Earn 22% Compounding Yield on $HYDX

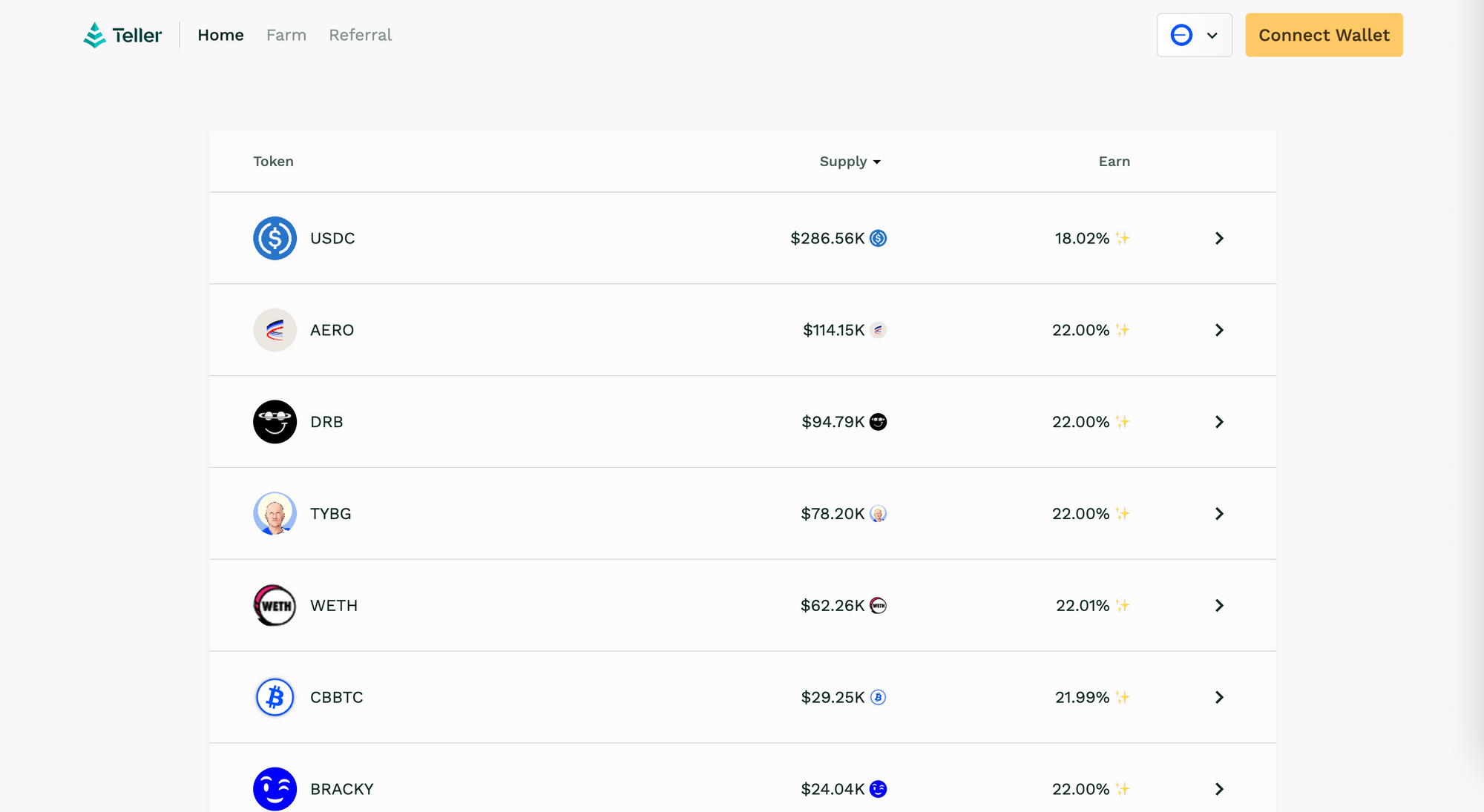

Teller has launched its Base rewards incentive program!

