Teller Yields, Weekly Digest 12/25

Date: December 16, 2025

Source: Teller on DeFiLlama

Lending yields continued to vary significantly this week. Pools maintained double-digit APYs.

🏆 Top Lending Pools

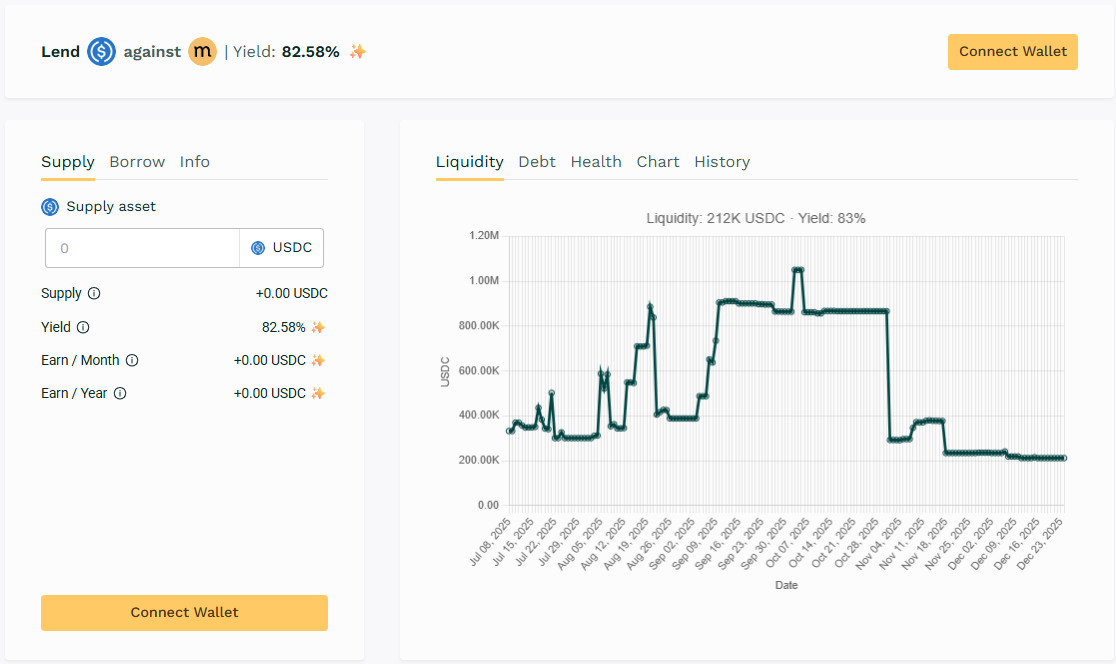

🥇 USDC / $MASA

🧮 APY: 82.58%

📉 Collateral: MASA (AI)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

One of the largest active pools this week sustaining APYs above 80%.

💡 Frequent loan cycles with substantial lending volume support.

