Teller Yields, Weekly Digest 06/26

Date: June 26, 2025

Source: Teller on DeFiLlama

Explore this week’s hottest opportunities on Teller Finance, where fixed-term lending meets high APYs. Yields are driven purely by borrower interest—no token inflation, no staking gimmicks.

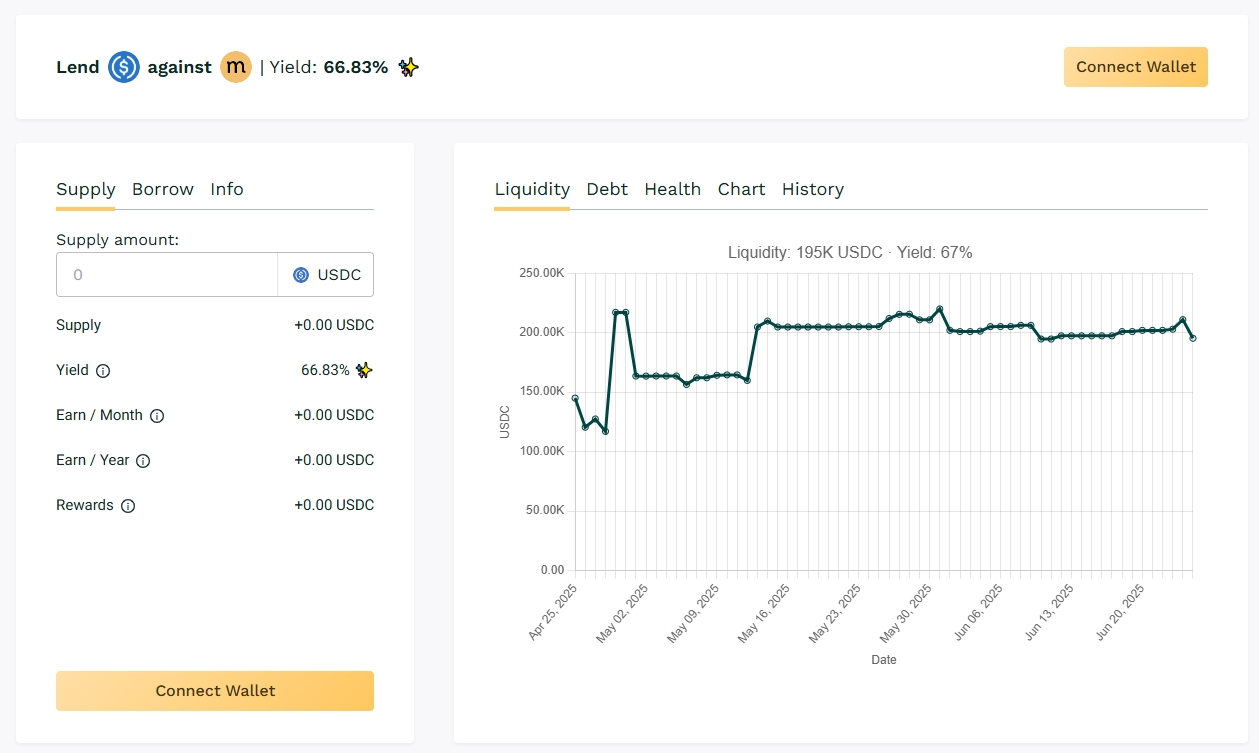

💰 1. USDC / MASA Pool

🧮 APY: ~ 68.8%

📉 Collateral: MASA (Masa Protocol Token)

🔐 Loan Term: 30 days

📊 Collateral Rate: 425%

This pool continues to dominate the yield charts. MASA is a decentralized identity protocol token, and lenders here are clearly being compensated for the higher volatility and lower liquidity of the collateral. If utilization remains high and repayments timely, lenders can earn nearly 70% APY—top of the board this week.

Yield Tip: Great for risk-tolerant lenders chasing top-tier APRs. Just be ready for potential volatility in the MASA token if defaults occur.

