Introducing: Perpetual, No Margin-Call Loans

In crypto, margin calls and forced liquidations have caused more pain than almost anything else. A small dip in price becomes a death spiral. Traders panic. Smart contracts auto-sell. And billions vanish in minutes.

But what if one could borrow—without ever worrying about liquidation?

No price alerts.

No forced collateral liquidations.

No stress.

With Teller’s new Perpetual, No Margin-Call Loans, that’s now possible.

💡 What is a Perpetual, No Margin-Call Loan?

Teller’s loan model is built for long-term users who want flexible debt without forced liquidation risk. Here’s how it works:

- Deposit crypto collateral.

- Borrow stablecoins (like USDC) or WETH.

Debt can be held forever—perpetually—as long as one condition is met:

🌀 Borrower's periodically "roll over" collateral to keep the Loan-to-Value (LTV) in check.

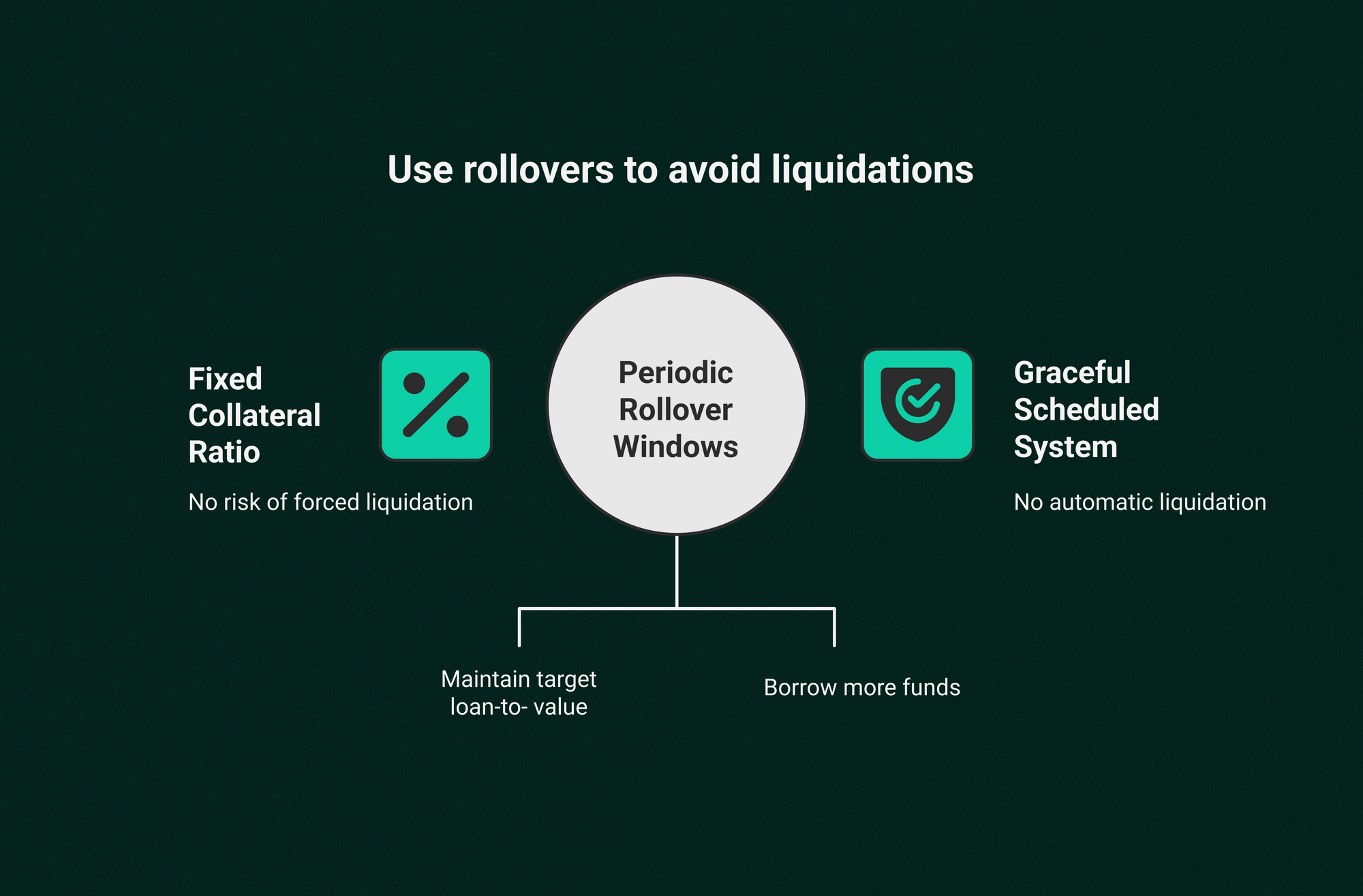

🔁 No Margin Calls. Just Scheduled Collateral Adjustments.

