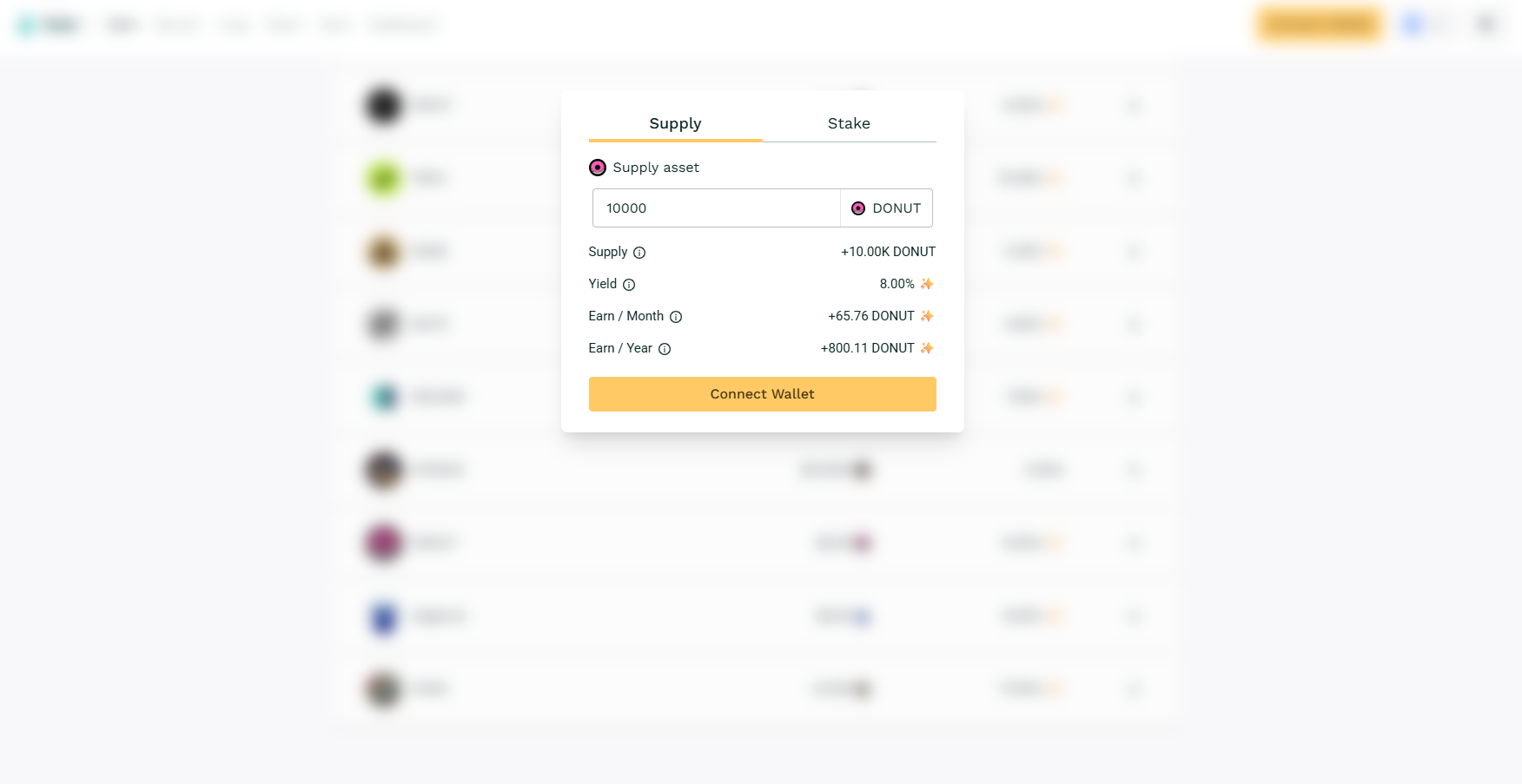

Got $DONUT? Earn Up to 12% Yield on Teller

Are you holding $DONUT on Base?

