Borrow & Earn Without Liquidations: How Teller Works

If you’ve ever been nervous about borrowing using your digital assets, you’re not alone. Most people worry that if prices dip, their collateral could be sold without warning. Teller changes that.

Teller is offering a new primitive: perpetual loans without liquidations. That means borrowers can access liquidity using their digital assets—from Bitcoin and Ethereum to long-tail community tokens like $SPX, $APU, and $PEPE —without fear of being liquidated due to market volatility.

Unlike traditional lending markets, Teller is permissionless, which means any Ethereum asset can be used to borrow or lend. No whitelist, no gatekeepers.

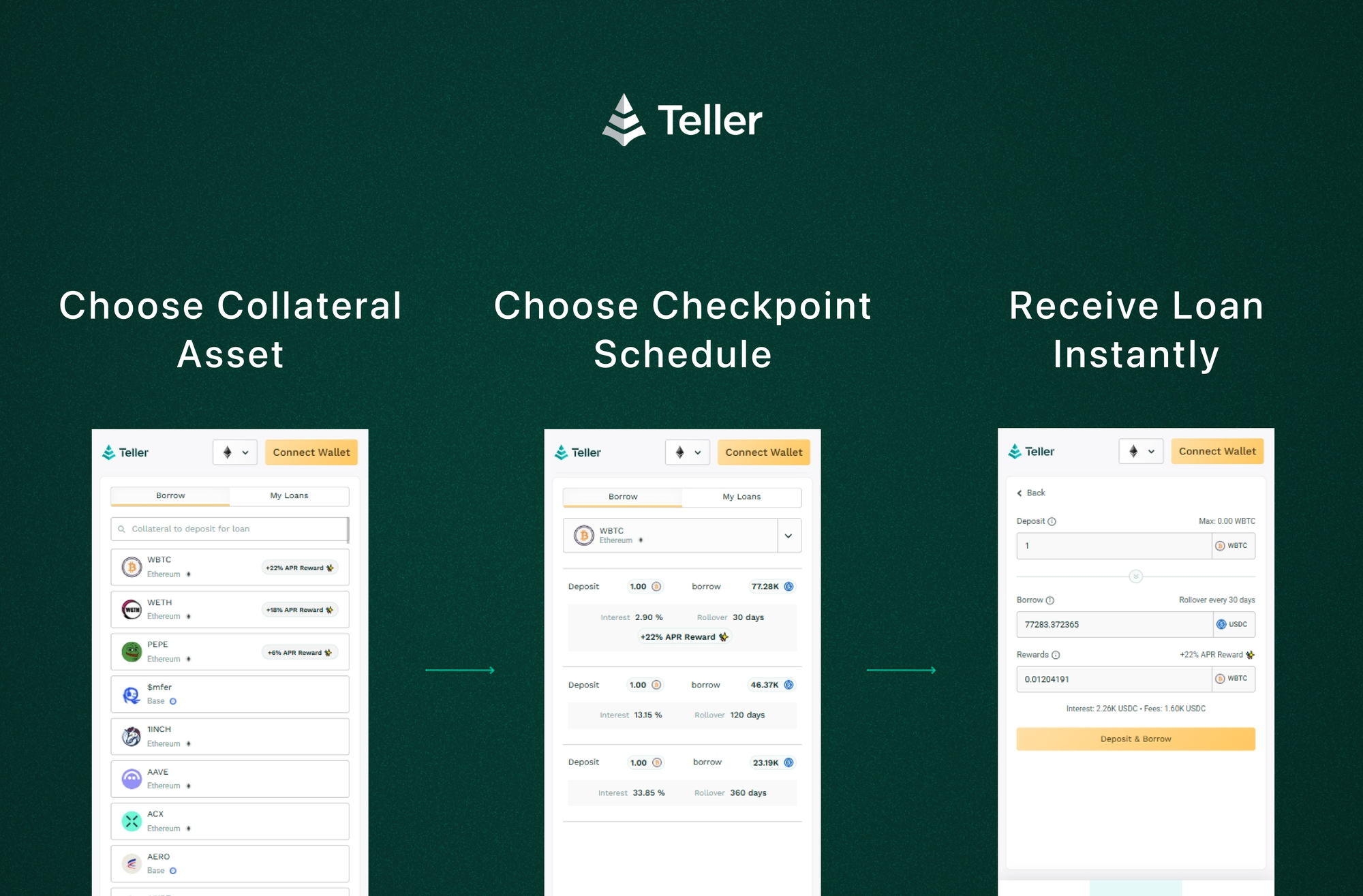

How It Works

Teller loans are structured around rollover checkpoints, not price triggers. As long as borrowers make their interest payments at the designated checkpoint, the loan continues. If they miss a checkpoint, the loan defaults and the collateral is auctioned.

