Delta-Neutral: How to Profit Using Teller When Funding Rates Go Negative

Negative funding rates can create steady income if used in a delta-neutral strategy. When perp markets turn bearish, longs receive payments from shorts — turning volatility into yield.

The challenge has always been staying hedged without getting liquidated. Teller solves that.

Below is a simple explanation of how a delta-neutral funding-rate strategy works and why Teller’s no-liquidation design makes it practical.

Why This Matters Now

Negative funding appears most often during choppy or bearish markets, especially in long-tail assets. These periods can last days or weeks, creating windows where long perp positions consistently earn funding.

A delta-neutral setup lets a trader capture that yield without betting on direction.

What Negative Funding Means

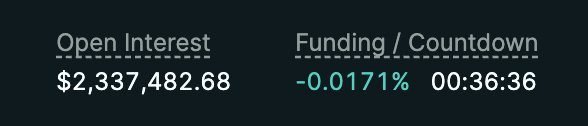

Perpetual futures use a funding payment to keep prices aligned with spot. When the perp trades below spot, funding goes negative.

In those periods:

- Shorts pay longs

- Long positions earn this funding rate

If the trade can stay neutral to price movements, traders can capture those payments without directional risk.

The key is hedging without margin calls.

Where Teller Fits In

Teller lets traders borrow assets against posted collateral and short them on spot — without real-time liquidations or margin requirements.

Loans have fixed terms and rollover checkpoints — no continuous collateral monitoring.

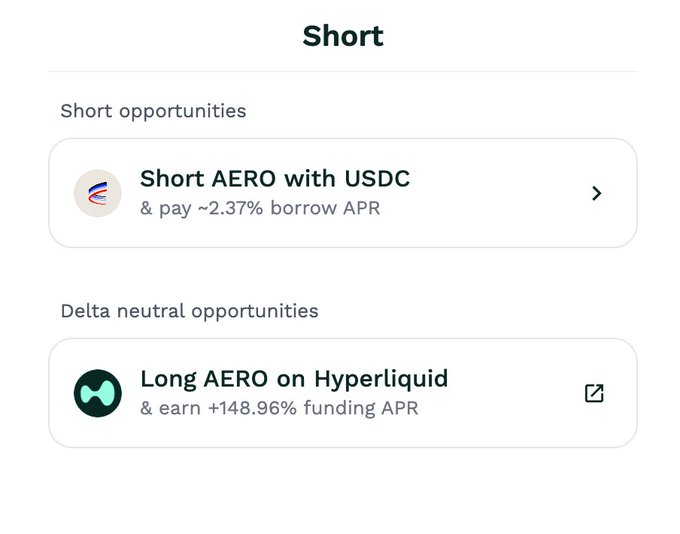

This makes the strategy simple:

- Long the perp to earn funding

- Borrow the asset on Teller

- Short the asset on spot to hedge

This neutralizes price exposure and earns the funding payment.

Because loans aren’t tied to intraday volatility, the hedge stays intact through price swings.

And since borrowing on Teller is single-asset, there’s no impermanent loss. There is no dual-asset pool, which would be exposed to price divergence.

A Simple Example

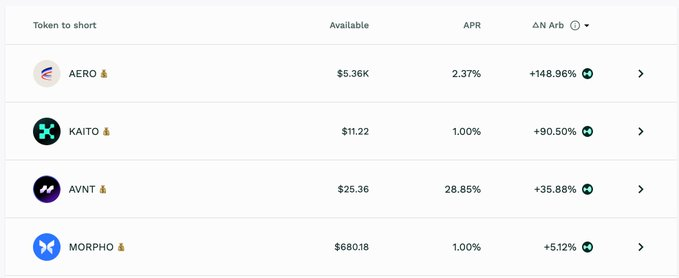

1. Find a perp opportunity with negative funding

Look for a perpetual market where funding is consistently negative. In these periods, longs receive payments from shorts, creating a predictable funding-rate yield.

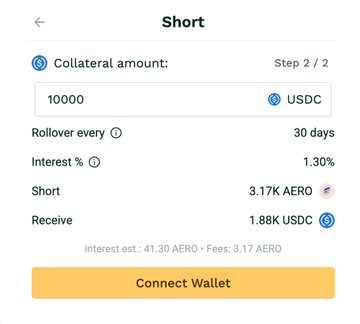

2. Open a short on Teller with no impermanent loss or liquidation risk

Post USDC as collateral on Teller and short the underlying asset directly. There’s no impermanent loss, no dual-asset exposure, and no liquidation pressure — the short stays intact through volatility.

3. Open a long perp position

Take a matching long position on any perp platform. The long and the short offset each other’s price movement, leaving the funding payment as the net yield as long as rates stay negative.

Why Traders Use Teller for This

No liquidation pressure

Short-term price swings don’t force close trades. The collateral LTV is managed only at rollover.

Single-asset exposure, no impermanent loss

Deposit one asset, borrow one asset, and avoid dual-sided LP risk.

Stable collateral

Posting USDC keeps collateral predictable and reduces second-order volatility.

Long-tail access

Some of the strongest negative funding periods occur in long-tail perps. Teller’s isolated pools make those borrowable.

Straightforward mechanics

No LP ratios, no lockups, and no pool divergence. Just long perp, short spot, collect funding.Delta-neutral funding strategies have existed for years, but constant liquidations make them hard to sustain. Teller removes that pressure and lets traders stay hedged long enough for funding cycles to play out.

Get Started

Now, funding-rate yield can be earned without taking margin call risk. Borrow the asset on Teller, long with a perp, and capture the negative funding rate — with no liquidations and no impermanent loss.

https://app.teller.org/ethereum/short-v2