Lend on Teller and start earning up to 12% compounding yield.

No impermanent loss. No pairing. Withdraw anytime.

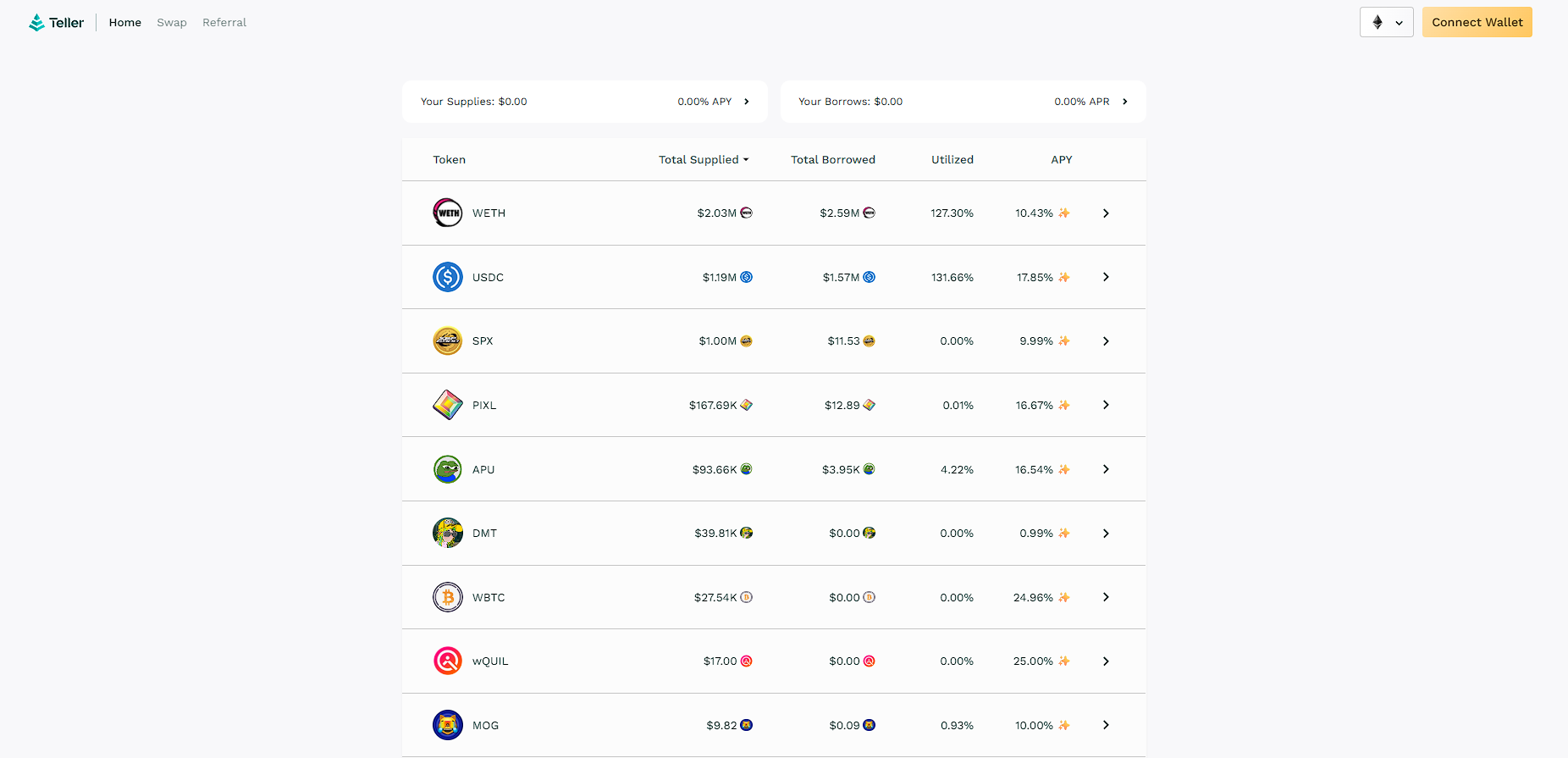

How Does Teller Work?

