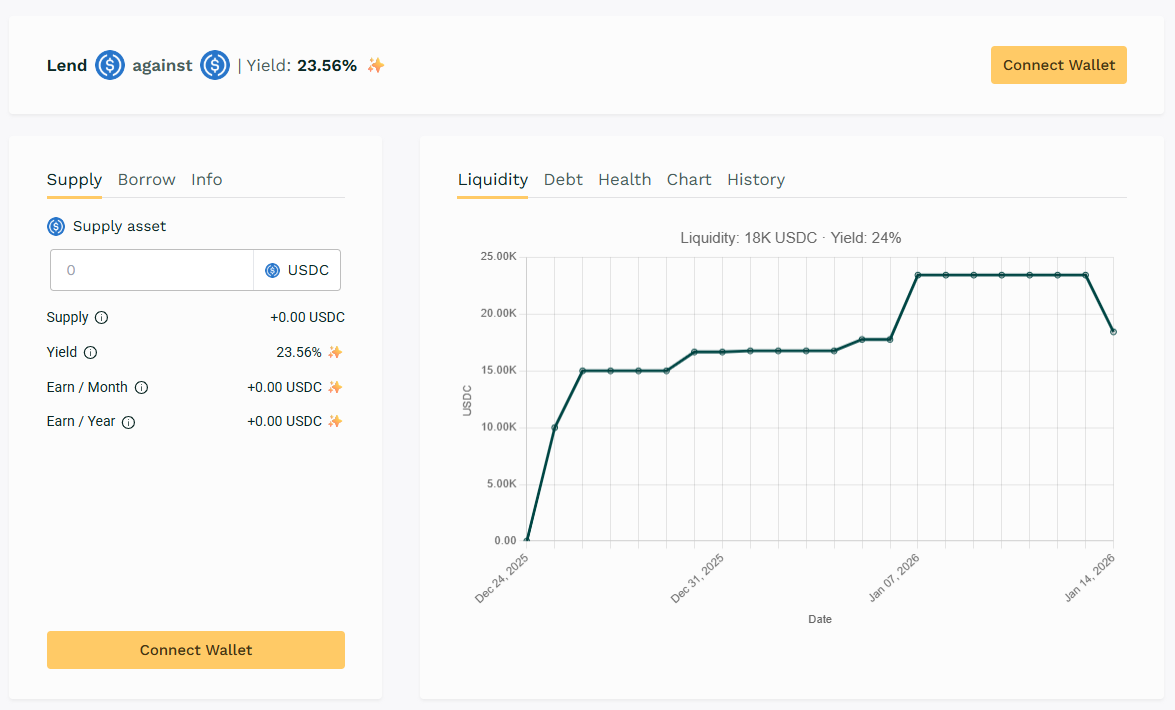

🥈 USDC/ $DN-FLAGSHIP

🧮 APY: 23.56%

📉 Collateral: DN-FLAGSHIP (Delta Neutral)

🔐 Loan Term: 30 days

📊 Collateral Rate: 120%

Teller's Delta Neutral Flagship pool takes the second spot this week now with 23% APY.

📌 DN-FLAGSHIP took the second top pool this week.

