Teller Yields, Weekly Digest 01/08

This week’s pool data shows dynamic APY shifts as rollover activity and borrowing trends moved across multiple pools.

Below is a breakdown of current pool activity and yields.

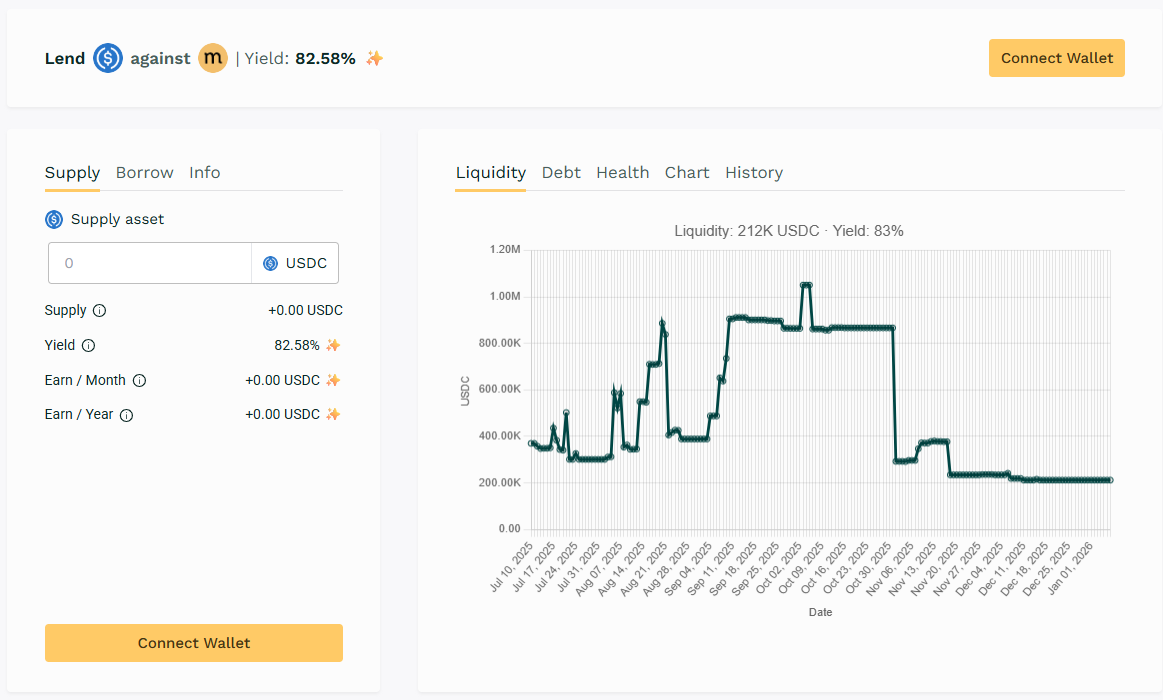

🥇 USDC / $MASA

🧮 APY: 82.58%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

Remains as one of the largest active pools in Teller this week sustaining APYs above 80%.

🎯 $MASA topped the charts, holding the 80% APY mark.