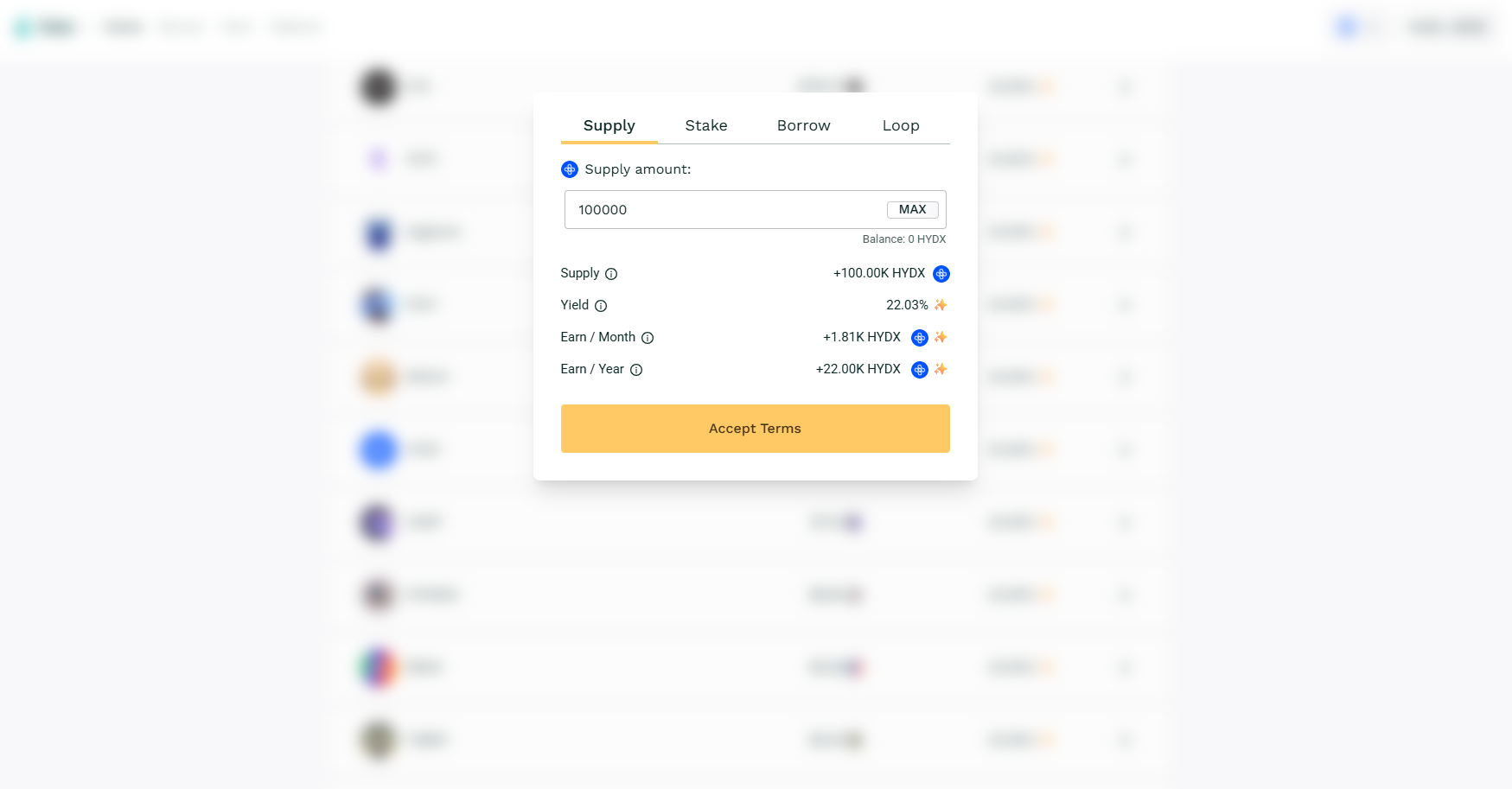

You can now supply and stake your $HYDX on Teller to earn 22% APY per block.

No lockups. Withdraw anytime. No impermanent loss.

Stake $HYDX = Earn more $HYDX automatically. No gimmicks or weird LST.

What is Teller?

Teller is a lending protocol designed to earn yield on long-tail assets.

Each pool is isolated and has its own APY range, which fluctuates between 20–60% based on borrowing demand.

Lenders deposit a single token and earn more of that same token, without dual-asset exposure or the risk of impermanent loss.

What is $HYDX?

Hydrex is a MetaDEX and liquidity infrastructure purpose built for Base.

100% of the protocol revenue goes directly to token holders who vote on where they want emissions for liquidity to flow.

At Hydrex, the DeFi user journey is refined and simplified into fewer clicks to allow smarter routing and better capital efficiency all within a Base-native user experience.

This allows for the swaps to have optimal pricing and minimum slippage and for all users to easily earn regardless of their DeFi knowledge.