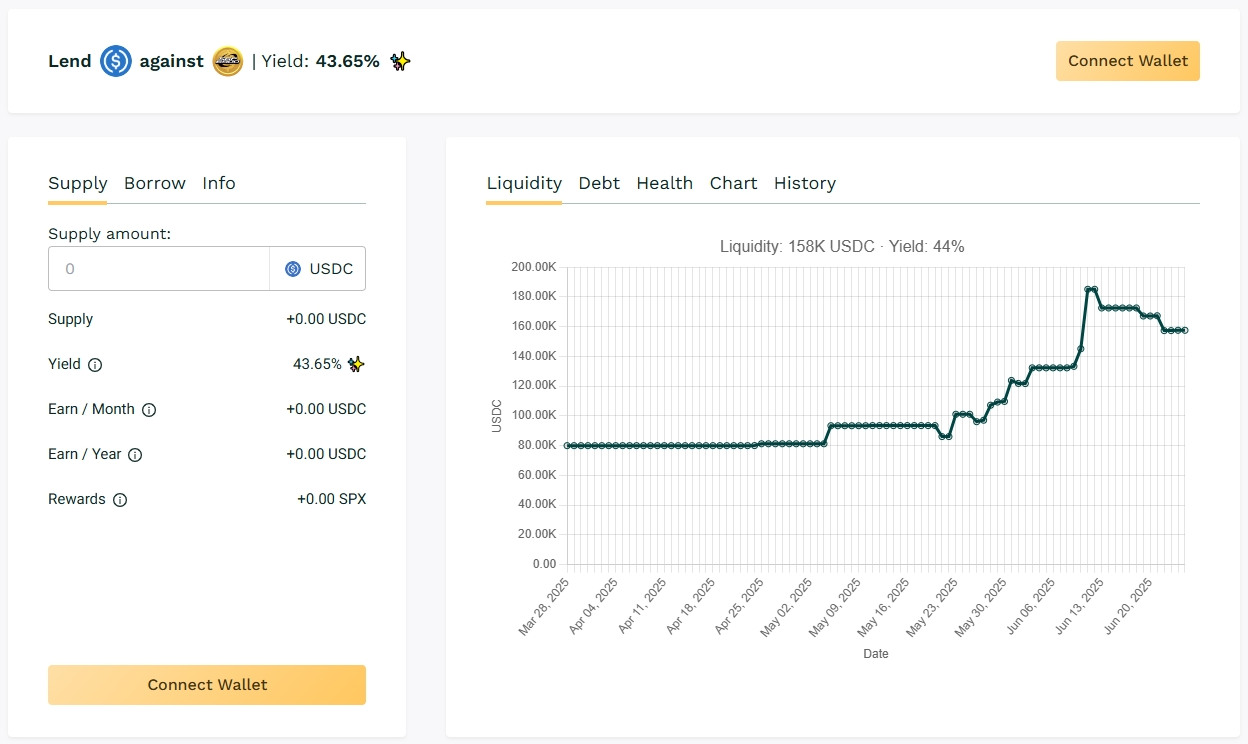

🧨 2. USDC / SPX Pool

🧮 APY: ~ 42.9%

📉 Collateral: SPX ($SPX6900 memecoin)

🔐 Loan Term: 30 days

📊 Collateral Rate: 600%

The cult-like memecoin $SPX is being used as collateral in this pool, with strong utilization pushing APY above 42%. This is one of Teller’s more experimental pools, but demand from borrowers shows growing traction from the DeFi memecoin crowd.

Yield Tip: For degens who don’t mind chaos—just make sure you're tracking SPX price trends to assess risk.