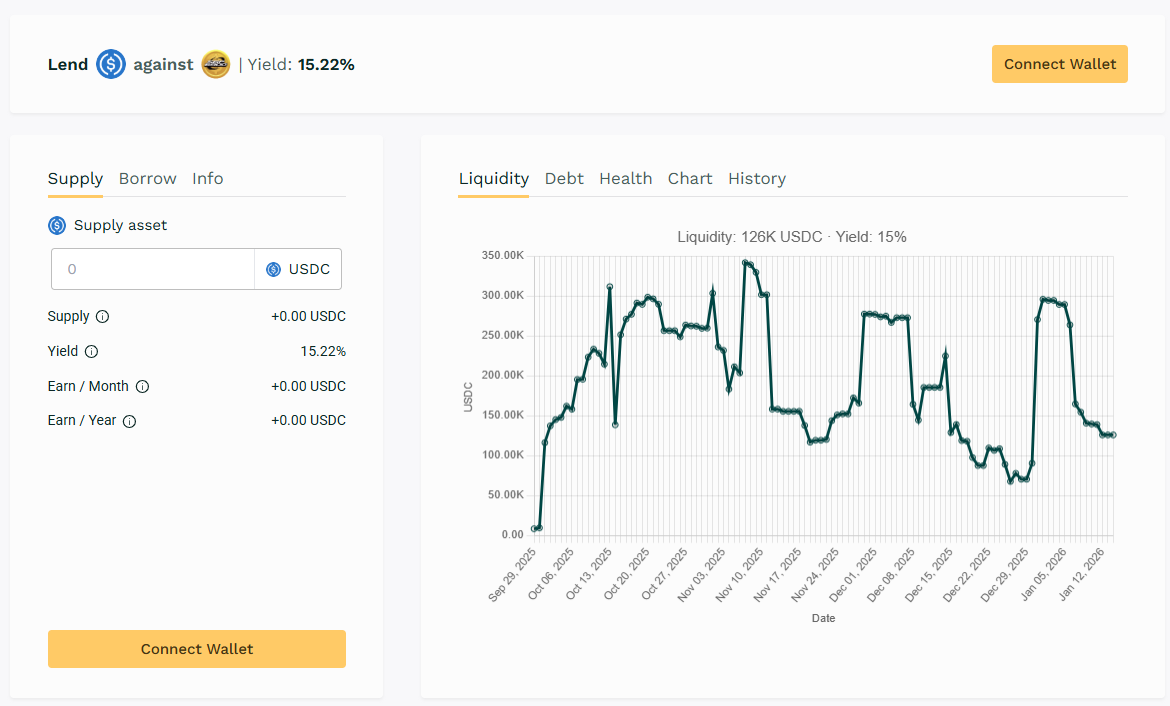

🥉USDC / $SPX

🧮 APY: 15.22%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

$SPX remains as a high-volume lending market with loan issuance and repayment frequency, maintaining yield levels above 15%.

📌 Ongoing borrower activity support yields reaching above the 15% range.

