Lend WELL to Earn Yield on Teller

Are you holding $WELL on Base?

Lend on Teller and start earning 8-15% compounding yield.

No impermanent loss. No pairing. Withdraw anytime.

Just your $WELL, earning more $WELL while you keep full control of your position.

How Does Teller Work?

Teller is your new home base for earning yield on stables and long-tail assets. Join over 250k active users today and start earning up to 12% yield on Ethereum, Base, Arbitrum, and Hyperliquid.

The thesis is simple. No one should be limited to a small number of assets when lending and borrowing. Teller is a permissionless protocol designed to unlock liquidity and passive income on any asset.

Lenders deposit a single token and earn more of that same token, without dual-asset exposure or the risk of impermanent loss. Borrowers unlock liquidity on a range of assets without worrying about liquidations.

What is $WELL?

Moonwell is a decentralized lending protocol that offers secure, transparent markets for supplying and borrowing digital assets. Built with audited smart contracts and clear risk controls, Moonwell focuses on making lending accessible while maintaining strong safety standards. It has grown into a multi-chain lending platform with an emphasis on simplicity and reliability.

$WELL is the governance and incentive token for the Moonwell ecosystem. Users can stake WELL to earn rewards and contribute to protocol security, and token holders guide decisions around risk parameters, listings, and upgrades. As Moonwell expands, $WELL serves as the coordination asset that shapes the protocol’s direction.

Where does the yield come from?

Teller yield is generated in 3 different ways: borrower interest payments, underlying protocol yield, and staking rewards.

With all 3 of these methods, there is no impermanent loss, and you can withdraw your assets at any time without penalty.

1. Borrower Interest Payments

The “base yield” from Teller pools comes directly from borrower interest payments. Unlike standard DeFi lending pools, where interest is paid per block, Teller’s yield is distributed equally to lenders at the exact time of each loan repayment. Note: if there is no borrowing activity on a specific pool, then there will be no base yield generated for that pool at that time.

As borrowers repay their loans to the pool, the interest they pay is distributed to lenders at the time of repayment. This yield is calculated based on the current pool utilization ratio at the time each loan is repaid.

Because of this, the yield fluctuates, ranging from 20–60% APY depending on how much liquidity is available and how much of it is being borrowed at the time of each loan repayment.

2. Integrated DeFi Protocols

Additionally, many Teller pools are backed by DeFi protocols like Yearn, Moonwell, Harvest, and Wasabi. When you supply liquidity to these pools, Teller automatically routes your assets to the underlying protocol.

This means your dry powder is earning passive income while you wait to deploy it onchain.

3. Staking Rewards

Staking rewards are paid by Teller to bootstrap liquidity on selected pools. Supply and stake your assets to start earning rewards per block. You can claim and restake rewards at any time.

When liquidity reaches $100K per pool, the incentive yield will gradually decline as the pool begins to scale organically.

Can I borrow using my supplied assets?

Yes. When an onchain opportunity appears, you can quickly deploy your assets using no-liquidation loans.

Teller loans are unique and do not use price oracles, leaving you insulated from mispricing events, scam wicks, and forced liquidations.

How does Teller protect against liquidations?

Teller loans are perpetual and built around 30-day rollover checkpoints. That means during each 30-day interval, you cannot be liquidated.

At each checkpoint, you pay the interest due and adjust the TVL of your loan. Teller then flash-loans the collateral, and you can choose to repay or roll over the loan for another 30 days.