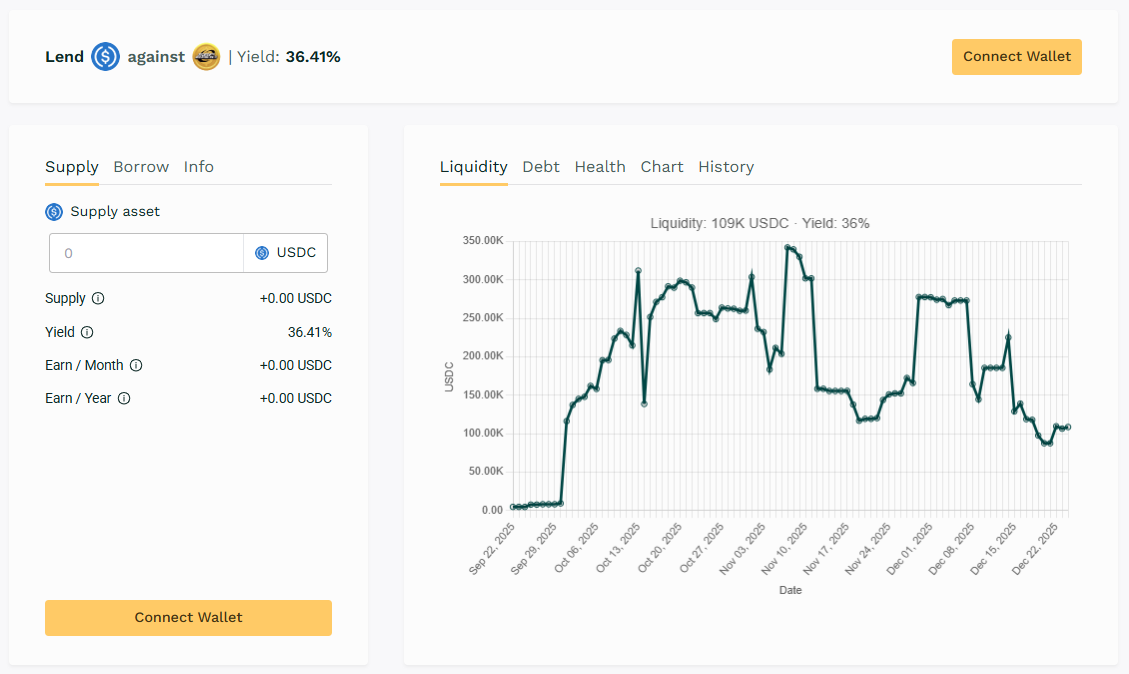

🥈 USDC / $SPX

🧮 APY: 36.41%

📉 Collateral: SPX6900 (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

Borrowers actively using SPX collateral maintain demand within this pool as yields approached 37%.

💡 $SPX takes the 2nd spot this week with 35%+ returns.

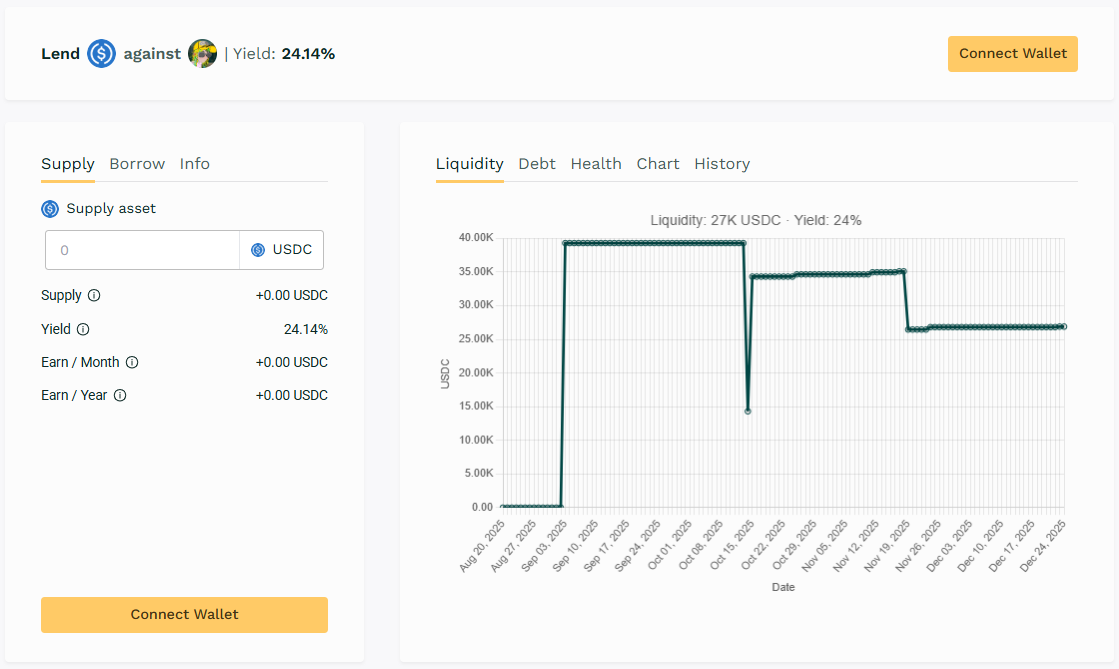

🥉USDC / $DMT

🧮 APY: 24.14%

📉 Collateral: DMT (GameFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 400%

$DMT utilization gained the APY in the upper-24% range. The pool shows activities maintaining its position as a mid-cap option for lenders.

💡 Recurring rollover behavior among borrowers.