Teller is your new home base for earning yield on stables and long-tail assets.

Join over 250k active users today and start earning up to 12% yield on Ethereum, Base, Arbitrum, and Hyperliquid.

The thesis is simple: No one should be limited to a small number of assets when lending and borrowing. Teller is a permissionless protocol designed to unlock liquidity and passive income on any asset.

Lenders deposit a single token and earn more of that same token, without dual-asset exposure or the risk of impermanent loss. Borrowers unlock liquidity on a range of assets without worrying about liquidations.

What is DONUT?

$DONUT is a store-of-value token on Base, mined through a continuous Dutch auction instead of proof-of-work or staking. Auction revenue increases $DONUT's liquidity and scarcity.

Treasury ETH is used to buy and burn DONUT-WETH LP in the Blazery. Once sufficient liquidity is established, the Glazery can be upgraded to buy and burn $DONUT directly, or governance can decide to acquire other assets or reinvest the treasury.

Think of DONUT as "Digital Gold for Base"

Just like Bitcoin became a store of value by having a fixed supply and requiring work to mine, DONUT achieves scarcity through fair mining that anyone can participate in, with no expensive hardware required.

Zero Pre-Mine

No team allocation, no VC presale, no insider advantages. Every single DONUT was earned through mining or bought on the open market.

Capital-Backed Issuance

New DONUT tokens are only minted when real ETH is deployed by miners. If no one mines, no new DONUT is created.

Deflationary Mechanics

Protocol fees are used to buy back and burn DONUT tokens, creating a shrinking supply instead of constant inflation.

Where does the yield come from?

Teller yield is generated in 3 different ways: borrower interest payments, underlying protocol yield, and staking rewards.

With all 3 of these methods, there is no impermanent loss, and you can withdraw your assets at any time without penalty.

1. Borrower Interest Payments

The “base yield” from Teller pools comes directly from borrower interest payments. Unlike standard DeFi lending pools, where interest is paid per block, Teller’s yield is distributed equally to lenders at the exact time of each loan repayment. Note: if there is no borrowing activity on a specific pool, then there will be no base yield generated for that pool at that time.

As borrowers repay their loans to the pool, the interest they pay is distributed to lenders at the time of repayment. This yield is calculated based on the current pool utilization ratio at the time each loan is repaid.

Because of this, the yield fluctuates, ranging from 20–60% APY depending on how much liquidity is available and how much of it is being borrowed at the time of each loan repayment.

2. Integrated DeFi Protocols

Additionally, many Teller pools are backed by DeFi protocols like Yearn, Moonwell, Harvest, and Wasabi. When you supply liquidity to these pools, Teller automatically routes your assets to the underlying protocol.

This means your dry powder is earning passive income while you wait to deploy it onchain.

3. Staking Rewards

Staking rewards are paid by Teller to bootstrap liquidity on selected pools. Supply and stake your assets to start earning rewards per block. You can claim and restake rewards at any time.

When liquidity reaches $100K per pool, the incentive yield will gradually decline as the pool begins to scale organically.

Can I borrow using my supplied assets?

Yes. When an onchain opportunity appears, you can quickly deploy your assets using no-liquidation loans.

Teller loans are unique and do not use price oracles, leaving you insulated from mispricing events, scam wicks, and forced liquidations.

How does Teller protect against liquidations?

Teller loans are perpetual and built around 30-day rollover checkpoints. That means during each 30-day interval, you cannot be liquidated.

At each checkpoint, you pay the interest due and adjust the TVL of your loan. Teller then flash-loans the collateral, and you can choose to repay or roll over the loan for another 30 days.

