Teller is Live on Katana: Borrow and Earn Without Liquidations

Katana’s ecosystem just became more powerful ⚔️

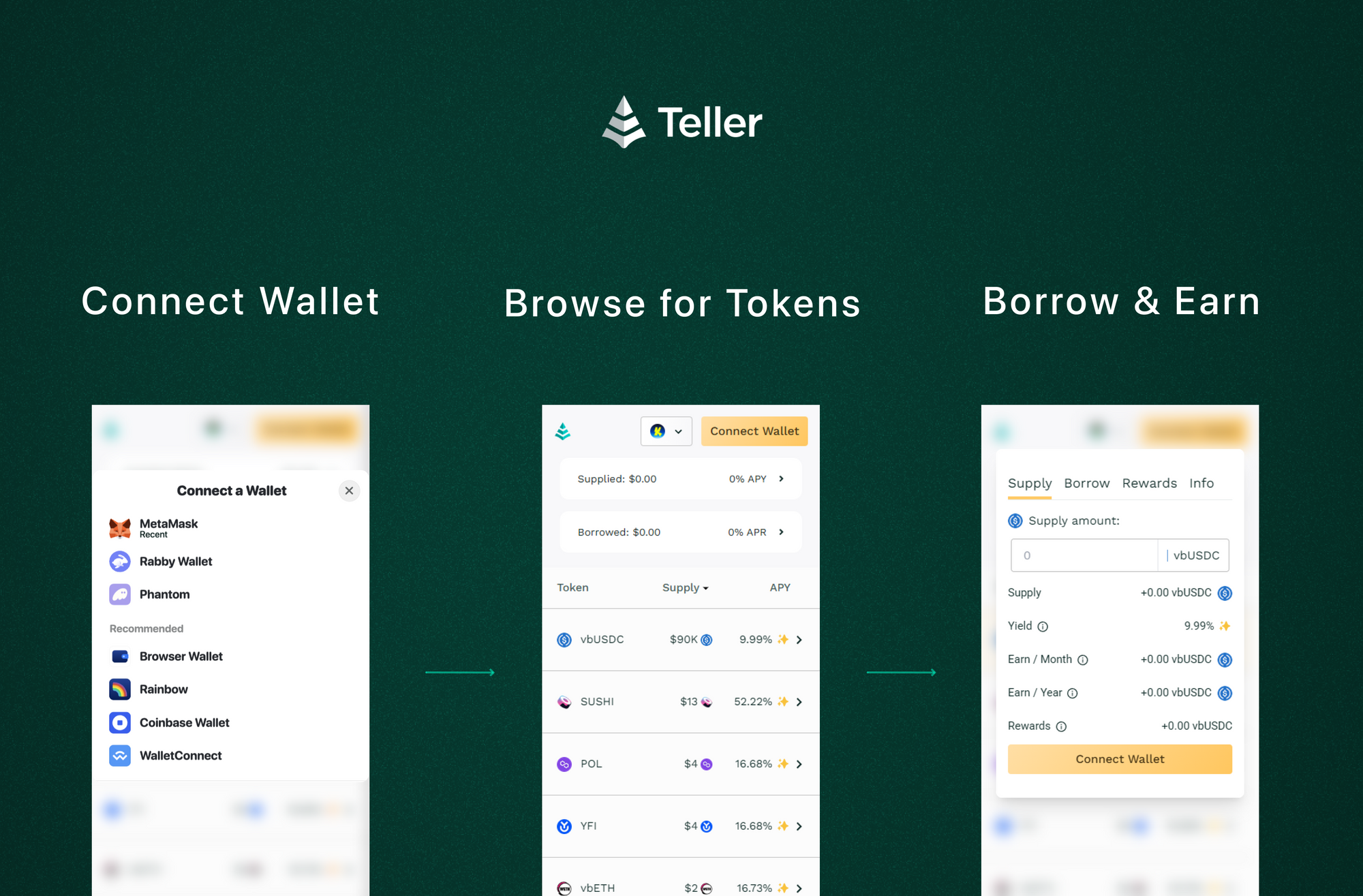

Teller is now live, introducing perpetual loans without liquidations and unlocking new ways to optimize your yield strategies on Katana.

With Teller, you can borrow, lend, and earn while keeping your spot exposure intact. No forced selling. No getting rekt by scam wicks. Just more control and new ways to make your assets work harder.

What is Teller and How it Works

Teller is a decentralized lending protocol that offers perpetual loans without liquidations. Unlike traditional lending platforms, Teller’s loans don’t rely on price-based liquidation thresholds.

Instead, they use 30 day rollover checkpoints:

- Use any Katana token as collateral for a loan, keeping your spot position intact

- Borrowers can repay at anytime or roll loans forward by paying interest when checkpoints arrive

- There are no margin calls and no forced liquidations due to price swings

- If you miss a rollover checkpoint, your collateral enters a Dutch auction, and proceeds are returned to the lending pool

This structure gives users predictable access to liquidity and the ability to hold their positions through volatility. Whether you’re borrowing or lending, you can now plan strategies with confidence.

Katana: The Fastest-Growing DeFi Ecosystem

In just two months since launch, Katana has rapidly scaled to over $450m in productive TVL, making it one of the most active and composable ecosystems in decentralized finance.

Katana’s design centers on unified liquidity and incentive-driven growth, enabling users to earn more from their assets through productive TVL and innovative flywheel mechanisms. With multiple integrated apps and deep liquidity, Katana has become a hub for advanced DeFi users looking to maximize returns.

How Teller Expands What’s Possible on Katana

With Teller added to the lineup, Katana users gain a powerful new tool for optimizing existing strategies and unlocking new ones without liquidation risk.

Here’s how advanced users are putting Teller to work:

- Borrow stables to rebalance health ratios

Use Teller to borrow against your Katana tokens without liquidation risk and manage leverage more safely. - Leverage loop positions

Borrow using $vbETH, $SUSHI, $POL, $YFI, $KITSU or any other Katana token to buy more of the same token, looping exposure and compounding returns. - Borrow the other side of an LP position without selling spot

Keep your existing Katana tokens, borrow the paired asset, and give yourself 30 days to clear your hurdle rate before checkpoints arrive. - Put your ALM tokens to work

Use your favorite ALM tokens like $USDCETH5 and $WBTCUSDC5 from Charm or $STEERUV11 from Steer, as collateral to get a perpetual no-liquidation loan. - Lend on Teller to earn single exposure, compounding yield

Earn competitive returns by lending stables or Katana tokens into Teller pools while maintaining single-asset exposure. No LST exposure. No impermanent loss.

Start Borrowing and Earning on Katana Today

Teller is now part of the Katana stack — giving you more ways to borrow, lend, and stay in control.

From looping to rebalancing, it keeps your capital working without selling spot.

Take control of your flywheel today.

Already on Katana? Click Here to start using Teller.

Need to bridge assets to Katana from another chain? Click Here to bridge.