There are no margin calls. No liquidations based on price movements. No need to top up collateral mid-loan. And rollover happens automatically using a flash loan, so there’s no need to repay the principal or manually reopen a new loan.

If the collateral value has dropped, borrowers can choose to top it up during the checkpoint. If it’s stable or increased, nothing changes. The loan is refinanced and continues seamlessly.

Why It Matters

- Predictable borrowing: No sudden collateral sales due to price dips.

- Long-term peace of mind: Hold through volatility without forced exits.

- Keep your upside: If your collateral appreciates, you keep the gains.

- Flexible structure: Loans stay open indefinitely with checkpoint payments.

- Borrow with confidence: Manage risk on your terms, not the market’s.

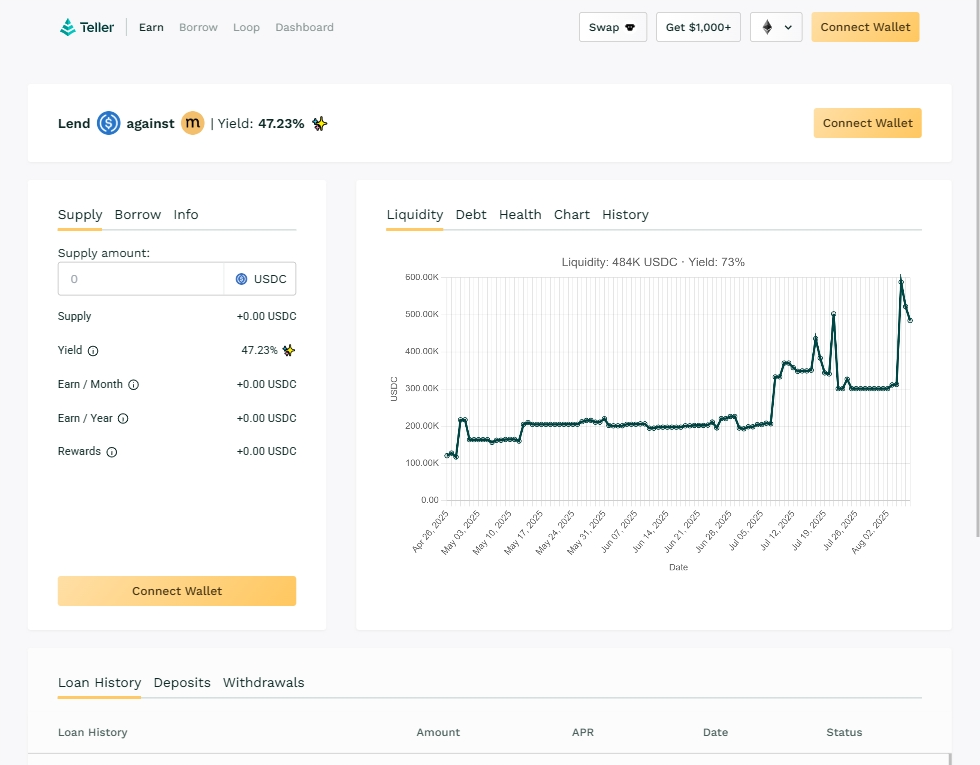

For Lenders

Teller is just as compelling. Lenders deposit assets like $USDC, $WBTC, or $cbBTC into isolated pools. Their yield comes directly from borrower interest payments. This translates to:

- No impermanent loss

- No paired asset exposure

- Single-sided pools only

- No manual claiming, yield compounds automatically

Every pool is single-sided, and risk is isolated. If a borrower defaults, the overcollateralized position is sold in an on-chain auction, and proceeds are returned to the pool.

Example: Traditional vs. Teller

Traditional money markets (e.g. Aave, Morpho, Compound): Deposit $10,000 in ETH to borrow $5,000. If ETH drops 30%, the position is auto-liquidated. You lose your collateral even if it recovers the next day.

Teller: Deposit $10,000 in ETH to borrow $5,000. If ETH drops 30%, the loan continues as long as you pay your interest. If ETH rebounds, your full collateral is still intact.

Use Cases That Save You Time and Money

- Rebalance positions on Aaave, Morpho, or Compound by borrowing stables

- Borrow the other side of an LP position, without selling assets

- Loop positions (e.g. borrow on $BTC to buy more $BTC)

- Establish an onchain credit line to use for everyday purchases

The Bottom Line

Teller makes borrowing predictable. No liquidations. No stressful chart watching. Just a clear, checkpoint-based system where users stay in control.

Whether you’re interested in earning yield or borrowing for flexibility, click here to get started today.