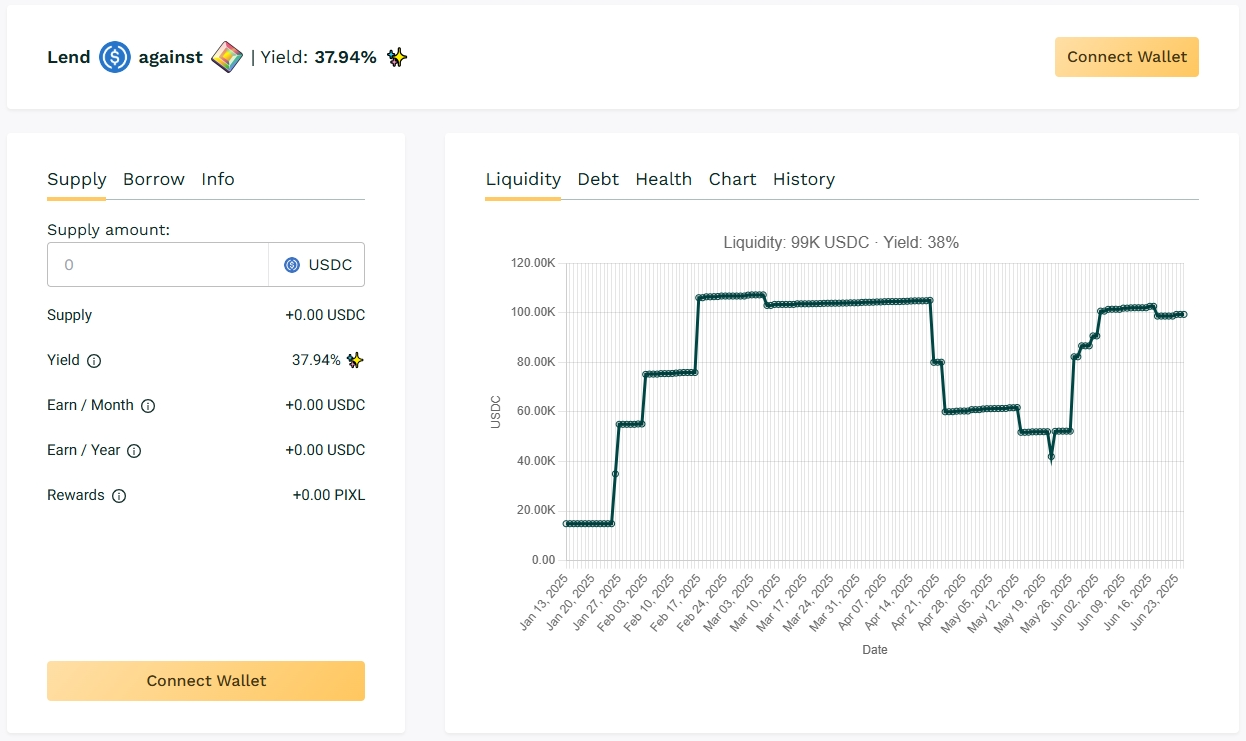

🎮 3. USDC / PIXL Pool

🧮 APY: ~ 41.7%

📉 Collateral: PIXL (Gaming/NFT-related token)

🔐 Loan Term: 7 days

📊 Collateral Rate: 300%

Another high-yielding, long-tail token pool. PIXL appears to be part of a gaming/NFT ecosystem. Yields here are high due to strong borrower interest and low competition among lenders.

Yield Tip: Diversify across a few high-yield pools to mitigate single-token risk.