Where Does the Yield Come From?

The 22% APY is the base staking yield for each pool, paid by Teller as incentive rewards to bootstrap Teller on Base.

Supply and stake your tokens to start earning $HYDX per block.

When liquidity reaches $100K per pool, the incentive yield will gradually decline as the pool begins to scale organically.

But that's just the beginning...

As borrowing activity increases, the APY will range between 22% and 60%, depending on how much of the available liquidity is being borrowed at the time.

This additional yield comes directly from borrowers’ interest payments when they repay their loans to the pool.

How Does Teller Avoid Impermanent Loss?

Impermanent loss only occurs in liquidity pools, where assets are constantly rebalanced based on market movements.

Teller, on the other hand, operates on a peer-to-pool lending model and doesn’t use AMMs or traditional liquidity pools. Lenders supply assets, borrowers repay with interest, and there’s no automated rebalancing or price exposure.

This means your funds aren’t exposed to price shifts or impermanent loss, and you continue earning yield on the same asset you deposited — regardless of market swings.

How Do I Start Earning?

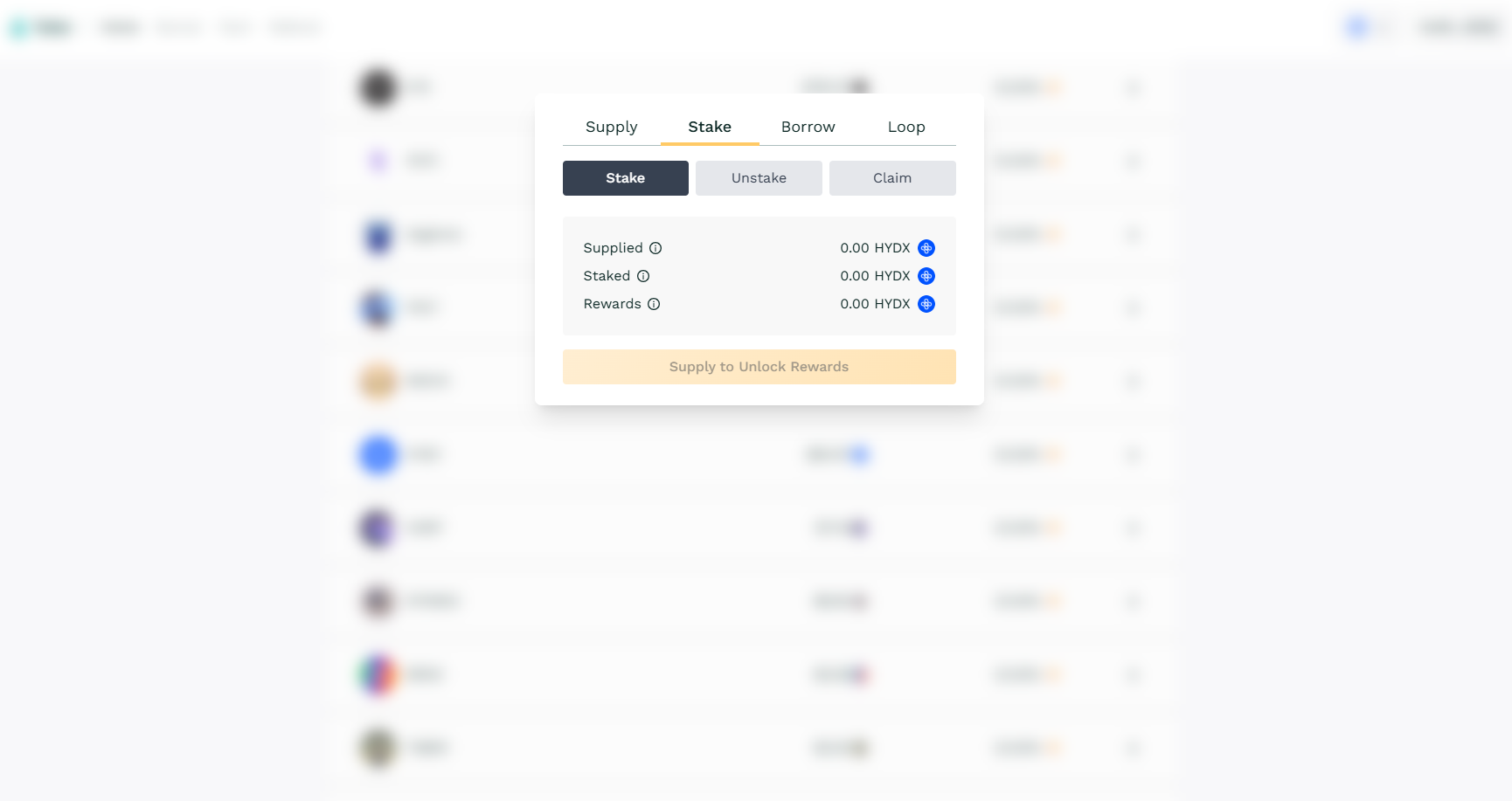

Step 1: View the Base pools on Teller: app.teller.org/base/earn

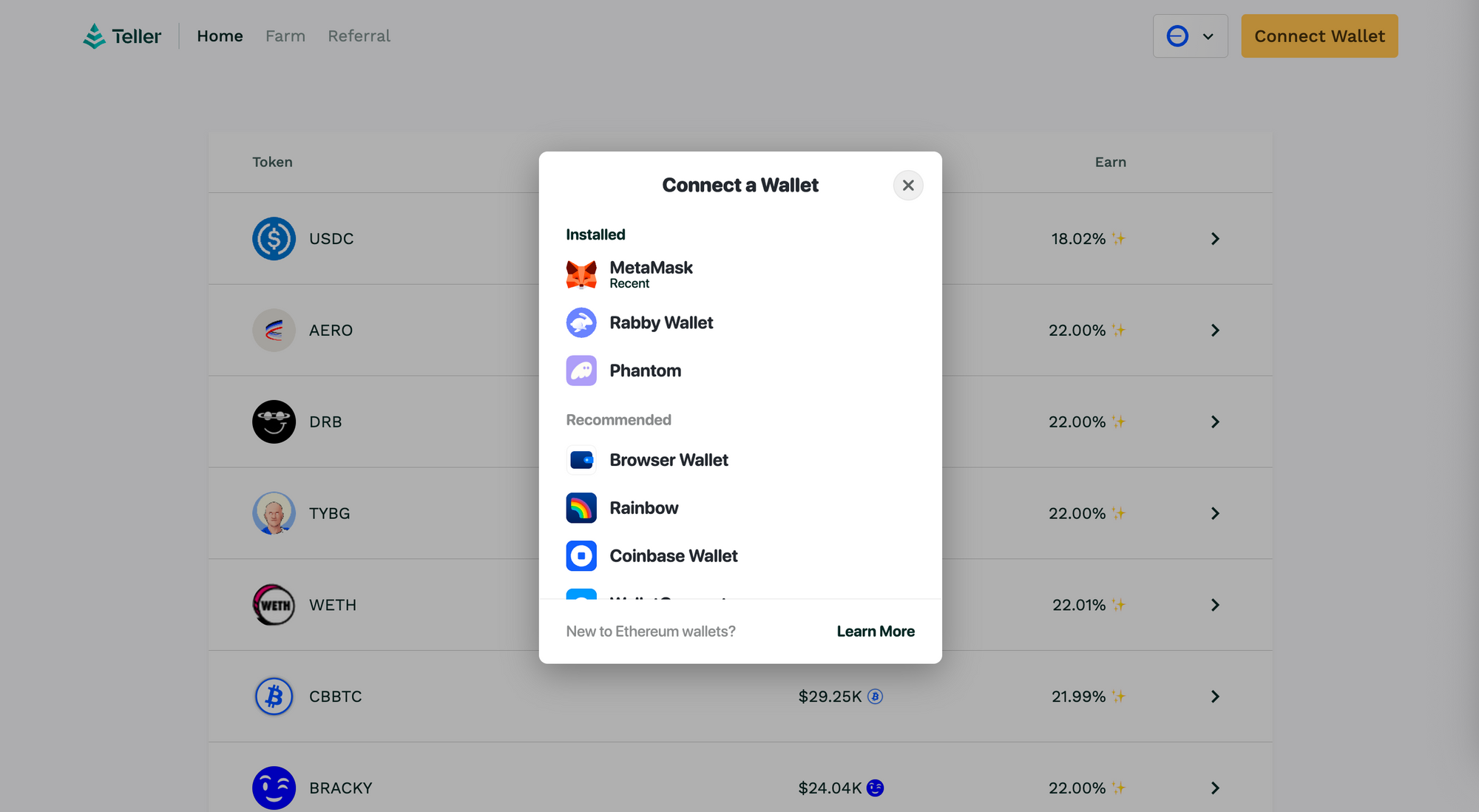

Step 2: Connect your wallet

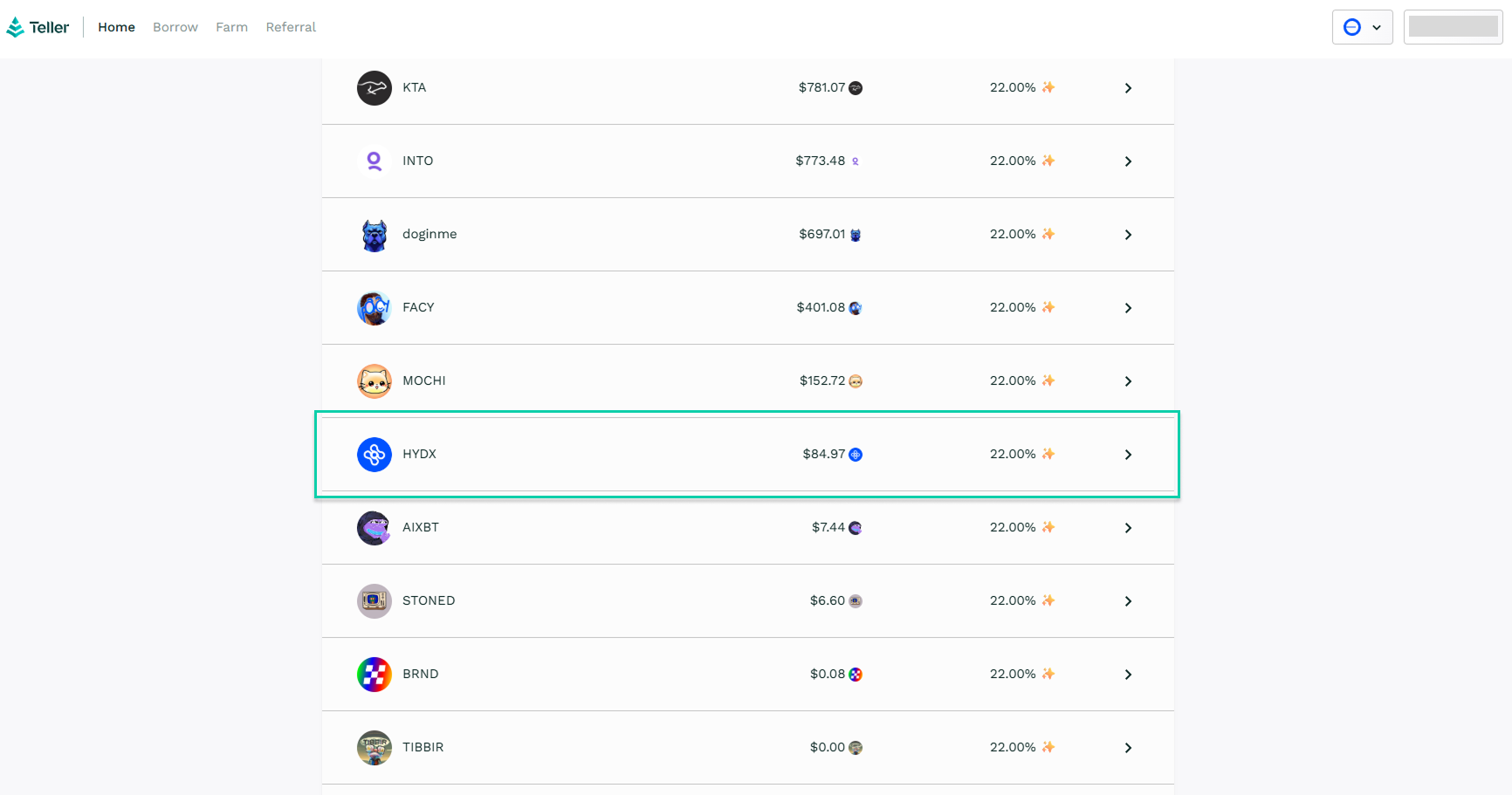

Step 3: Select the $HYDX lending pool

Step 4: Supply your tokens to the pool

Step 5: Stake your tokens to start earning 22% yield per block, withdraw anytime

Have any questions or feedback?

Shoot us a DM on X: https://x.com/useteller

Start earning here: app.teller.org/base/earn