Teller Collaborates with Chainlink to Build Undercollateralized DeFi Lending

We are super excited to announce that we have collaborated with Chainlink, the world’s leading decentralized oracle network, and DECO, Chainlink’s privacy-preserved oracle protocol, to build a Proof of Concept for issuing undercollateralized crypto loans.

Teller’s PoC with Chainlink is a future-proof coalescence of traditional finance and Decentralized Finance (DeFi) to enable the lending of digital assets in a manner that hasn’t been possible before and has been touted as the future of DeFi - the undercollateralized loans.

Teller is bringing the best of both worlds together to develop a POC that has made undercollateralized loans plausible without jeopardizing users’ privacy, security, and easiness of getting crypto loans.

Here’s what Ryan Berkun, CEO at Teller, and Dahlia Makhi, Chief Research Officer at Chainlink Labs, have to say about this collaboration.

“This proof of concept between Teller and Chainlink Labs showcased the true power of the DECO protocol and how privacy-preserving oracle technology can enable trillions of dollars in untapped value to be brought on-chain via undercollateralized lending. We’re excited to continue working with Chainlink on the development and refinement of the DECO protocol.” - Teller Finance CEO Ryan Berkun.

“DECO is an innovative new technology that enables smart contracts to serve even more powerful use cases in a truly privacy-preserving manner. This proof of concept with Teller successfully demonstrated how the application of academic research can be applied to real-world use cases. We are excited to continue our collaboration with Teller on their use of DECO and look forward to making DECO available to the broader community.” - Chainlink Labs Chief Research Officer, Dahlia Malkhi.

What are undercollateralized loans?

Undercollateralized loans are loans in which the amount deposited or put as collateral is less than the principal amount of the loan. This means if the borrower defaults on the loan, the collateral will not be enough to cover the loan's principal. Undercollateralized loans are common in banks and the traditional finance industry as it is conceived to protect the interest of both borrowers and lenders.

All DeFi loans are overcollateralized because of two reasons - Trust and Volatility. It is understandable to keep crypto loans overcollateralized because of cryptocurrency’s high volatility as the collateral value can fluctuate massively. However, DeFi is the land of trustlessness.

DeFi leverages public blockchain with pseudoanonymity and smart contracts to automate lending and borrowing, calculate interest rates, and establish collateralization rules. DeFi ensures this trust by implementing algorithms that ensure that all the crypto loans are overcollateralization.

What if there was a different way to ensure this trust?

Teller has succeeded in testing a blockchain-based undercollateralized crypto lending platform that preserves users’ privacy with its cutting-edge infrastructure.

