Instant Liquidity For all Tokens

Teller v2 Overview

On Teller, you can borrow against any token in your wallet with fixed duration loans.

Teller loans are protected from market volatility because health factors and oracles are replaced with isolated liquidity order books. That means, if you make a payment on time, there is zero chance of liquidation.

Here's a quick breakdown of how to leverage any token as collateral on Teller:

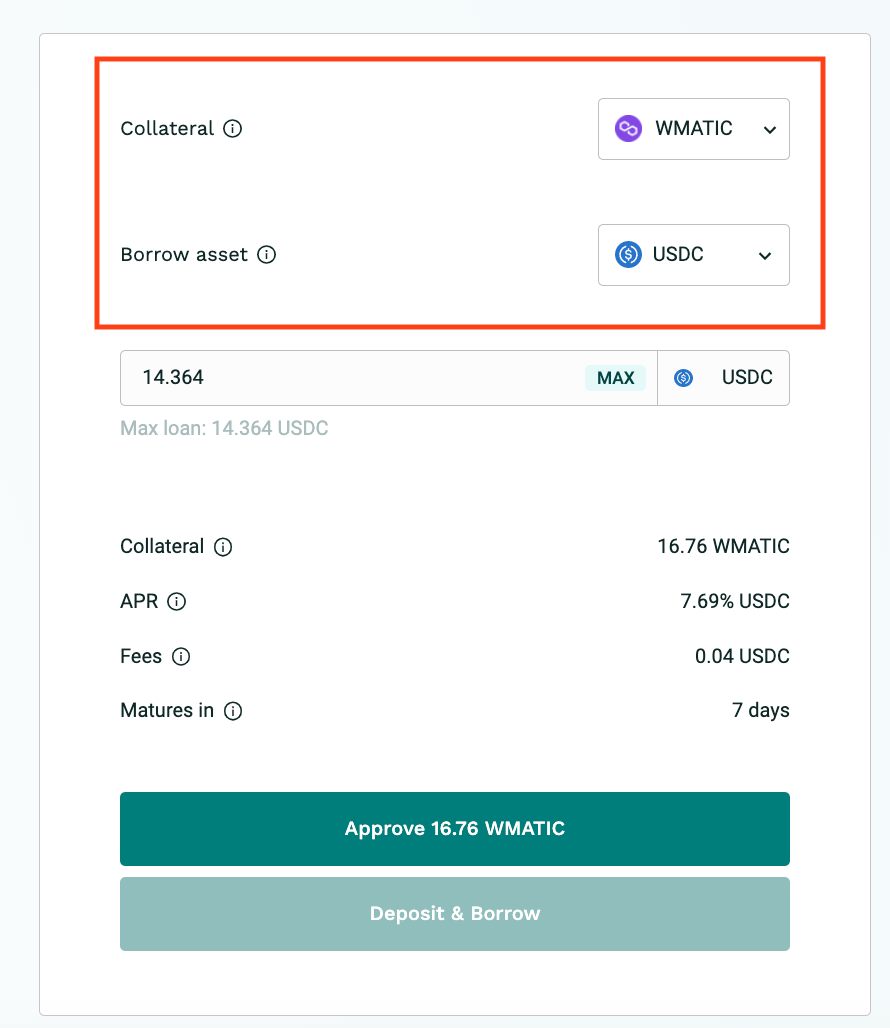

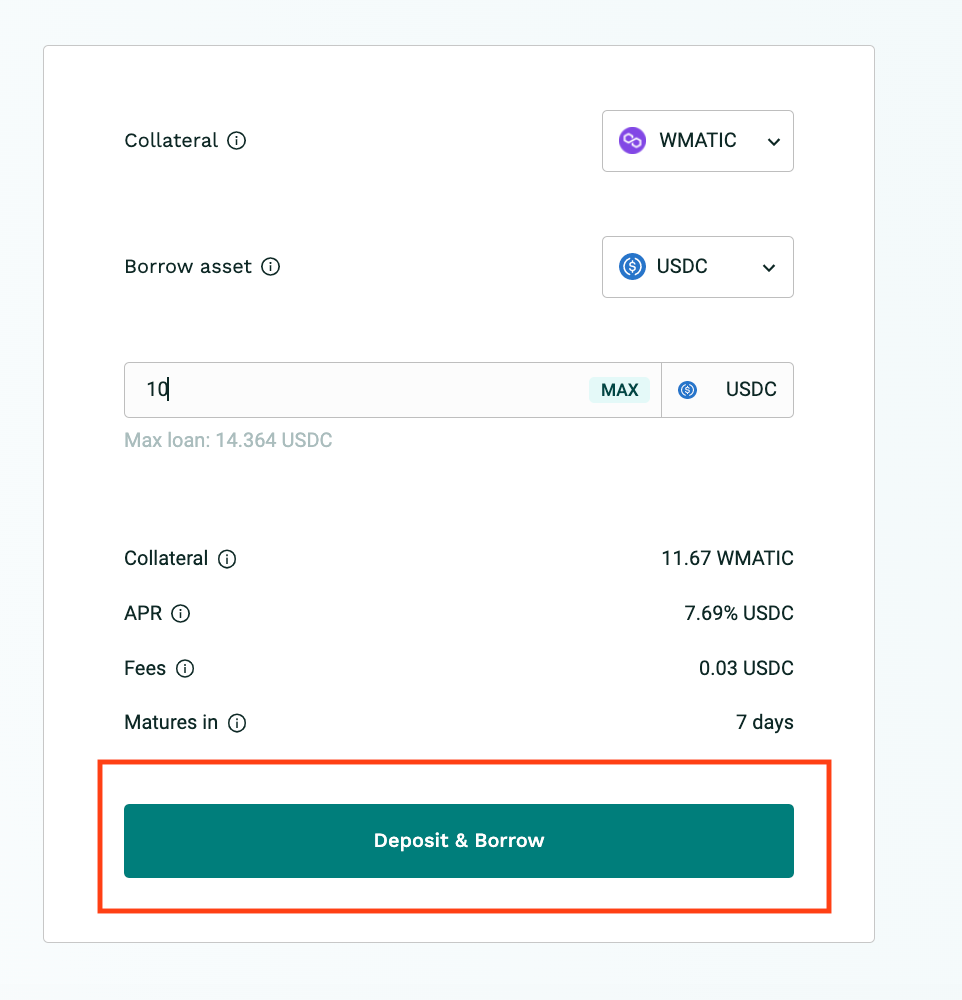

Step 1

Select an asset as collateral (any ERC-20, ERC721, ERC1155) and select a borrow asset (USDC, USDT, wETH, DAI).

