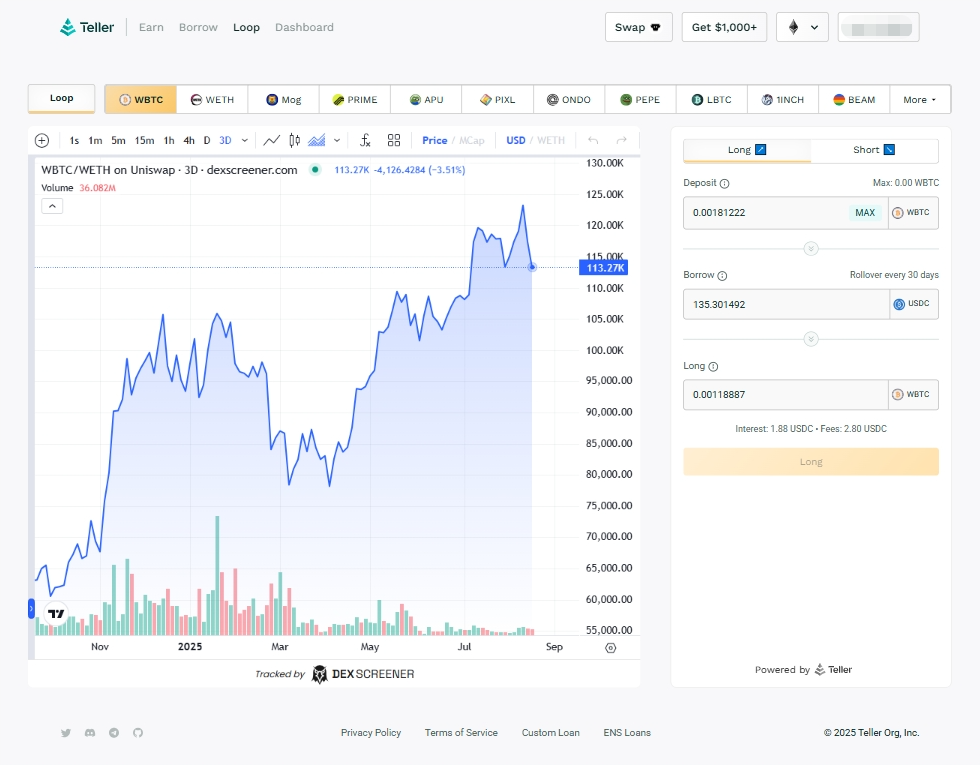

Teller Loop: Perpetual Loans for Long Positions

Teller Loop enables borrowers to amplify their exposure to a single token through a perpetual, no-liquidation loan structure. Each loop represents a single long position for the same token, facilitating a straightforward and repeatable process.

What is Teller Loop and What it Does?

Teller Loop allows users to deposit a token, borrow against it, and automatically swap the borrowed funds back into the same token, which is then sent to their wallet—enabling them to grow a long position with the same collateral. It builds directly on Teller Long, where a token is used as collateral to borrow USDC and purchase more of that same token — effectively increasing exposure.

Teller Loop allows borrowers to:

- Deposit a token (e.g., WBTC) as collateral.

- Borrow USDC against the deposited token.

- Swap the borrowed USDC for additional WBTC.

This cycle can be repeated to increase exposure to the same token, with each loop representing a single long position. The loan remains perpetual, with no margin calls, and interest is managed through scheduled duration dates.

How it works:

- Deposit WBTC as collateral and

- Borrow USDC against the WBTC.

- Swap the borrowed USDC for additional WBTC.

- Repeat the cycle to reach the desired exposure.

Result: larger WBTC exposure. The loan remains non-liquidatable; only scheduled interest checkpoints matter.

Why it matters:

Loop transforms Teller Long from a single-step exposure increase into an activated compounding strategy.

- Compounded exposure: loop into conviction tokens (e.g., WBTC, ETH) with a single action.

- No liquidations: price moves do not trigger forced sells.

- Operational simplicity: extend at checkpoints; no need to unwind collateral to keep the position active.

- Rewards compatibility: eligible loans can accrue borrower rewards and be claimed after the rollover window.

About Teller

Teller enables no margin-call loans for Bitcoin and 100+ altcoins. Teller Loop allows borrowers to maintain long-term positions without operational delays.

Loans are perpetual and non-liquidatable across supported networks, ensuring capital remains deployed through scheduled rollovers rather than price-based liquidations.

👉 Open Teller Loop today.