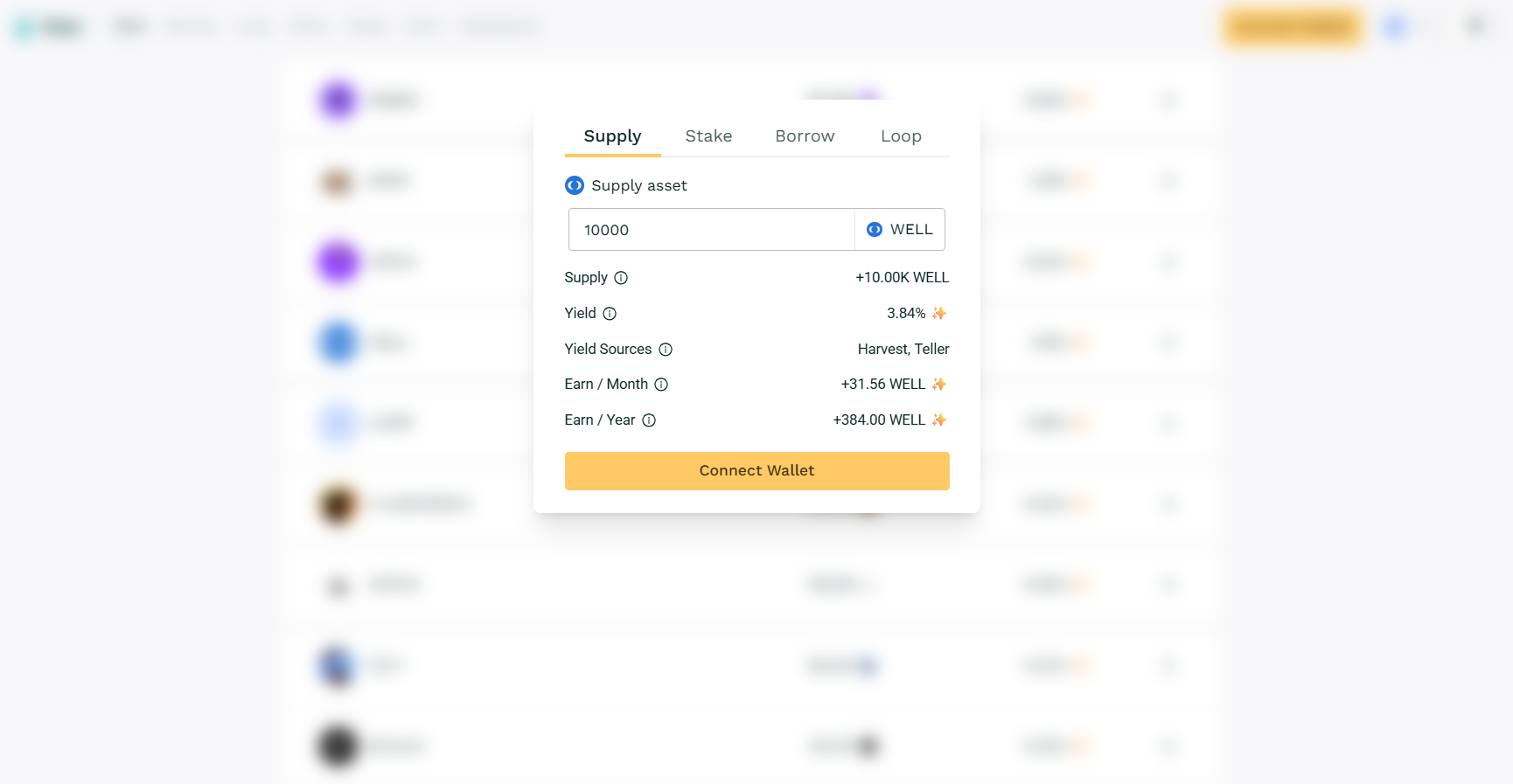

Start Earning with $WELL

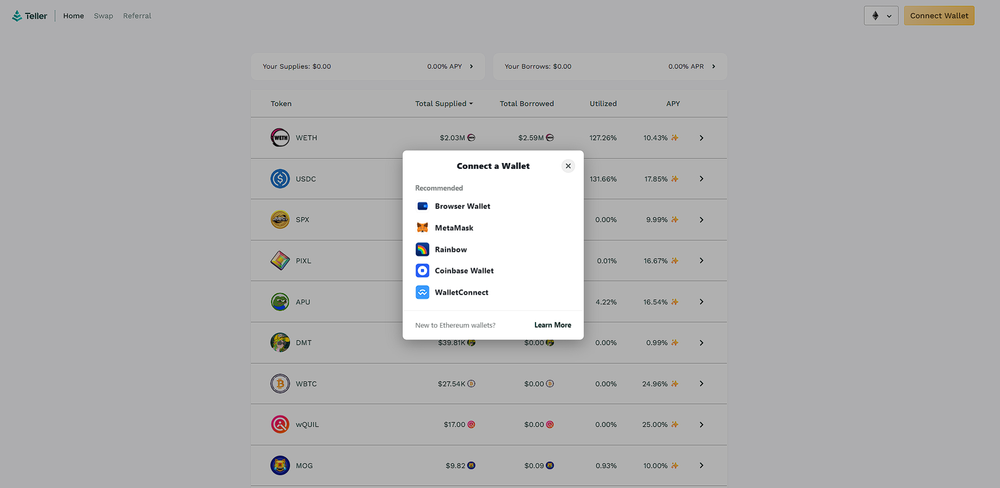

2. Connect your wallet and switch to Base Network