Traditional crypto loans require maintaining a fixed collateral ratio, like 150%. If the collateral value drops below the threshold, it’s forcibly liquidated.

Teller introduces a graceful, scheduled system:

Instead of margin calls, loans have periodic Rollover Windows (e.g. every 30 days).

During the window, a borrower can either top up or withdraw collateral to maintain the loan’s target LTV (e.g. 60–70%).

If the collateral grew in value, a borrower can withdraw excess or borrow more.

If it dropped, the borrower must top it up—within the rollover window, but without automatic liquidation.

That’s it.

🌲 No More Forced Liquidations

Forced liquidations are brutal, especially for low liquidity coins, where a single liquidation can crash the whole market. In June 2025, over $1.1 billion in liquidations occurred in a single day, triggering cascading sell-offs and massive slippage—most of which were automated.

Teller's model eliminates this entirely:

🧱 The position is isolated in a vault.

⏳ Borrowers control their rollover timing.

🧘 No margin calls, ever.

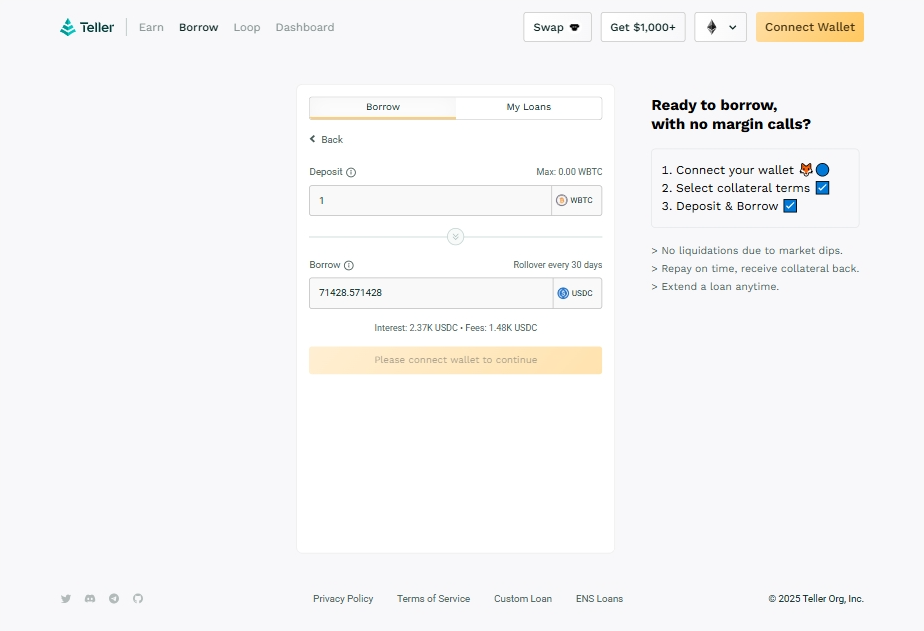

🏧 Get Cash at the Teller ATM

Teller works like a crypto-native ATM:

- Deposit assets like ETH, WBTC, or stables.

- Instantly borrow against them.

Use the cash for real-world expenses, yield farming, or any onchain activity.

Want to extend a loan? Just roll over collateral, and keep going.

⏱️ Set & Forget. Borrow and Live Life.

No margin monitoring.

No sudden liquidations.

Just a loan, collateral, and a time horizon.

📊 Why This Matters: Market Context

In 2022–2025, forced liquidations were responsible for billions in lost value, especially during events like Terra’s collapse and flash crashes.

Even low-LTV users were affected, as liquidation cascades caused collateral prices to spiral down.

DeFi needs a calmer, more user-friendly debt systems—and perpetual loans offer exactly that.

✅ Feature Recap

| Feature | Benefit |

|---|---|

| No margin calls | Never lose collateral automatically due to price drops. |

| Perpetual structure | Keep a loan indefinitely. |

| Rollover-based collateral mgmt | Adjust collateral manually during scheduled periods. |

| Collateral isolation | One vault per loan. No cross-position risk. |

| Borrow in stablecoins | Instantly access liquid capital. |

🌍 The Future of Borrowing is Calm

Teller’s Perpetual Loan system isn’t just an upgrade—it’s a rethinking of what crypto borrowing should be:

Peaceful.

Predictable.

Personalized.

So go ahead—get cash at the Teller ATM 🏧, set it, forget it, and live life.

DeFi debt is no longer a time bomb. It’s a tool.

And now, it’s finally on pre-determined terms.

Want to learn more or try out no margin-call loans?

👉 Visit teller.org