Start Earning with $DONUT

2. Connect your wallet and switch to Base

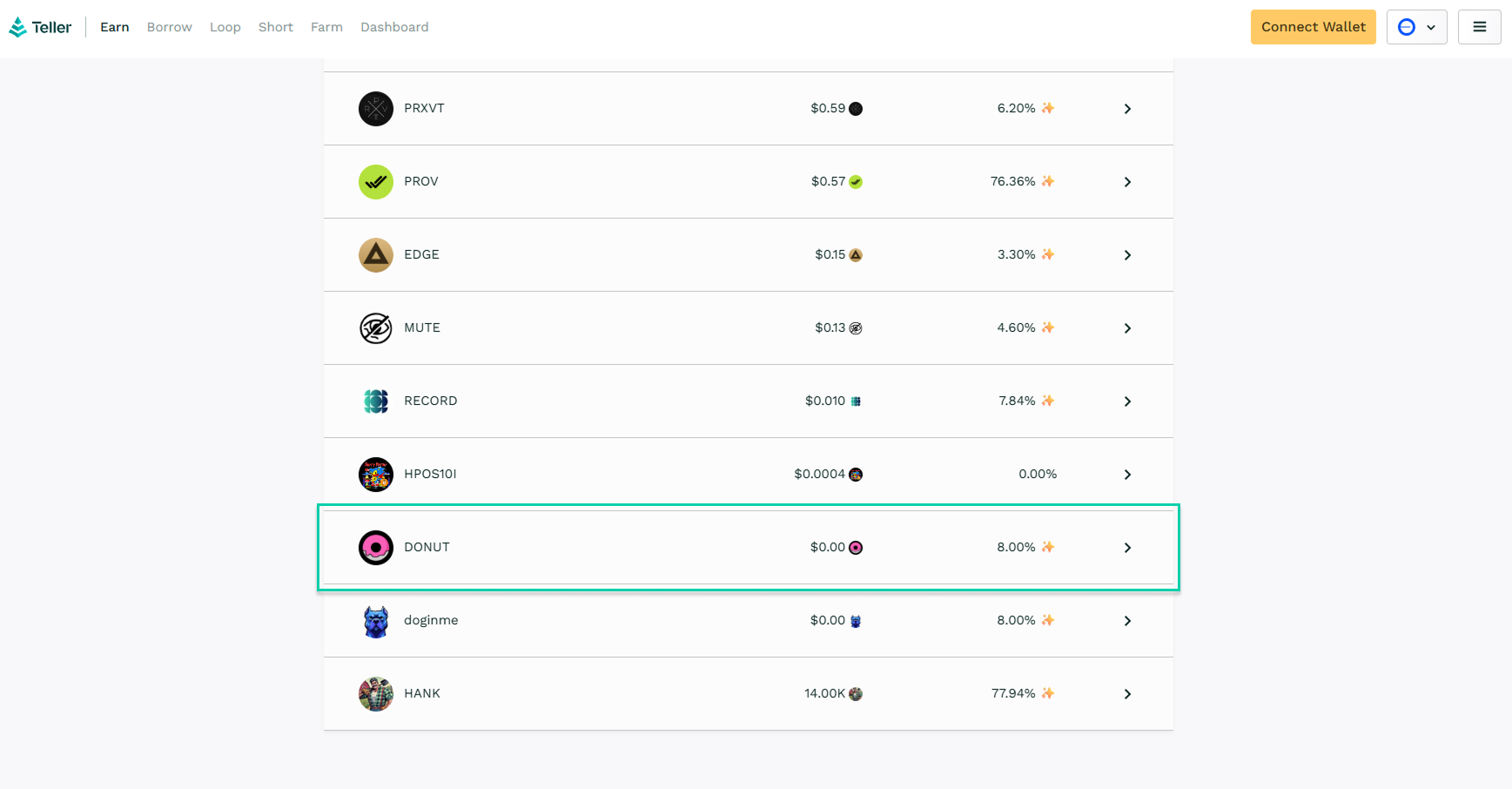

3. Select the $DONUT lending pool

4. Deposit and start earning compounding yield