Borrow Ethereum (ETH) into the merge event!

Key takeaways:

- Borrow ETH into the merge with zero collateral

- Teller offers a simple plug-and-play solution to start borrowing ETH

- While other leading lending platforms are shutting down their ETH markets, Teller is building a platform that caters to investors needs

Ethereum’s most anticipated event, The Merge is almost complete and DeFi investors find it to be the best time to increase their pre-merge Ethereum exposure. Borrowing Ethereum (ETH) is now easy, fast, secure, and the most important part - uncollateralized.

Note - This event is exclusively for the Teller supporters and community. Other users who wish to participate can make borrow requests on this market but the loans would be funded by external lenders and are not guaranteed to be funded!

How does it work?

I am one of the whitelisted users, how to borrow ETH without collateral?

Here’s a step by step guide on how you can borrow Ether (wETH) on Teller and hold it till the merge and the predicted hard fork of Ethereum is completed.

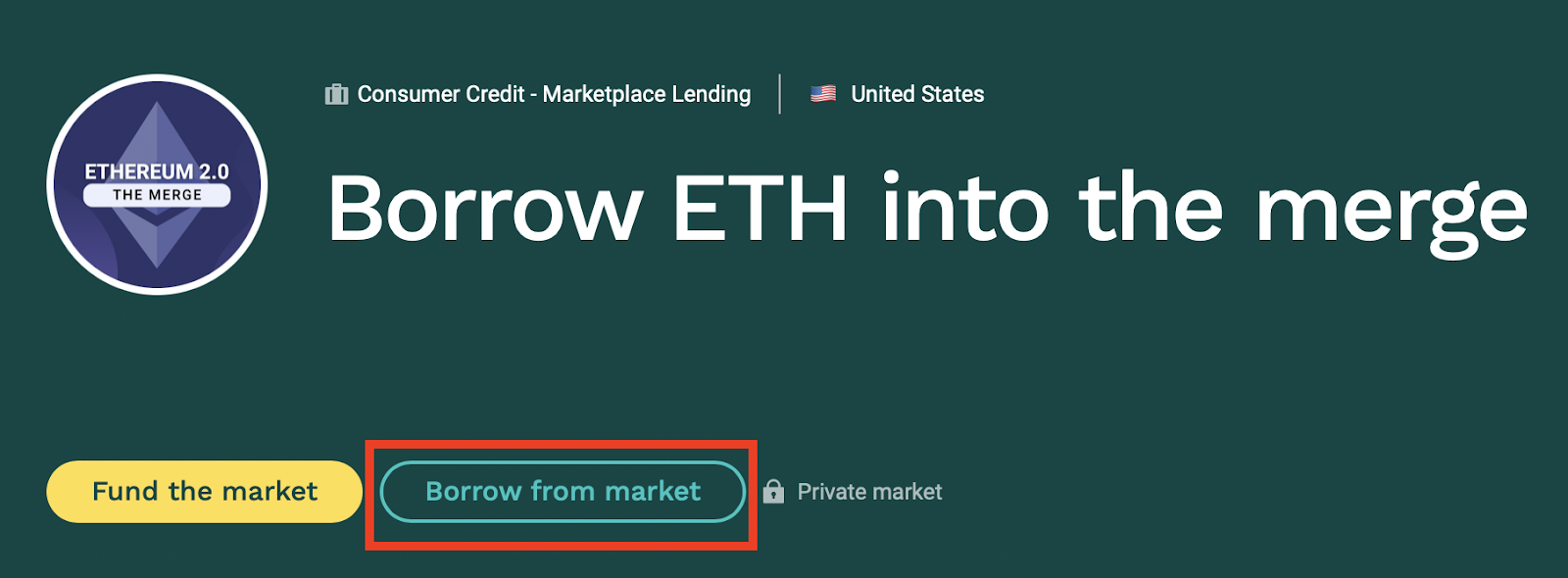

- Start by going to the Borrow ETH market on Teller’s Marketplace.

- Connect your wallet on our platform by click on ‘Connect Wallet at the top-right button on the screen.

- Find the ‘Borrow ETH’ market and click on ‘Borrow from this market’.

4. Fill in the form as illustrated below.

Please note the address 0x36d638eDf9eF8b3A358AdEfA440a6D8537EF5E1C as the receiving address. Once done, click on ‘Borrow’. The above address is the escrow account that will be receiving the loan funds after the merge, and once the hardfork is completed, the escrow account will pay back the loans and send the new hardforked (ETHPOW) tokens to your wallet.

Please note to type in your own Teller Discord handle instead of - discordhandle

5. Wait for the underwriter to fund your loan request and that’s it. Your borrowed ETH will be sent to the escrow wallet.

6.After the merge, the loans will be repaid by the escrow wallet and the respective ETHPOW airdrop will be sent to your wallet.

Why is everyone borrowing ETH before the Merge?

Ethereum’s Merge is abandoning its mining ecosystem and Proof of Work for Proof of Stake, a more energy-efficient, scalable, and faster consensus mechanism. Along with the entire Ethereum’s dApp ecosystem that is preparing for the transition, it is anticipated that the miners are preparing to hard fork Ethereum’s blockchain into a new chain that will continue to run using the Proof of Work consensus. This chain will allow miners to continue mining on the forked chain and to receive rewards in a new token, which might be called ETHPOW.

Hence, in easy words, you will be airdropped the new forked tokens (ETHPOW) in your Ethereum wallets if two conditions are met:

- You hold ETH at the time of the hard fork.

- The hard fork happens successfully.

Various DeFi lending and borrowing platforms like Aave and Compound have either temporarily suspended ETH markets or have put a strict hard cap to limit their utilization rate. Borrowing rates on other platforms have spiked to all-time highs making it exceedingly challenging for retail investors to borrow on them.

This is not the case with Teller. Teller is offering the most affordable rates for borrowers. All the borrowed ETH can be held by the borrower in their personal wallets or they can be held in a Gnosis safe, a multi-sig wallet, on behalf of the borrower. The wallet is entirely non-custodial, i.e. users will have complete control of their borrowed assets.

Conclusion

DeFi platforms like Teller provide borderless, hassle-free, and instantaneous ways to borrow and lend ETH. All you need to do is connect your Ethereum wallets and whichever side of the market you want to be on, lender or borrower, you can interact with the platform accordingly.

As a lender on Teller, you can supply your deposits for lending to a web3 borrower (individual or organization) or directly lend it to the underwriter.

As a borrower on Teller, you can borrow ETH without any KYC or strict registration procedures. Teller is an on-chain open ecosystem of lenders, borrowers, and underwriters (market creators).

Regardless of its current price, Ethereum is one of those most attractive coins to hodl for years. Its utility and ever-expanding ecosystem have attracted investors worldwide to invest, hold, borrow, lend, and now stake it on DeFi platforms.