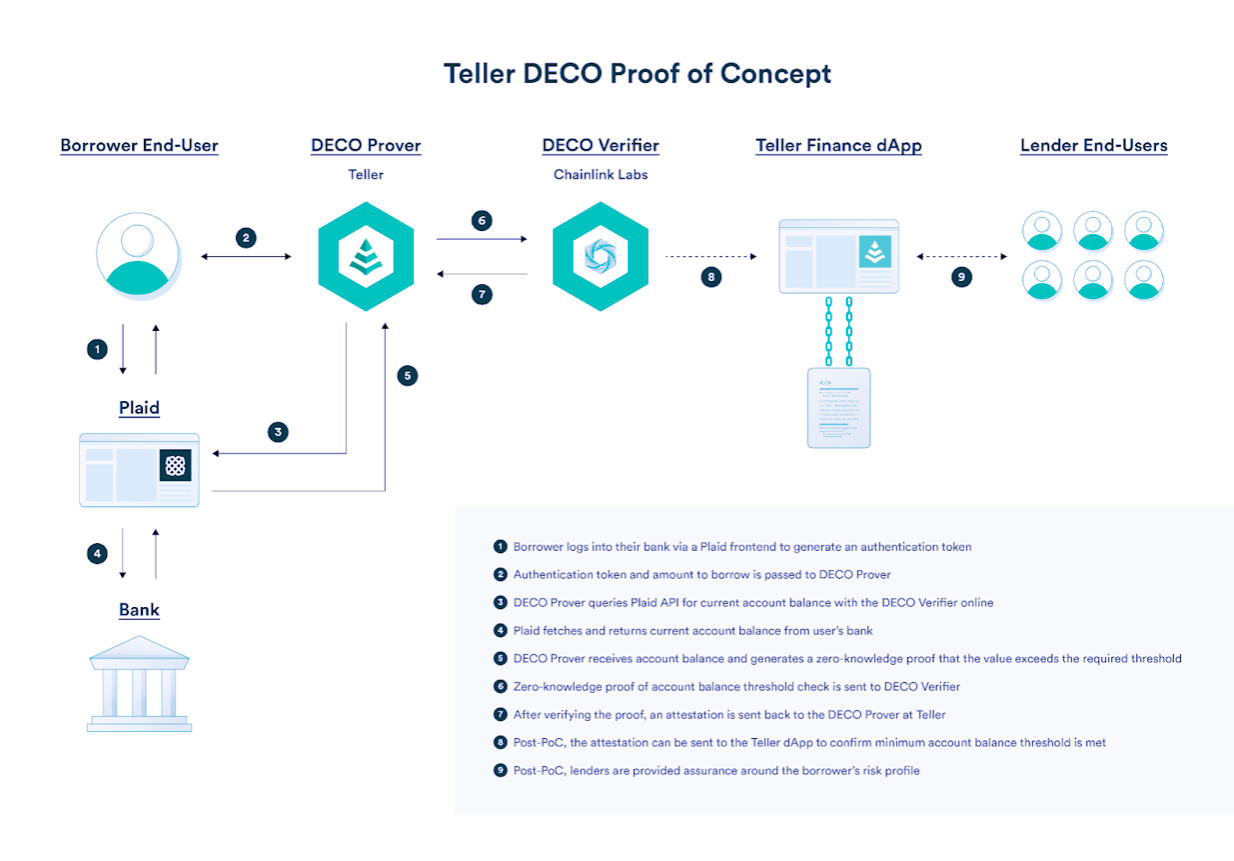

Teller’s POC with Chainlink explained

Teller’s DeFi platform is building trust with the borrower by requesting the borrower to submit his private information created by the centralized institutions in a privacy-preserved manner. This information will be used to measure the user’s creditworthiness and establish trust between the borrower and the platform.

The information we discussed above can be the borrower’s bank account balance, credit history, past installment schedules, or something more technical like credit utilization ratio. This information is private to the user and can’t exist on a public blockchain for everyone to see.

At Teller, we decided to take this data on-chain without compromising users’ privacy of their confidential information. This is where Chainlink DECO comes in. DECO uses zero-knowledge proofs to enable the use of personal data within smart contracts without revealing the data on-chain.

Let’s consider an example where a borrower requested a loan of $5,000. In this case, the user would have to prove they have at least $5,000 in their bank account. Teller used the DECO protocol to prove that the sum of a user’s off-chain bank accounts had a balance exceeding a dynamic threshold specified by the requested loan amount. If the sum of a user’s account balances exceeds the threshold, then their risk profile as a borrower would be reduced, allowing for significantly lower collateral requirements for loans.

To generate this proof, a test user first logged into their bank via Plaid—a developer-focused financial services company—to generate an authentication token. This token was then passed to a DECO Prover instance as a private input to query the Plaid API.

In this POC, Teller used DECO’s Prover Instance and Chainlink Labs deployed DECO’s verifier. Teller and DECO were able to successfully demonstrate issuing undercollateralized loans on ZkP (Zero knowledge Proofs) that are generated regarding a borrower’s creditworthiness. As a next step, Teller’s smart contract-based DeFi platform will be able to rely on a specific credit worthiness information in zero-knowledge and facilitate attestations on-chain with Chainlink Core using DECO.

Conclusion

Undercollateralized crypto lending has been considered an ‘impossible to achieve aspiration of DeFi. Often projects saw compromising one end of the triangle in the trilemma of privacy, repayment security, and collateral. This means the projects that have been working to build a prototype since 2017 have been struggling to assign creditworthiness of borrowers and assure the security of lenders. Teller has directly targeted this problem with this proof of concept with Chainlink.

Undercollateralized lending will make DeFi loans more profitable, feasible, and practically relevant for its mainstream adoption. Teller's successful POC with Chainlink DECO, when transformed into a working product, will make getting loans a lot easier for the borrowers and generate better passive income opportunities for the lenders. Consequently, this will boost up the transaction volumes in the DeFi space and fuel the adoption of Crypto assets setting up the foundations of the next wave of DeFi innovations.