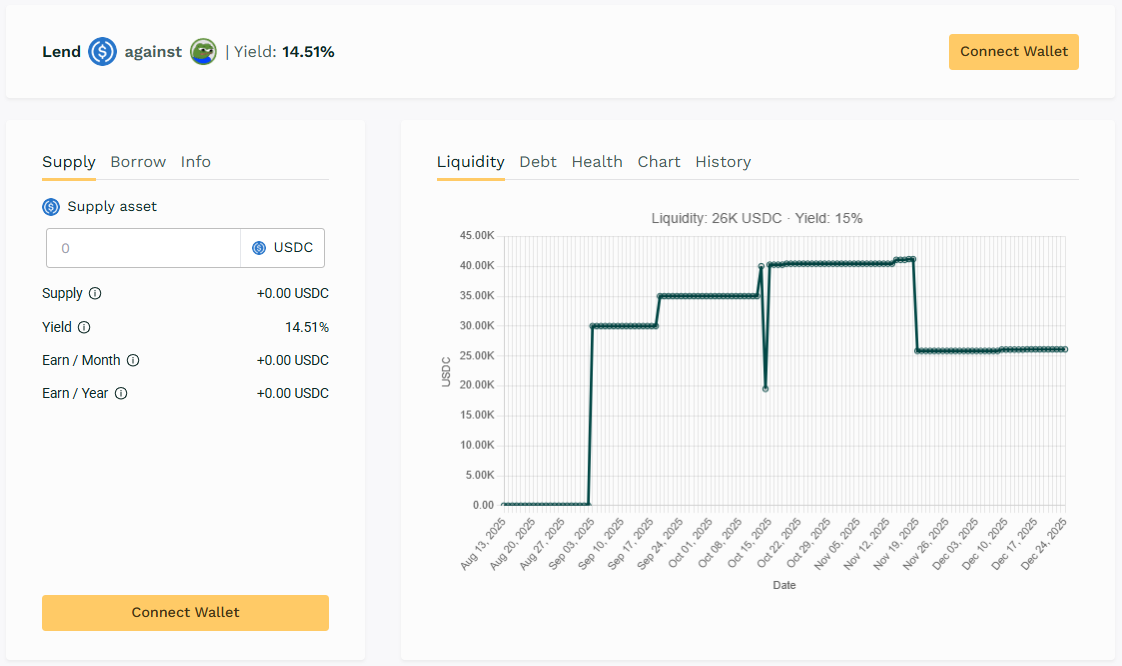

🏅USDC / $APU

🧮 APY: 14.51%

📉 Collateral: APU (Meme)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

$APU collateralized pool accounted for over 26K in liquidity. Borrower engagement reached yields in the 14% range.

💡 Still earning above 14% APY with borrower base.

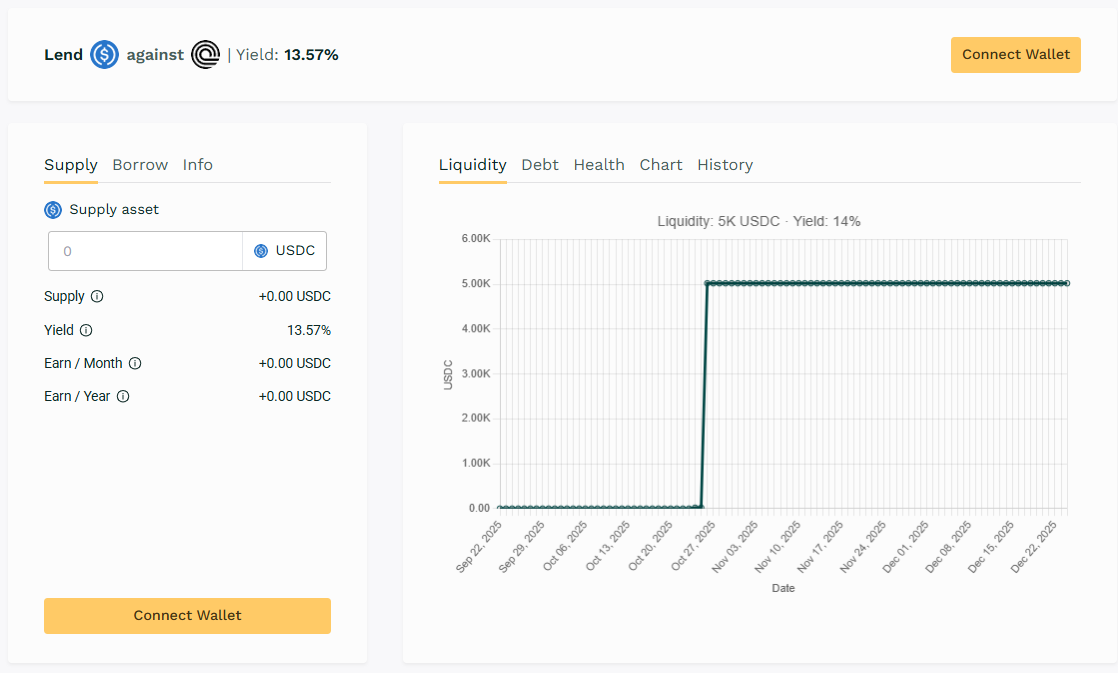

🏅 USDC / $ONDO

🧮 APY: 13.57%

📉 Collateral: ONDO (DeFi)

🔐 Loan Term: 30 days

📊 Collateral Rate: 350%

Limited borrower use keeps utilization and yield in this token pool producing returns for above 13% APY.

💡 $ONDO held a 13% APY despite smaller liquidity.

📈 Yield Takeaway:

Across these pools, borrower demand and rollover behaviors continue to shape APYs. Pools with higher utilization rates saw APYs rise, while fresh liquidity inflows held back yields in lower-utilization pools.

📅 Next Update

We’ll be back with fresh rankings, usage stats, and updated APYs.

Until then, happy lending. Stay yield-aware.

👉 View the Teller App: View Pools