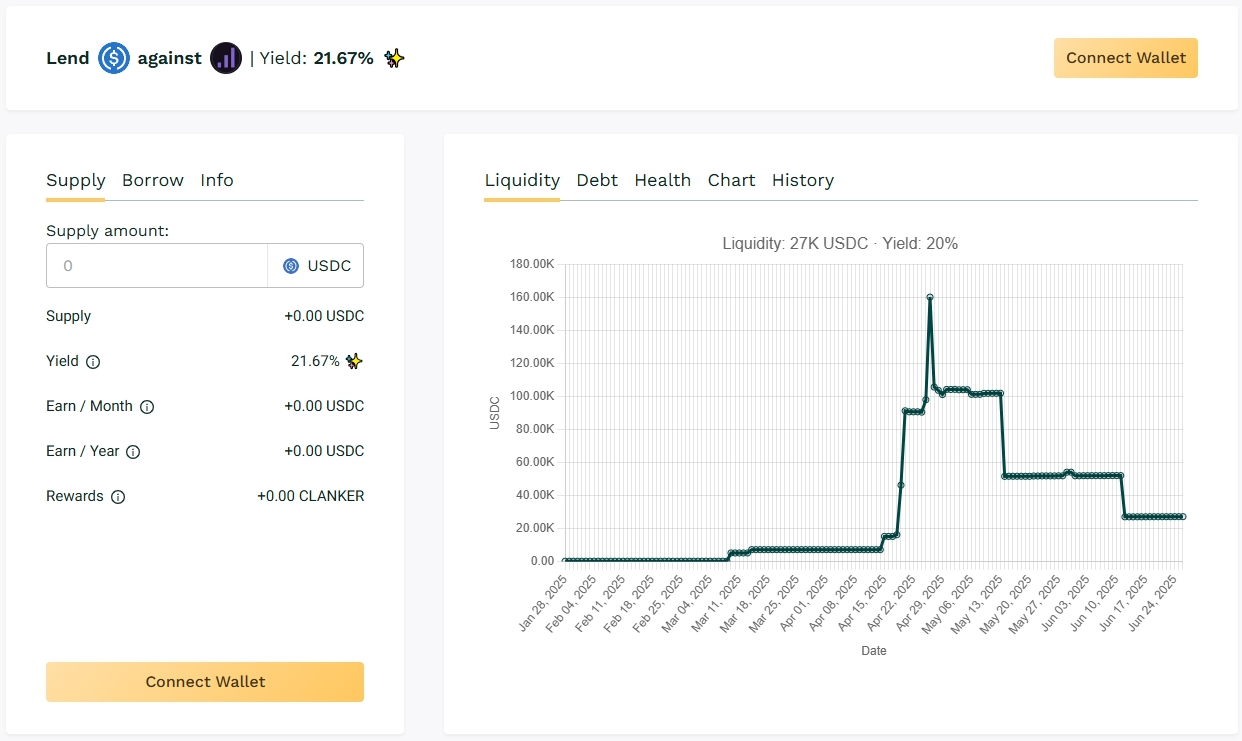

🔮 4. USDC / CLANKER Pool

🧮 APY: ~ 39.0%

📉 Collateral: CLANKER (AI)

🔐 Loan Term: 7 days

📊 Collateral Rate: 500%

CLANKER is one of Teller’s lesser-known pools, but strong borrowing demand has pushed the APY up near 40%. As always with small-cap collateral, lender rewards reflect the increased risk of default or price drop.

Yield Tip: Use smaller allocations and watch utilization rates daily.

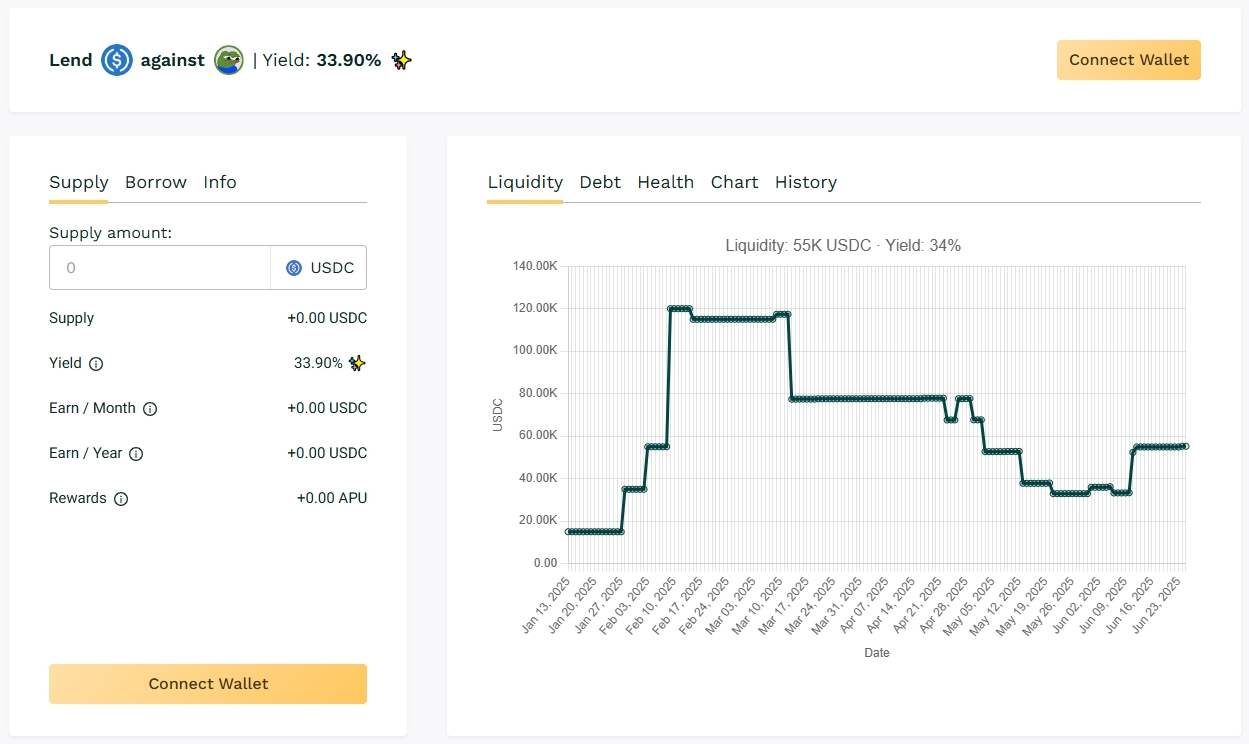

🐸 5. USDC / APU Pool

🧮 APY: ~ 31.4%

📉 Collateral: APU (memecoin)

🔐 Loan Term: 30 days

📊 Collateral Rate: 450%

APU is another meme-heavy token pool offering big rewards for lenders. With more than 30% APY and strong utilization, this pool is becoming a staple for yield-maxi degens.