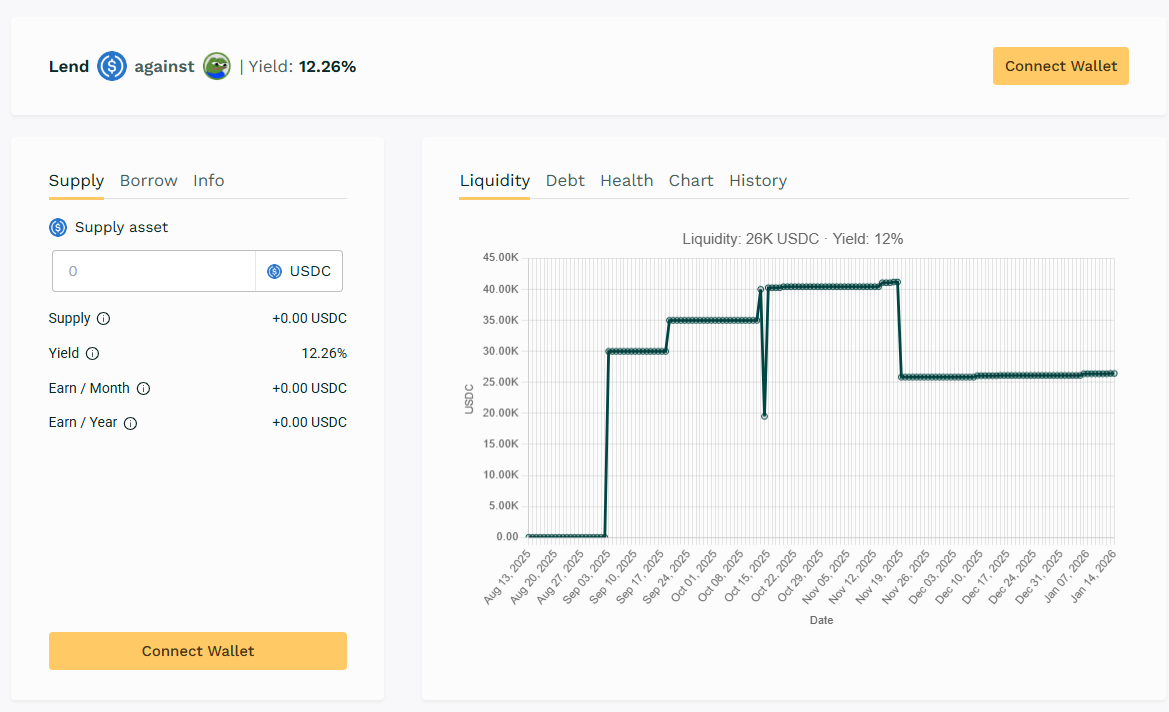

🏅 USDC / APU

🧮 APY: 12.267%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU continues to demonstrate active loan rollover behavior, maintaining yield levels at 12%.

📌 $APU pools raised over 26K liquidity with near 12% range yields.

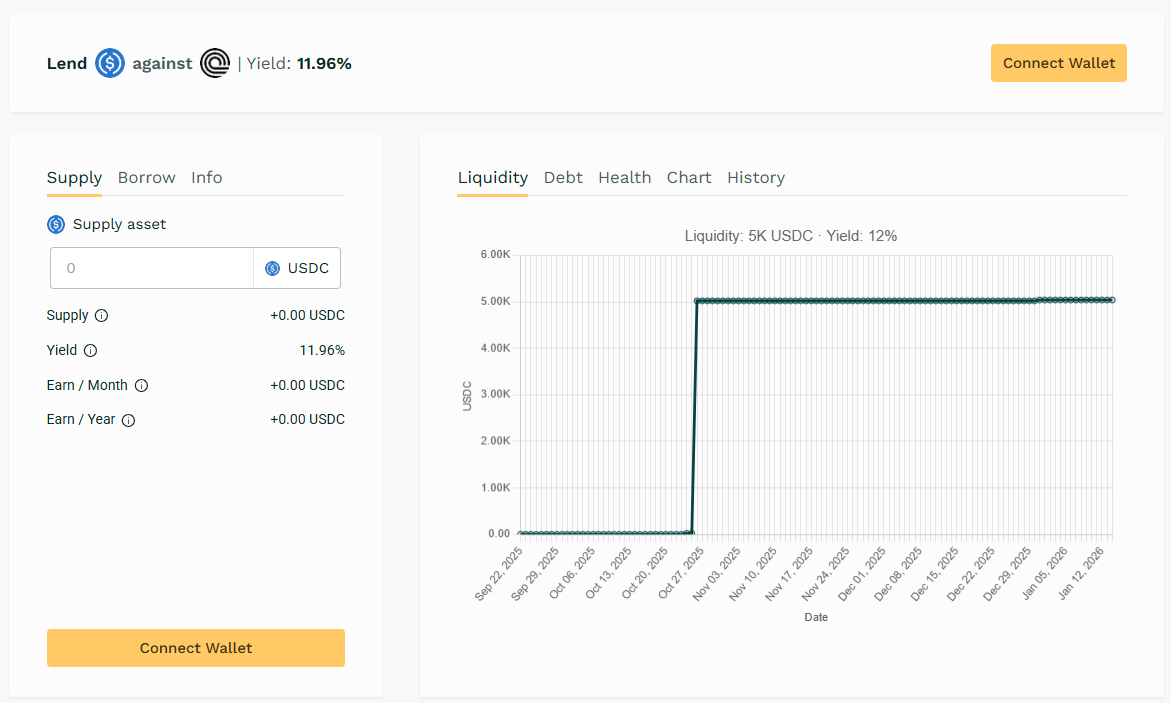

🏅 USDC / $ONDO

🧮 APY: 11.96%

📉 Collateral: ONDO (DeFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 350%

$ONDO pool's borrowing delivered yields close to 12% despite smaller liquidity size.

📌 $ONDO held almost 12% APY despite smaller liquidity.

📈 Yield Takeaway:

APYs across active pools continue to reflect organic borrower behavior, with rollover-driven earnings shaping yield distribution week to week.

📢 Next Week

Tracking continues next week as pool dynamics shift with new borrower demand.

View live data here 👉 https://app.teller.org/ethereum/lend