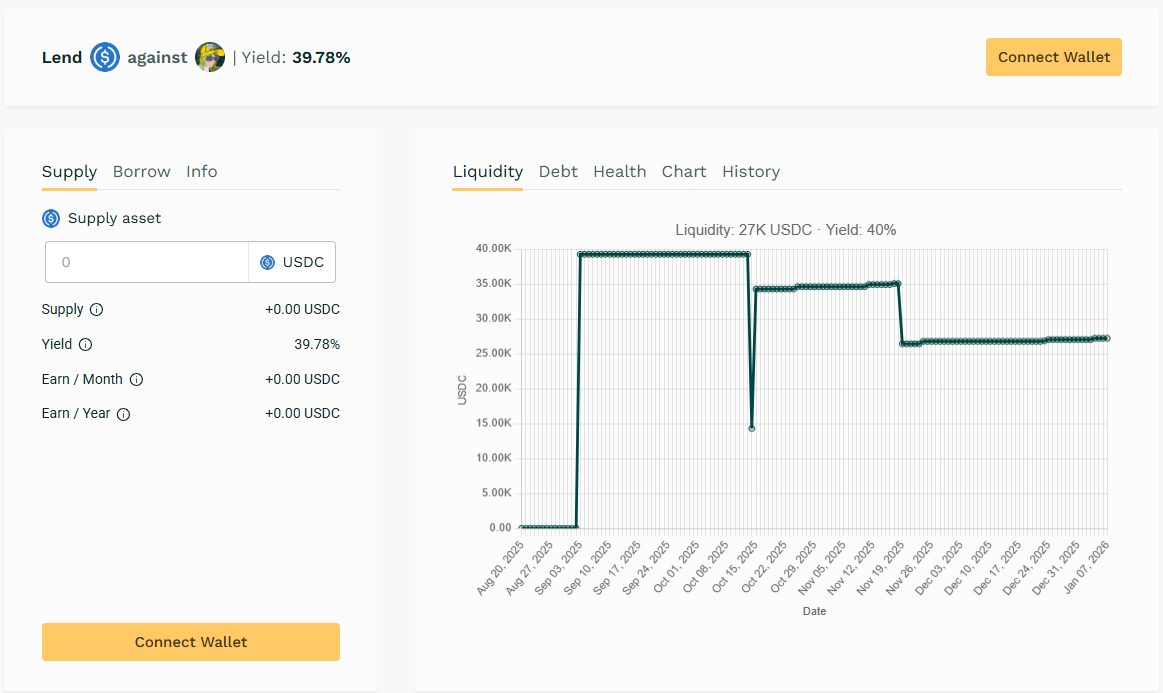

🥈 USDC / $DMT

🧮 APY: 39.78%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

Borrowers actively using DMT collateral maintain demand within this pool. APY remains consistent as loans continue rolling over.

🎯 Borrower rollovers keeping yield above 39%.

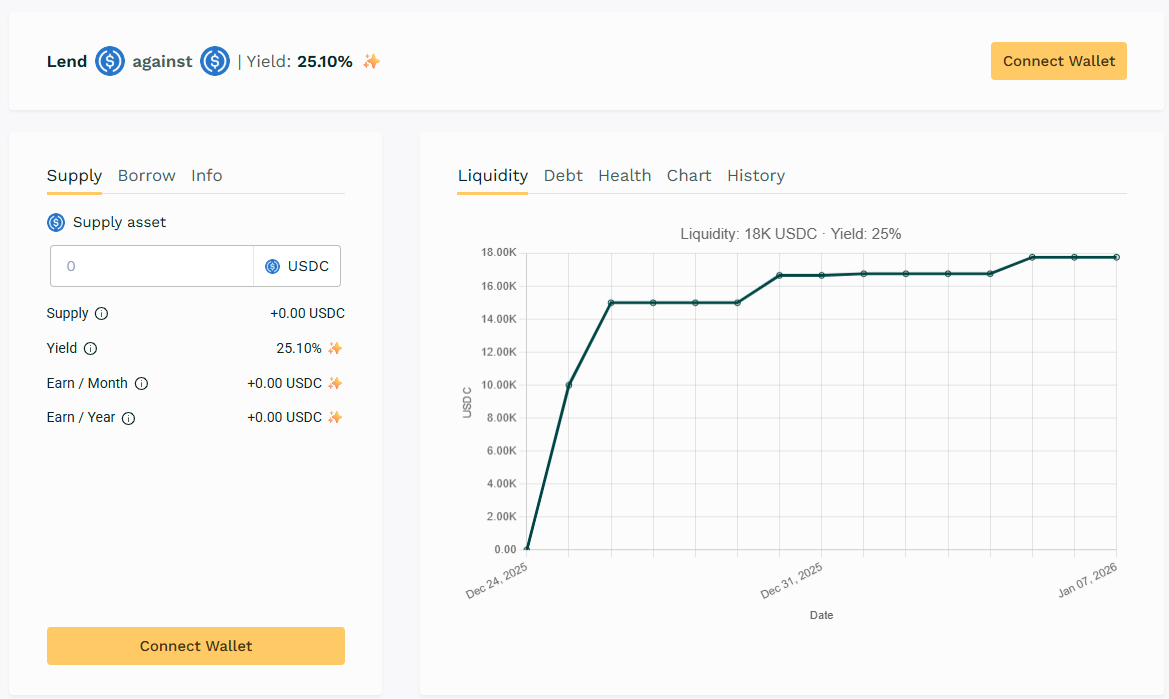

🥉 USDC/ $DN-FLAGSHIP

🧮 APY: 25.10%

📉 Collateral: DN-FLAGSHIP (Delta Neutral)

🔐 Loan Term: 30 days

📊 Collateral Rate: 120%

Teller's Delta Neutral Flagship pool takes the third spot this week as a recently launched pool now with 25% APY.

🎯 DN-FLAGSHIP entered the top pools this week.