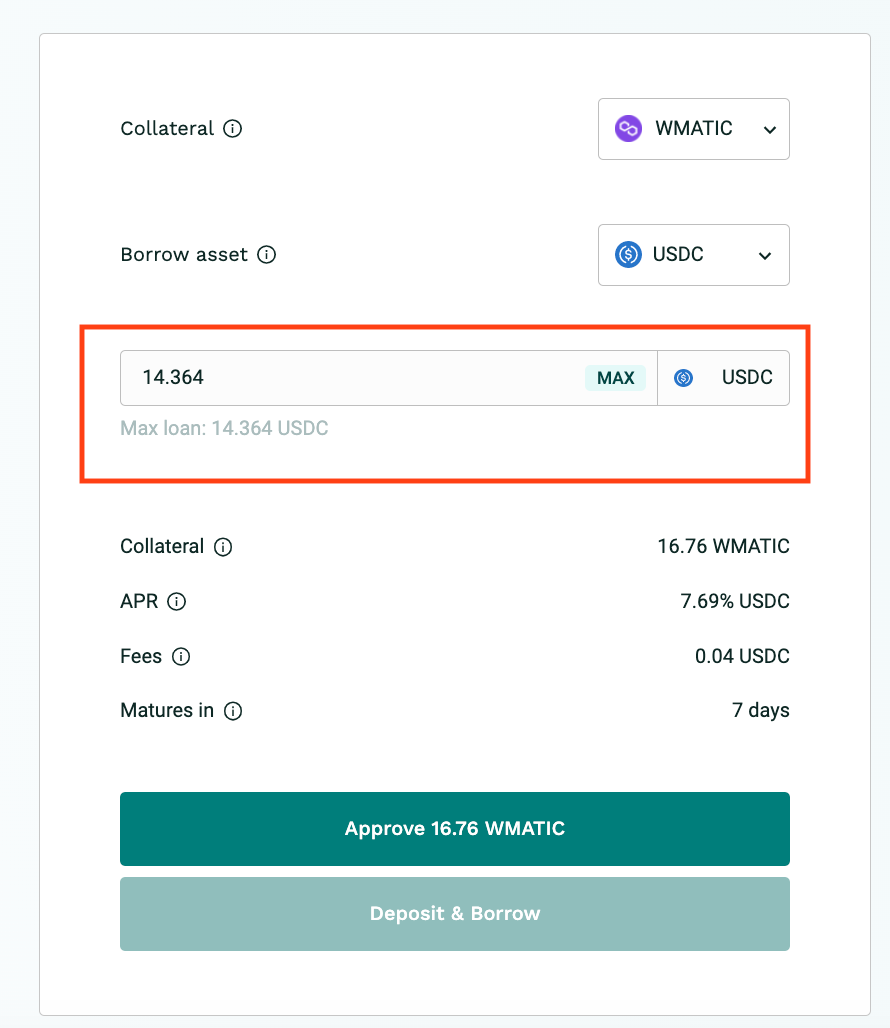

Step 2

Type in the amount to borrow.

For instant loans, loan duration, APR, and collateral LTV are set by LPs and can not be modified.