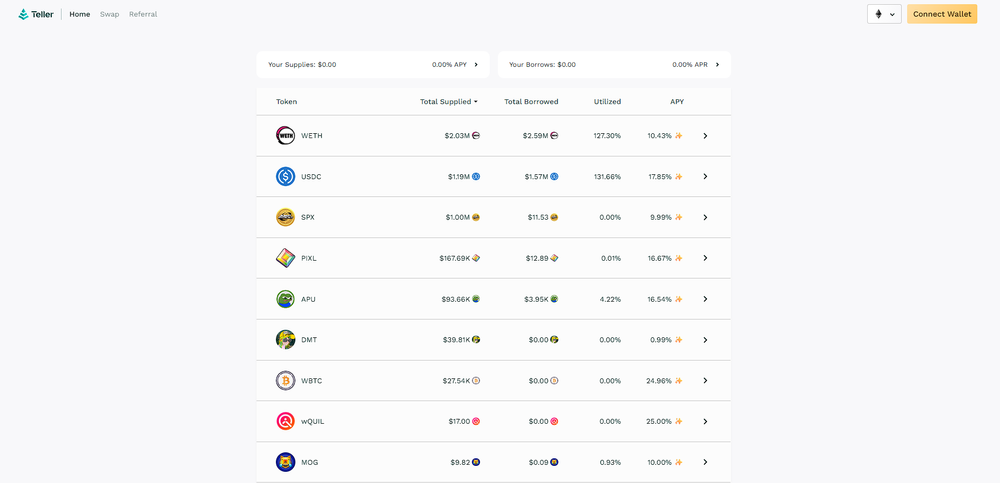

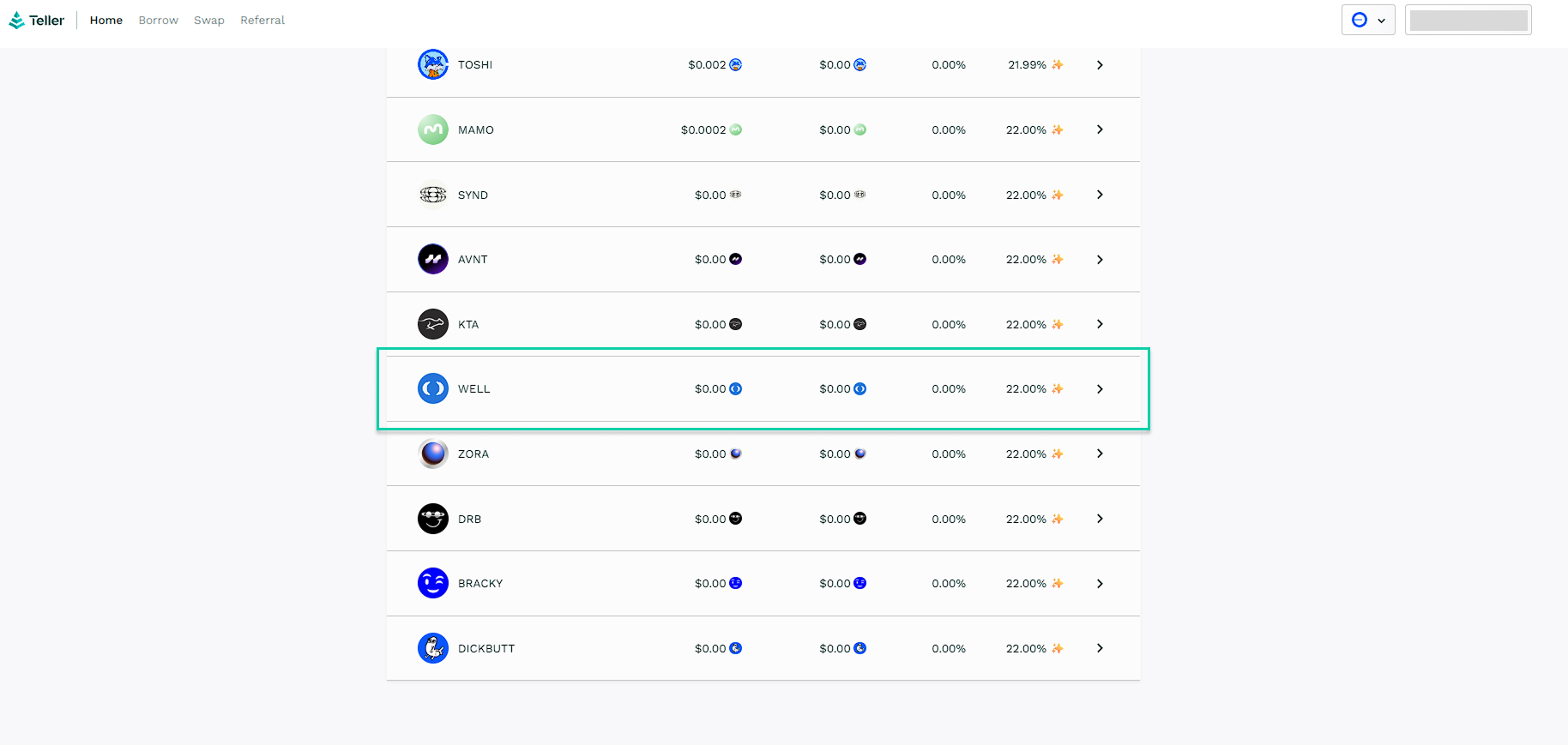

3. Select the $WELL lending pool

4. Deposit and start earning compounding yield