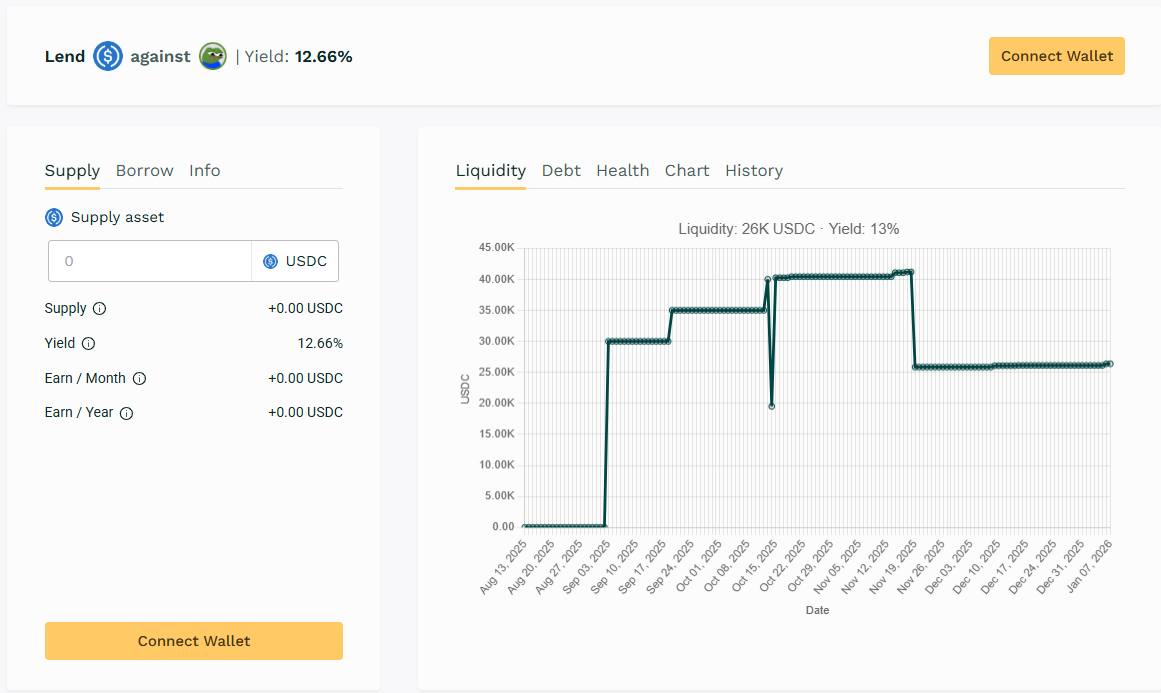

🏅 USDC / $APU

🧮 APY: 12.66%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

APU maintains 26K in liquidity with borrower engagement sustaining yields in the near 12% range.

🎯 APYs are sustained by consistent monthly borrowing volume.

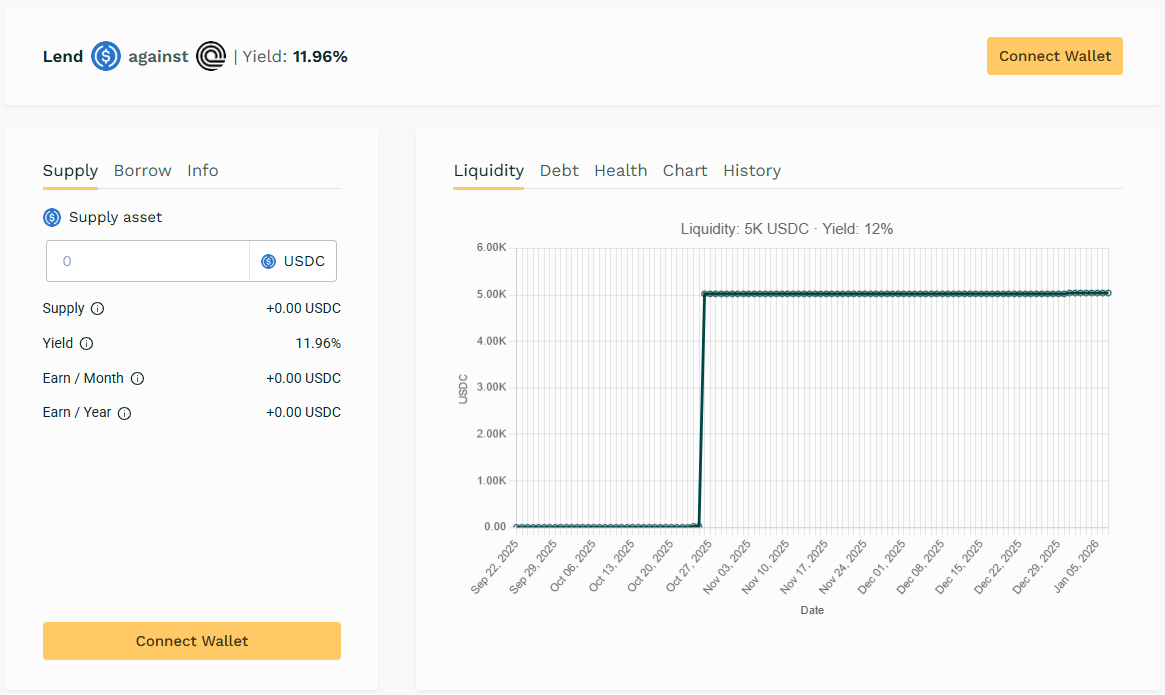

🏅 USDC / $ONDO

🧮 APY: 11.96%

📉 Collateral: ONDO (DeFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 350%

Even with limited borrower use, utilization and yield in this token pool produced returns for above 11% APY.

🎯 $ONDO held 11% APY despite smaller liquidity.

📸 Snapshot

- Top performing pools: $MASA and $DMT

- Highest liquidity: $MASA (212K USDC)

- Across these pools, borrower demand and rollover behaviors continue to shape APYs.

🛎️ Next Digest

Next week’s update will track rollover trends and analyze whether utilization shifts toward high-yield pairs continue into November.

Track live data here 👉 https://app.teller.org/ethereum/lend