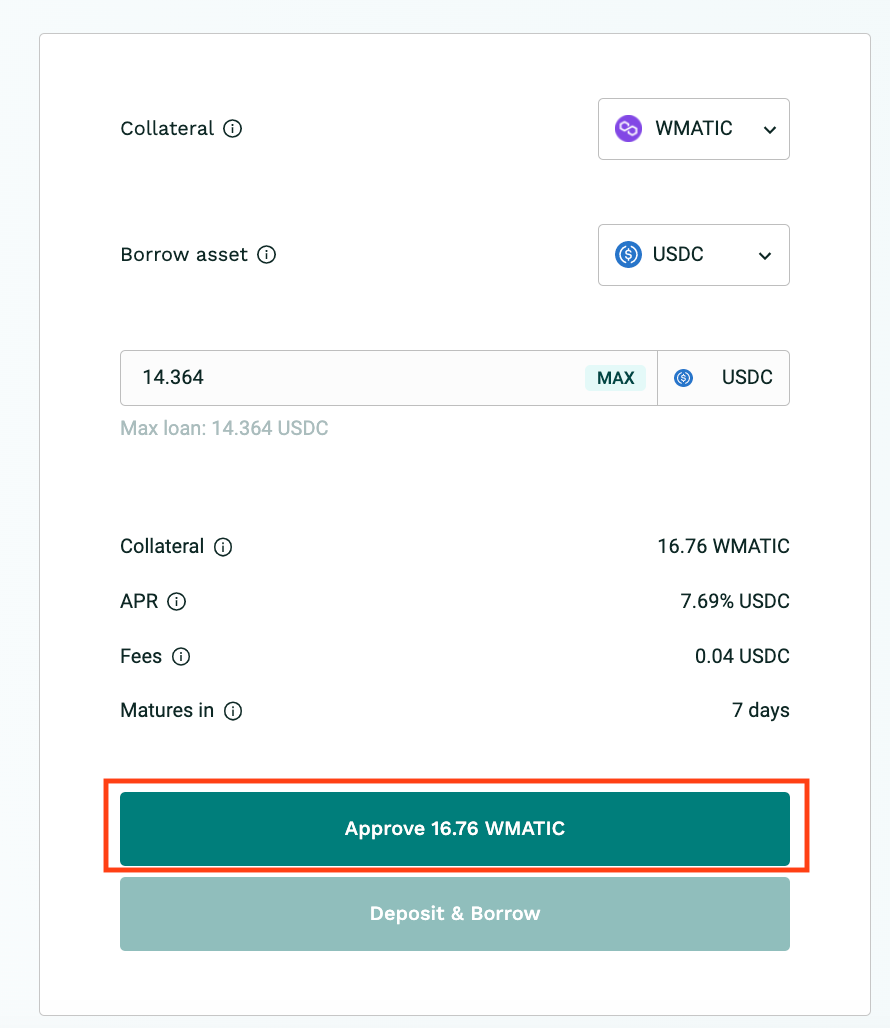

Step 3

Approve the collateral in your wallet

Step 4

Click Deposit & Borrow

Step 5

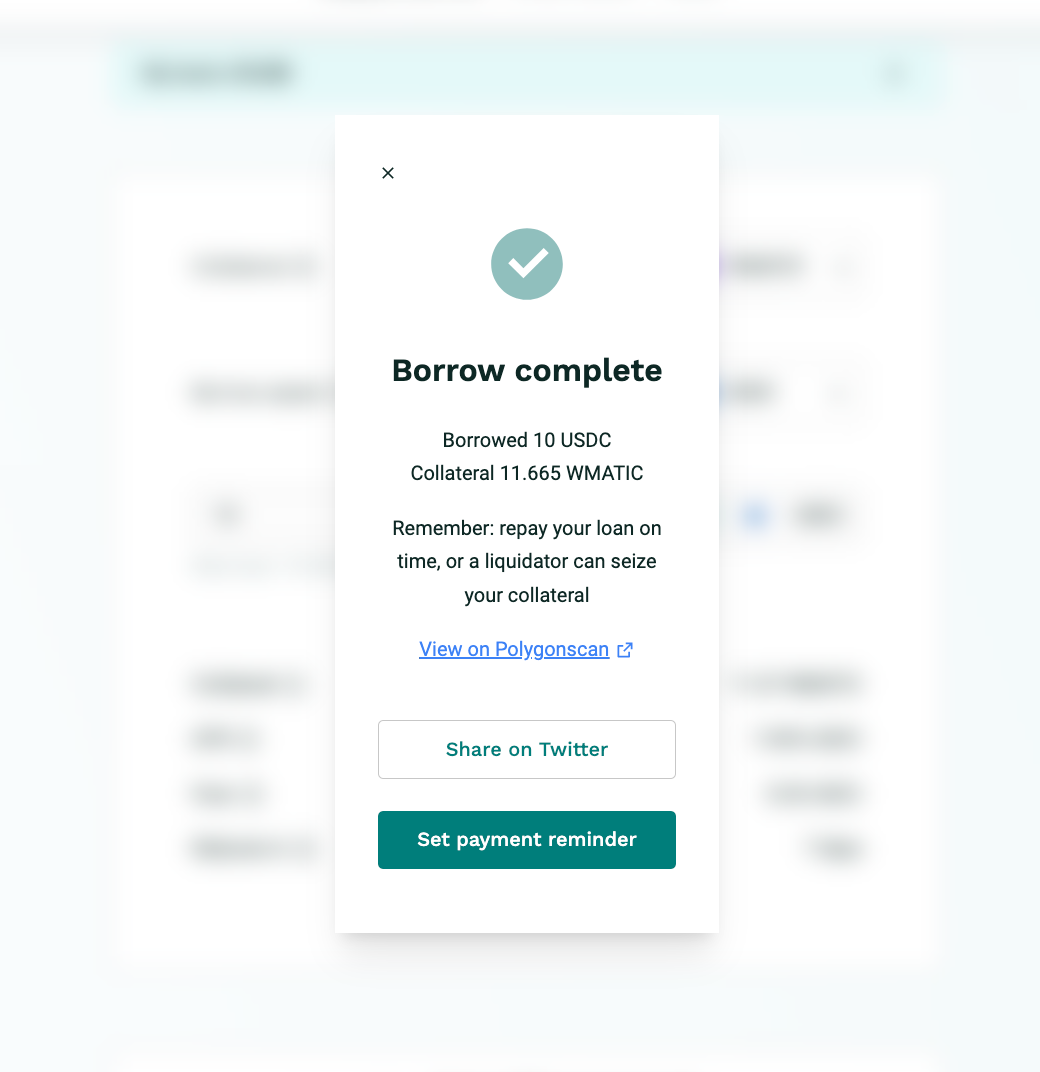

Success!

You can use your loan freely across DeFi. But remember, Teller loans have time based liquidations. This means, if you miss a payment, you’ll lose 100% of your collateral.