Yield Tip: Use this pool if you’re rotating through meme DeFi cycles—just know the loan durations are tight and repayment volatility is a factor.

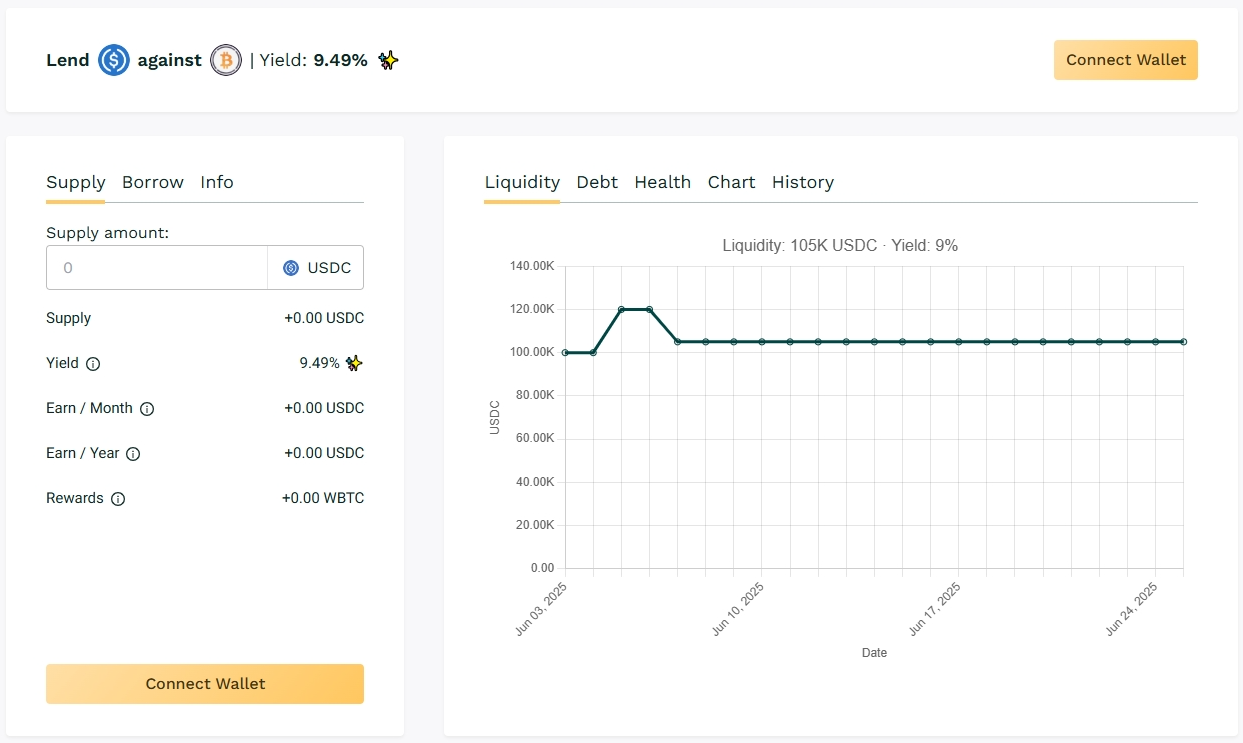

🟠 Bonus: USDC / WBTC Pool

🧮 APY: ~ 8.9%

📉 Collateral: Wrapped Bitcoin (WBTC)

🔐 Loan Term: 30 days

📊 Collateral Rate: 150%

While not a top earner, this pool is a reliable favorite. WBTC is trusted collateral, and APYs here are competitive with most stable DeFi protocols. For those seeking safer, lower-yield exposure, this is a go-to pool.

Yield Tip: Use as a hedge or base allocation while rotating riskier plays.

🧠 Summary: Yield Ladder Snapshot

| Pool | APY | Collateral | Collateral Ratio (CTL %) | Duration |

|---|---|---|---|---|

| USDC / MASA | 68.8% | MASA | 425% | 30 days |

| USDC / SPX6900 | 42.9% | SPX6900 | 600% | 30 days |

| USDC / PIXL | 41.7% | PIXL | 300% | 7 days |

| USDC / CLANKER | 39.0% | CLANKER | 500% | 7 days |

| USDC / APU | 31.4% | APU | 450% | 30 days |

| USDC / WBTC | 8.9% | WBTC | 150% | 30 days |

🔁 Start Earning

Head over to the Teller app to view yields, pool utilization, borrower activity, and collateral price movements.

👉 Teller App: View Pools