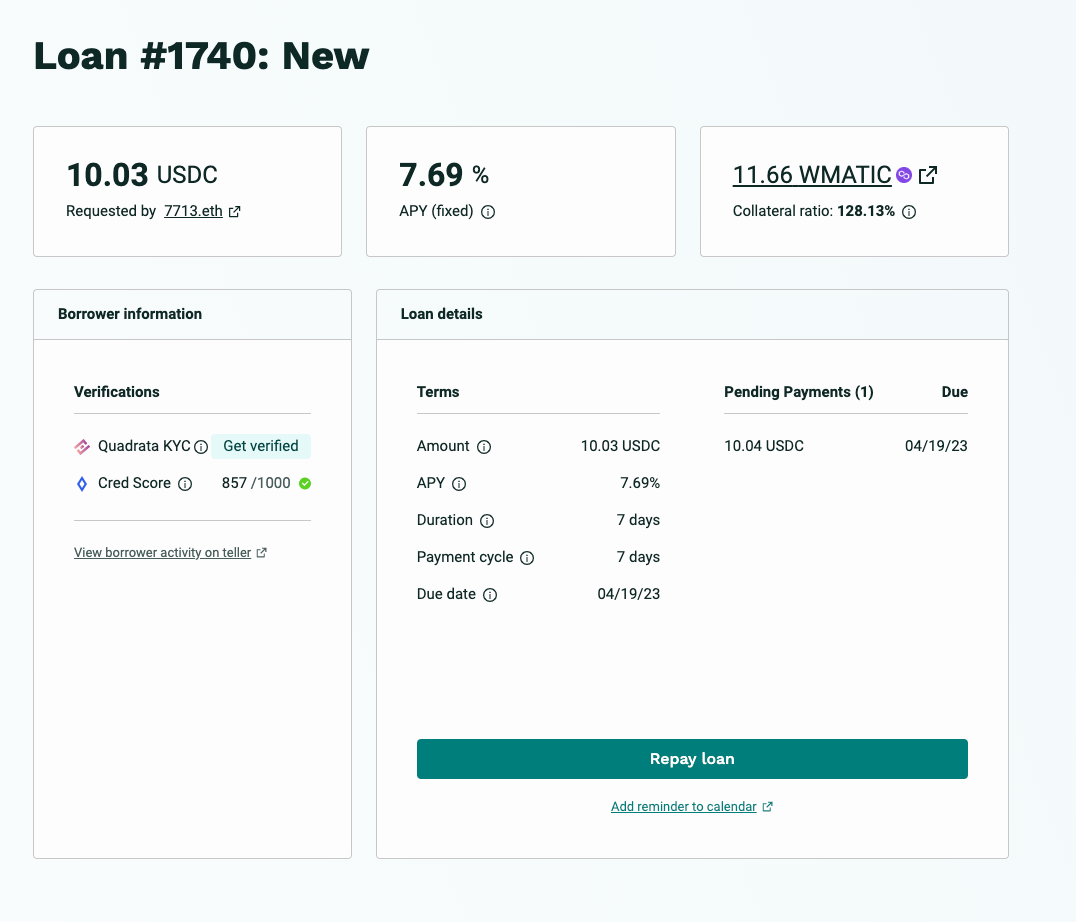

You can view individual loans by clicking on a loan in the My Loans tab: Here

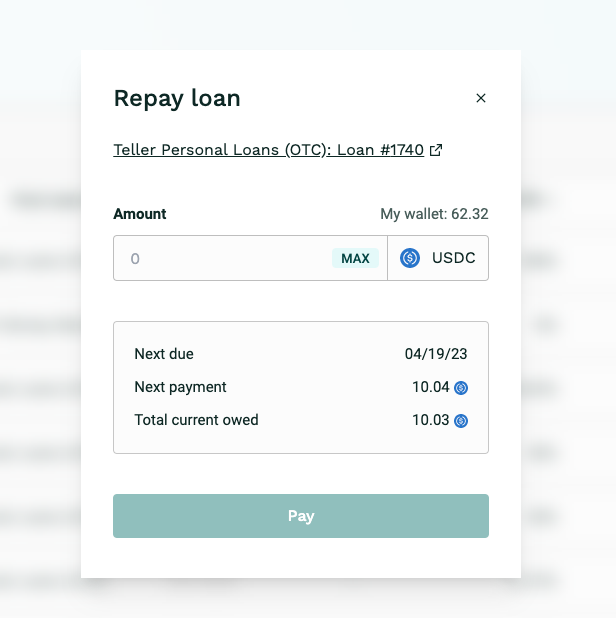

Loan Repayment

Your loan payment schedule can vary based on the pool owner and liquidity providers (LPs) pre-set terms. You can make your scheduled loan payments either in the My Loans tab or on individual loan pages. You can also make additional payments or pay off the loan early.

Remember, if a loan defaults, a liquidator can repay the loan and seize all of the collateral associated with the loan.

Teller V2 is in alpha. Limited access is available for select community partners.

📃 Teller V2 Docs – https://teller.gitbook.io/teller-lite/

🔒Github – https://github.com/teller-protocol

👾 Discord – https://discord.com/invite/teller

🐦 Twitter – https://twitter.com/useteller

🖥️ Teller App – https://alpha.app.teller.org